- APT was the second highest loser over the past 24 hours, highlighting the current bearish momentum.

- However, market indicators and sentiment suggest that this downturn is only a minor setback.

CoinMarketCap reports that Aptos [APT] has seen a notable decline, losing 8.09% in value over the past 24 hours. Despite this decline, the overall outlook for the asset remains bullish, supported by a 36.63% gain for the month.

AMBCrypto has provided an in-depth analysis of why this growth is expected to continue.

APT is ready for a potential rally

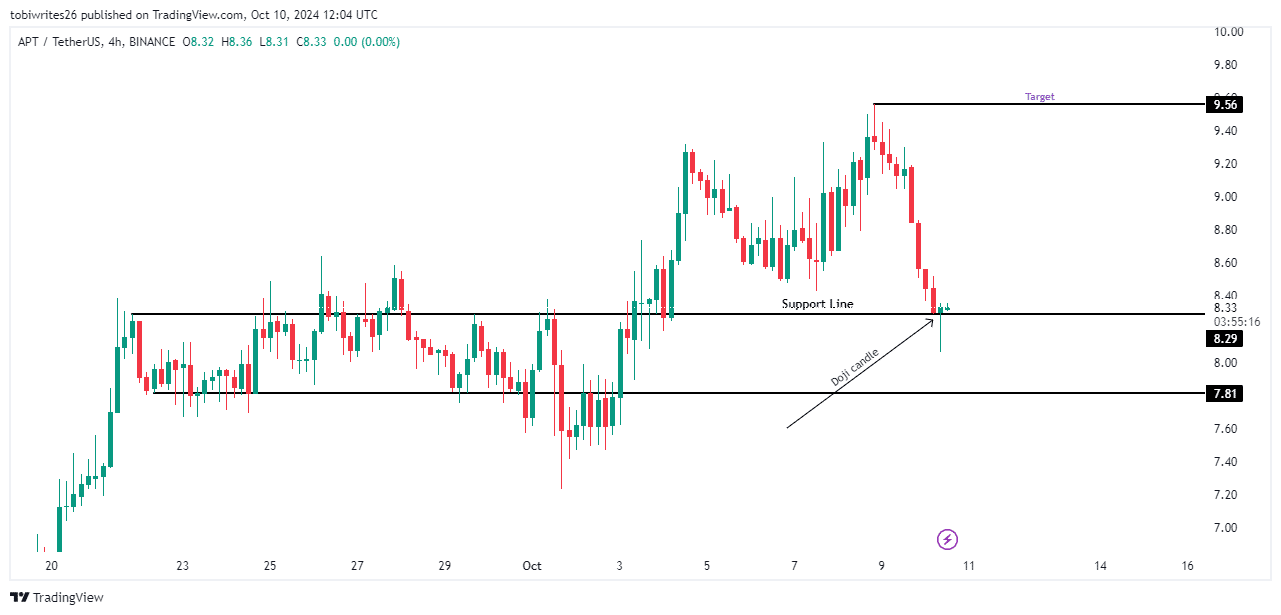

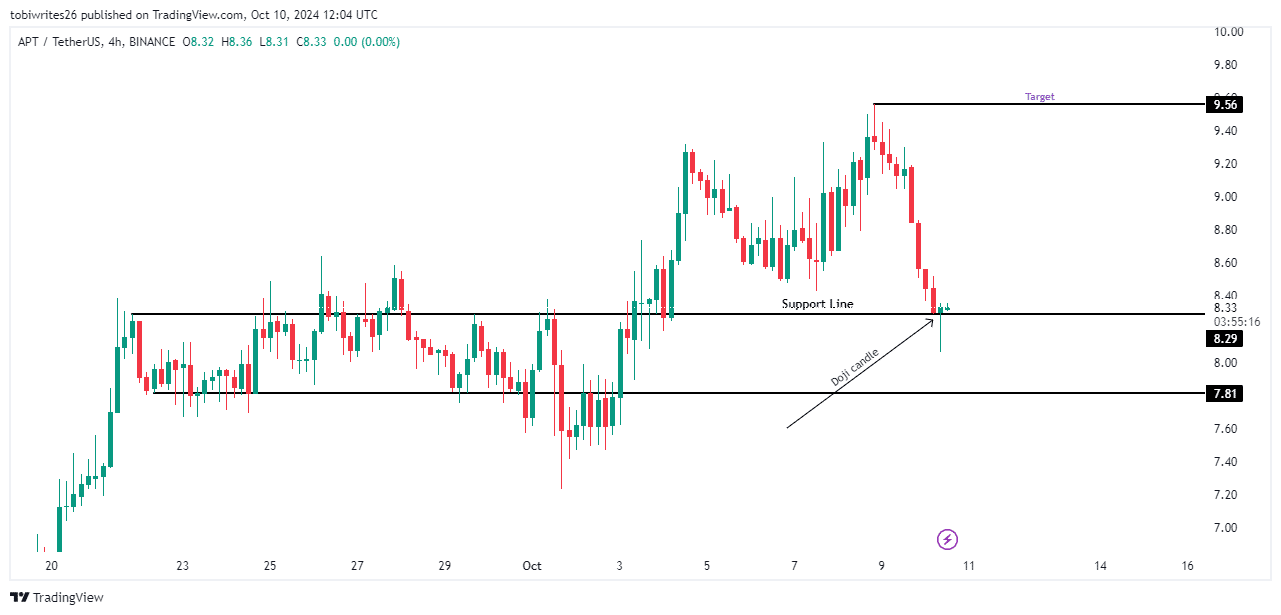

Using the four-hour time frame, APT appears bullish, having retreated to a resistance level that could convert to support, which could serve as a catalyst for an upward move.

The support level at $8.29 is crucial as significant buying pressure is expected. This level is likely to hold as indicated by a bullish Doji candlestick pattern, indicating strong buying interest at this price.

If this support level is maintained, APT is expected to regain its previous high at $9.56, where a major liquidity cluster resides. Otherwise, it could trade lower and find temporary support at $7.81.

