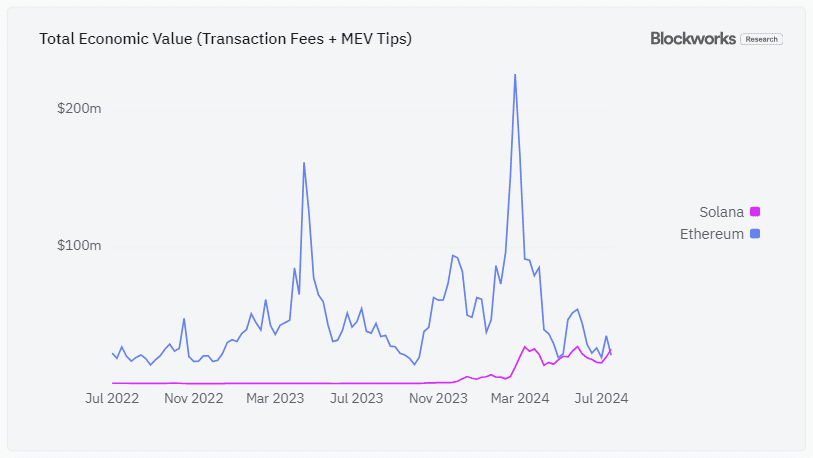

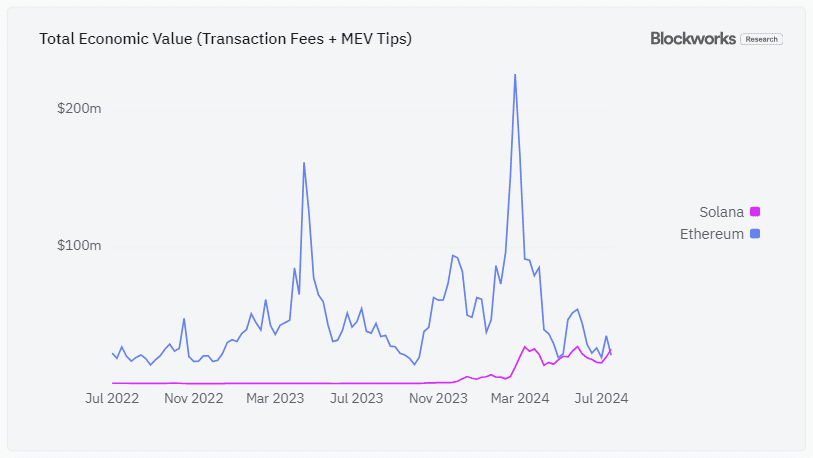

- Solana’s transaction revenue and MEV tips have surpassed Ethereum.

- Solana’s total value increased by 25%, but ETH remained dominant.

The crypto market has been experiencing high volatility lately, and Solana [SOL] is no exception. This month, however, SOL has seen fortunes change in terms of trading volume, market capitalization, and meme coin adoption.

Two days ago, Solana made headlines after flipping Binance Coin [BNB] on the market capitalization, while the former’s market capitalization rose to $85 billion. At the same time, the BNB fell to $83 billion CoinMarketCap.

Solana continues its growth with higher trading volume, DEXs and surpassing Ethereum [ETH] in compensation and MEV.

