- The increasing volume combined with the price drop could cause a lower value for the memecoin.

- If a reversal occurs, PEPE could jump to $0.000014.

The past seven days have been tough for memecoins, including Pepe [PEPE]. According to data from CoinMarketCap, the price of the token was $0.000012.

This marked a decline of 15.92% over the past seven days.

However, it doesn’t seem like things will change for the better. One reason for this could be related to the increasing volume of PEPE.

At the time of writing this amounted to $1.22 billion. An increase in volume means that interest in a particular cryptocurrency is increasing. On the other hand, a decrease in volume indicates less buying and selling.

No way forward for the memecoin

If the volume increases along with the price, it means that a lot is being purchased. In this case, the uptrend could be strengthened.

However, as the volume of PEPE increased, the price decreased, indicating that the downward trend could become stronger. If this continues, the token’s price could plummet and a price target of $0.000020 is possible.

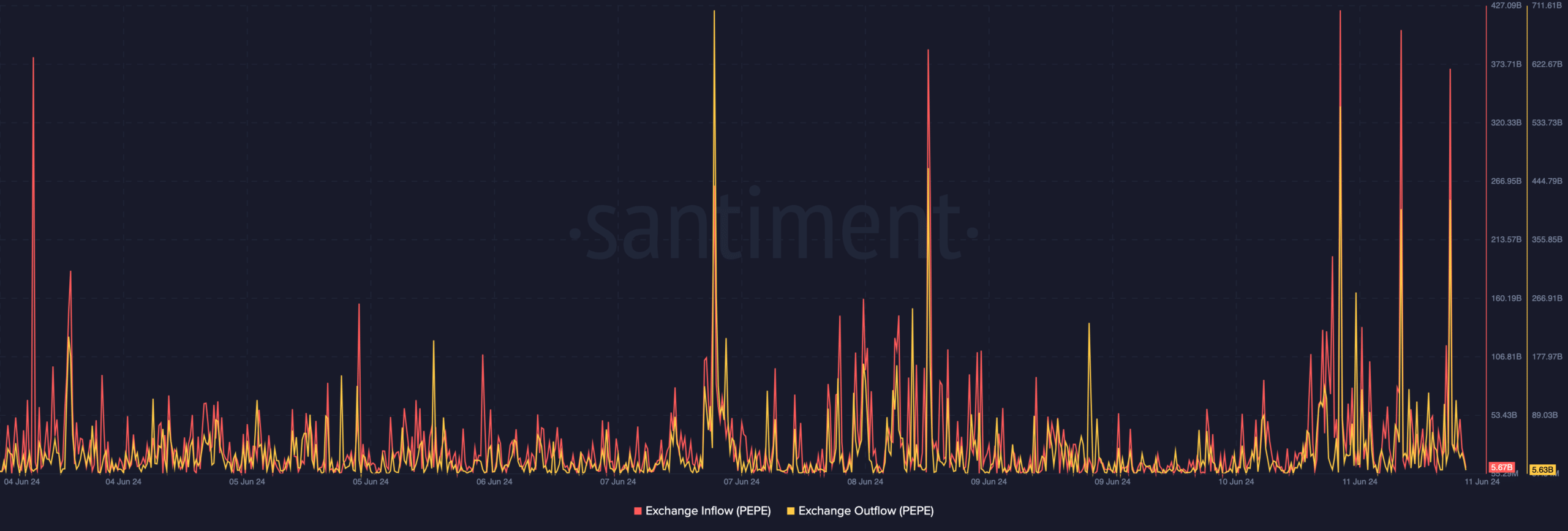

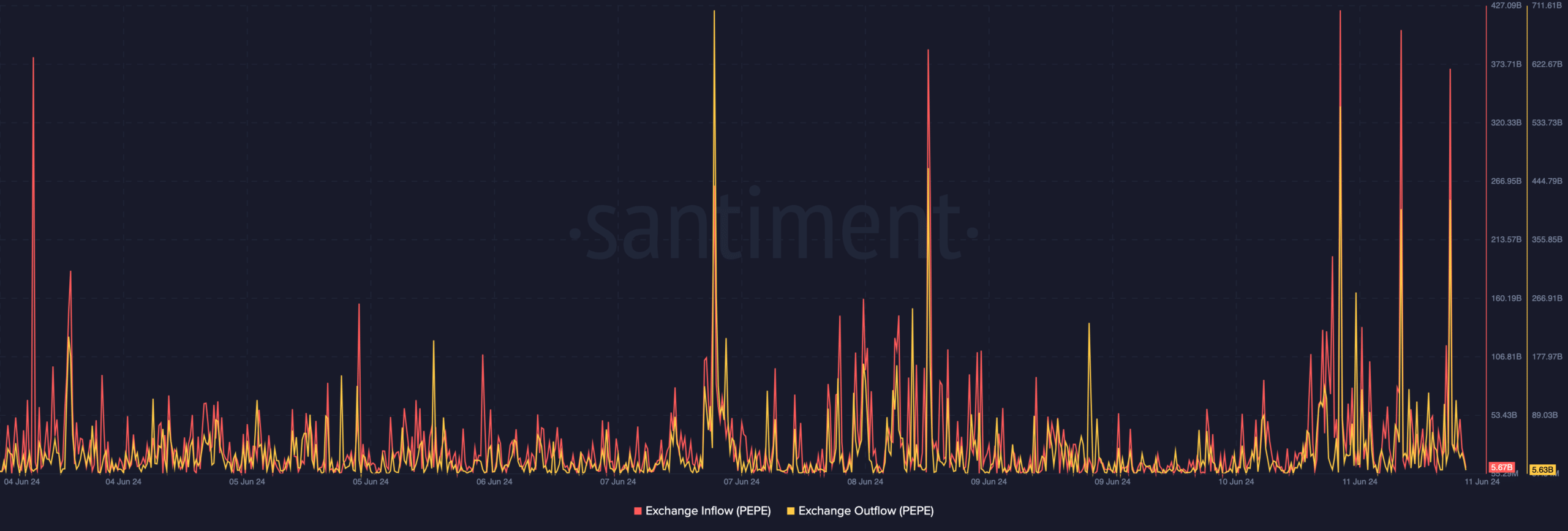

Source: Santiment

A few days ago, AMBCrypto reported that whales were buying the dip. In non-crypto terms, a whale is an individual who owns large amounts of cryptocurrency.

Due to their large assets, whales have the ability to significantly influence the price. However, the effect of the accumulation has yet to be reflected on the price of the memecoin.

As a result, we went further to check whether the sales were still intense or not. To do this, we looked at the exchange flow.

According to Santiment, the inflow of foreign exchange amounted to 5.63 billion. On the other hand, PEPE outflows amounted to $5.67 billion. Exchange Inflow tracks the number of tokens sent to exchanges.

An increase in stock market inflows usually leads to a price drop. However, if the outflow of the currency increases, it means that market participants are choosing to hold the cryptocurrency.

Source: Santiment

Hence the difference in and outflow was minimal. Therefore, the token may not undergo another correction.

PEPE’s price looks at $0.000010

As such, PEPE may not fall below $0.000010. However, if market conditions become overheated, bearish forces can drive the price down.

