- Solana reclaims $180 after a strong 11% rise through $162 support.

- Social volume hits a six-month high as positive funding rates indicate continued bullish momentum.

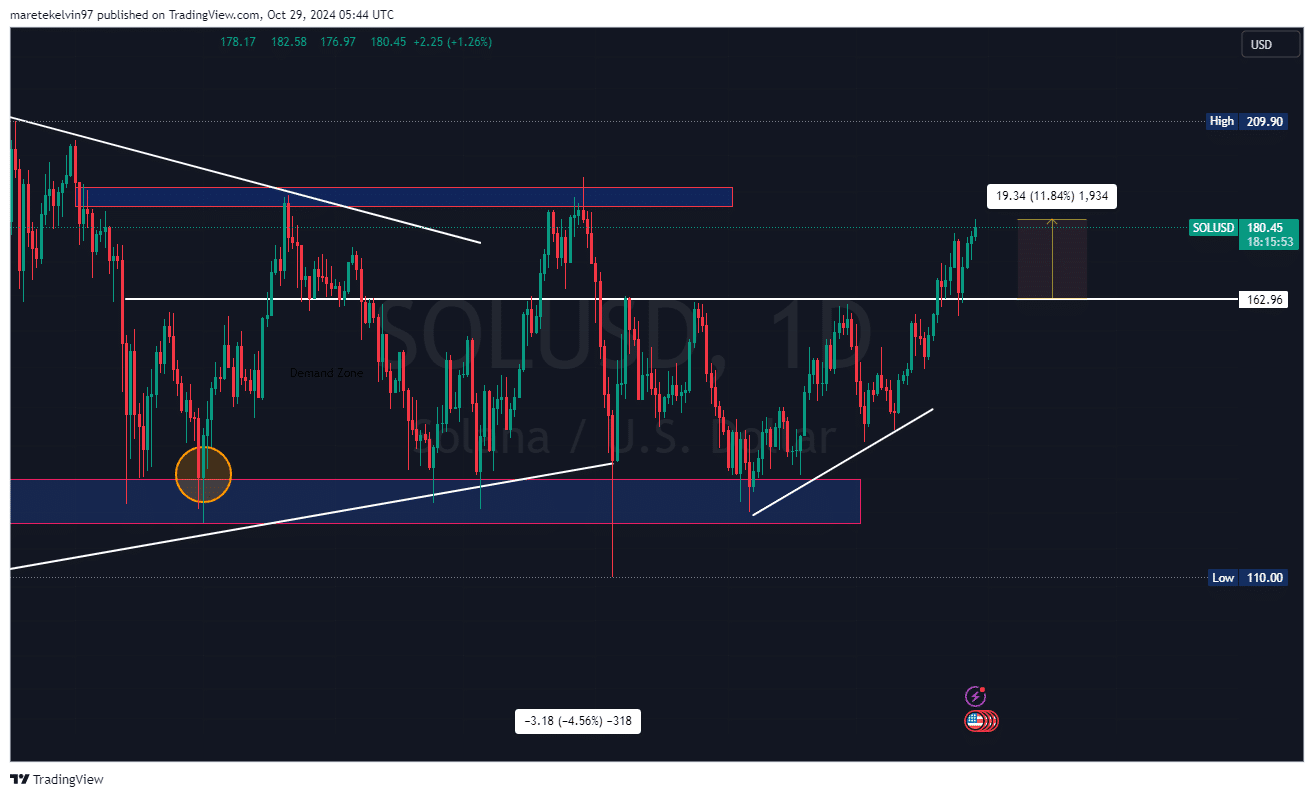

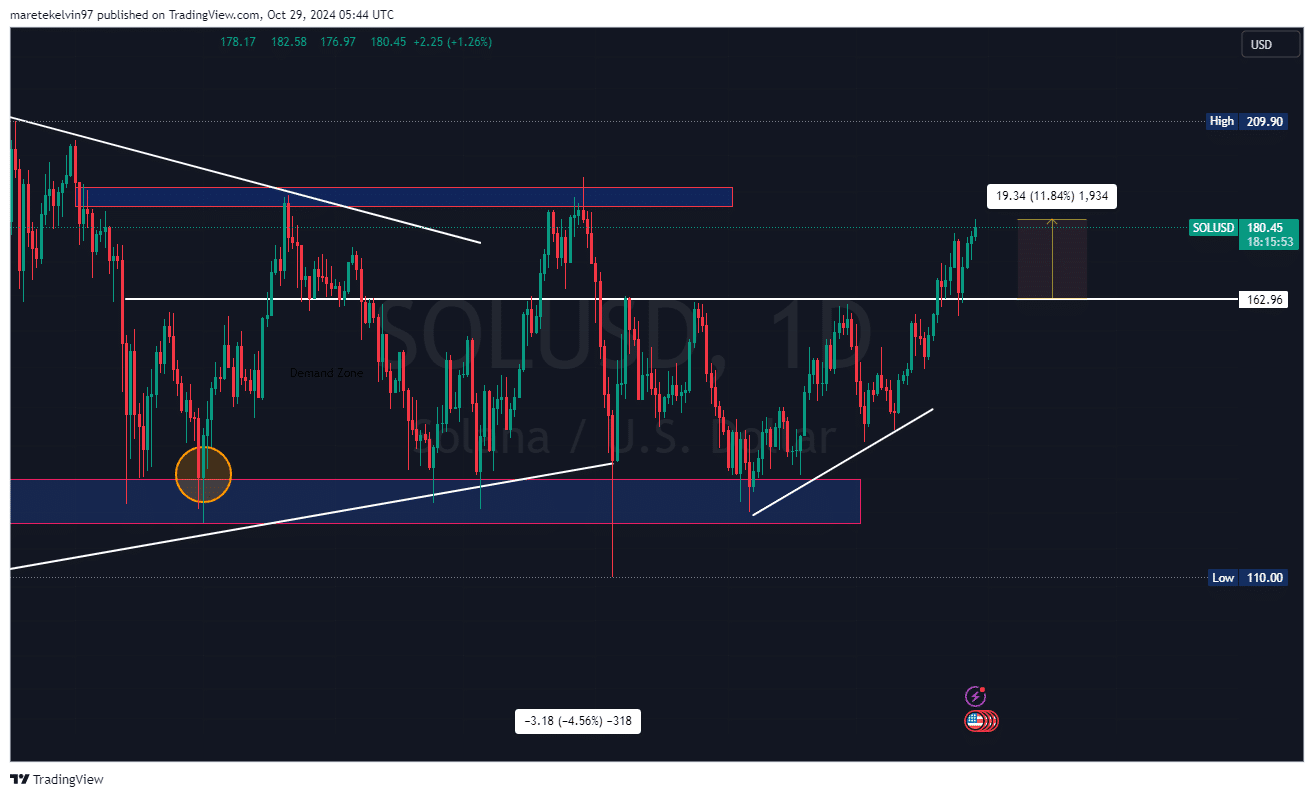

Solana [SOL] has shown remarkable resilience after successfully defending the critical support zone at $162. The latest charts indicate an 11% increase since the altcoin retested the key support level at $66.5. SOL was trading at $180.45 at the time of writing.

Solana’s recent rebound occurred in a key demand zone, indicating a strong buyer presence at lower levels.