Source: trading view

Bullish signals strengthen for APT

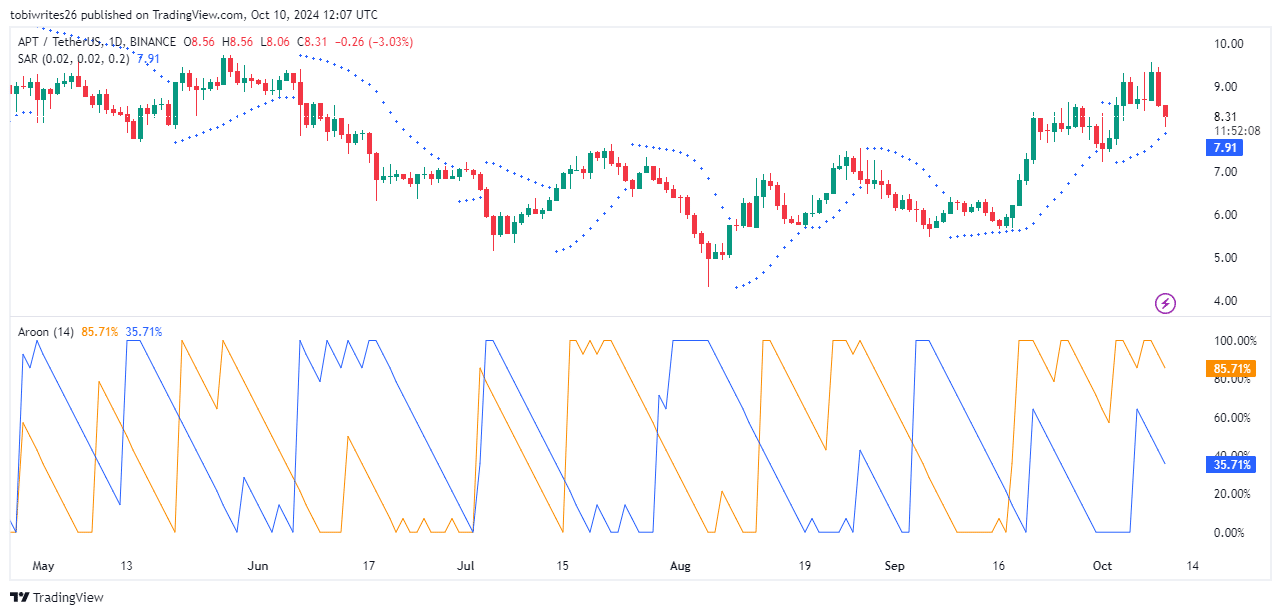

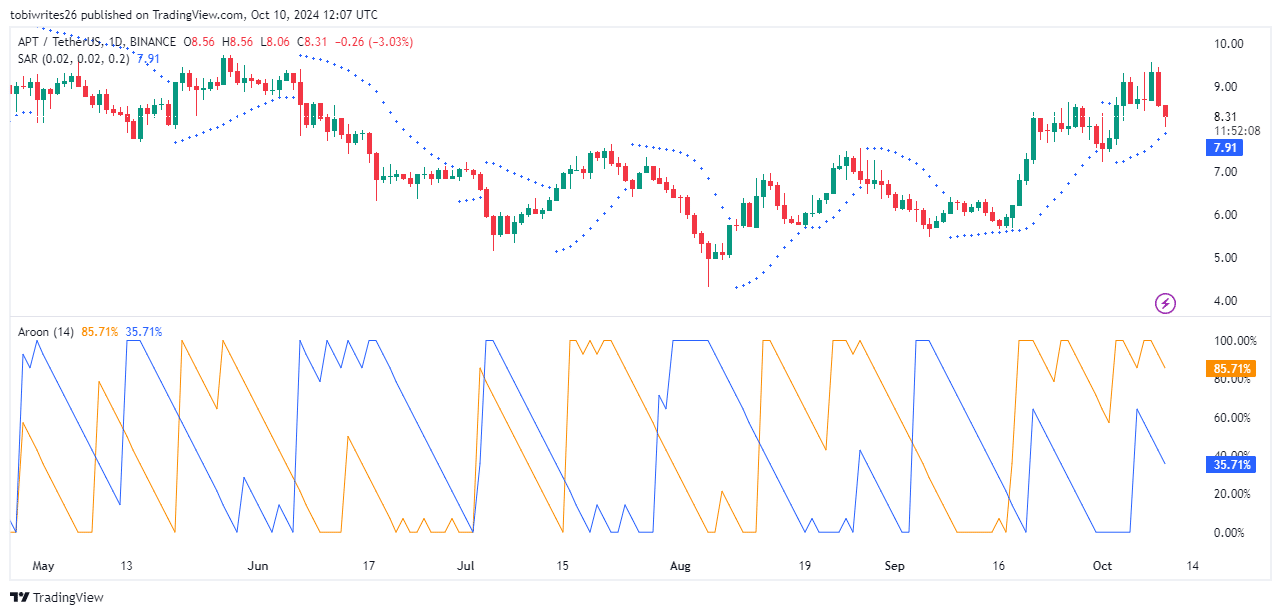

Technical indicators such as the Parabolic SAR (Stop and Reverse) and the Aroon Line show that APT appears bearish at a glance, but underlying trends suggest a continued bullish stance, according to AMBCrypto.

The Parabolic SAR, which uses dots to indicate the direction of the market, shows dots placed below the price bar, indicating an uptrend. This arrangement suggests that bulls are still actively influencing the market.

Similarly, the Aroon indicator, which uses two lines – the Aroon Up (orange) and Aroon Down (blue) – to measure market movements, supports the bullish outlook.

APT is currently in a bullish phase, with the potential to rise further as indicated by the Aroon Up line placed above the Aroon Down line.

Source: trading view

Mixed signals are emerging, but for APT the bulls may gain the upper hand

APT’s market presents mixed signals, according to the latest on-chain metrics.

For example, Open Interest has fallen 10.72% to $162.74 million over the past 24 hours. Mint glass. This decline indicates a bearish undertone, indicating that derivative contracts are trending bearish.