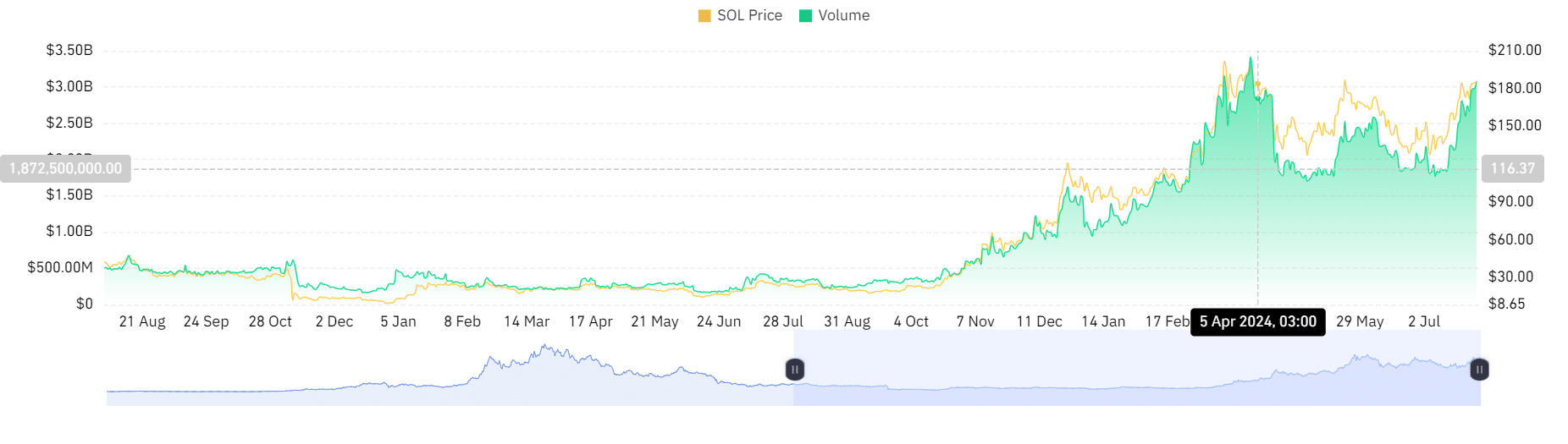

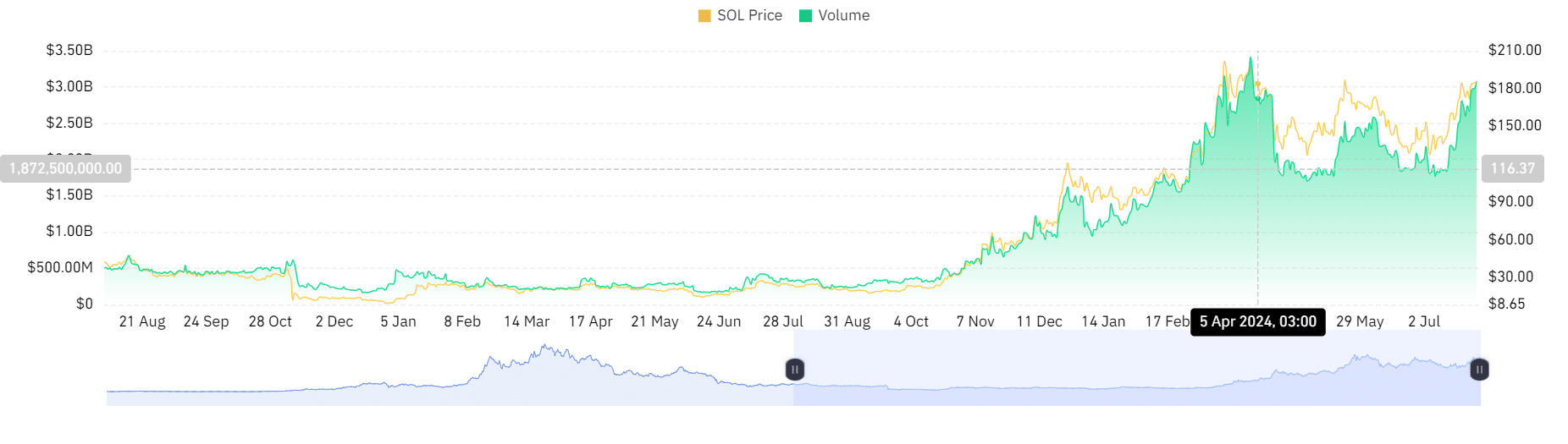

Solana DEX trading volume is $2 billion

SOL is surging and trading volume on the decentralized exchange (DEX) has risen to a record $2 billion. Over the past 24 hours, Solana’s DEX trading volume has increased by 50% from $2.7 billion to $3.09 billion, surpassing both ETH and BNB, per Coinglass.

Source: Coinglass

SOL beats ETH in transaction fees

Looking further, Solana has attempted to dethrone Ethereum in key metrics including total fees and MEV.

On weekly charts, Solana generated $25 million in transaction fees (revenue), while ETH reported $21 million in the same period.

Source:

Dan Smith shared the development via his X Page (formerly Twitter) stating that:

“For the first time ever, Solana surpassed Ethereum in total transaction fees and MEV tips on the weekly timeframe ($25 million vs. $21 million). Solana validators and strikers are absolutely eating this cycle.”