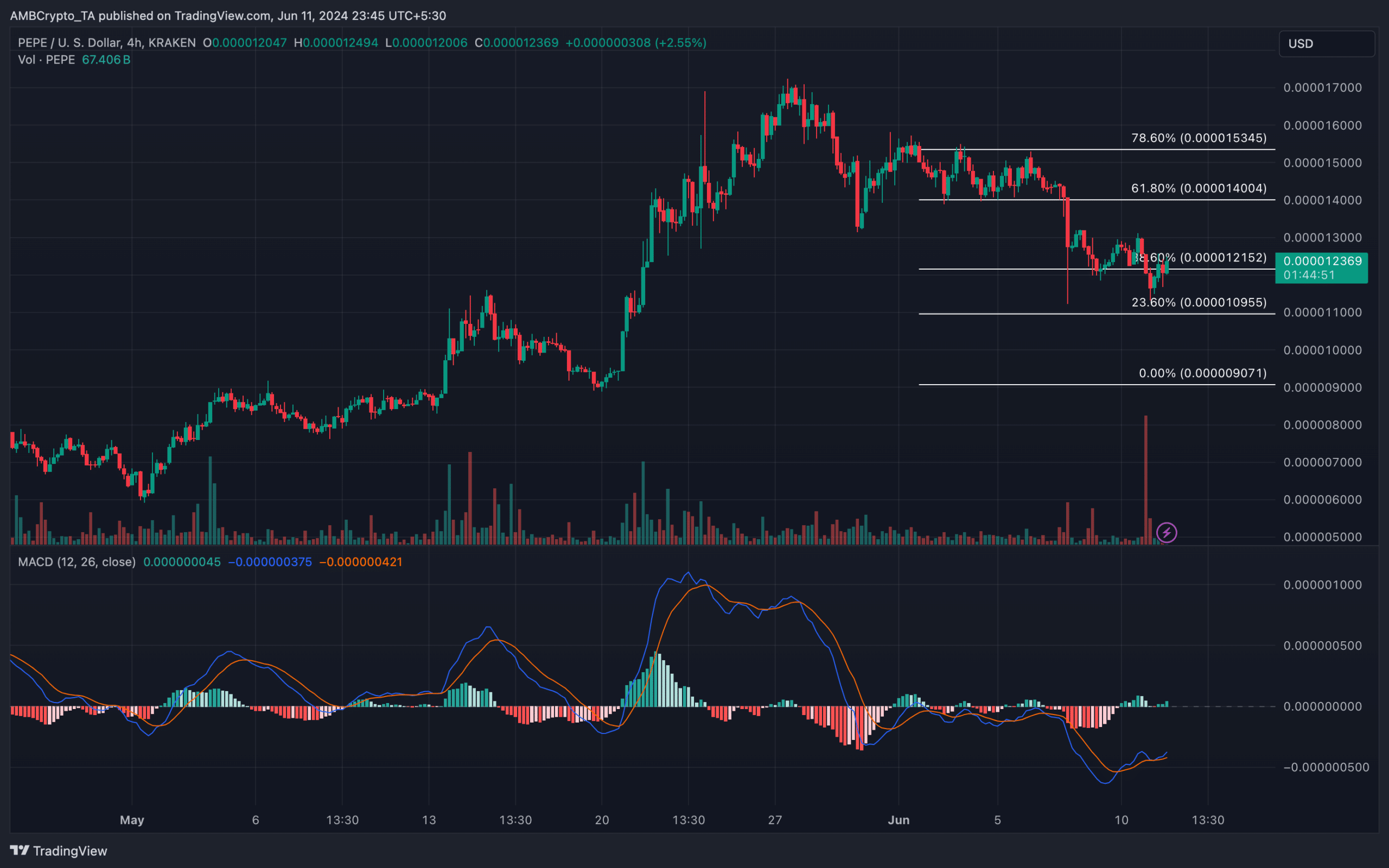

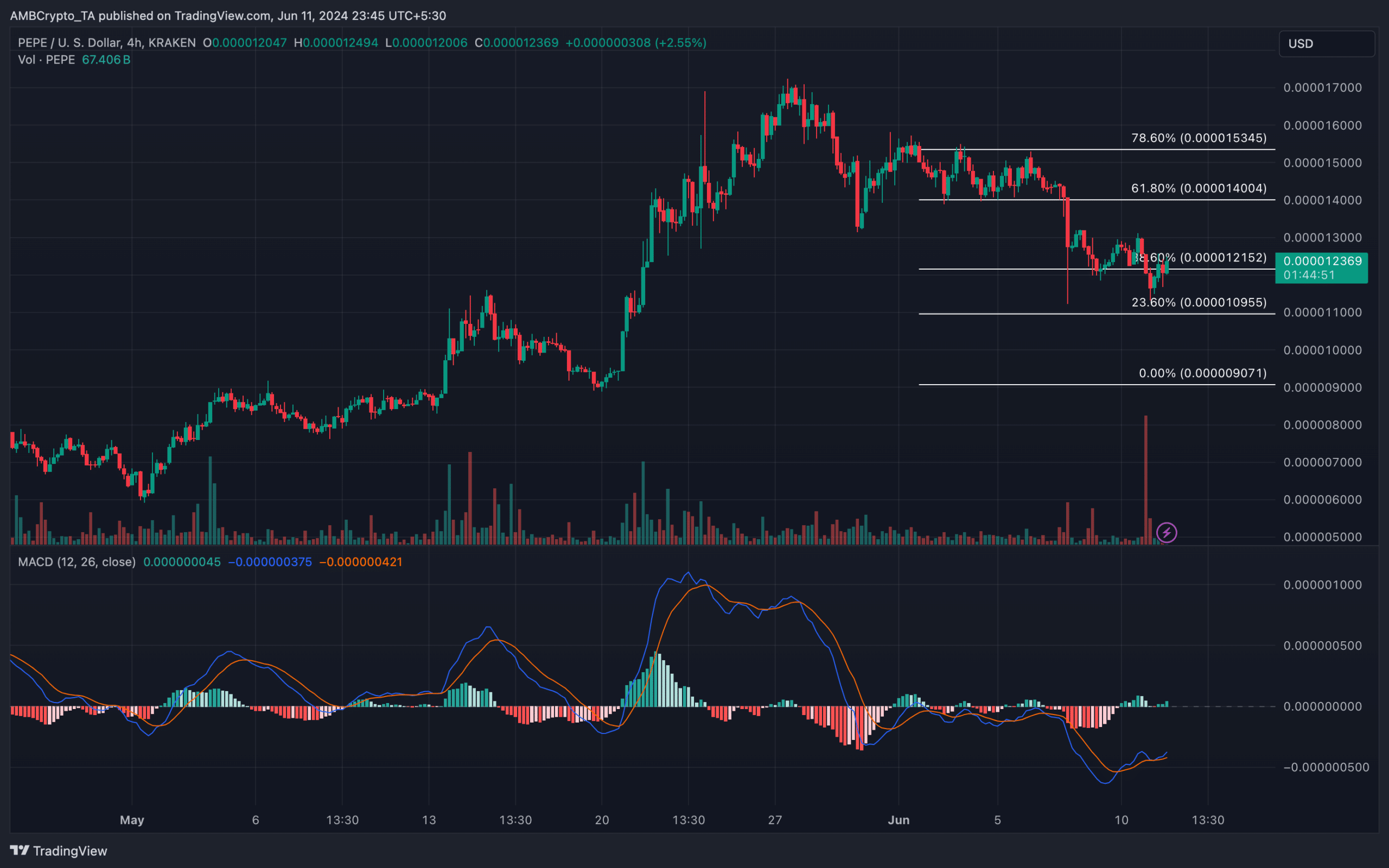

From a technical perspective, AMBCrypto analyzed the token on the 4-hour chart. First, we looked at the Fibonacci retracement tool, which shows a specific support and resistance point.

This could be critical to the token’s price movement. At the time of writing, the Fibonacci level of 0.236 stood at $0.000010. This was a support level for PEPE and indicates that the price could fall to the region.

This was also supported by the Moving Average Convergence Divergence (MACD). At the time of writing, the MACD was positive.

Source: TradingView

Read Pepe’s [PEPE] Price forecast 2024-2025

But the 12 EMA (blue) and 26 EMA (orange) were in the negative territory, implying that the momentum was not completely bullish.

However, if buying pressure increases, PEPE’s price could add to the resistance at $0.000014 where the gold ratio of 0.618 was.