- Shiba Inu enjoyed a bearish structure on the daily period

- Lack of purchasing pressure and the structure of liquidation levels meant that Memecoin could stay within reach this week

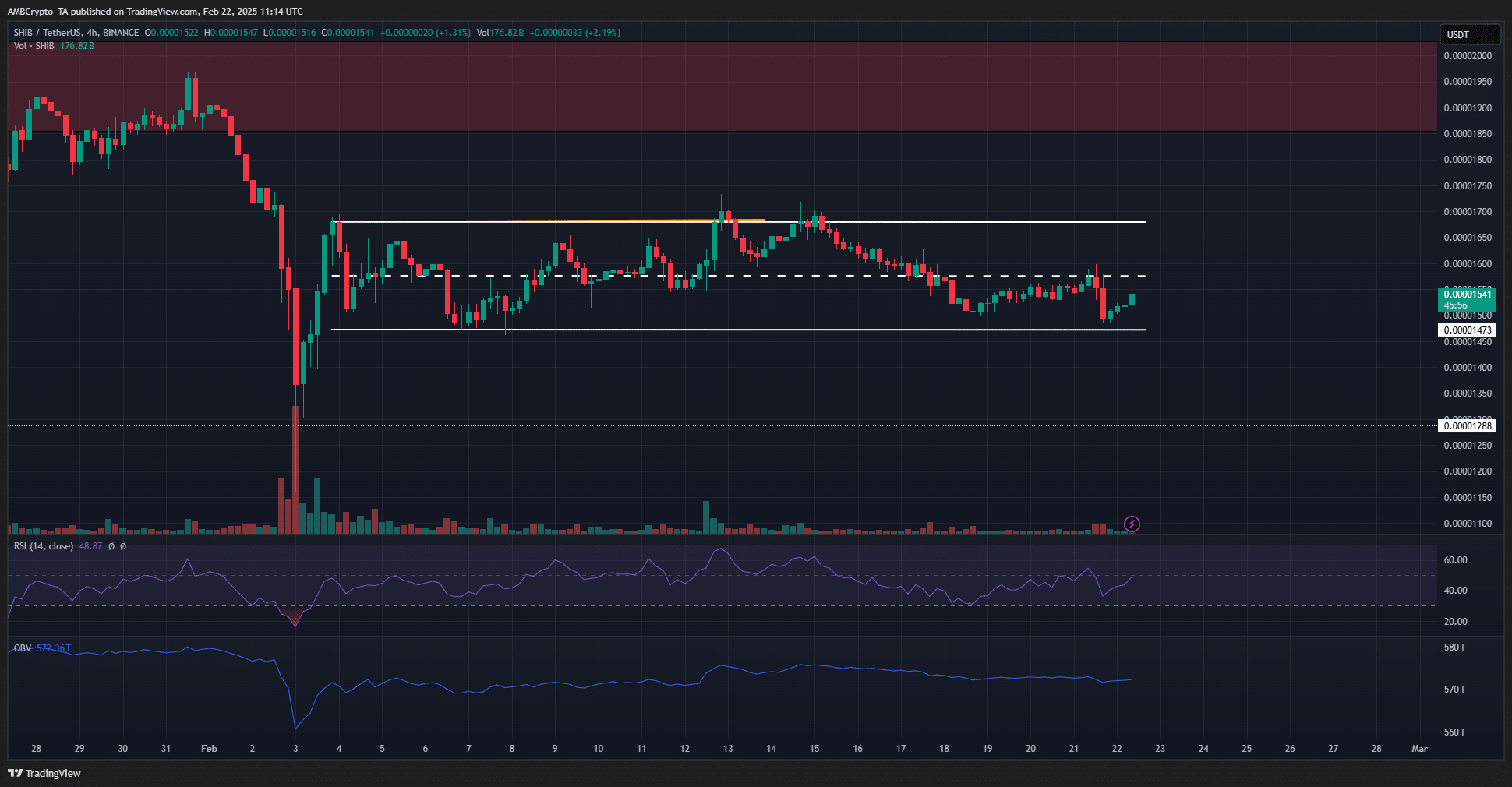

Shiba Inu [SHIB] seemed to make a bullish structure on the 4-hour graph ten days ago. Since then, however, this break has been shaking and the prize has re -tested its local lows twice. Instead, a lower time reach has been materialized, which reflects Bitcoin’s [BTC] Lack of direction on the graphs.

