- SHIB’s breakout from a falling wedge pattern signals strong bullish momentum, with immediate resistance at $0.00001911.

- Positive technical indicators and reduced foreign exchange reserves support SHIB’s potential upward trajectory.

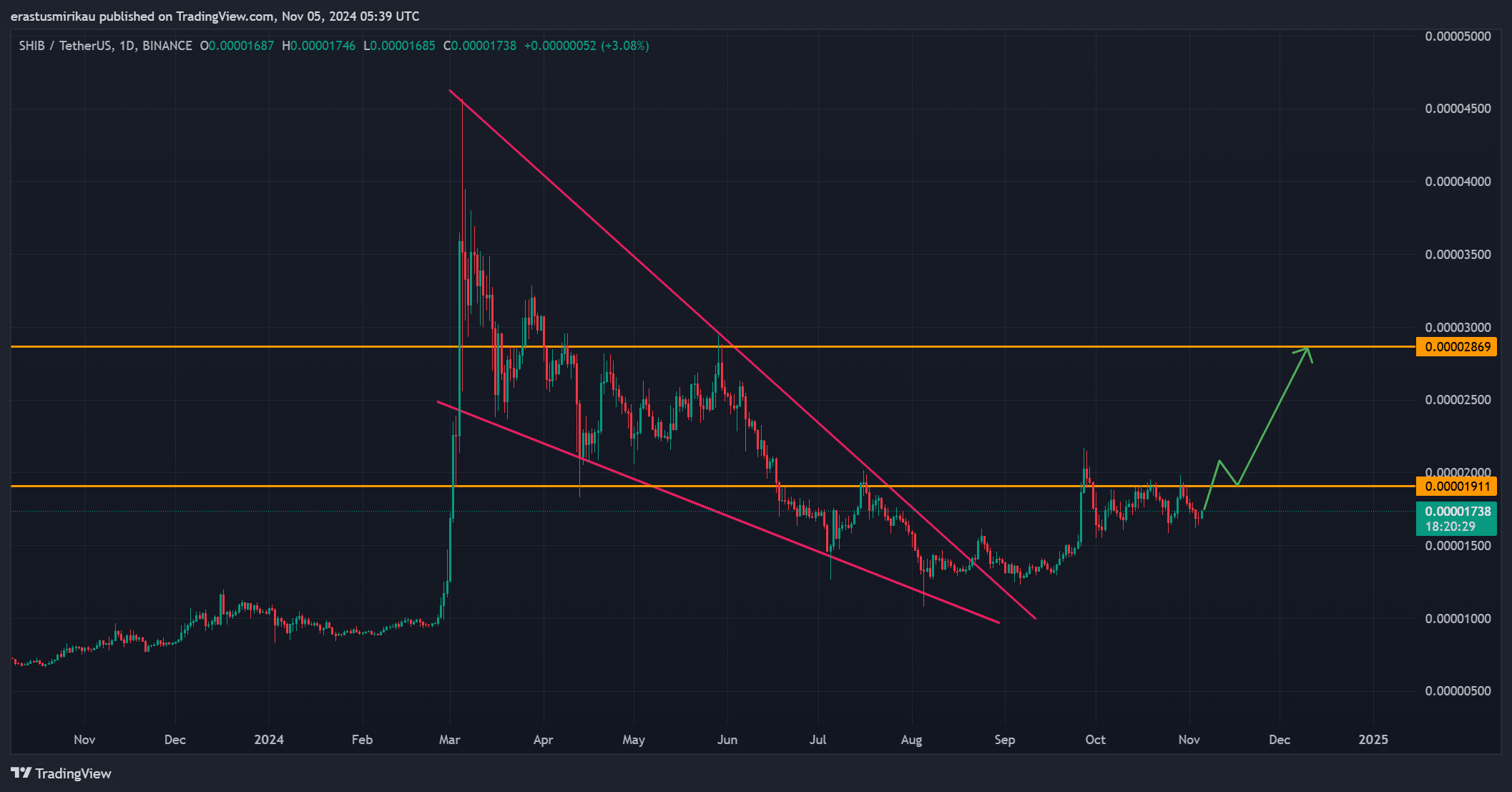