Source: Tradingview

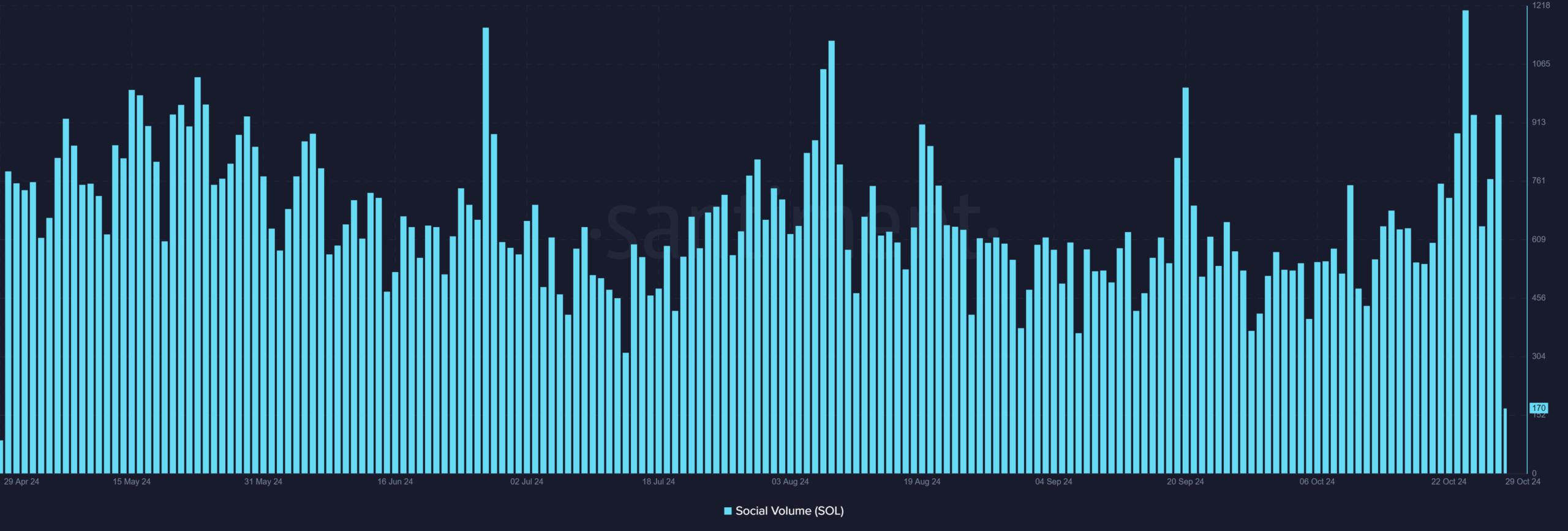

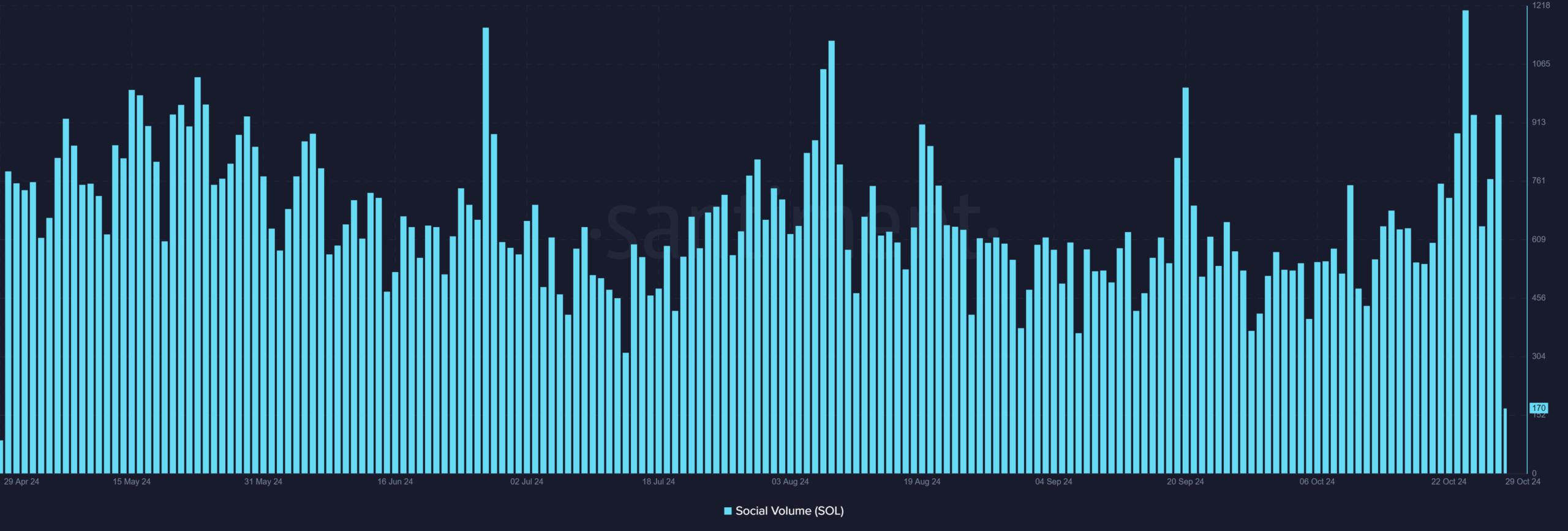

Solana’s social interest reaches a fever pitch

According to data from Santiment, Solana’s social volume has reached levels not seen in the past six months. Altcoin social volume data indicates a dramatic spike in discussions and mentions on social platforms, especially since early October.