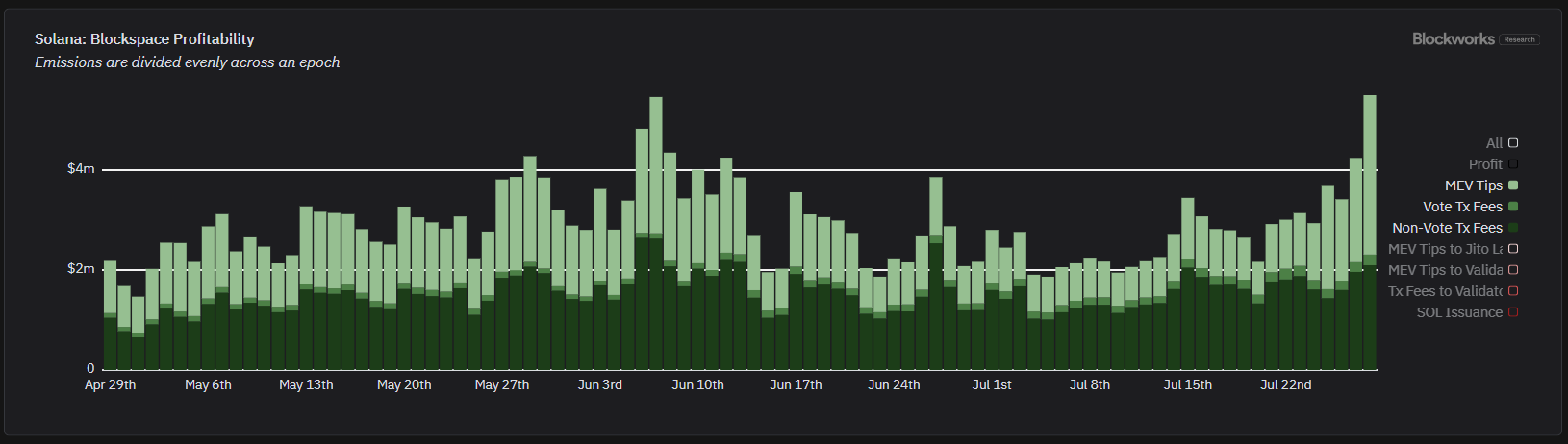

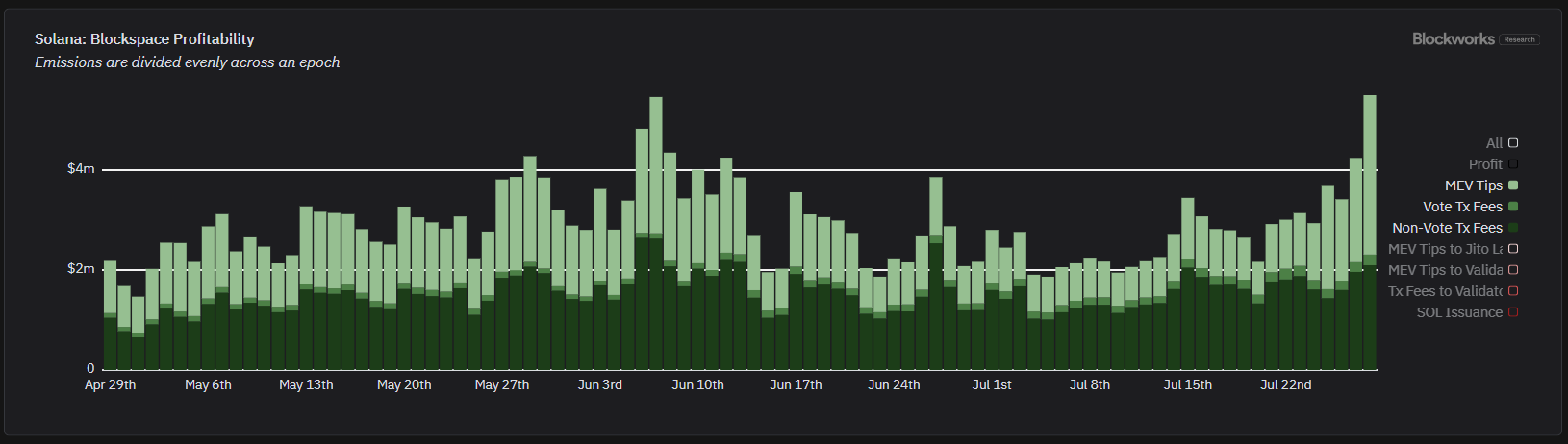

Source: Blokwerken

Solana generated a large portion of his revenue from spot DEX trading. In the last 24 hours, it generated 58% of value from MEV tips and 37% from fees. Sales of $5.5 million were the highest in the past two months.