Shiba Inu set to consolidate within reach

Source: Shib/USDT on TradingView

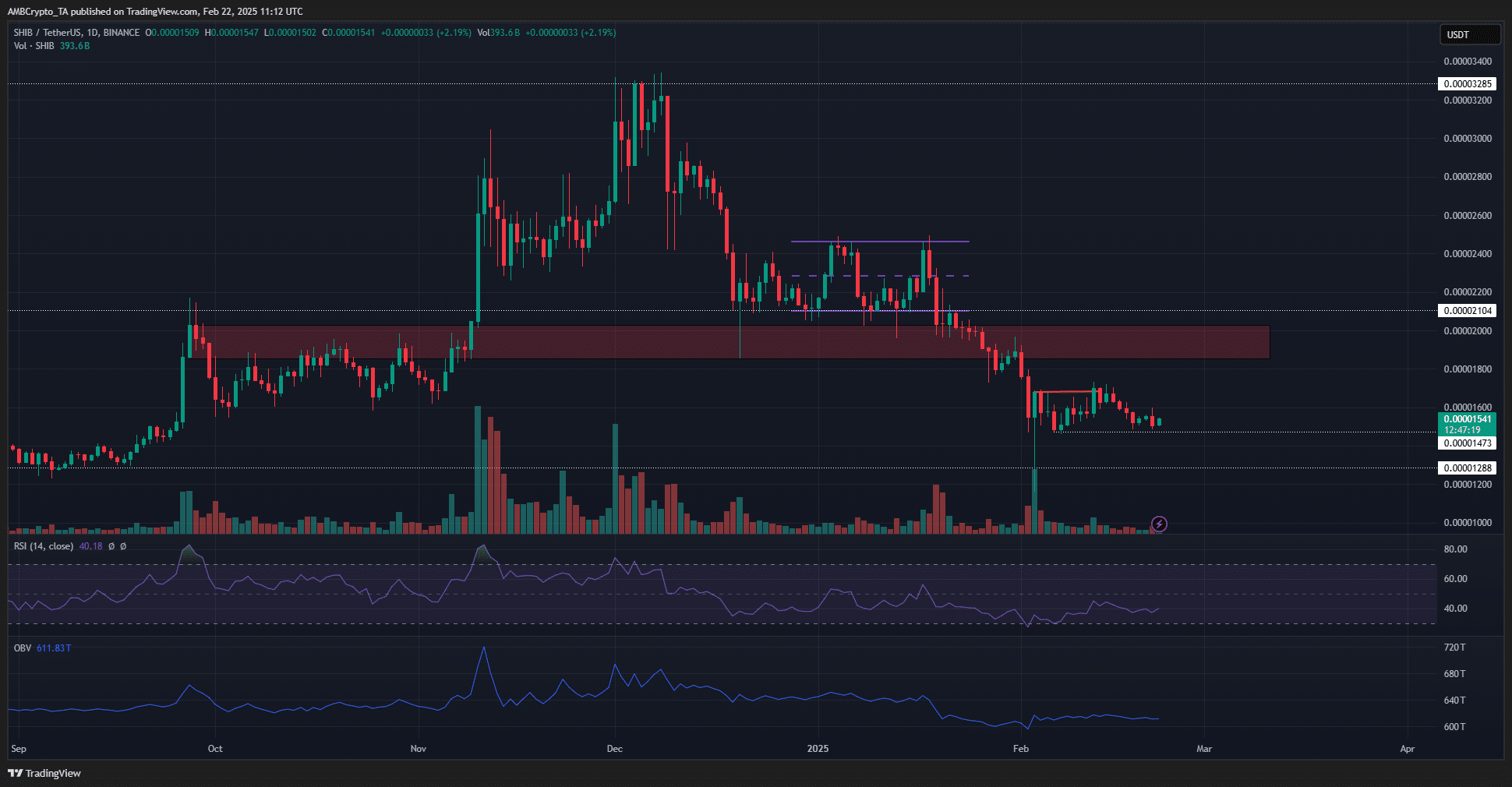

The 1-day graph revealed that the swing structure was strong bearish. A price movement beyond the recent lower high at $ 0.0000196 would be needed to shift the structure. As things stand out, there seemed to be no evidence that such a movement would appear soon.

A local support zone was also established at $ 0.0000147. Further south, the level of $ 0.0000128 has been a considerable level of support from September 2024.

At the time of the press, the daily RSI Bearish remained with a lecture of 40. The BBV climbed higher after the losses at the beginning of February, which indicated some buying pressure. And yet this was not enough to force the Memecoin to register new highlights.

Source: Shib/USDT on TradingView

The range was clear at the 4 -hour period. What a structural interruption (orange) seemed to be on the H4 turned out to be the local highlights at $ 0.000017. The middle reach level at $ 0.0000157 also seemed to be emerging as an important resistance in the short term.

