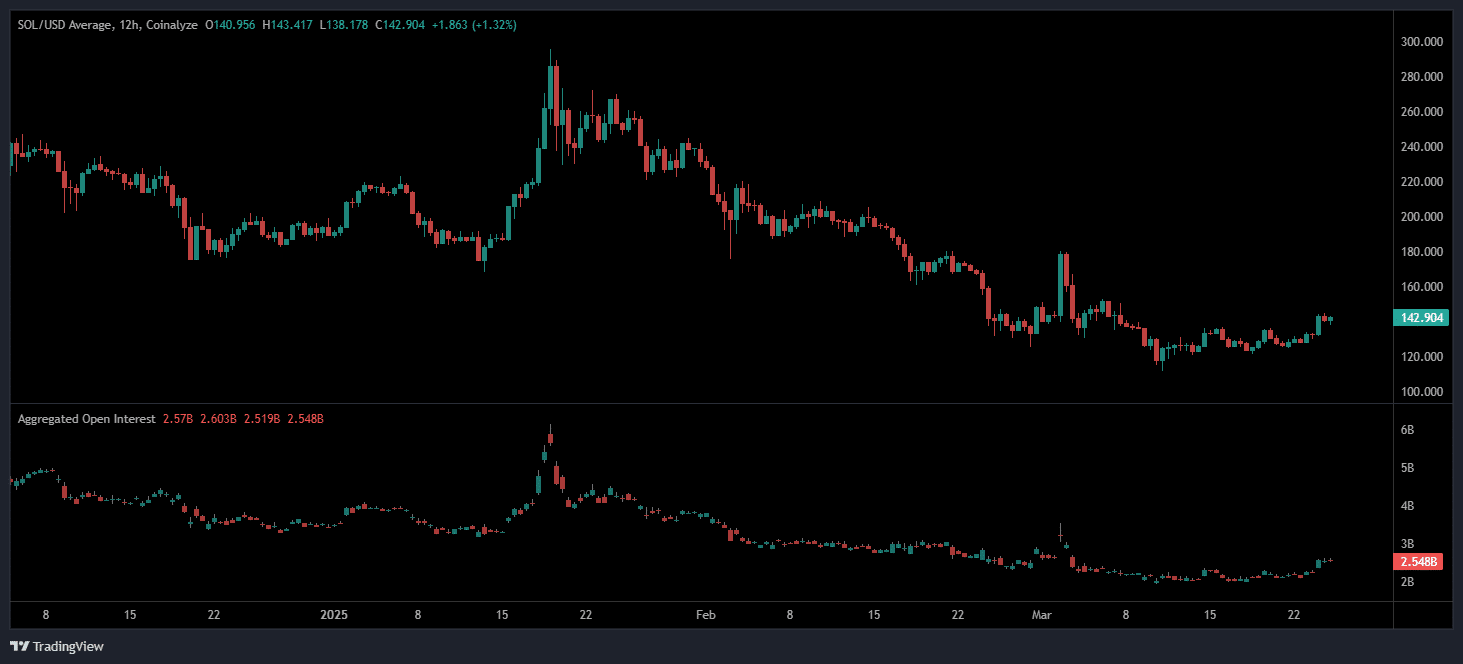

- Open interest fell by 58% since the peak of $ 6 billion from January.