This surge in social interest often precedes significant price movements, as seen during SOL’s previous rallies.

Source: Santiment

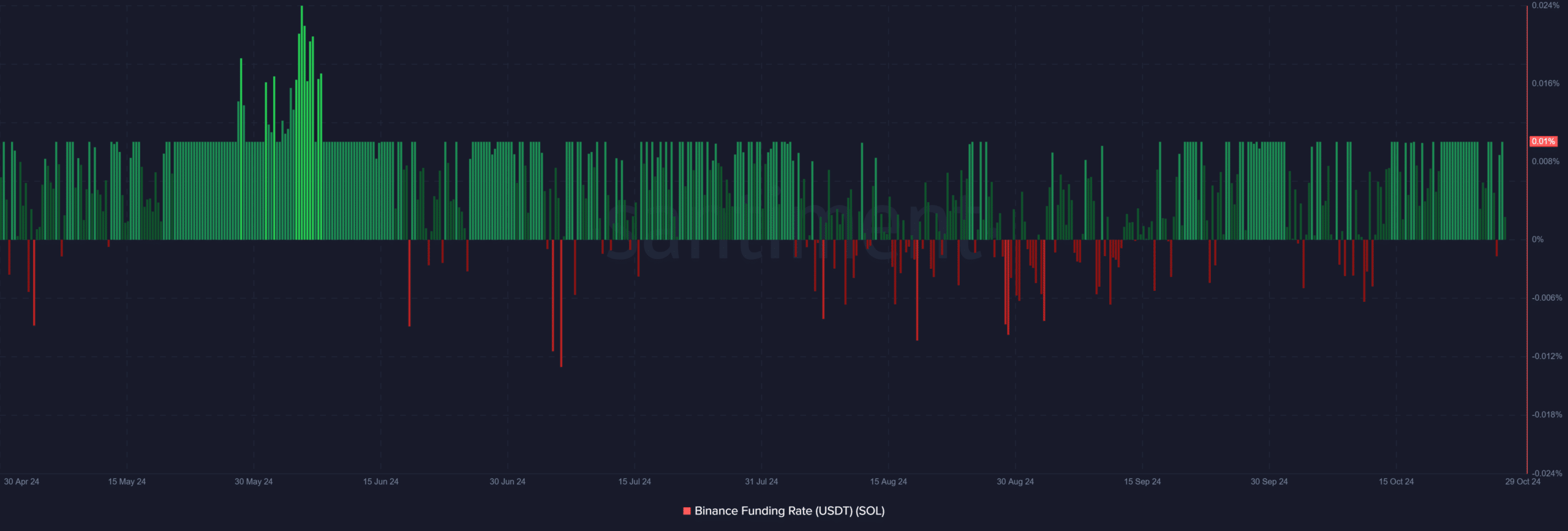

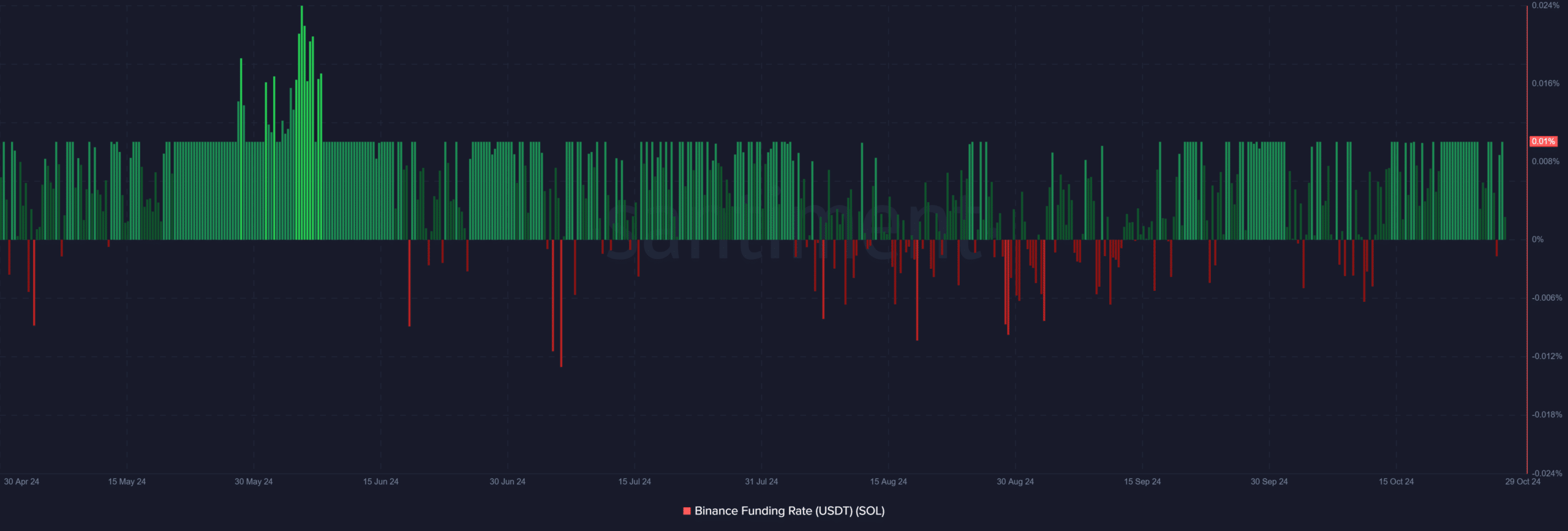

Funding rates indicate bullish momentum

Further analysis from AMBCrypto on the Binance funding rate data shows a significant positive trend, with minimal negative numbers since July 2024.

This continued positive environment for funding rates indicates that market participants are willing to pay a premium to maintain long positions, reflecting strong bullish sentiment in the futures market.

Source: Santiment

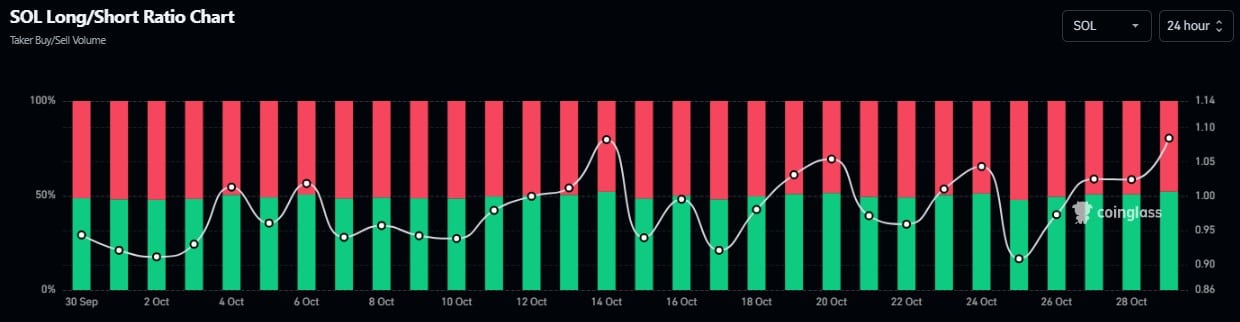

In addition to the positive financing rates mentioned above, the Solana has also registered a spike in its long-short ratio. Long positions account for approximately 52% of all positions.

The long positions are overwhelming the short positions, which is an important bullish sentiment for the expected price increase.

Source: Coinglass

Solana’s technical setup points higher

The technical structure shows a clear breakout from a multi-month consolidation phase.

With the price testing the $180-$190 resistance zone, SOL seems positioned for a potential move towards the psychological $200 level.

The formation of higher lows since July further reinforces this bullish outlook.

Given the confluence of positive social sentiment, positive funding rates, and a strong technical setup, SOL could be setting itself up for another bullish rally.

Is your portfolio green? View the SOL Profit Calculator

However, the USD 189 resistance level still looms as a decisive break above it could accelerate momentum towards USD 250.

The key support at $162 remains crucial for maintaining the bullish structure.