- The price of SOL has risen by more than 12% in the past seven days.

- Market indicators turned bearish on the token.

Solana [SOL] has successfully broken a major bullish pattern that indicated continued price appreciation in the coming days. Moreover, an indicator has given a buy signal for SOL.

Let’s see what’s going on and assess whether SOL can continue its bull rally in the coming days.

Solana’s bullish move

CoinMarketCaps facts revealed that Solana’s price has risen more than 12% in the past seven days. However, the past 24 hours have been bearish as the token’s price fell by more than 1%.

At the time of writing, SOL was trading at $174.5 with a market cap of over $81 billion, making it the fifth largest crypto.

But this recent setback could be short-lived as SOL managed to break a bullish pattern. According to the recent version of World of Charts tweetSOL broke out above a bullish pennant pattern and has already made a 25% gain.

If SOL continues to follow this trend, investors may soon witness another major price increase in the coming days.

Apart from this, Ali, yet another popular crypto analyst, recently posted one tweet points to another bullish development. Notably, Solana’s TD sequential marked a buy signal.

When this happens, it means there is a high chance of a price increase.

Is Solana ready for a bull rally?

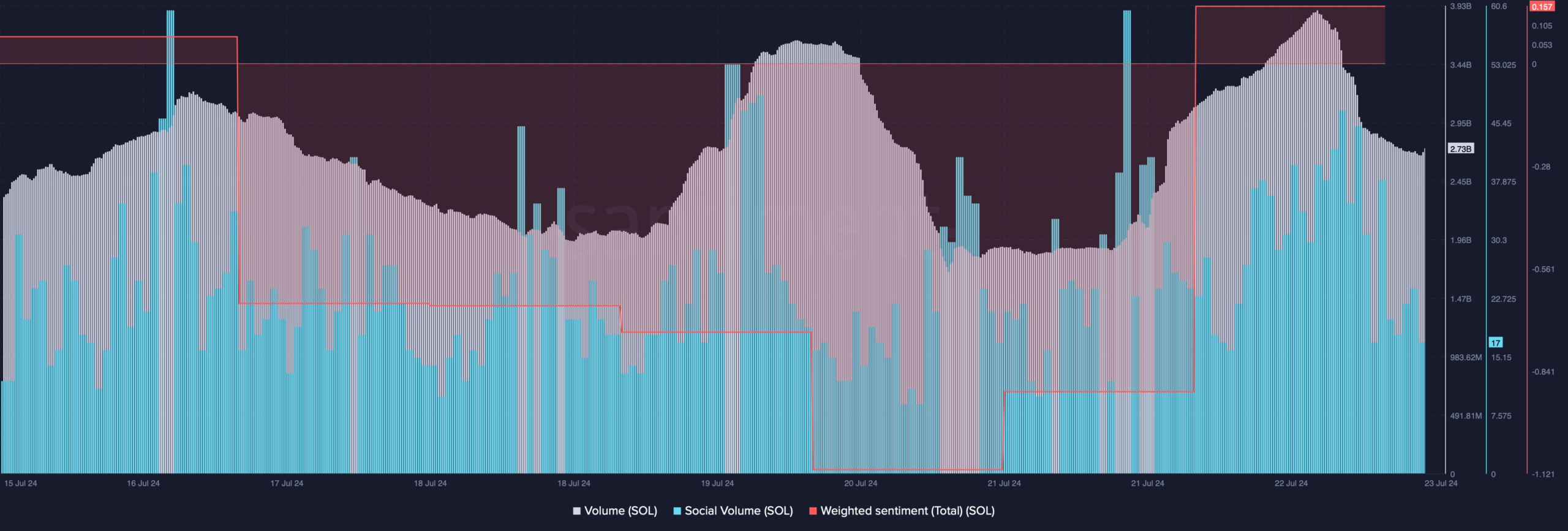

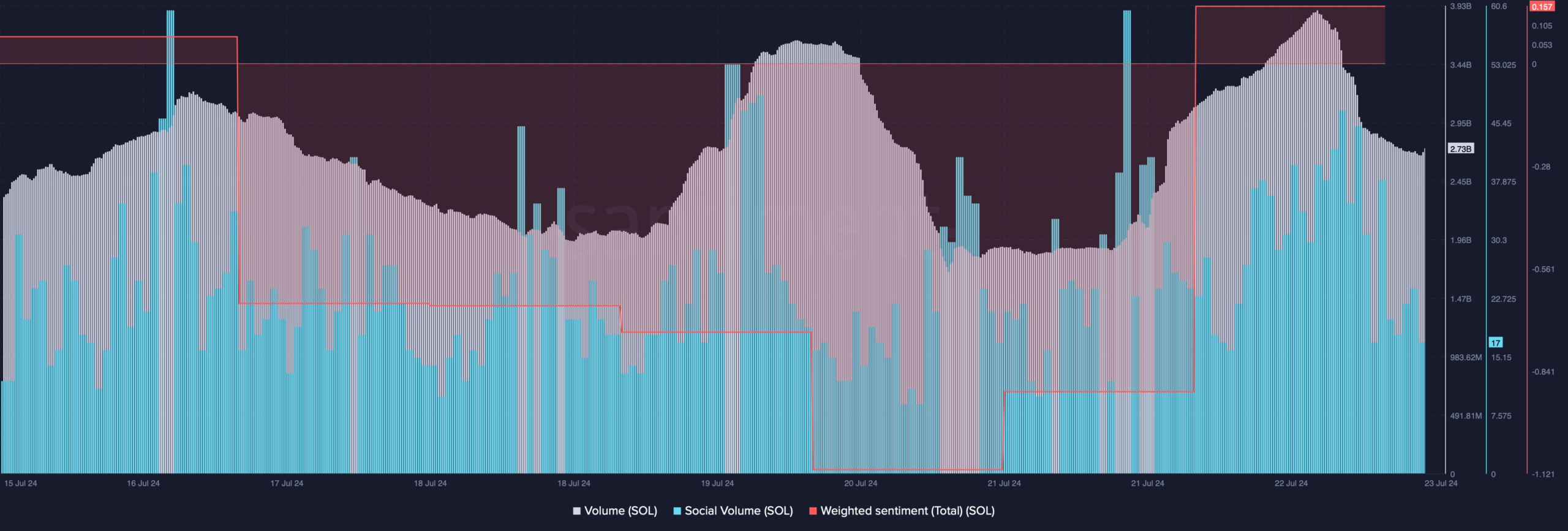

AMBCrypto then checked the token’s on-chain data to see which metrics suggested a bull rally. We found that SOL’s volume remained high over the past week, which can be inferred as a bullish signal.

Social volume also increased, reflecting popularity. Moreover, Solana’s weighted sentiment ended up in the positive zone. This suggested that bullish sentiment surrounding the token was dominant in the market.

