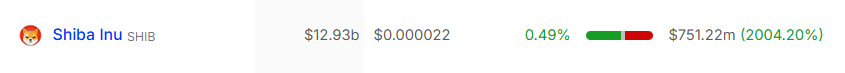

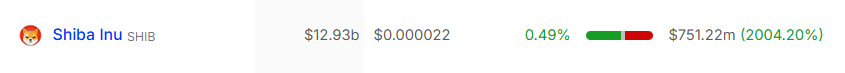

- High transaction volumes have increased by 2004% in the last 24 hours.

- Currently, 67.16% of top traders have long positions, while 32.84% have short positions.

Despite a notable price drop in the past 24 hours, Shiba Inu [SHIB] remained optimistic and appears poised for an upward rally.

Currently, the market is facing significant selling pressure following yesterday’s crash in which Bitcoin [BTC]Ethereum [ETH]and other assets saw significant price declines.

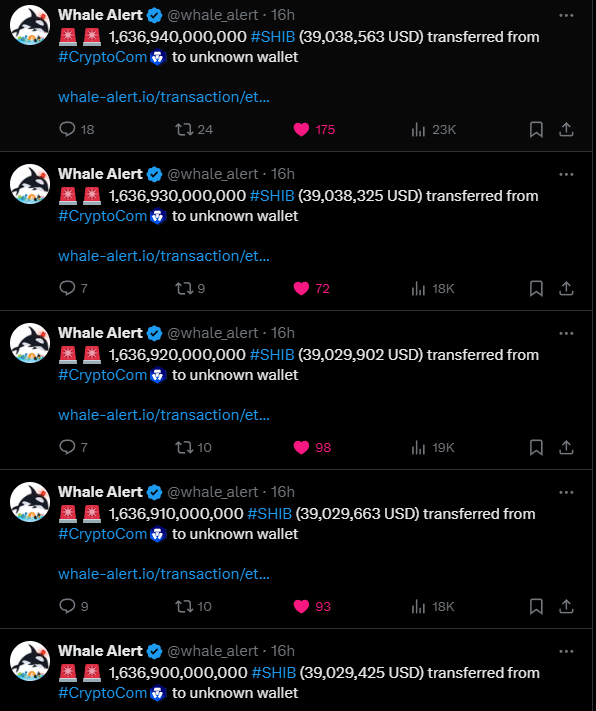

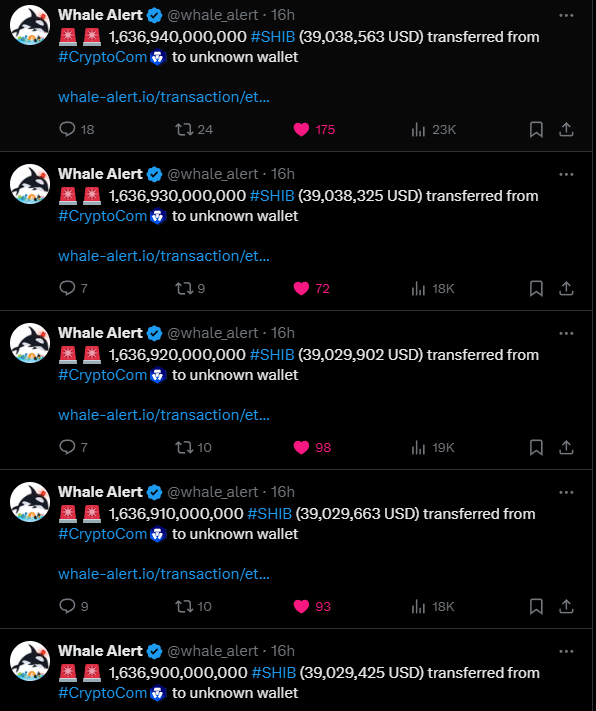

Whale moves 8.18 trillion SHIB

On January 3, 2024, SHIB broke out of a bullish double-bottom price action pattern and subsequently entered a consolidation phase.

The consolidation lasted almost three days, during which a would-be whale transferred a significant 8.18 trillion SHIB coins, worth $195.1 million, from CryptoCom exchanges to a wallet.

This transfer occurred while the overall market was experiencing upward momentum and remaining stable.

Source:

Later, after the opening bell of the US market, the Institute for Supply Management (ISM) released a report that caused the market as a whole to turn bearish.

