- The 1-day price diagram showed that further losses were likely, but the H4 graph did not agree.

- A lack of question meant that the 9% bouncing in the past ten days could quickly reverse.

The withdrawal of 151.61 billion Shiba Inu [SHIB] Coinbase tokens, worth $ 2.41 million, was an interesting development. Persistent outflows of the memecoin would be a good sign of accumulation on the market.

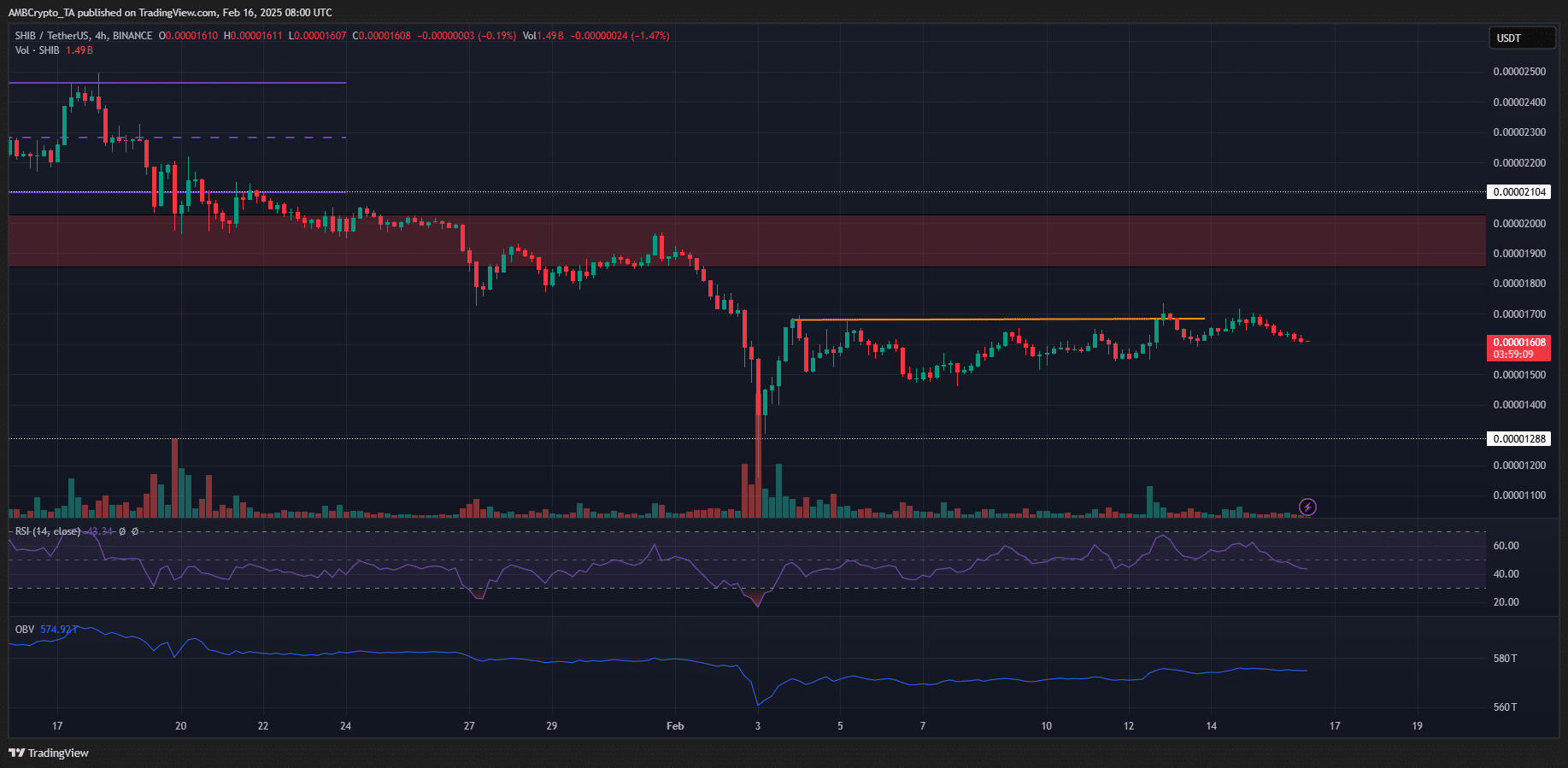

The daily price promotion remained Bearish, but there was a market structure shift on the 4-hour graph. Was there sufficient demand to maintain this lower time frame, or should traders brace themselves for more losses?

