Disclaimer: The information presented does not constitute financial, investment, trading or other advice and is solely the opinion of the author.

- There was a possibility that SOL could recoup last week’s losses before heading lower again.

- The slow rise in prices over the past week suggested that sentiment could turn bullish.

The crypto market was in an uncertain place. Sentiment has been strongly bearish over the past two weeks, but many altcoins showed that a break in the current bearish structure was possible. Solana [SOL] was one of them, but such a structural break need not be followed by an upward trend.

Read Solana’s [SOL] Price Forecast 2023-24

A return to the late May highs before another rejection was therefore also possible, so traders need to make a decision. Are they trying to drive momentum up from the lower time frame, in the event of a bullish shift? Or are they waiting for opportunities to go short with a higher probability?

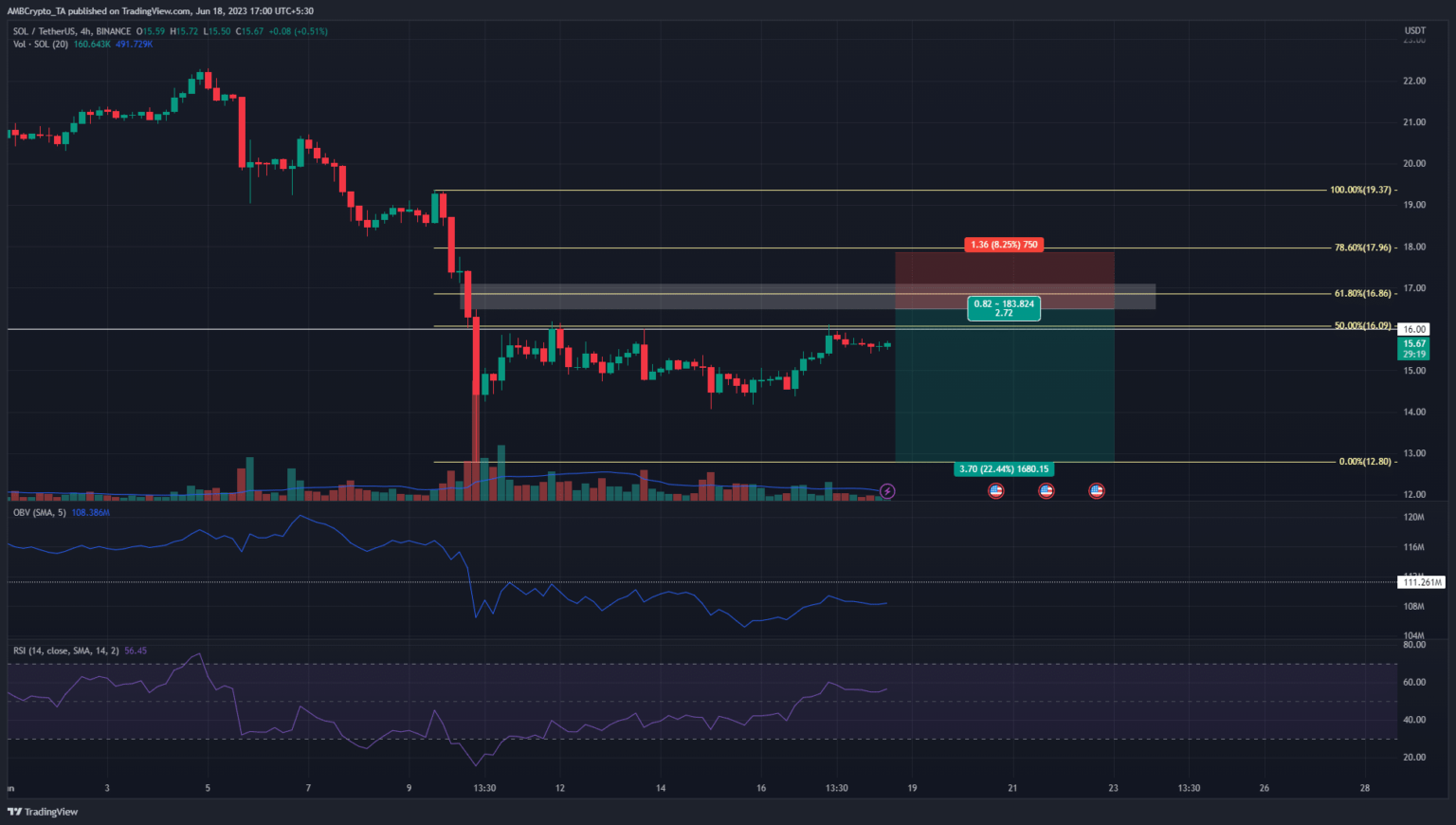

Fibonacci confluence and imbalance around $17 could halt SOL bulls progress

Source: SOL/USDT on TradingView

On the daily time frame, the Solana market has been bearish since May 8. The upward moves from early June to $22.3 did not change the outlook for the higher time frame. It turned out to be a quick bearish reversal on the H4 chart after what appeared to be an uptrend from USD 20.3.

At the time of writing, the price was stuck below the 50% Fibonacci retracement level and trading volume was low. This pointed to sidelined market participants waiting for a direction to be established. The RSI stood at 56 to show upward momentum for SOL, but the OBV was unable to break above a significant resistance level.

This level extended to May, when it served as support. Therefore, a move above this level would be one of the first strong signs of an uptrend on the 4-hour chart. But until then, traders may be bearishly biased.

The FVG in the $16.8 region (marked by the white box) had confluence with the 61.8% retracement level at $16.86. A test of this level or the imbalance itself could provide a risky short position for SOL bears, which are targeting $12.8.

Coinalyze data showed that sentiment remained bearish despite the uptick

Source: Coin analysis

Solana’s spot CVD was in a downward trend in June. On June 11, as prices plummeted, the financing rate shot deep into negative territory. This reflected the dominance of short positions in the market.

How much are 1, 10 or 100 SOL worth today?

Since then, the price has slowly climbed higher, but Open Interest has slid lower on the chart. This signaled discouraged long positions and bearish sentiment prevailed in the market.

Therefore, while a bullish reversal cannot be ruled out, the evidence presented pointed to further losses for SOL.