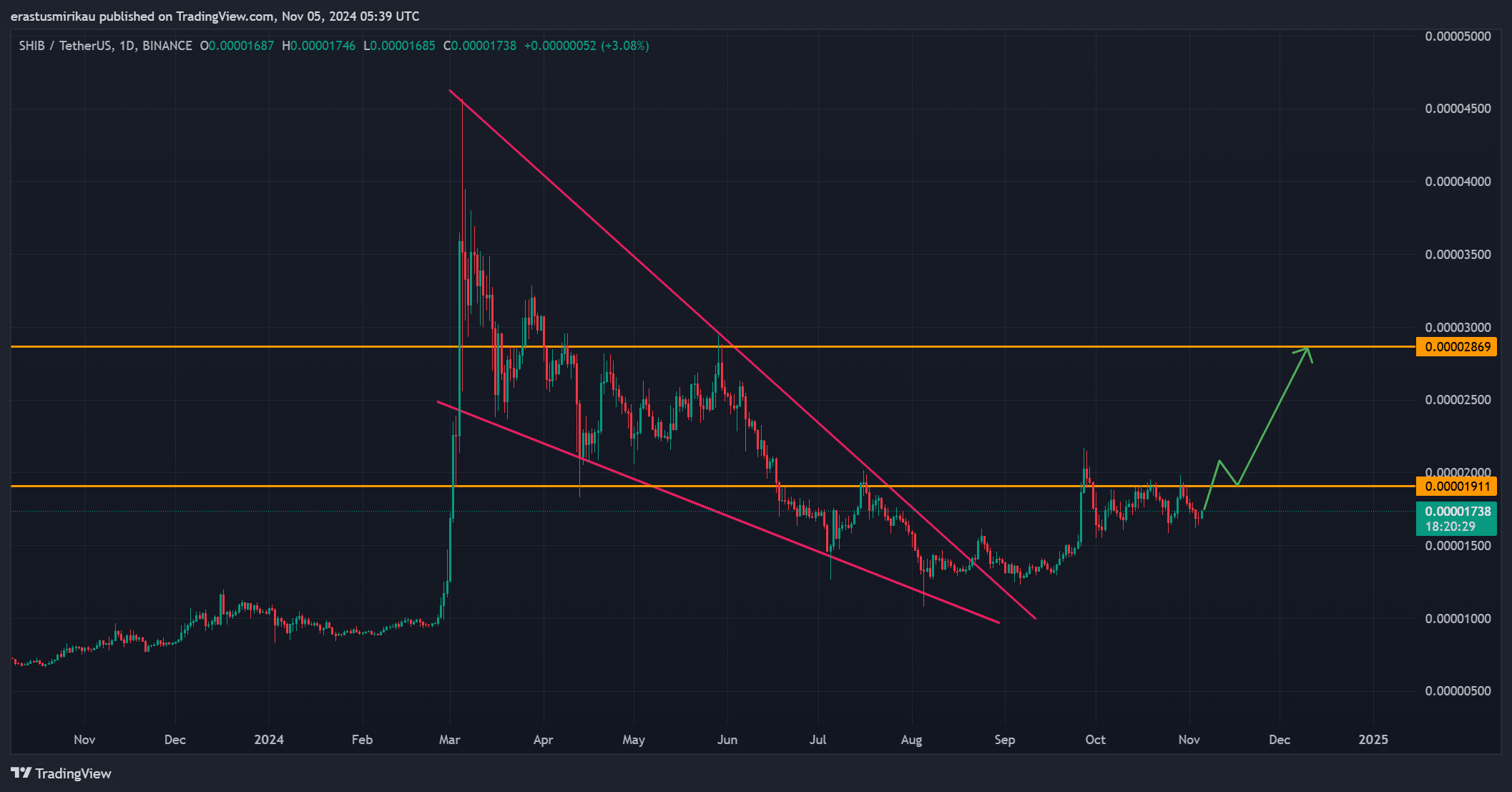

Shiba Inu [SHIB] has shown strong bullish signals and recently broke out of a falling wedge pattern on the daily chart. This breakout suggests a potential shift in momentum for SHIB as it heads to higher levels.