Source: Santiment

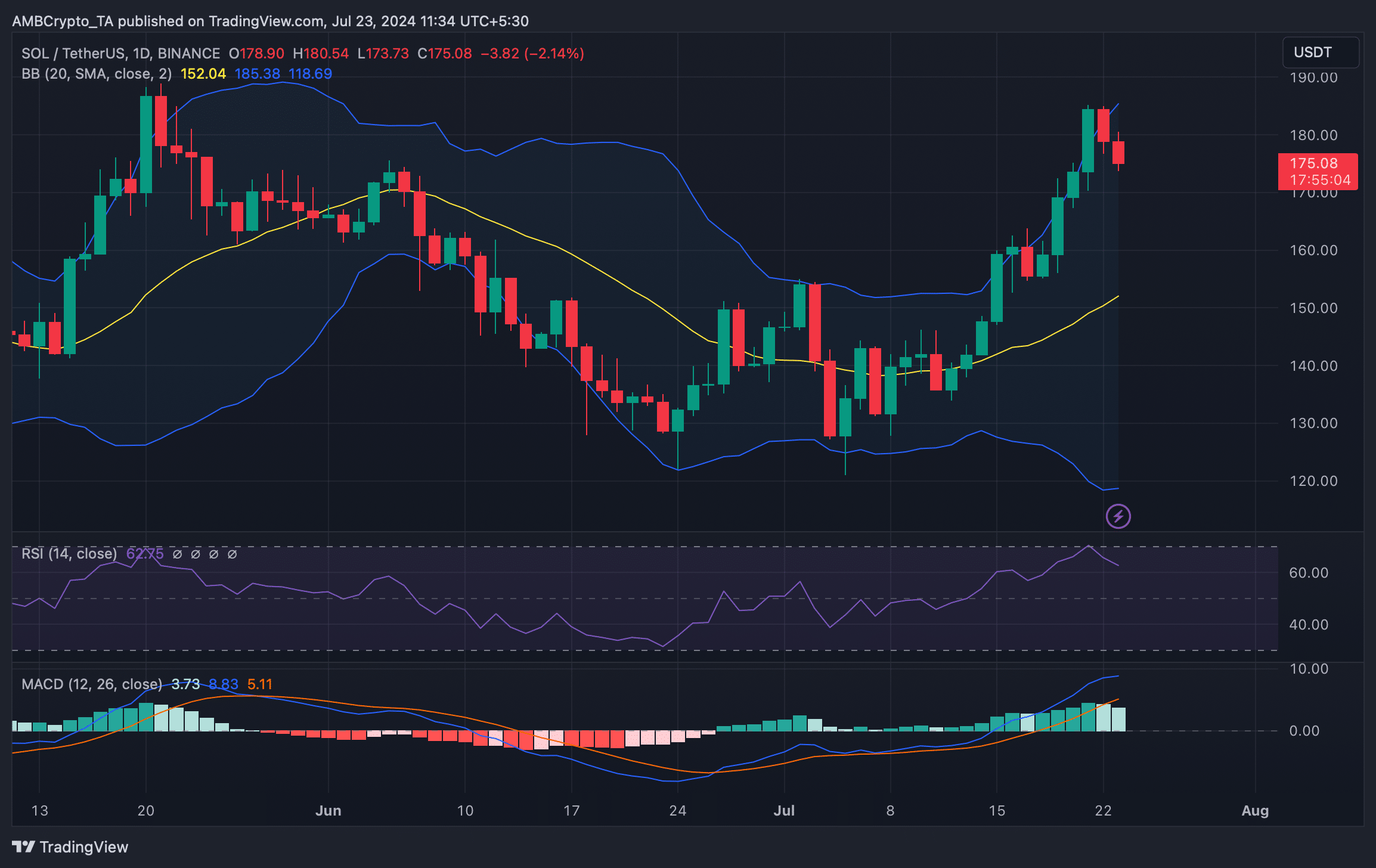

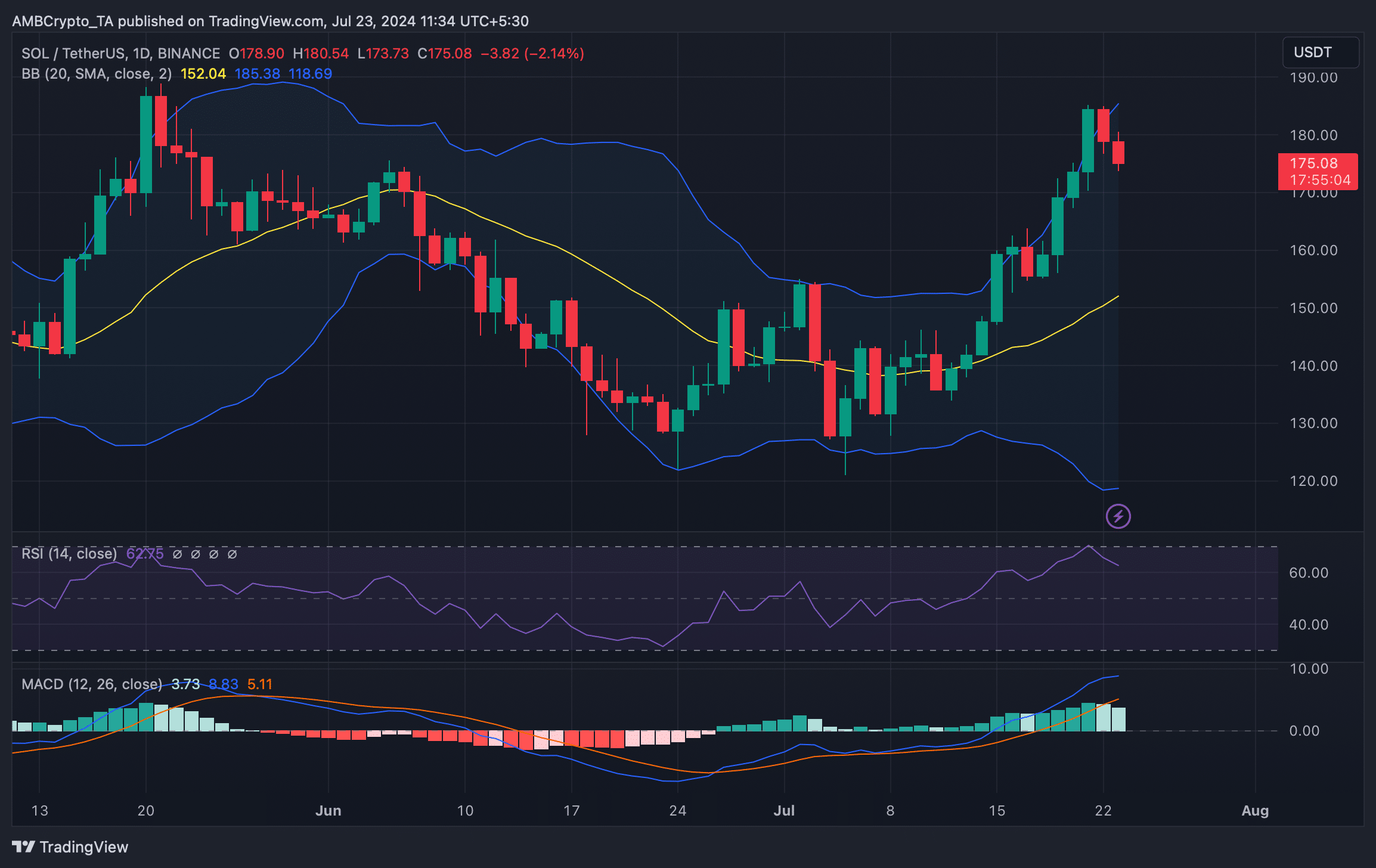

Next, we planned to check the daily chart of the token. According to our analysis, the price of SOL reached the upper limit of the Bollinger Bands, which often results in price corrections.

Moreover, the Relative Strength Index (RSI) recorded a decline, further indicating that the chances of a price decline were high. Nevertheless, the MACD showed a bullish edge in the market.