Shiba Inu Obv at Key in conjunction

Source: Shib/USDT on TradingView

The Bullish Brekerblock of $ 0.00002 had already been reversed against resistance before the sale at the beginning of February.

The next support level was at $ 0.00001288, but the consolidation around $ 0.000016 in October 2024 emphasized it as a different demand zone.

The OBV was at the lows from October, although the price was at the lows. This indicated intense sales pressure for the past two months.

The OBV was unable to scale the October low, and this could delay bullish efforts in a recovery. The RSI was also lower than 50 to emphasize Beerarish dominance.

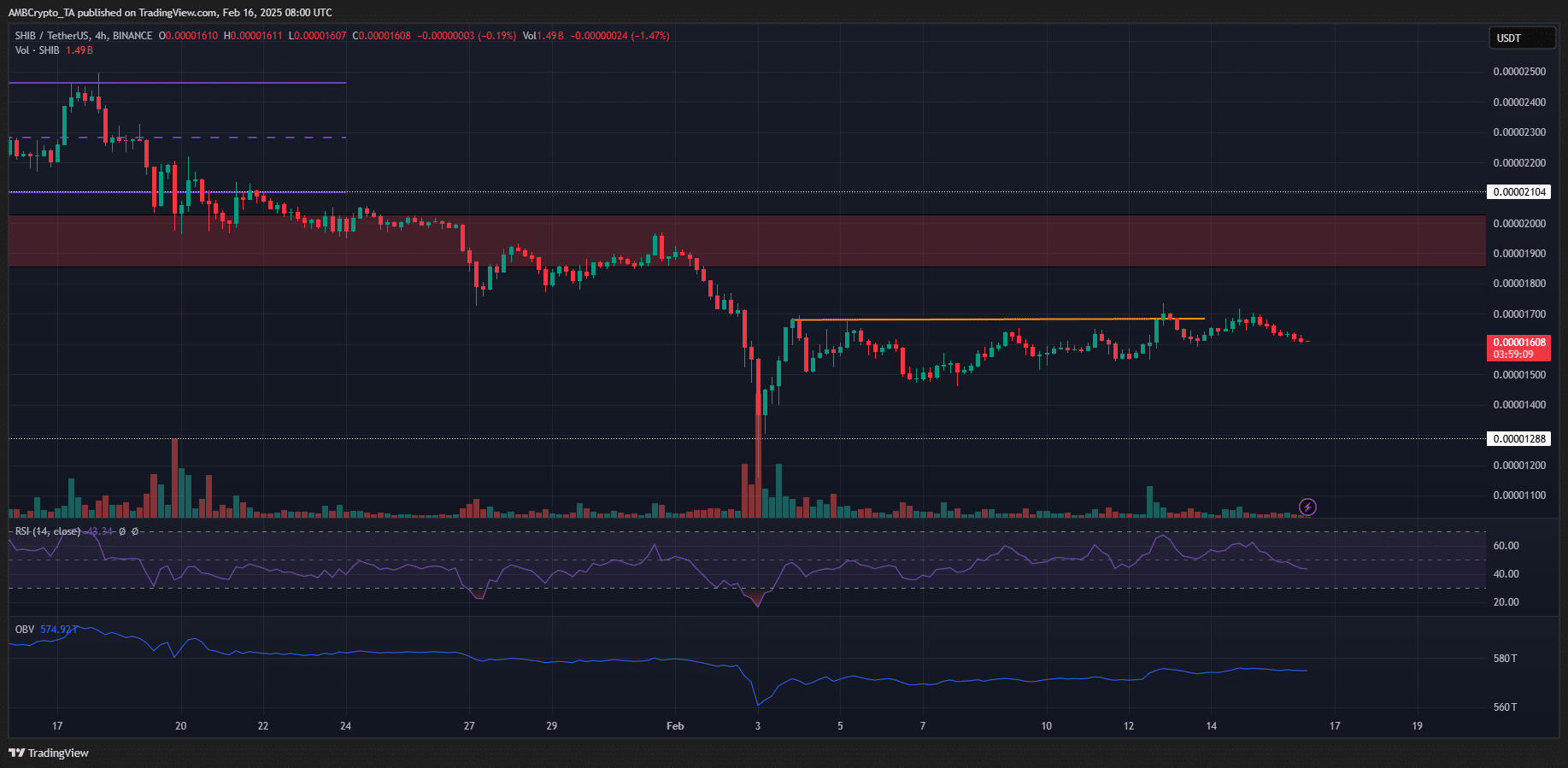

Source: Shib/USDT on TradingView

A bullish market structure break (orange) was seen on the H4 graph. In addition, the prize made higher lows last week.