At the time of writing, SHIB is trading around $0.00001735, up 3.21% in the last 24 hours.

The token now faces immediate resistance at $0.00001911, with a more challenging barrier at $0.00002869. Therefore, a successful breakout could confirm continued bullish momentum.

Can Shiba Inu overcome these key resistances and reignite broader market interest?

Does the falling wedge breakout signal a new rally?

SHIB’s recent breakout from a falling wedge pattern, a classic bullish reversal, signals renewed strength. The chart shows SHIB approaching first resistance at $0.00001911, and momentum indicators appear to support this uptrend. Should Shiba Inu reach this level, it will face a stronger barrier at $0.00002869.

Consequently, the break of both could indicate a longer-term bullish trend, potentially generating more market interest. However, this setup will require follow-up momentum. Can SHIB benefit from this outbreak?

Source: TradingView

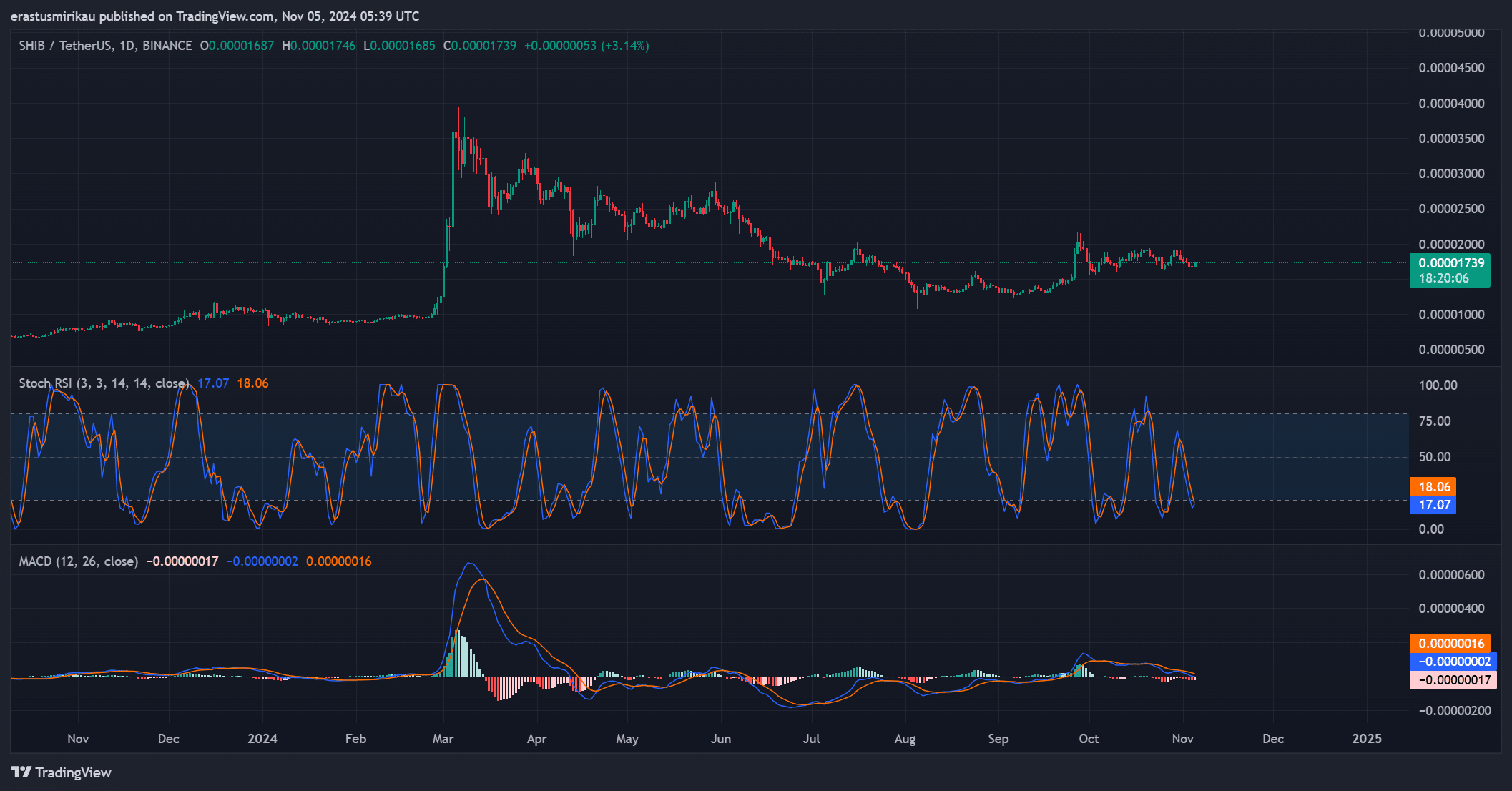

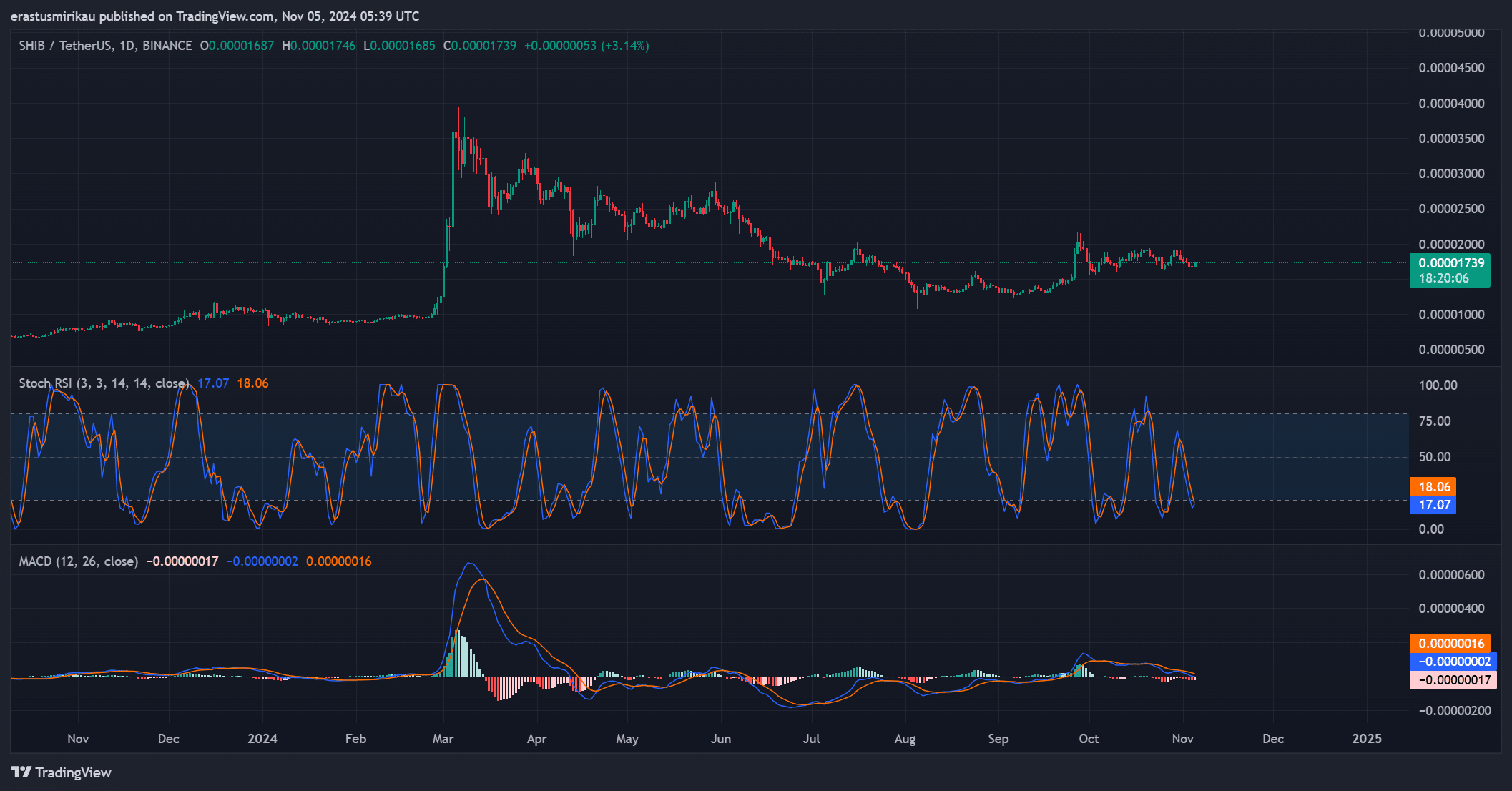

The stochastic RSI and MACD show a momentum shift

The analysis of SHIB’s stochastic RSI shows an optimistic picture. The Stochastics RSI stands at 17.07 (blue line) and 18.06 (orange line), indicating an oversold condition that often precedes a price recovery.

The recent upward movement of this indicator could signal a stronger uptrend if it breaks above 20.

Moreover, the MACD supports this momentum shift. The MACD line is approaching zero and showing early signs of a bullish crossover. Therefore, the combination of the Stochastic RSI and MACD signals indicates potential buying pressure.