In the midst of this crash, SHIB broke out of the three-day consolidation phase and experienced a price drop of over 14.5%.

Recent whale activity

In this price crash, retail traders appear to be dumping their holdings, while long-term holders appear to be accumulating.

Data from on-chain analytics firm IntoTheBlock revealed that large transaction volumes increased by 2004% in the past 24 hours, indicating strong participation from whales, investors and long-term holders.

Source: IntoTheBlock

During the same period, another analytics firm, Coinglass, revealed that the exchanges witnessed an outflow of $7.04 million worth of SHIB coins.

This data suggests the potential accumulation of the memecoin, as its price fell by more than 10%, attracting investors and long-term holders.

Traders’ strong bets on long

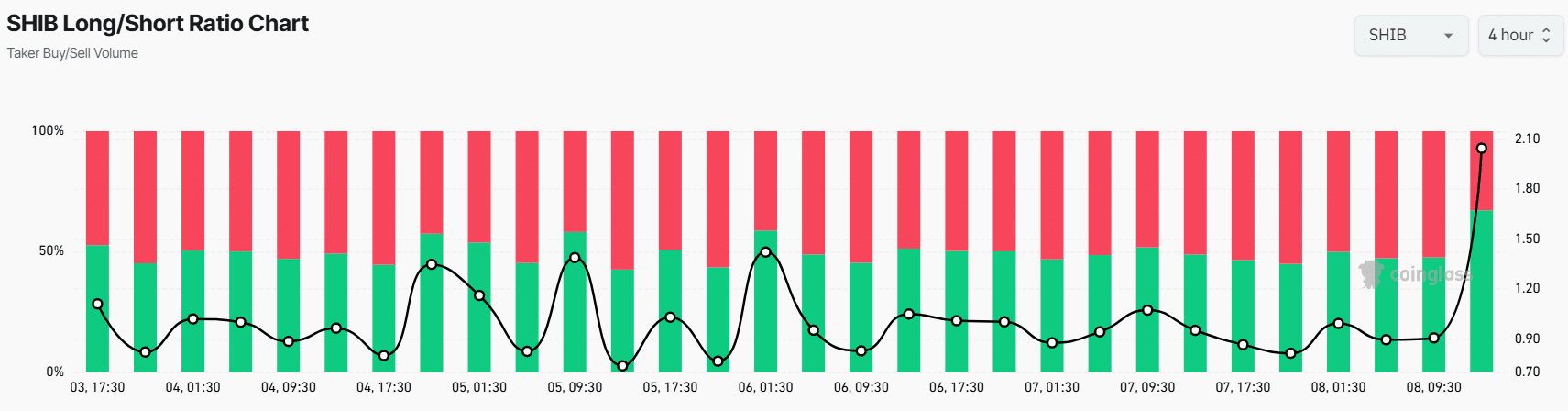

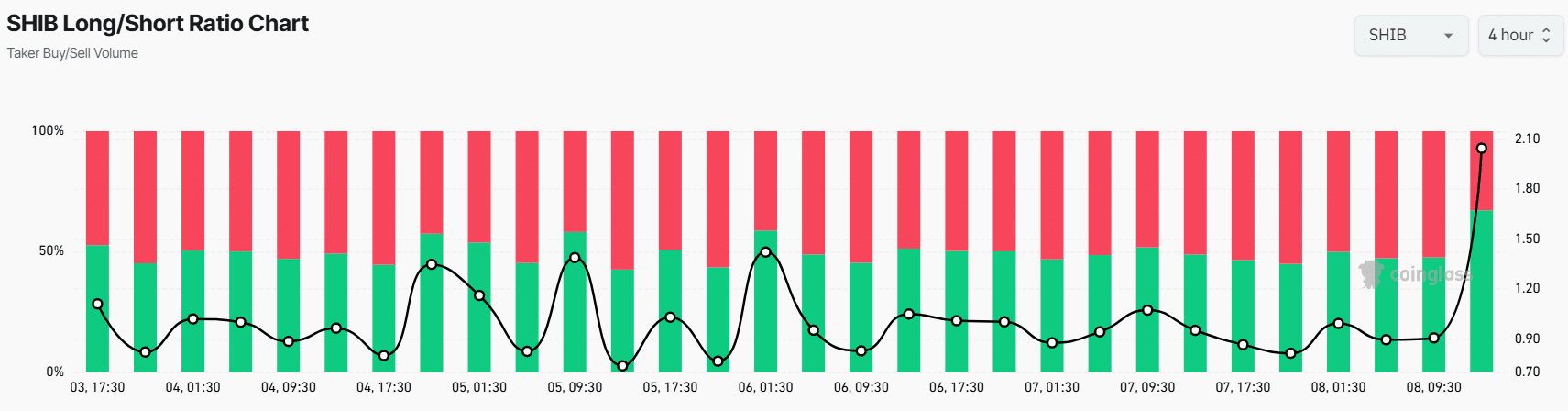

In addition to whales, investors and long-term holders, traders also seem more optimistic about the memecoin. Coinglass’ SHIB Long/Short Ratio stands at 2.04, the highest since early 2025, indicating strong bullish sentiment among traders.

Currently, 67.16% of top traders have long positions, while 32.84% have short positions, reflecting a particularly bullish outlook.

Source: Coinglass

Combining all these on-chain metrics, it appears that bulls are currently dominating the asset and could soon trigger a recovery in SHIB’s price.