The OBV, which we saw at the Low Point of October at the daily graph, has slowly risen higher.

Persistent purchasing pressure could push prices higher, but it was unclear whether that would arrive in the coming days.

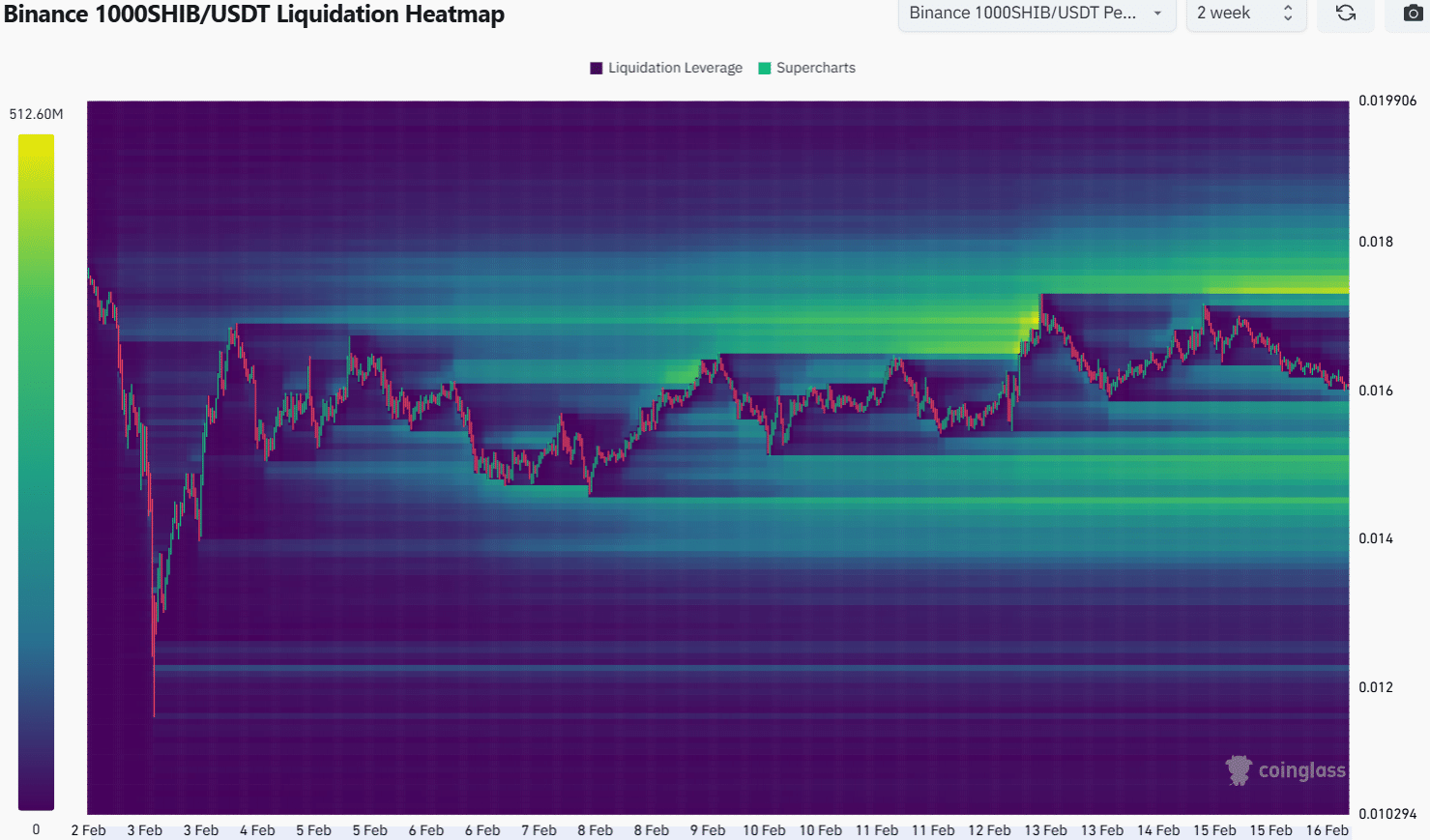

The liquidation heat of the rooting of the local lows earlier this month showed that the region was $ 0.0000154- $ 0.0000157 a target.

The $ 0.0000174 was a magnetic zone in the north, a different price objective in the short term.

This level was just above the local highlights that were seen on the 4-hour graph. That is why traders were able to make a profit in a long position at this level, because the market -wide sentiment was not bullish in the short term.

Disclaimer: The presented information does not form financial, investments, trade or other types of advice and is only the opinion of the writer