Source: TradingView

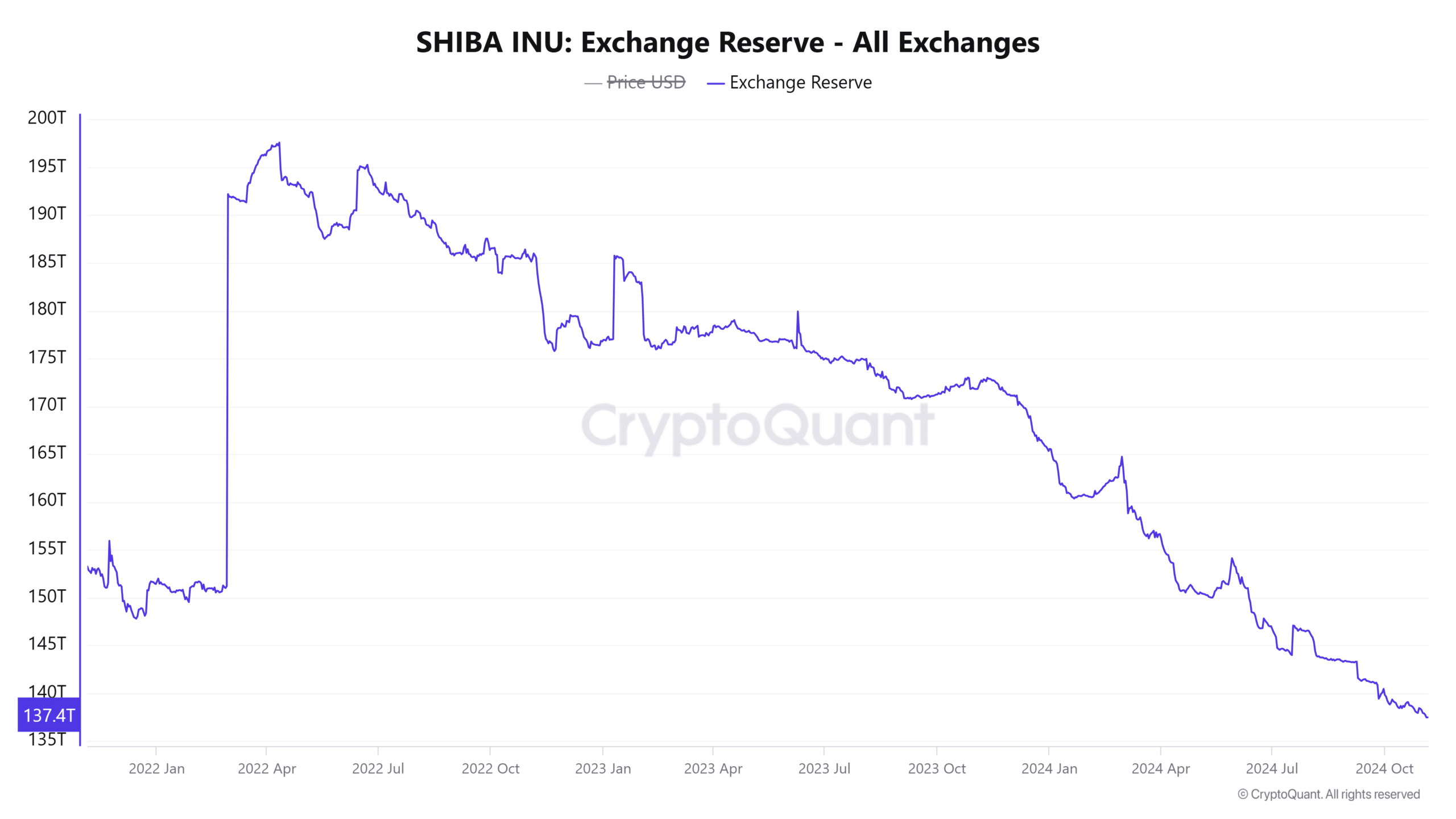

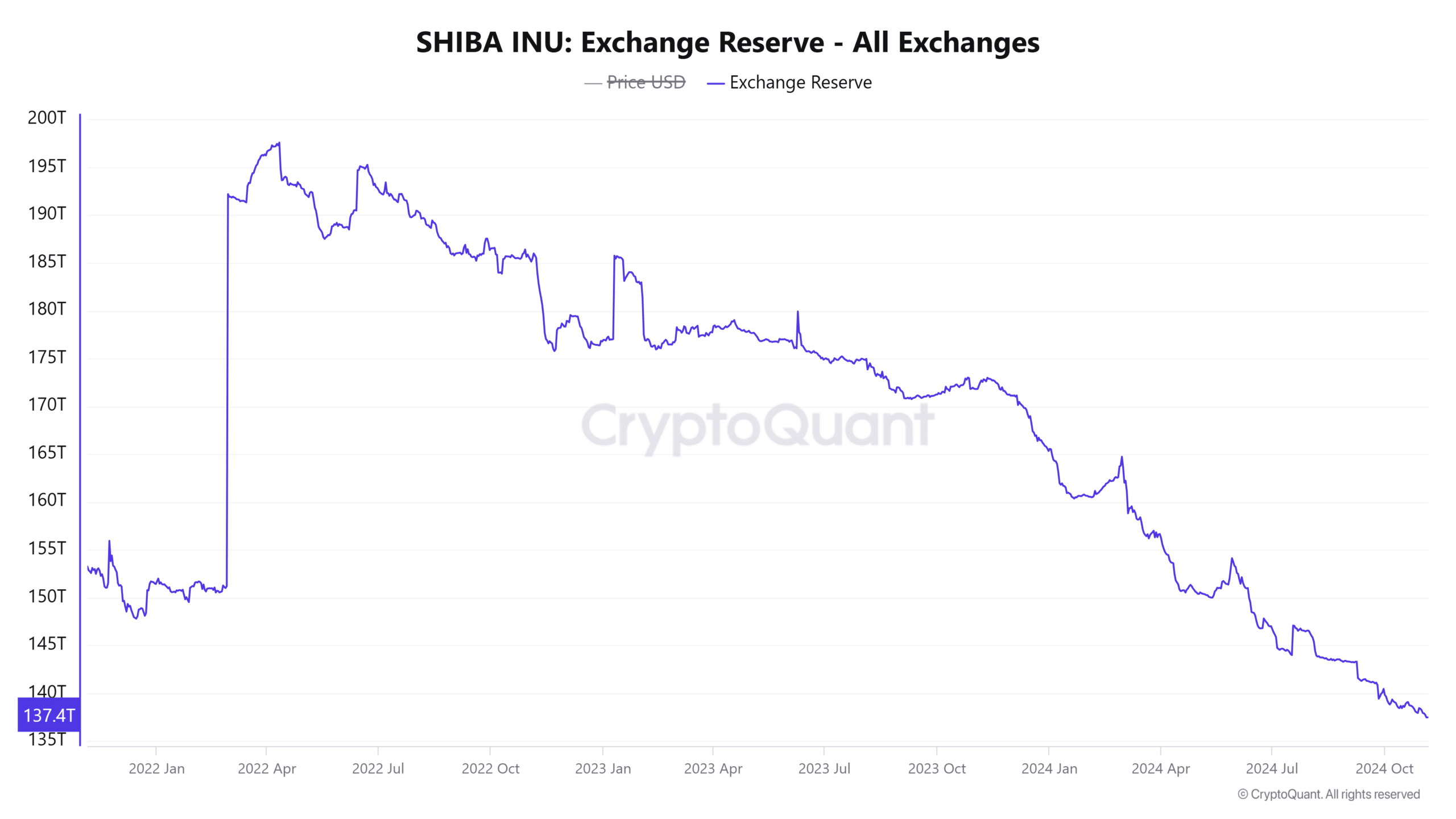

Falling foreign exchange reserves reduce selling pressure

Exchange reserves currently stand at 137.4918 trillion tokens, showing a decline of 0.21% in the last 24 hours. A decrease in currency reserves implies that there are fewer tokens available for sale, reducing selling pressure.

This trend aligns well with SHIB’s bullish outlook, indicating holders are withdrawing tokens from exchanges in anticipation of profits.