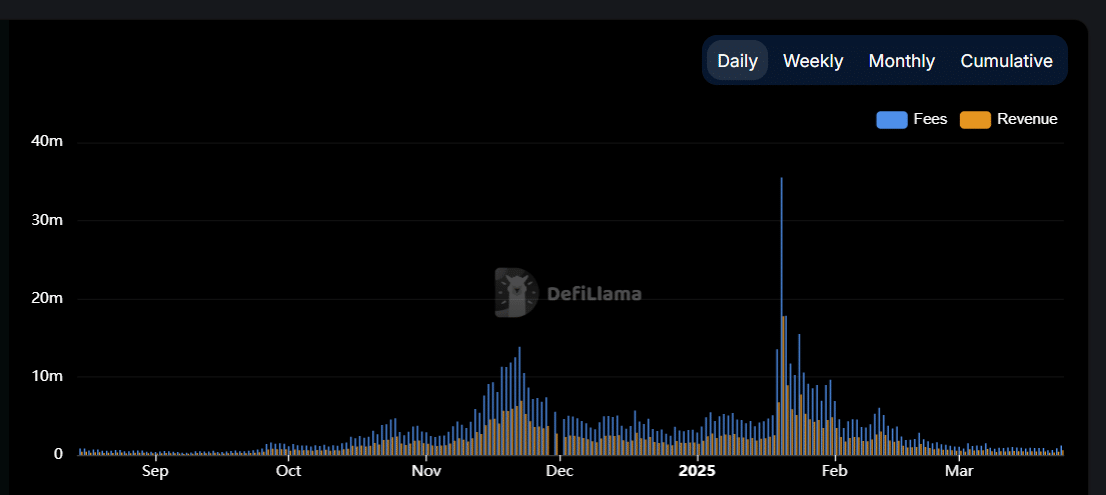

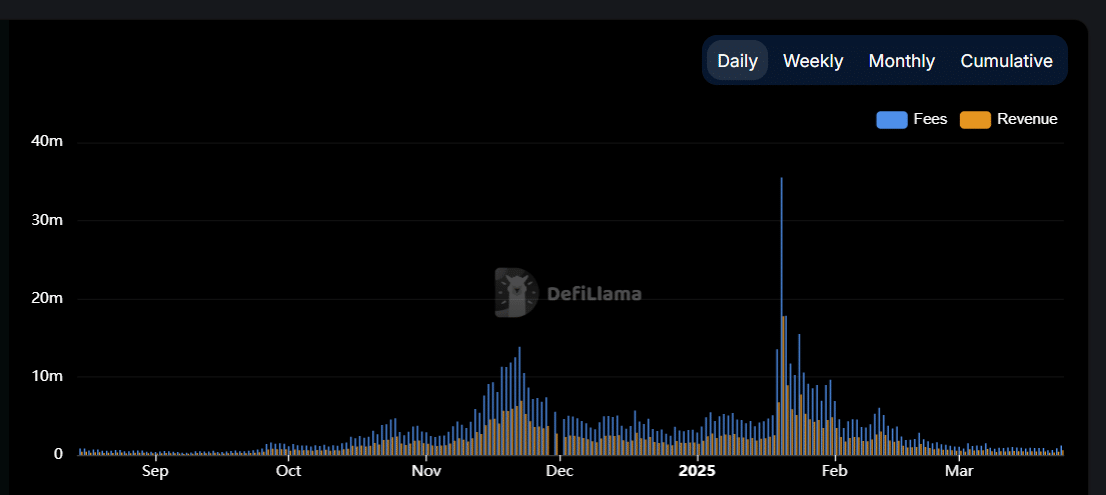

- The daily network costs fell by 96.5% from January to March.