Source: Dune

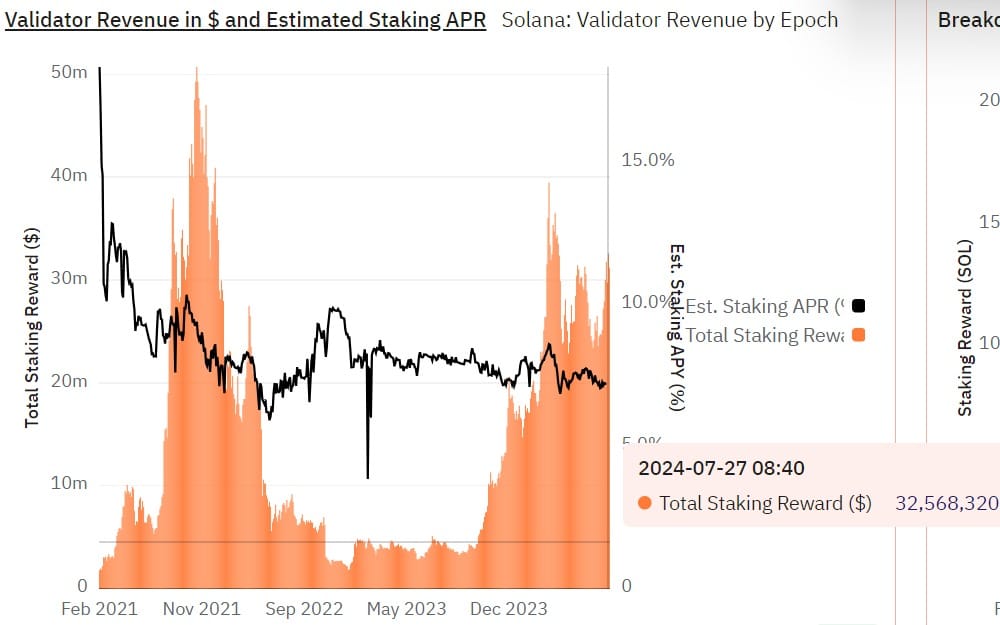

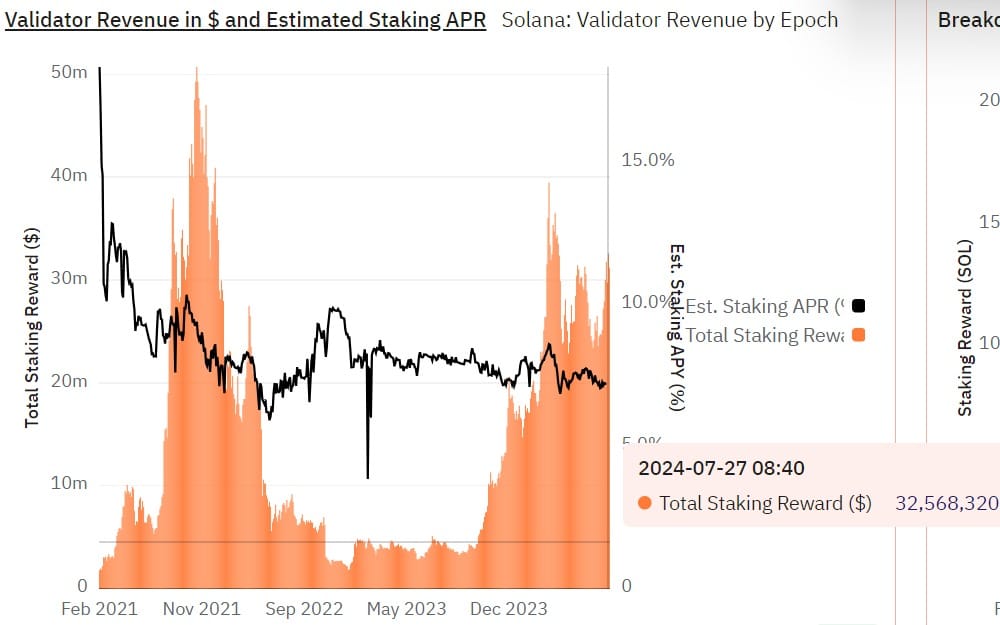

Additionally, Solana holdings have seen significant revenue growth, earning $32 million in the past. These earnings surpassed ETH, which has only generated 3%, while SOL stakes earned 7%.

