- Solana’s network costs recently hit an all-time high after surpassing $5 million.

- Solana is outperforming the Ethereum blockchain in terms of fees and revenue as the SOL/ETH chart made a new high.

Solana [SOL] is up over 13% over the past seven days and was trading at $173 at the time of writing. The recent rally coincided with a surge in network activity and usage, as the Solana blockchain outperformed other networks, including Ethereum [ETH] in key statistics.

This growth has put Solana on a path to extend its rally and possibly break $200.

Solana turns Ethereum into network fees

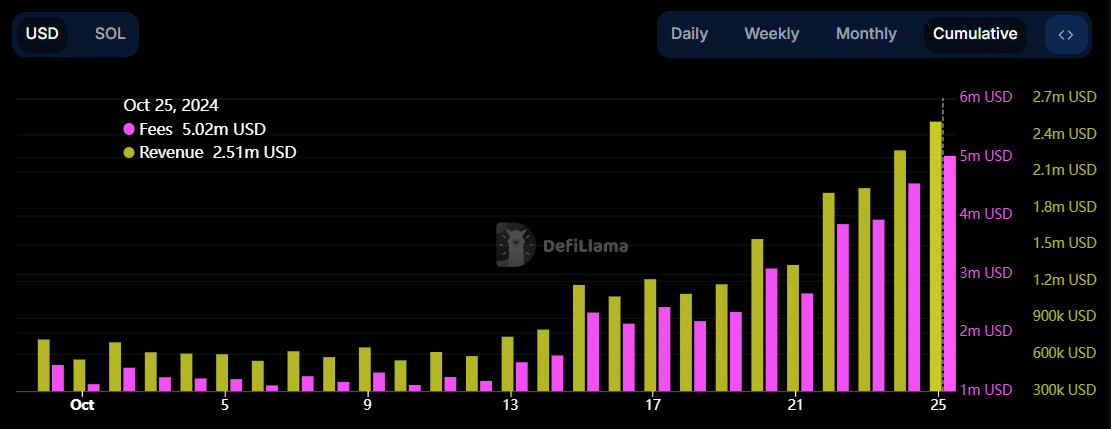

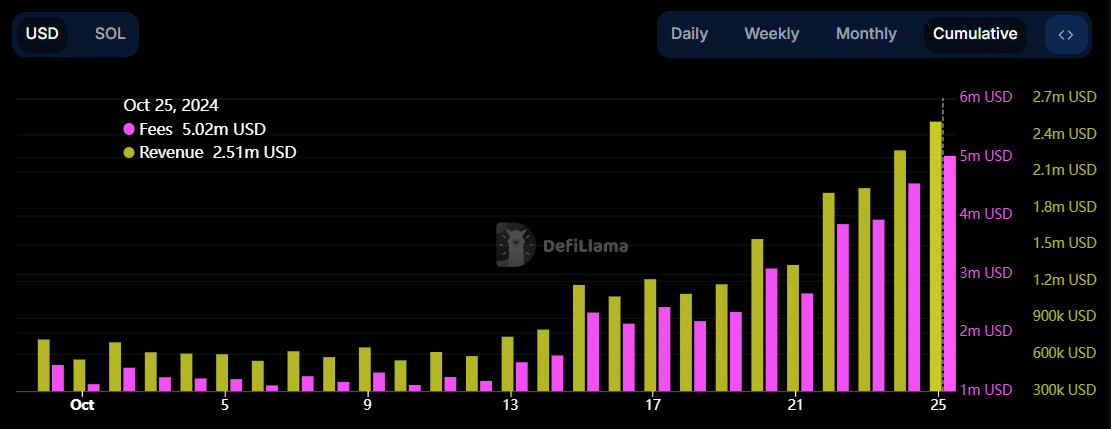

DeFiLlama data shows that network costs for Solana have risen above $5 million. This statistic is at an all-time high and has increased fivefold since the beginning of the month.

In addition to fees, Solana’s revenues have also been on the rise, reaching $2.5 million at the time of writing.

