Capital movement on blockchain networks is always an important sign for assessing the trust of investors and network activity. Looking at the last week, Base Blockchain came at the top for a positive net flow and did better than all other chains.

Solana was just behind and took second place, even with constant concerns about his network stability.

Basic and Solana Dominate Blockchain Net Inflow

Bitcoin, Ethereum and Arbitrum also saw positive net streams, although not so much. On the other hand, Polygon Pos, Sui and Starknet had small intake, while Avalanche C chain and Op-Minnet experienced important outflows.

It was remarkable that on -Minet had the greatest capital outflow, which showed a weaker investor sentiment against that chain.

Basic is the only chain that does better than $ Sol.

Great considering the sentiment around $ Sol. pic.twitter.com/fuc1mthfug

– Altcoin Buzz (@altcoinbuzzio) 18 February 2025

Base catches Solana in capital inflow

Even with market uncertainty, Base became the leader in net capital inflow. This is quite remarkable, especially given the leading position of Solana in recent times

Market sentiment against Solana is mixed, mainly because of the past and centralization talk. However, the ability to continue to attract strong enhancement suggests confidence in the long -term potential. The recent money flow emphasizes the optimism of investors, even when prices go up and down in the short term.

Solana Price Analysis: Important levels to view

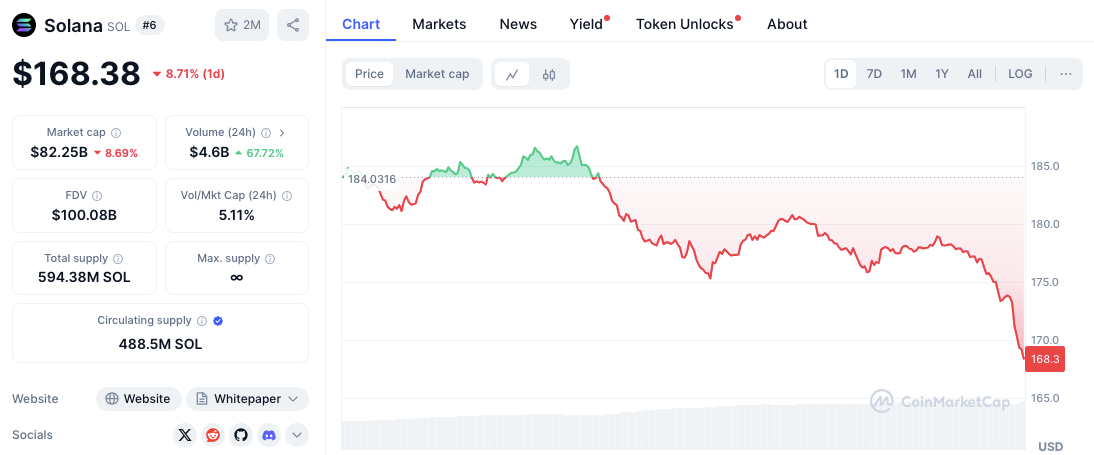

The Solana prize has fallen lately and currently acts at $ 172.16 after a decrease of 6.45% in the last 24 hours.

The prize initially went to an intraday highlight of $ 184.03 before he became resistance, which caused a downward trend. A strong resistance level appeared about $ 184- $ 186, where the sales pressure increased, which led to a withdrawal.

The most important support levels form at $ 172, $ 170 and the range of $ 165- $ 168. If the price does not remain above $ 172, further falls can push it to $ 170. A stronger breakdown can lead to a retest of the $ 165- $ 168 support zone, where buyers can come back to the market.

Source: Coinmarketcap

Market sentiment remains cautious, whereby the trade volume increases by 61.85%and shows more activity, mainly from sellers.

The market capitalization of Solana also fell by 6.45%, which indicates reduced confidence of investors. A recovery above $ 176 could, however, change the momentum, so that the price may be pushed to the range of $ 180.

Related: Solana Meme coins plummet with 91%, but analysts see signs of solid rebound

Technical indicators point to caution

SOL/USD Daily price tag. Source: TradingView

The Relative Strength Index (RSI) is currently 31.27, close to sold -up territory. This suggests that a potential bounce could occur if buying pressure enhances. However, the downward process of the RSI indicates that Beerarish sentiment remains dominant.

In addition, the advancing average convergence -divigence (MACD) shows a bearish crossover. The MACD line is located on -2.69, under the signal line at -10.11, which confirms the narrow pressure. Negative histogram stations also reinforce the prevailing bearish Momentum.

February 2025 price output for Solana

Coincodex market projections for February 2025 suggest a possible price increase of up to 10.51%, which means that the average price of Solana is around $ 189.50.

Related: Despite the difficult year, Solana shows growth in some important areas

Predicted price fluctuations indicate a reach between $ 177.26 and $ 195.47. If these predictions are correct, Solana could yield a short -term efficiency of around 13.99% compared to current levels.

Safeguard: The information presented in this article is only for informative and educational purposes. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses as a result of the use of the aforementioned content, products or services. Readers are advised to be careful before taking action with regard to the company.