Source: Staking Rewards

Therefore, the increase in investment returns plays a key role in attracting investors, increasing Solana’s active address and trading volume.

Source: Defillama

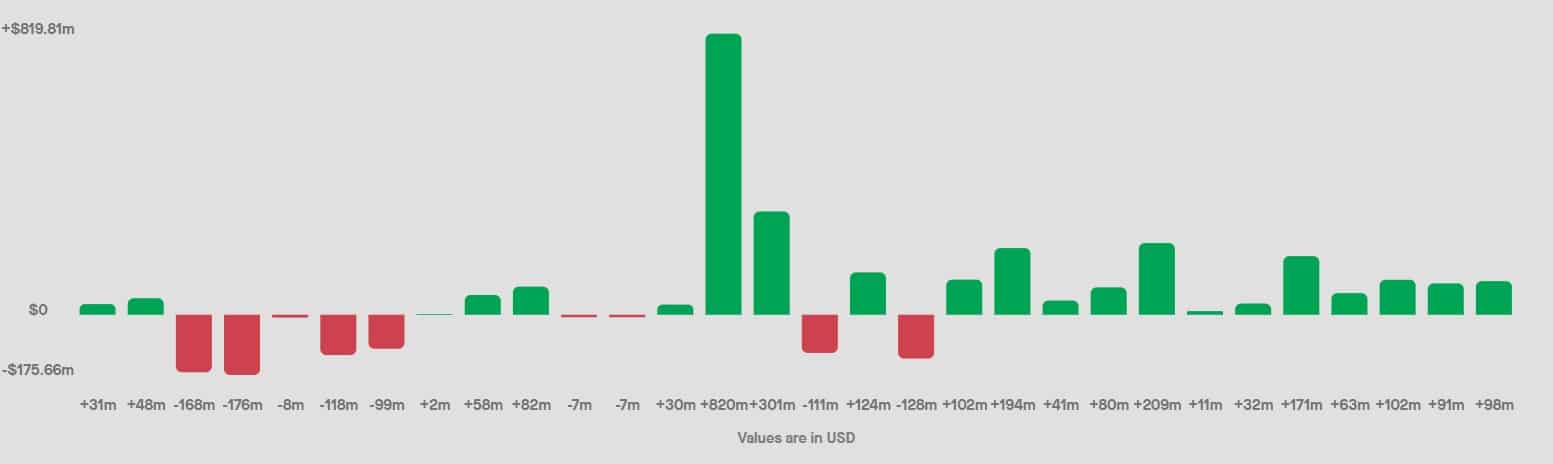

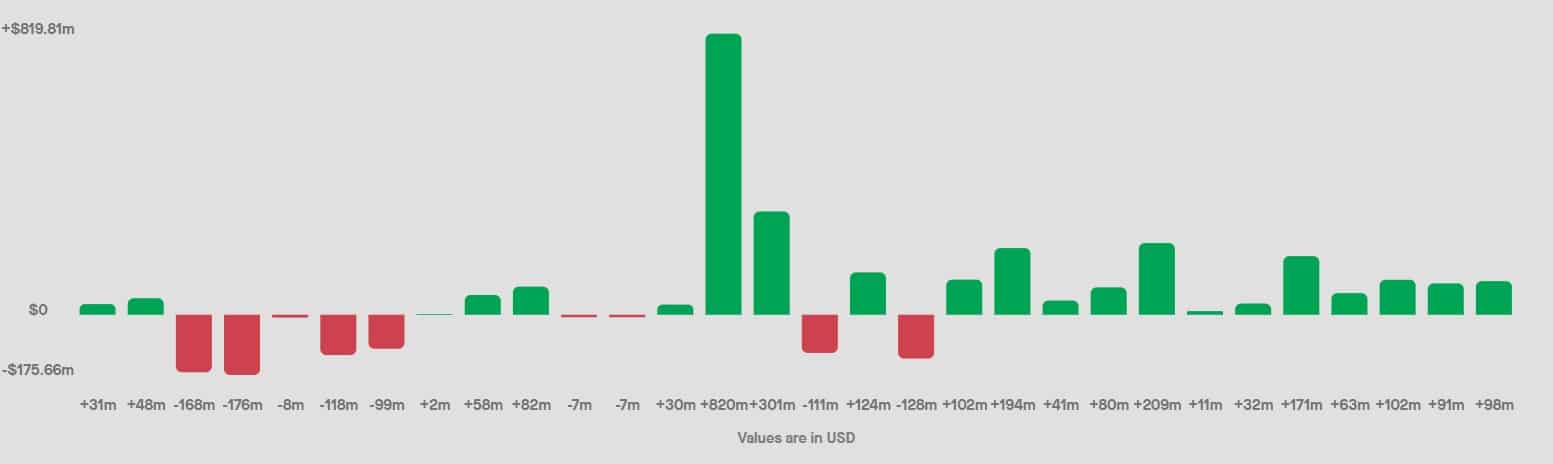

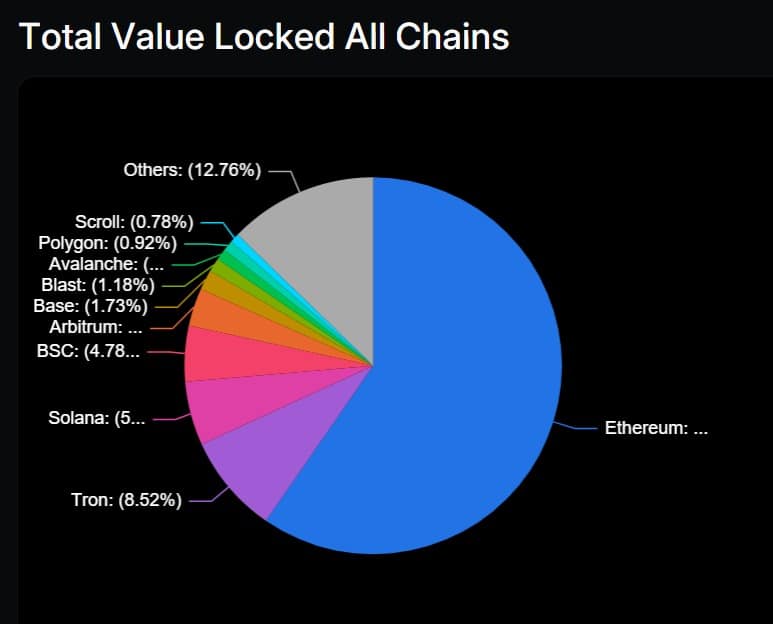

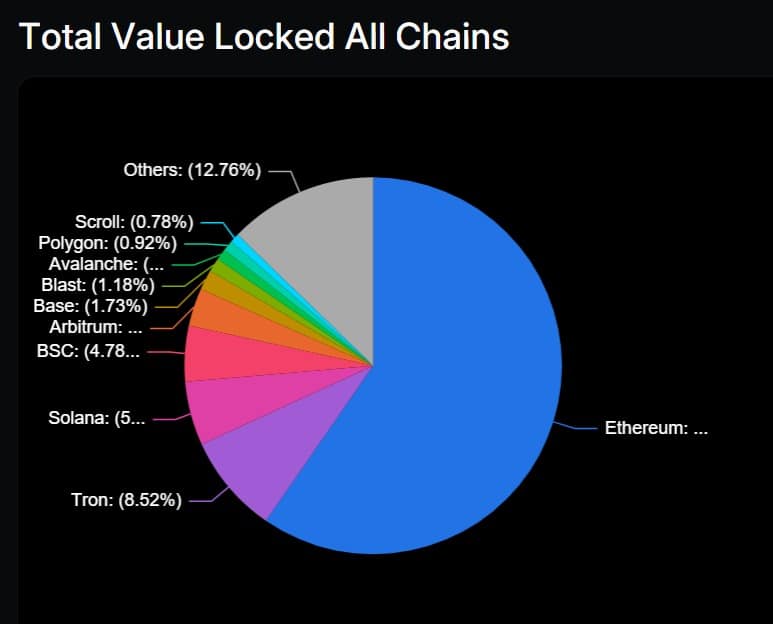

While Solana has experienced an increase in MEV tips and revenue, it still lags in terms of overall value. It rose 25% on the monthly charts to $5.5 billion.

Read Ethereum’s [ETH] Price forecast 2024-25

In this aspect, ETH remains at the top, with a total value of $58 billion. However, Solana surpassed ETH in total economic value by more than $2.2 million, compared to ETH’s $1.97 million.

These shifts in market trajectories position SOL to become the real ETH killer, as it is being called.