Source: CryptoQuant

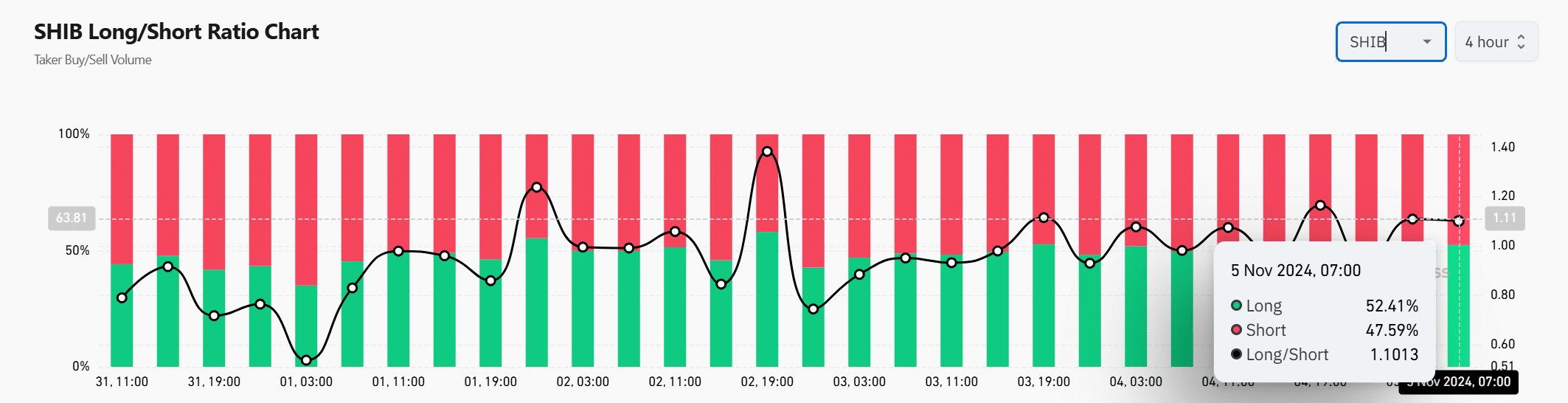

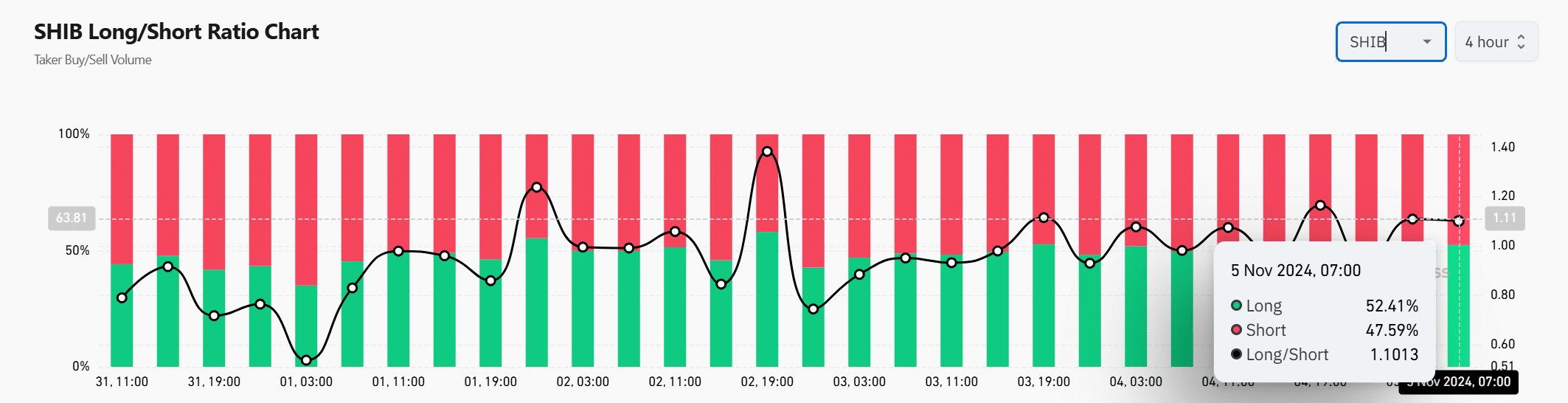

The bullish sentiment in the long/short ratio supports the recovery

SHIB’s long/short ratio is 1.1013, with 52.41% of positions being long and 47.59% short. This bullish tilt indicates that the market is favoring an upward move, with more long positions than short positions.

Consequently, a sustained higher ratio could strengthen SHIB’s momentum, supporting SHIB’s ability to overcome near-term resistance.

Source: Coinglass

Is your portfolio green? Check out the Shiba Inu Profit Calculator

Can SHIB maintain this momentum?

With strong technical support from indicators such as the Stochastic RSI, MACD and a bullish long/short ratio, SHIB seems poised to continue its uptrend.

If SHIB can break the critical resistance levels at $0.00001911 and $0.00002869, it is likely to continue its rally and possibly attract greater interest from the market. For now, SHIB appears poised to move higher and could consolidate its bullish momentum in the near term.