Source: DeFiLlama

For comparison, Ethereum fees at the time of writing were $3.47 million, while revenues were $2.48 million. The discrepancy shows that Solana is quickly surpassing Ethereum in terms of network usage.

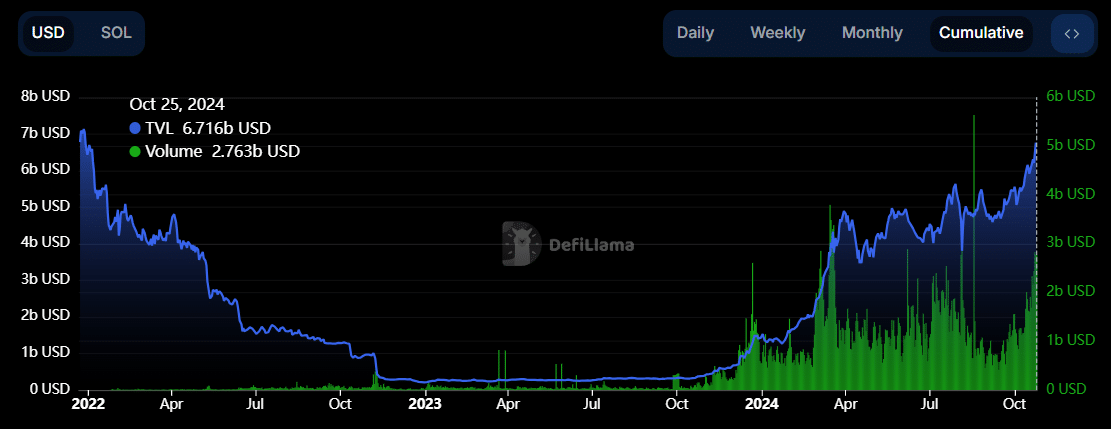

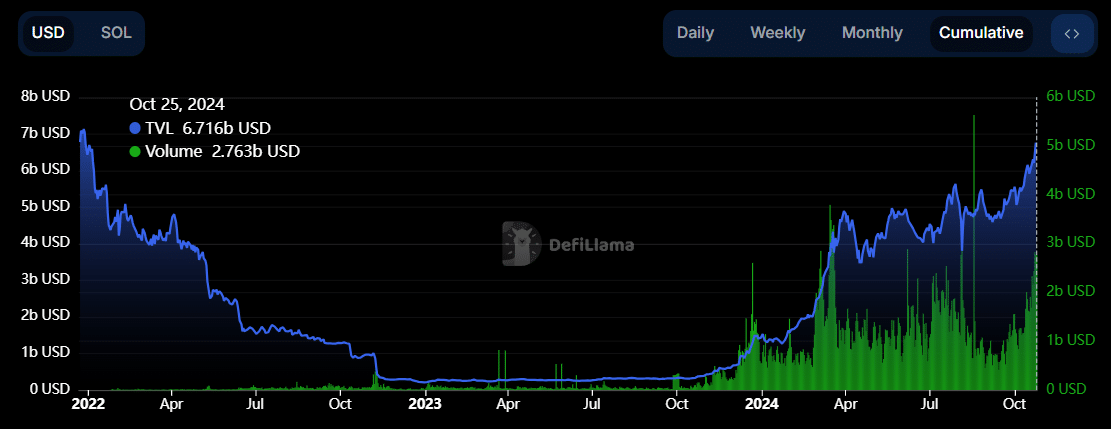

Solana’s decentralized finance (DeFi) business is also at record highs. Total Value Locked (TVL) has risen to $6.7 billion and is approaching a three-year high. This month alone, Solana has added more than $1 billion to its DeFi TVL.

DeFi volumes have also increased to $2.7 billion, the highest level in two months.

Source: DeFiLlama

DappRadar also shows that Solana’s decentralized application (dApp) activity has gradually increased this month, underscoring the blockchain’s growth.