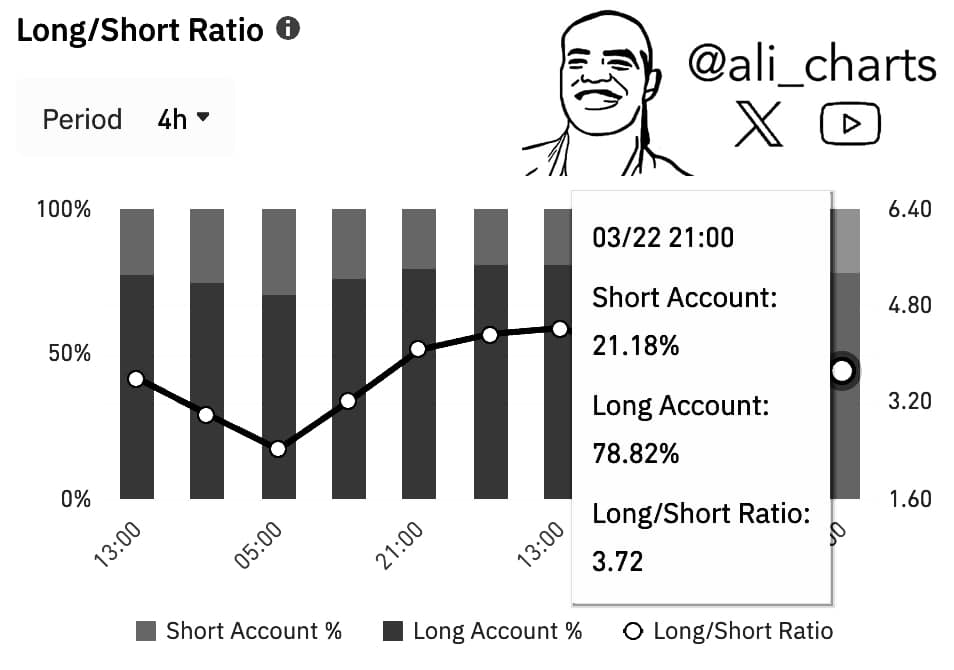

There is an increase in bullish sentiment with Solana traders [SOL] Futures.

According to Data shared Due to Ali -Hitlijsten, 78.82% of the open Solana positions on Binance -Futures long from March 22.

Source: X

This figure translates into a long/short ratio of 3.72, which suggests that traders have more than three times as much chance of turning it upside down than disadvantage.

But how does this get against the rest of the market?

Interrogate

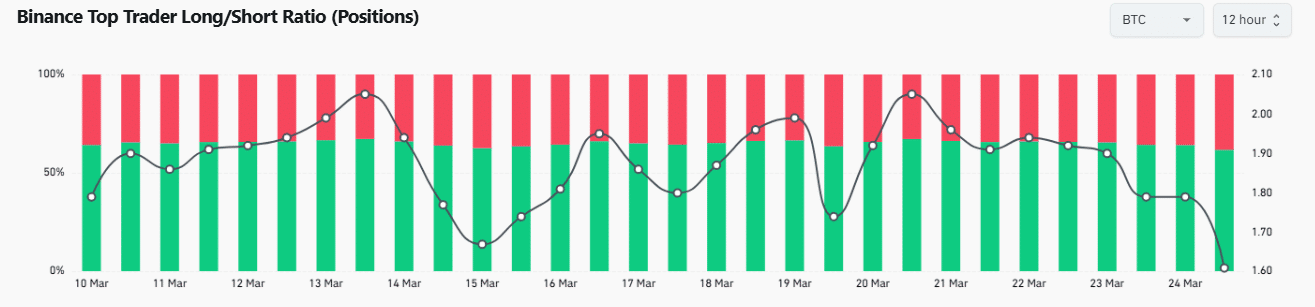

Other data sets with long/short ratio of Binance show a more conservative trend among top traders.

Source: Coinglass

For example, on March 21, Bitcoin Futures showed a long/short ratio of 2.05. But by March 24 it had fallen to 1.71, which marked a decrease of 16.6%.

