- SOL followed BTC’s lead and rose more than 15% to overturn BNB and become the fourth largest cryptocurrency.

- A new ATH could be within reach if SOL remains above $180.

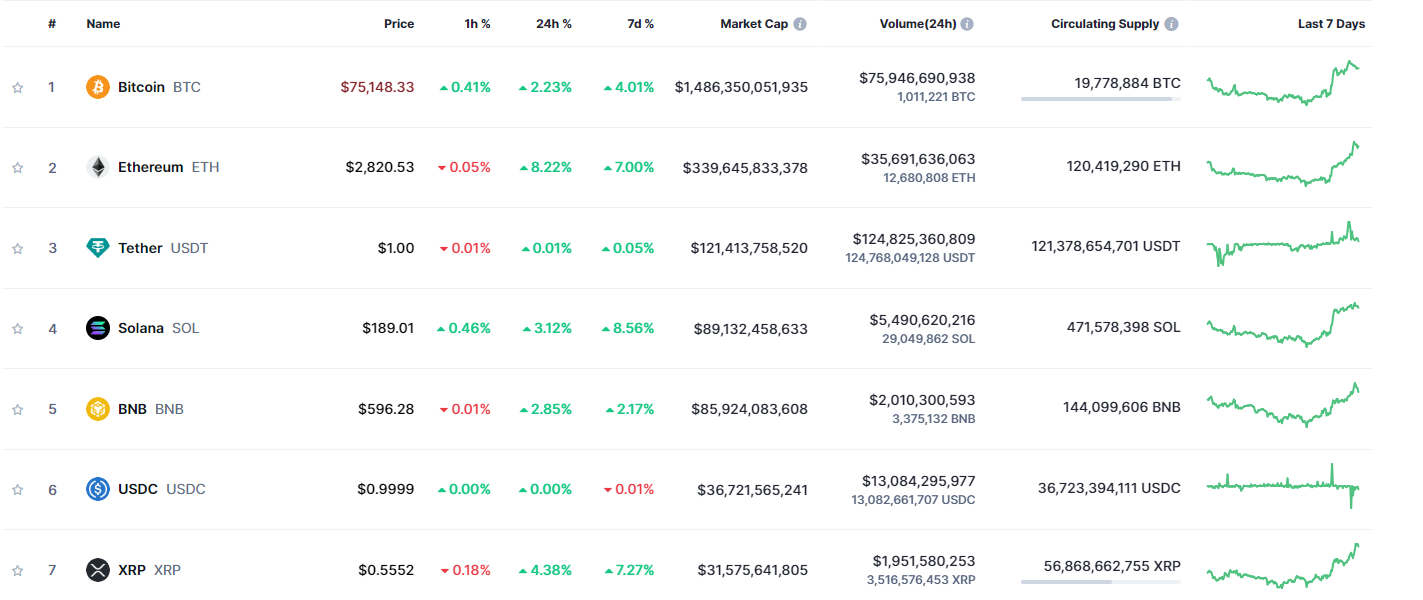

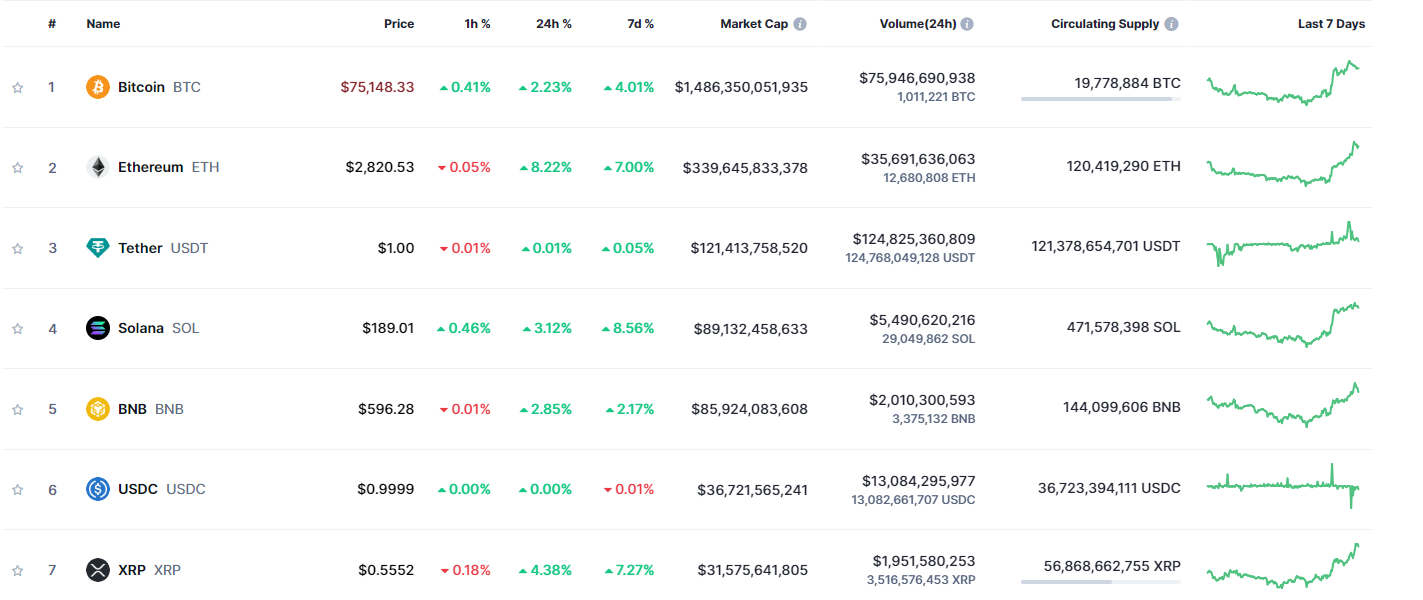

The crypto market is buzzing, up 3% after the US elections, with Solana [SOL] he steals the spotlight, rising 15.8% and flipping Binance Coin [BNB] to become the fourth largest cryptocurrency.

With the SOL rising above $180, analysts are eyeing a potential run towards $250. After a 30.5% monthly tear, is this the one to keep an eye on?

There’s more to it than SOL-flip-BNB

Interestingly, SOL has not only dethroned BNB but also emerged as the best performing among the top 5 altcoins, grabbing significant liquidity from Bitcoin.

This is the second time in a row that Solana is seen as one of the strongest cryptocurrencies. During the third quarter market pullbacks, SOL remained above its breakout levels while most altcoins struggled.

Furthermore, SOL posted a daily gain of over 11%, slightly outperforming BTC on the day of the election results, while Ethereum was up 4%.

So a market shift is taking place. Once the top coin that attracted the most capital while BTC moved bullishly, Solana is now slowly eclipsing Ethereum.

Source: CoinMarketCap

Flipping BNB was a solid confirmation of this shift. If this trend continues in the long term, SOL could soon reach a market cap of $100 billion, which could potentially target ETH’s position next.

What are the chances?

