- The Solana network saw growth after the Jupiter Airdrop.

- The price of SOL rose, but social sentiment remained negative.

On January 31, Jupiter, the primary decentralized exchange (DEX) on Solana[SOL]conducted an airdrop event within the network, which attracted significant interest among users.

Solana managed to handle the huge increase in activity, even though it was a major stress test for the network.

Stick to JUP

More than 440,000 addresses successfully claimed 622 million JUP tokens (equivalent to $3.6 billion) from Jupiter Exchange. However, 54% of eligible wallets have not yet claimed JUP, leaving approximately JUP 378 million unclaimed.

The majority of claimants received less than 1000 JUP, with 59% (261,000 wallets) receiving 200 JUP, while approximately 1500 wallets received 100,000-200,000 JUP.

In particular, claimants with higher airdrop amounts tend to retain their JUP holdings.

Interestingly, 72% of claimants who received less than JUP 1,000 have already divested their holdings. The most steadfast group consists of wallets that received between 50,000 and 100,000 JUP.

1/ One of the largest Airdrops on @solana is live

More than 440,000 addresses claimed 622 million ($3.6 billion) JUP token from @JupiterExchange. 54% of eligible wallets have not yet claimed JUP, and there are ~378 million unclaimed JUP pic.twitter.com/7my3PLTo5I

— Tom Wan (@tomwanhh) February 1, 2024

Solana stands tall

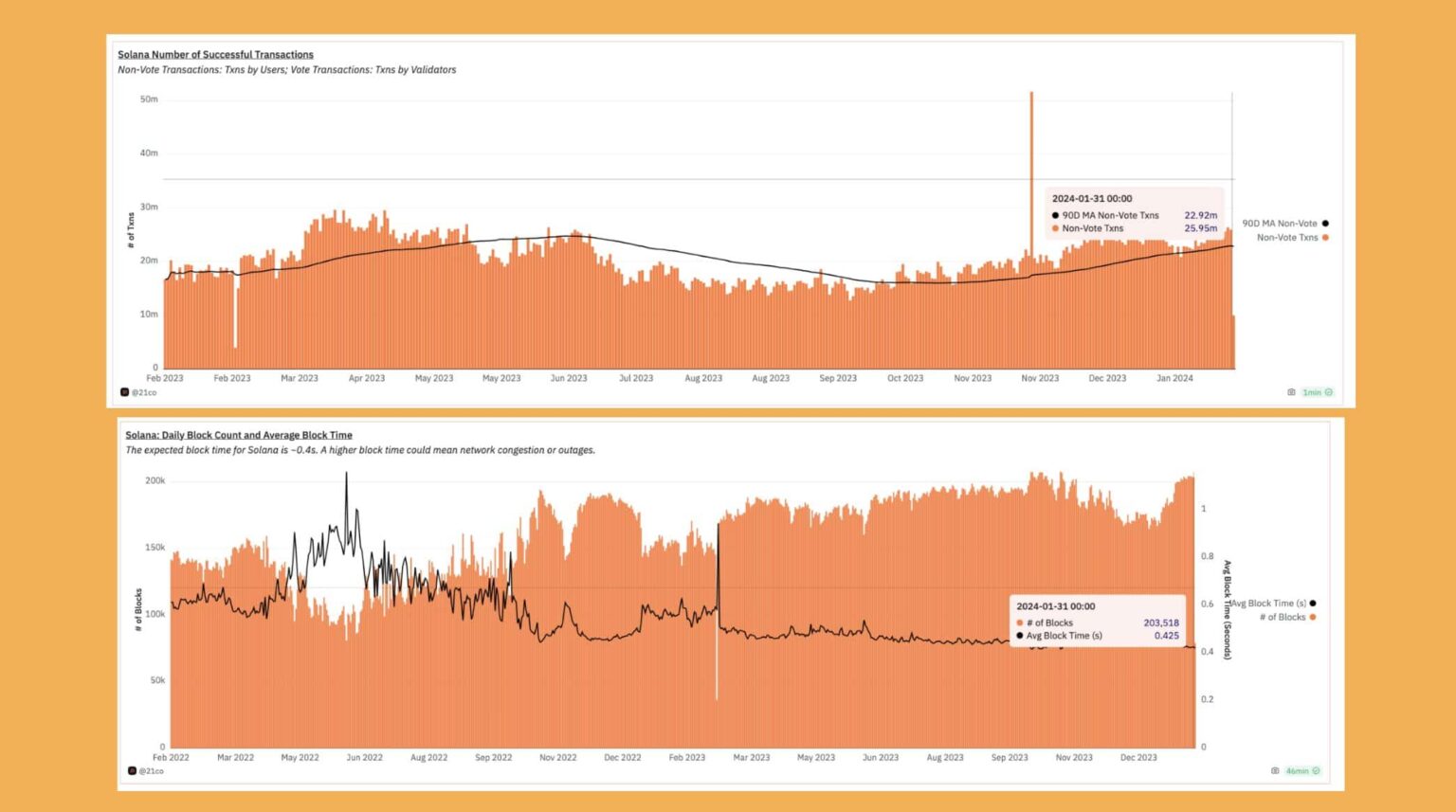

Solana processed 13% more transactions than in the previous 90 days, with a block time of approximately 400 milliseconds.

Although the network appeared to be functioning normally, there was an increase in wallet activity, with increased competition for faster transaction inclusion.

It is striking that on the day of the JUP Airdrop, Solana had a record number of active addresses in one year.

Source: Dune Analytics

At least 50% of these active wallets claim JUP. The increased wallet activity could potentially lead to an increase in average transaction fees, which have already doubled compared to the previous day, January 30.

Nevertheless, the impact on users remained minimal, with each transaction costing approximately $0.017.

Source: Dune Analytics

Skepticism on the social front

A positive impact was also observed for the SOL token. The price of SOL has increased by 4.6% in the last 24 hours. Furthermore, social volume around SOL also saw an increase, indicating that the token was gaining popularity.

However, negative sentiment around SOL grew significantly, indicating that negative reactions around SOL outnumbered positive ones.

Is your portfolio green? View the SOL Profit Calculator

While SOL’s price could rise further from here due to interest generated by Jupiter, the negatively weighted sentiment could hinder its rally.

Source: Santiment