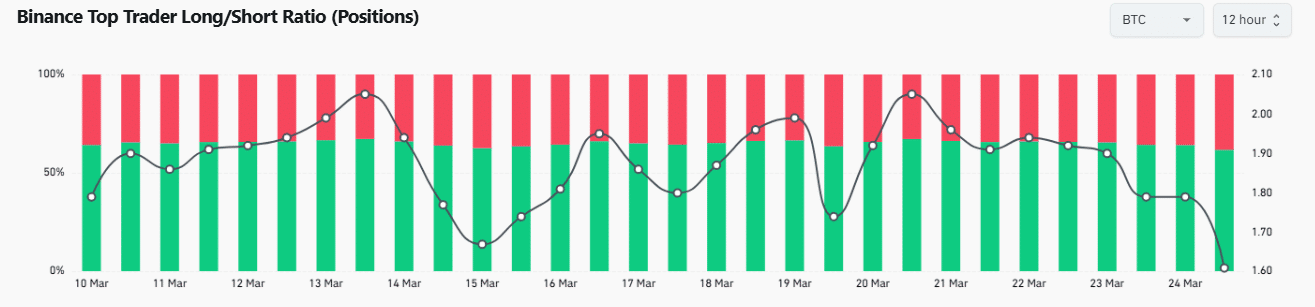

Eyes on Solana Open Interest

This bullish positioning takes place, just as the open interest in Solana Futures seems to be after months of decline.

Aggregated open interest in Solana Futures peaked in January 2025 near $ 6 billion. Since then, according to Coinalyze, it has fallen by 58% to $ 2,548 billion from 25 March.

Source: Coinalyze

This decrease corresponds to a decrease of 52% in the price of SOL, from more than $ 290 in mid -January to $ 142 at the moment. The synchronized price fall and open interest reflects a wide -scale settlement of lifting tree positions.

Now traders are watching closely – because the graph may turn.

Graphs suggest that the price now stabilizes, with Sol registering a modest +1.32% daily profit on 25 March.

Whispers on the chain

Activity on the chain also flashes similar signals, for example, the income data of the reimbursements a similar image.

From October 2024 to January 2025, the daily network costs of Solana rose by 3,453%and reached $ 35.53 million at the end of January. Sales rose parallel and peaked to $ 17.77 million.

Source: Defillama

Since then, the network activity has been crater. From 25 March the daily costs have fallen to $ 1.28 million, a decrease of 96.5% compared to January.

So what does user confidence stop?