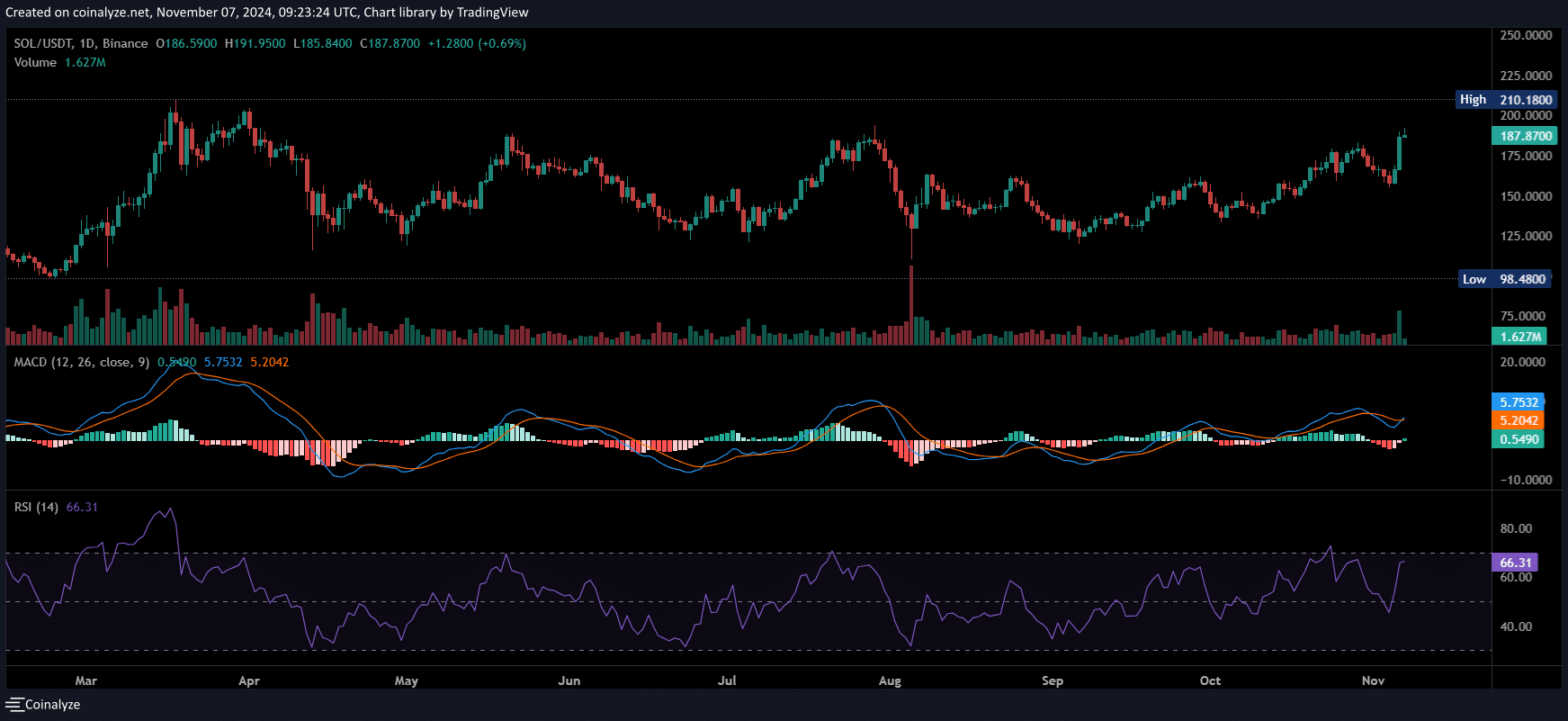

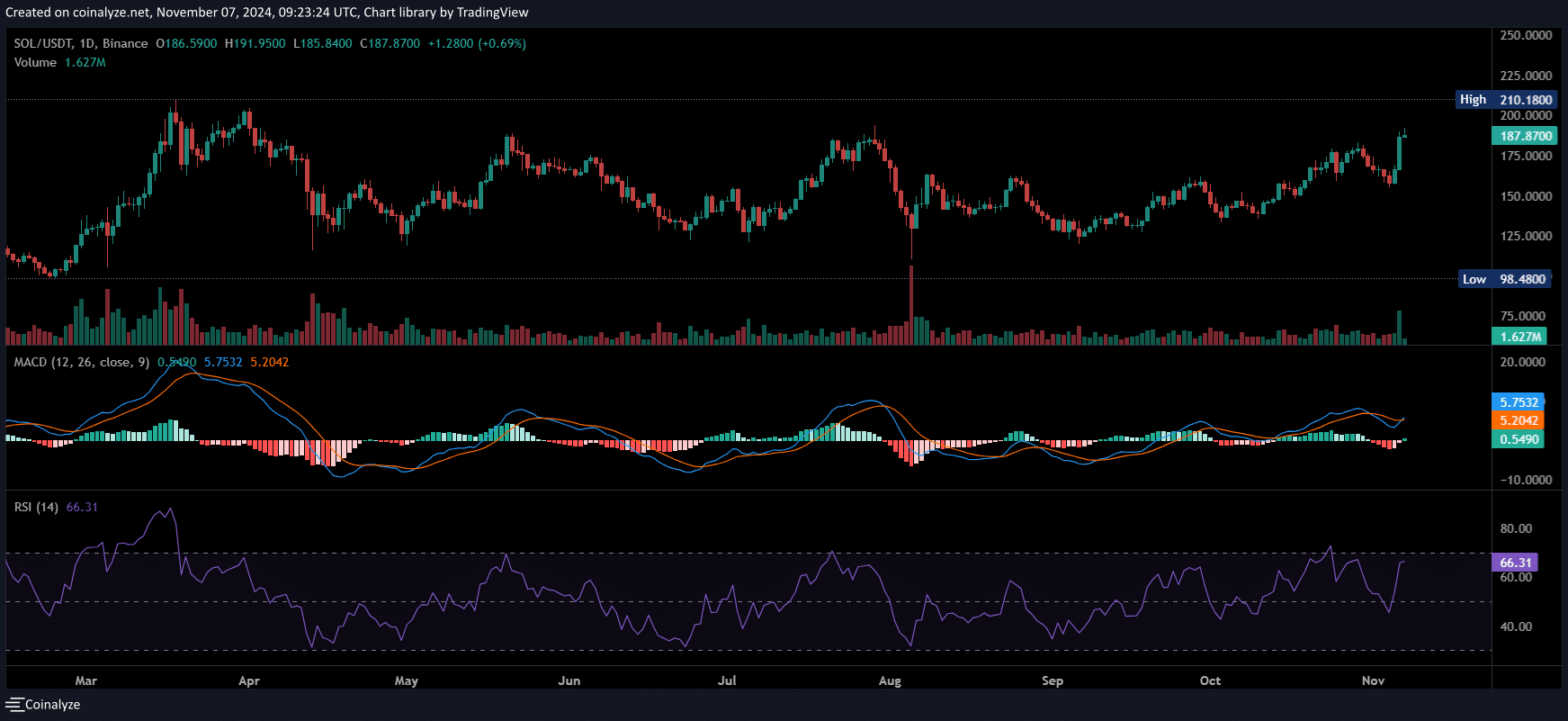

SOL’s break above $180 represents a breakout from an 8-month consolidation range that began after SOL reached its yearly high of $202, coinciding with BTC reaching $73K.

In the past 24 hours, SOL’s daily trading activity increased 210% to $10.7 billion. Moreover, the market capitalization increased by 14.66% to $88.1 billion.

As a result, SOL BNB, with a market cap of $85 billion, has turned around to become the fourth largest cryptocurrency by this measure.

With a bullish MACD crossover on the daily chart, the chances of the SOL testing above the yearly high are high.

Source: Coinalyse

A recovery from the $200 mark, not seen since March, could push the SOL past its previous ATH of $260 in the coming weeks.

If this momentum continues, SOL’s market cap could potentially reach $100 billion. However, to achieve this, BNB will likely have to underperform.

A neck-and-neck race for dominance

With BNB approaching a key resistance level at $600, it will be important to keep an eye on its performance in the coming days.

A recent one report from AMBCrypto noted a bullish near-term outlook for BNB, suggesting it is likely to consolidate within a range unless there is strong accumulation.

Interestingly, this could present an opportunity for Solana bulls to keep SOL in the fourth spot, a position that could be crucial for raising capital amid rising market volatility.

While current momentum is fueled by Bitcoin reaching an ATH alongside a pro-crypto majority in Congress, SOL could see a pullback if it fails to hold its support level, potentially causing it to fall back below the BNB.

Read Solana’s [SOL] Price forecast 2024–2025

In short, Solana has achieved a number of important points milestones This quarter, it has established itself as the go-to high-cap token for stability as BTC enters a risk zone.

While the odds currently favor SOL over BNB, a push towards a new ATH above $260 would further strengthen this trend.