Source: TradingView

Is your portfolio green? look at the SOL profit calculator

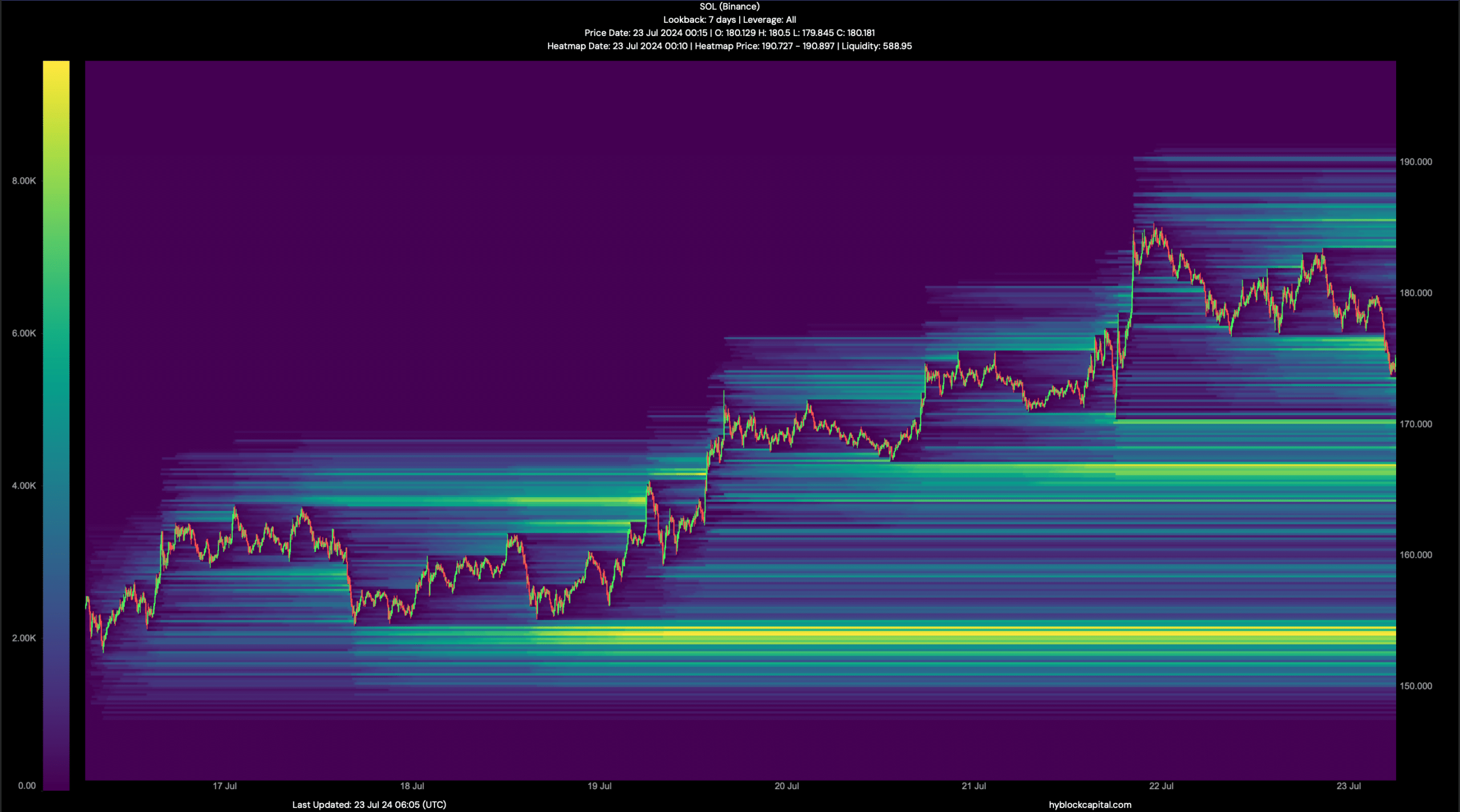

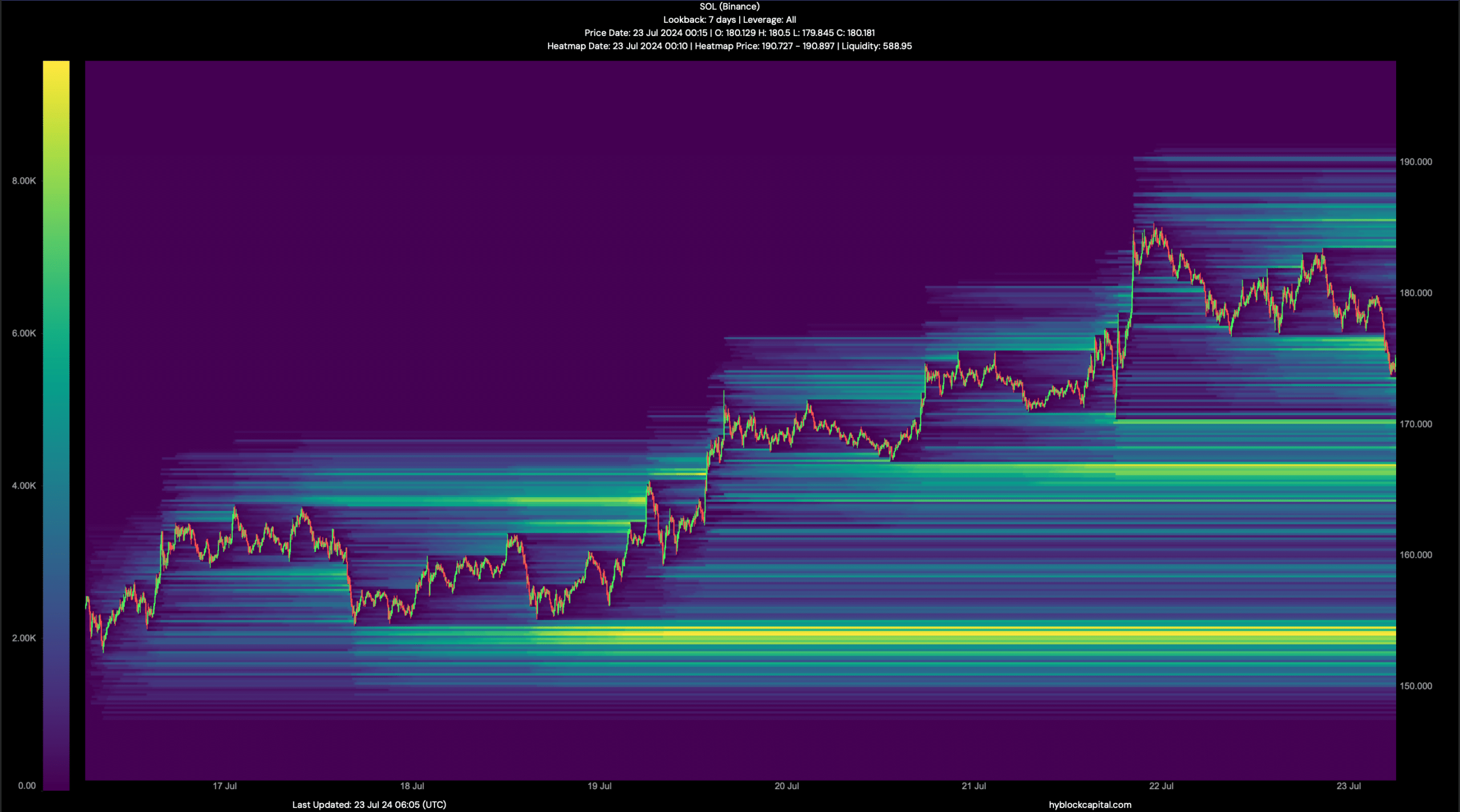

Our analysis of Hyblock Capital’s data showed that if the bears take control of the market, it will not be surprising to see the SOL fall to $166.

However, in the event of a sustained bull rally, investors could witness SOL hitting $190 in the coming days or weeks.

Source: Hyblock Capital