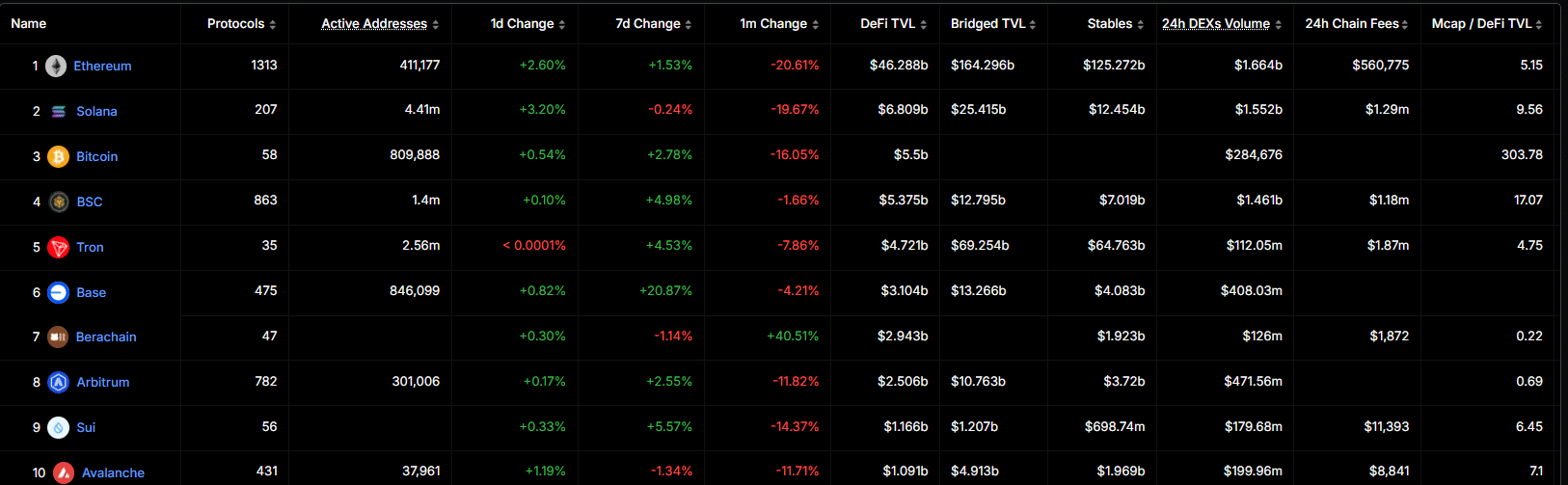

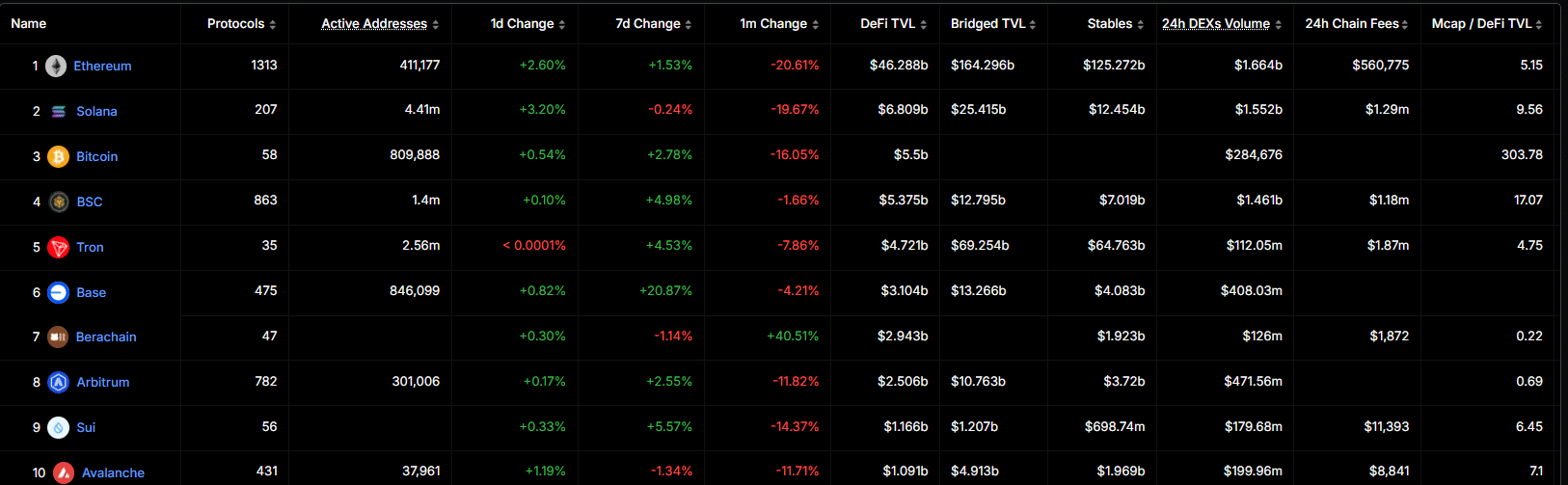

Dex volume on Solana reached $ 1,552 billion in 24 hours, almost corresponding to Ethereum’s $ 1,664 billion, despite Ethereum [ETH] With more than 6x the TVL.

Source: Defillama

This indicates that Solana users transact more often, which contributes to higher transit and possibly higher efficiency per user.

It is also not an insulated metric.

Solana has the second highest Defi TVL under all chains at $ 6,809 billion, behind $ 46,288 billion from Ethereum. This pattern suggests that even if the reimbursements and prices fall, Solana continues to attract real user activity.

Where does Sol go from here?

The Solana price rose upstairs $ 270 by mid -January in October 2024.

It then fell by 51% and settled almost $ 132 in March. Modered by 24 March to 6.13% as the price of $ 142 fluctuated near $ 142.

The dominance of market capitalization also decreased from 70.44% to 34.93% in that time frame. These figures indicate a slower momentum.

With Solana Futures Long/Short Ratio with 3.72, traders seem to anticipate a leap.

This optimism follows a major decrease in costs, open interest and price. Yet the strengths activity of Solana and user involvement, hints on stabilization.