Earlier this week, Solana’s dApp volumes rose to $341 million, the highest level in two months. The number of transactions also rose to 23.55 million, the highest in more than a year.

Solana makes a new high against Ethereum

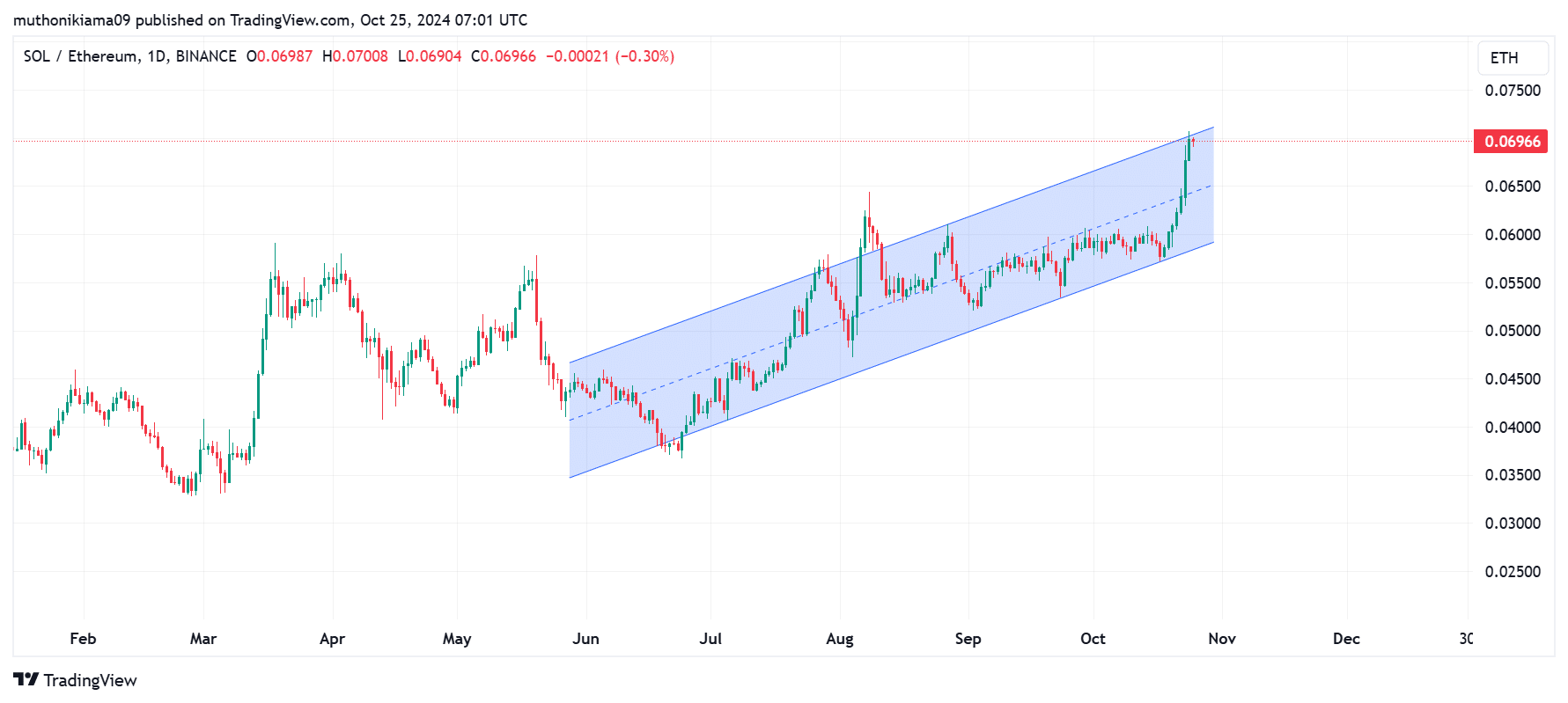

Solana not only outperforms Ethereum in terms of network usage, but also in terms of price performance. The SOL/ETH chart shows that Solana recently made a new high against Ethereum after reaching $0.07.