The RSI Bearish was also on the 4-hour graph. In fact, it remained under 50 last week. A movement above 50, in addition to a flip of the mid-range resistance to support, can enable traders to go long-oriented on the local resistance of $ 0.0000168.

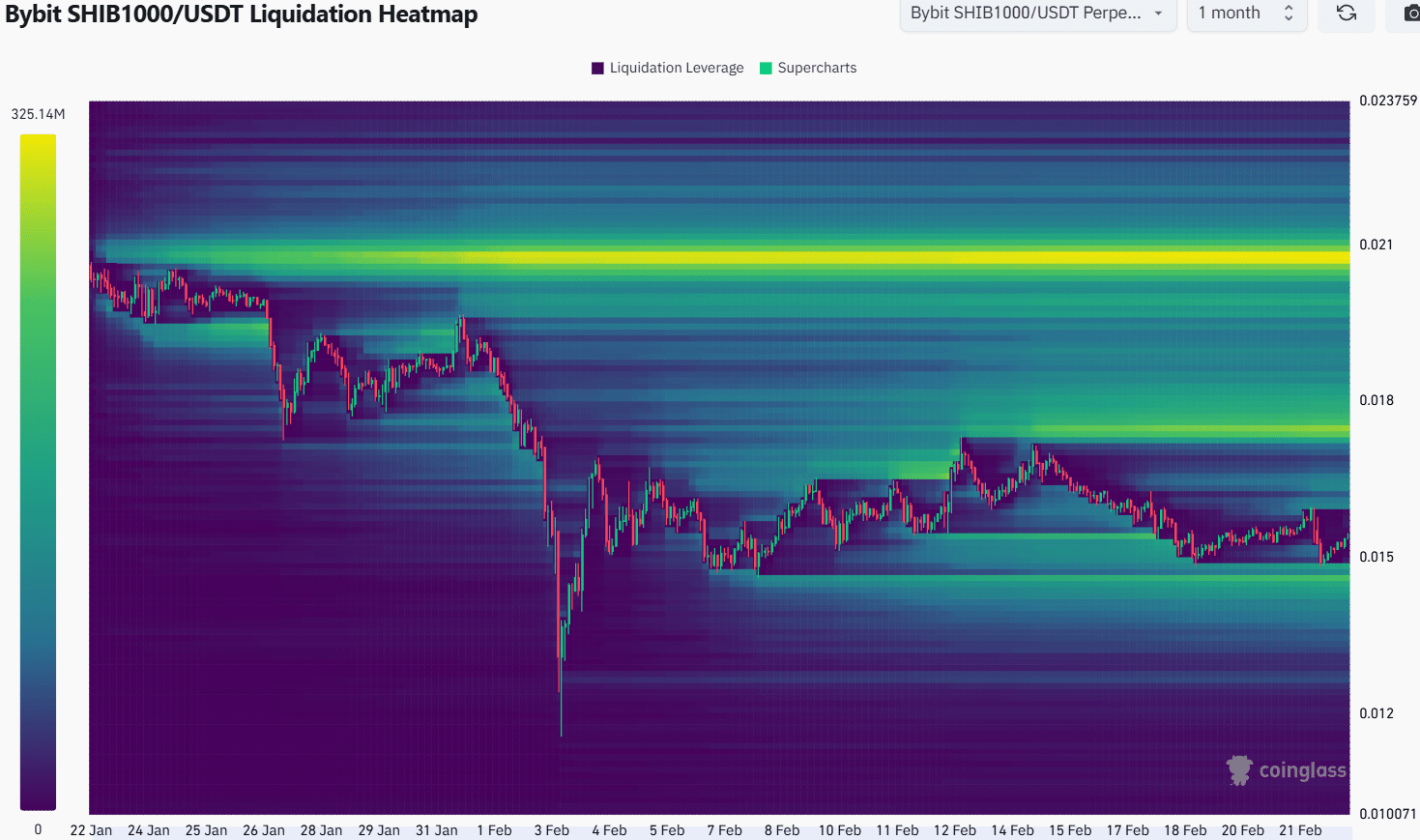

The liquidation heat jap of the past month underlined the range. It revealed two liquidity clusters around $ 0.0000145 and $ 0.0000176, levels just beyond the extreme of the range marked on the 4-hour graph.

The structure of liquidation levels on these prices implied that the price will probably be attracted to one, than the other, in the coming days. That is why a retest of $ 0.0000145 would be a buying option, and the $ 0.0000175 level A Take-Profit goal.

Disclaimer: The presented information does not form financial, investments, trade or other types of advice and is only the opinion of the writer