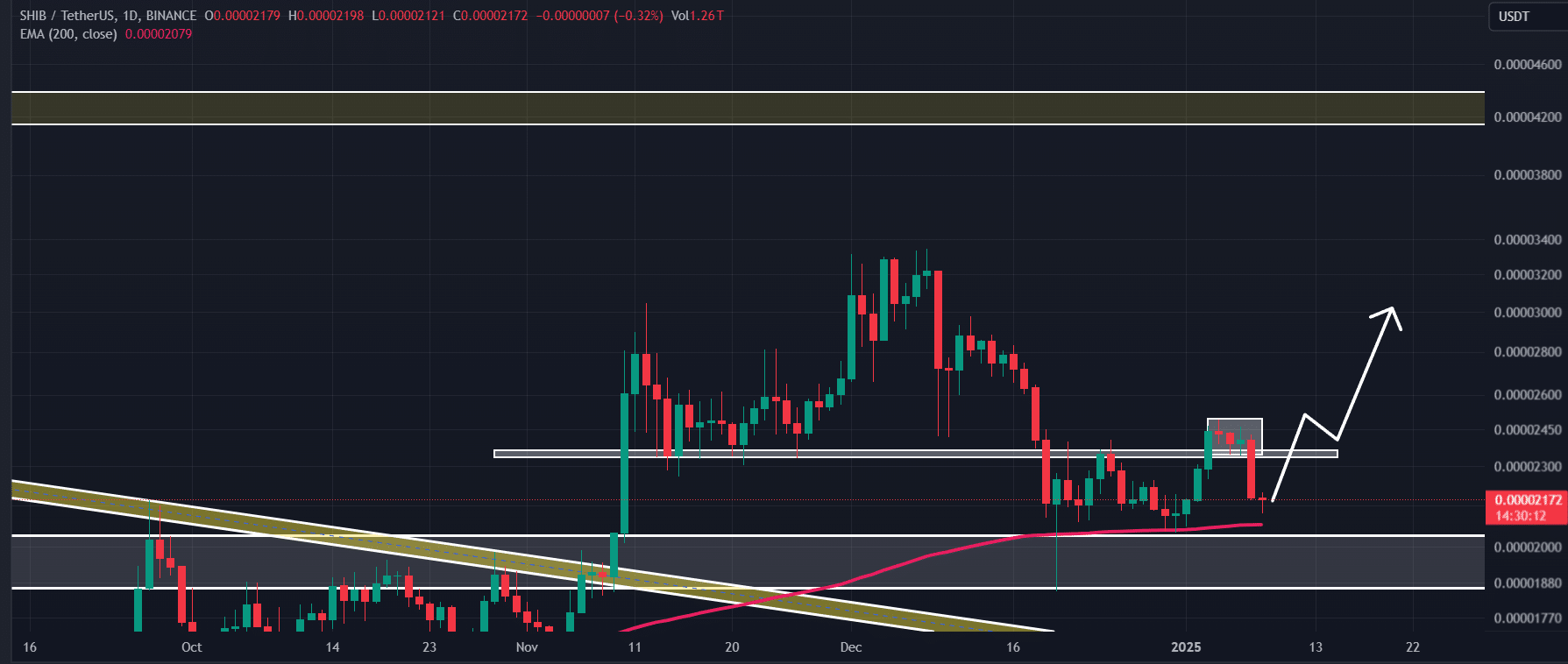

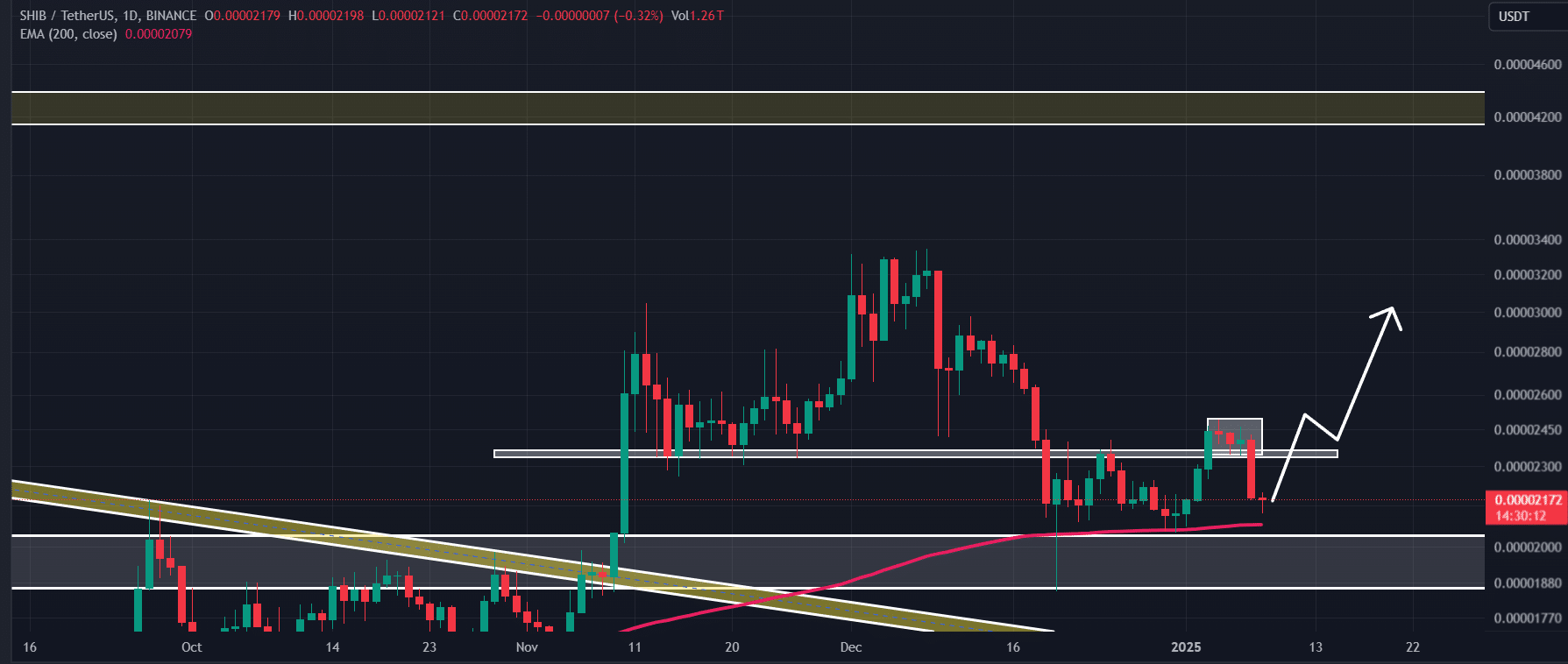

Shiba Inu’s technical analysis and key levels

According to AMBCrypto’s technical analysis, the recent price decline has taken SHIB to a crucial horizontal support level and the 200 Exponential Moving Average (EMA) on a daily time frame.

This positioning makes SHIB optimistic about potential upside momentum.

Source: TradingView

Based on recent price action, if SHIB maintains its position above the 200 EMA, there is a high chance that it could rise by 80% to reach the $0.00003939 mark in the future. This step will take time and patience.

Is your portfolio green? View the SHIB Profit Calculator

At the time of writing, SHIB was trading around $0.0000217, having experienced a price drop of more than 10% in the past 24 hours.

However, during the same period, trading volume increased by 80%, indicating greater participation from traders and investors compared to the day before.