Source: Tradingview

SOL/ETH is trending within a rising parallel channel. This shows that Solana has been gradually outperforming Ethereum since June.

Read Solana’s [SOL] Price forecast 2024–2025

Solana is now at the upper limit of this channel, and if the price were to reverse to this level, the uptrend could continue.

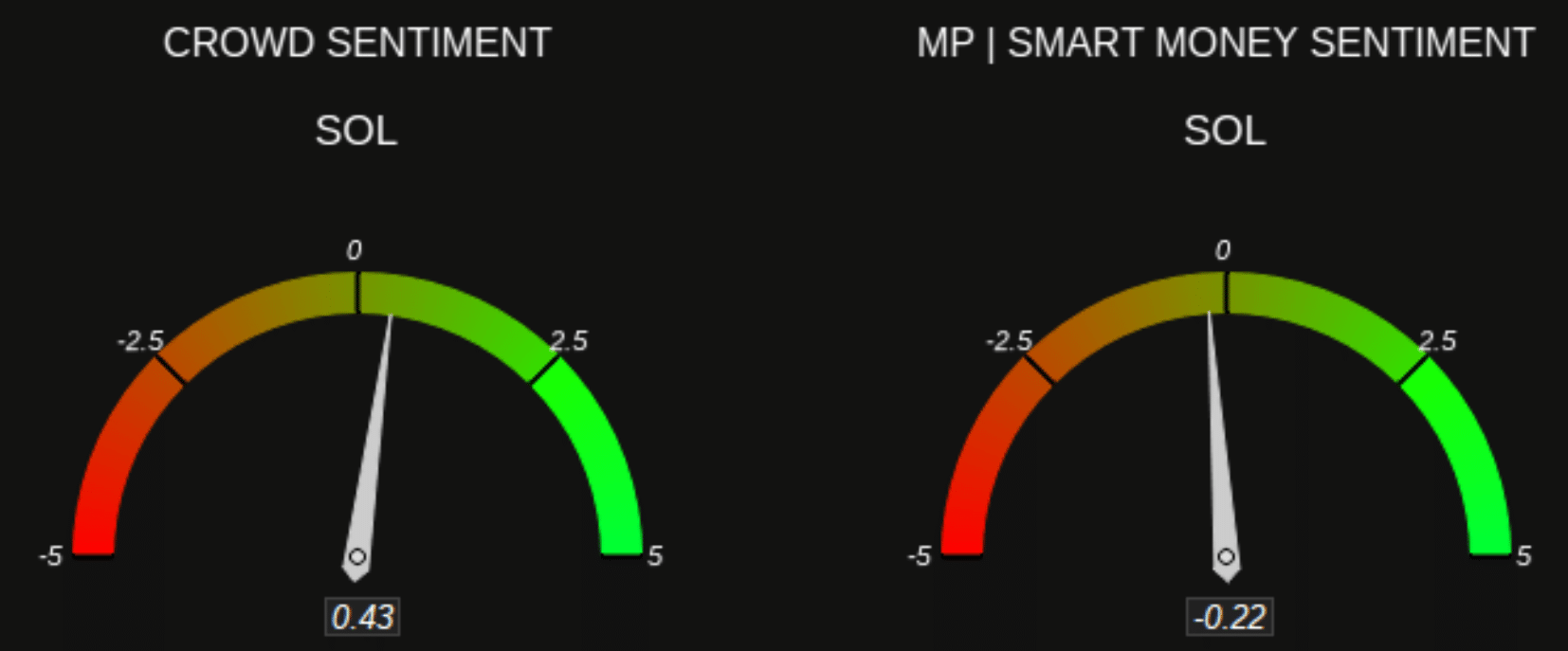

The surge in activity on the Solana blockchain has renewed positive sentiment. According to Market Prophit, public sentiment on SOL is bullish. At the same time, sentiment around smart money is bearish, reflecting concerns about the sustainability of recent price gains.

(Source: Markt Profhit)