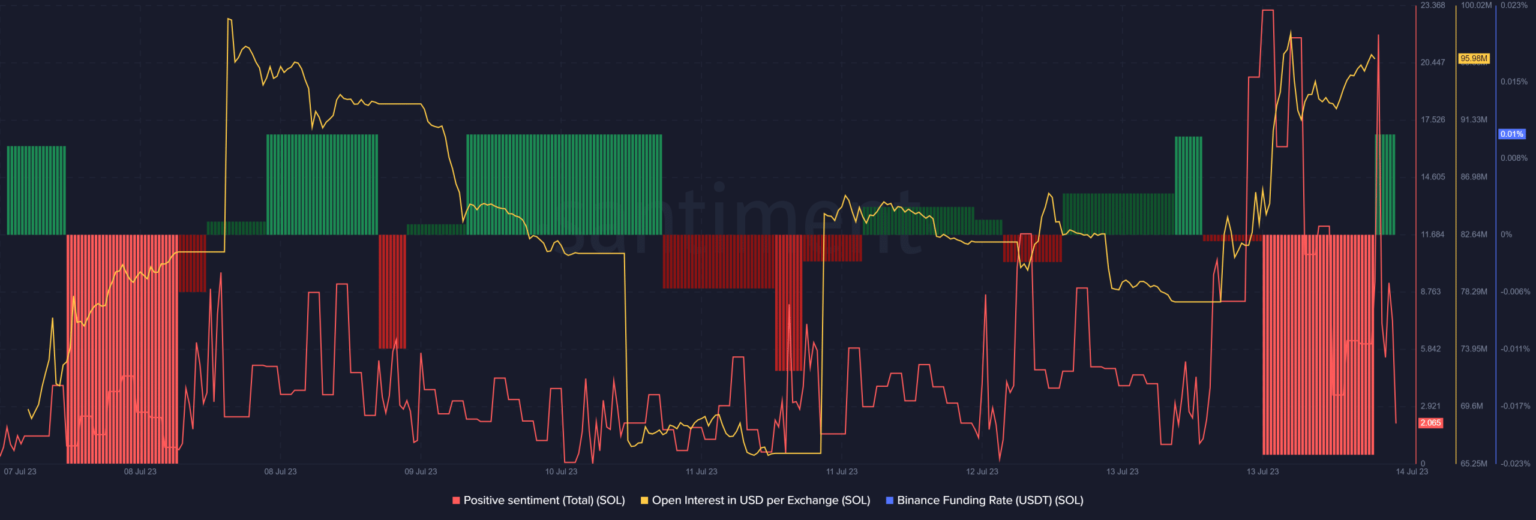

- The positive sentiment and Open Interest around SOL has increased in recent days.

- Although network activity declined, market indicators remained optimistic.

The bullish market condition paid off for most cryptos, but Solana [SOL] stood out from the rest with its huge profits. Over the past 24 hours, the token’s price has risen significantly, helping it recover its market cap.

Realistic or not, here it is SOL’s market cap in terms of BTC

However, it was surprising to note that despite the massive price increase, the blockchain network activity was declining. Will reduced network usage negatively impact price action?

Solana’s price skyrockets!

According to CoinMarketCap, the price of Solana is up more than 40% in the past seven days. While this was extremely bullish, the better news was that SOL’s value is up nearly 31% in the past 24 hours alone.

Not only that, while the price of SOL increased, the trading volume also increased by more than 300%, which was the basis for the increase. At the moment of writing, SOL was trading at $28.46 with a market cap of over $11 billion, making it the eighth largest cryptocurrency.

Thanks to the price increase, positive sentiment around the token also increased, as shown by Santiment’s chart. In addition, SOL’s Open Interest also increased. An increase in this metric means that the current price trend could continue.

SOLDemand in the derivatives market also improved as Binance’s funding rate chart turned green.

Source: Sentiment

Solana’s network stats are acting weird

However, Solana’s network activity did not reflect the price action. According to Artemis’ chart, SOL’s number of daily active addresses and daily transactions decreased, indicating less usage.

However, it was interesting to note that despite the drop in transaction volume, the blockchain’s fees and revenues gained an upward momentum. The same trend was also noticed in terms of the TVL.

Source: Artemis

How many Worth 1,10,100 SOLs today?

Will the bull rally continue?

Regardless, some market indicators remained bullish on Solana. For example, the Exponential Moving Average (EMA) ribbon showed a bullish crossover. The Bollinger Bands also revealed that SOLThe price of the stock was in a zone of high volatility, further increasing the likelihood of a sustained uptrend.

However, SOL’s Chaikin Money Flow (CMF) fell slightly. In addition, SOL’s Relative Strength Index (RSI) was in the overbought zone. This could increase selling pressure and, in turn, result in a halt to the token’s bull rally.

Source: TradingView