- Solana ETFs would not attract much demand from American investors, according to Sygnum’s director.

- However, the co-founder of Syncracy Capital claimed that Solana could break out through DePIN.

American place Solana [SOL] ETFs may not see significant flows if they are approved, according to an executive at crypto bank Sygnum.

Sygnum’s head of research, Katalin Tischhauser, recently told Cointelegraph that the flows would be “minuscule,” citing Grayscale’s low AUMs (assets under management) from SOL trust GSOL.

She added:

“The small assets under management reflect the relative brand awareness of Solana versus Bitcoin,”

Solana ETF Flow Outlook

At the time of writing, GSOL’s assets under management stood at $67 million, which was far short of GBTC’s nearly $30 billion before the ETF conversion in January.

According to Tischhauser, this demonstrated likely weak demand for future SOL ETFs from US investors.

The outlook comes weeks after asset managers such as VanEck, Franklin Templeton and 21Shares filed a US spot SOL ETF application with the SEC (Securities and Exchange Commission).

However, BlackRock recently stated that it would not qualify for the SOL ETF, citing a lack of near-term customer demand.

Interestingly, Tishchhauser’s flow projections mirror Bloomberg ETF analyst Eric Balchunas’ ETH ETF outlook before they went live on July 23.

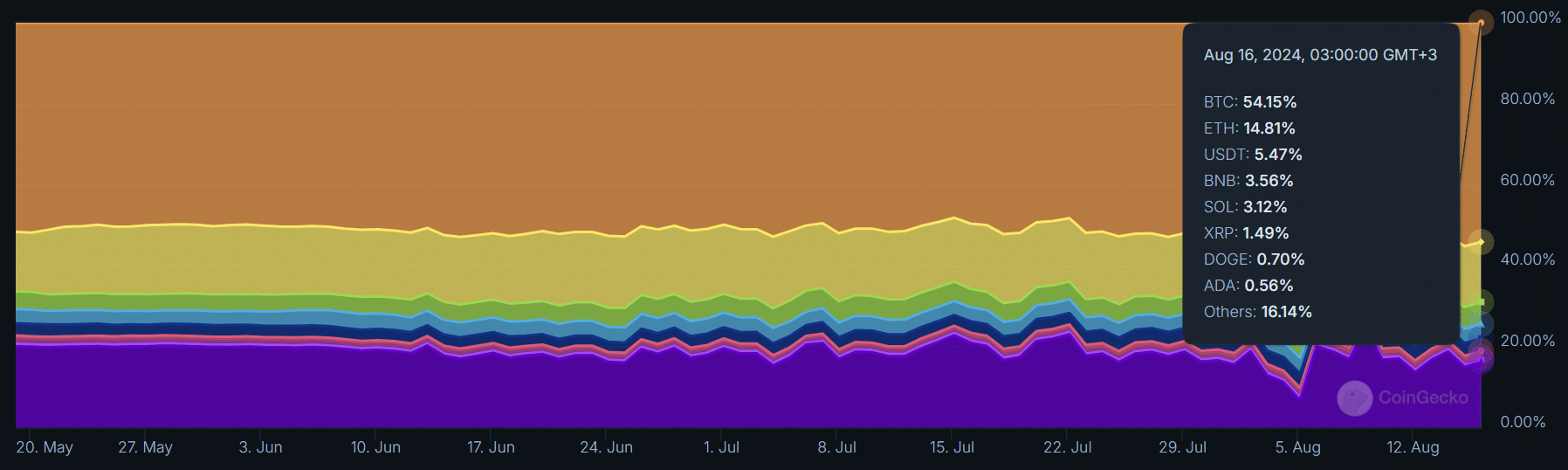

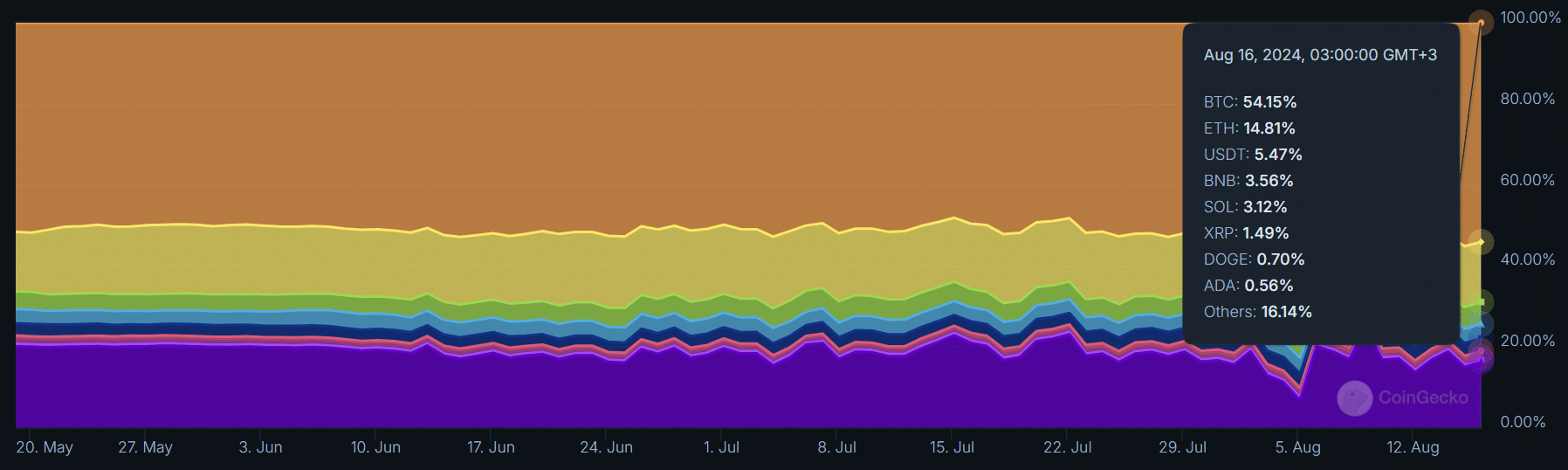

Balchunas estimated that the flows could follow the dominance of the asset based on market capitalization.

As a result, he predicted 15%-20% equivalent BTC ETF flows for day 1. ETH’s dominance was around 15% at the time. However, the ETH ETF’s performance on its debut date was slightly higher, hit the estimates.

At the time of writing, SOL’s market dominance stood at 3.12%, according to CoinGecko facts.

Source: Coingecko

This meant that, as Tischhauser stated, it could see fewer flows for its ETF products if the trend followed market dominance and assets under management.

Will Solana’s DePIN change the odds?

However, Ryan Watkins, co-founder of crypto hedge fund Syncracy Capital and former Messari Crypto analyst, believed SOL could see its breakthrough moment from DePIN (Decentralized Physical Infrastructure Network).

“I’m starting to believe Solana will have a breakthrough moment with DePIN, similar to what Ethereum had with DeFi in 2020.”

Watkins noted that DePIN could be the next segment after stablecoins to see real-world adoption.

With notable traction from DePIN projects such as Helium [HNT]Solana’s dominance in this segment could increase the network’s position.

However, whether this would change US investor sentiment towards SOL remains to be seen.