Source: Coinglass

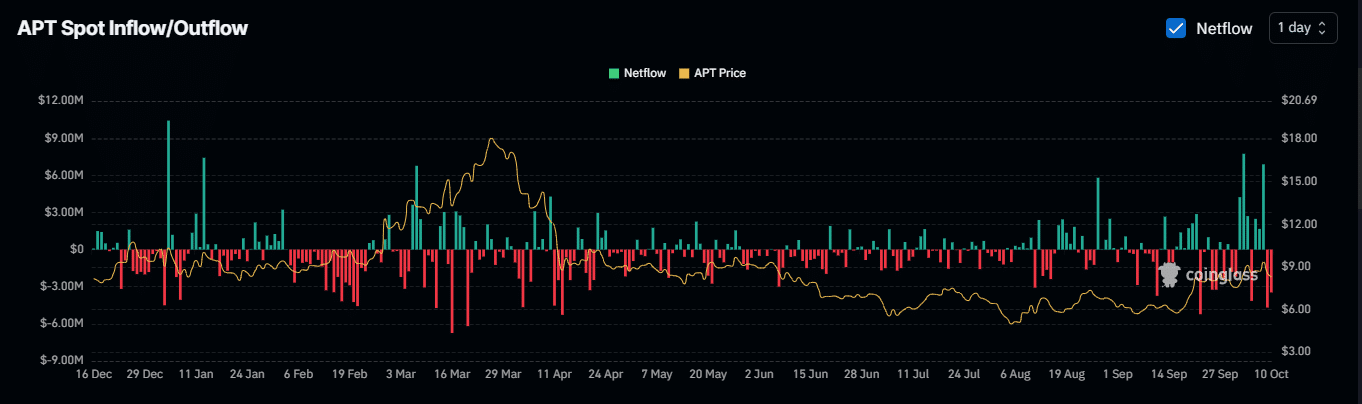

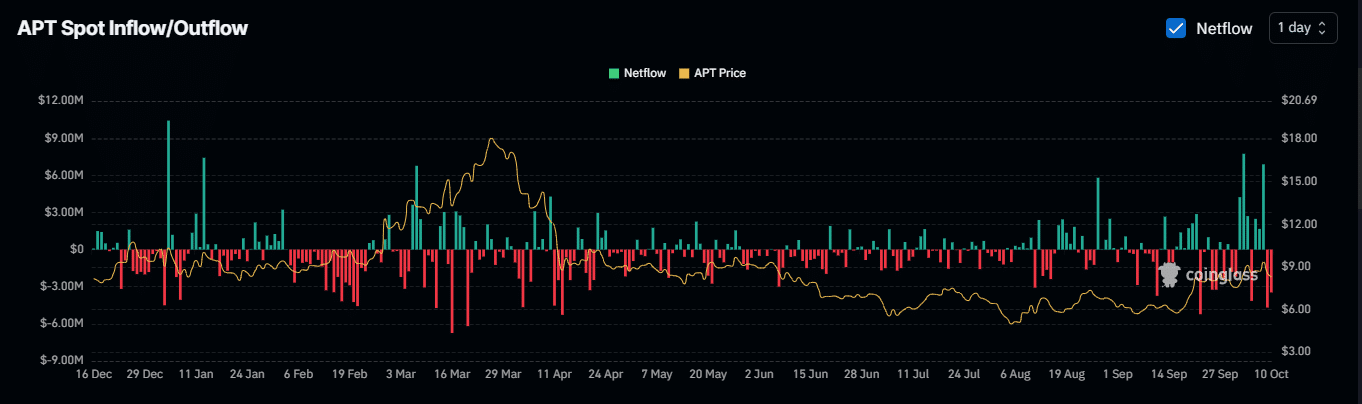

Conversely, the spot market for APT is showing promising signs. A negative Exchange Netflow indicates that more than $5 million worth of APT has been withdrawn from multiple crypto exchanges.

Read Aptos’ [APT] Price forecast 2024–2025

This activity signals a possible near-term increase in the price of APT and signals a coming supply squeeze.

For APT to return to an uptrend, an increase in Open Interest with more long positions on APT would be necessary.