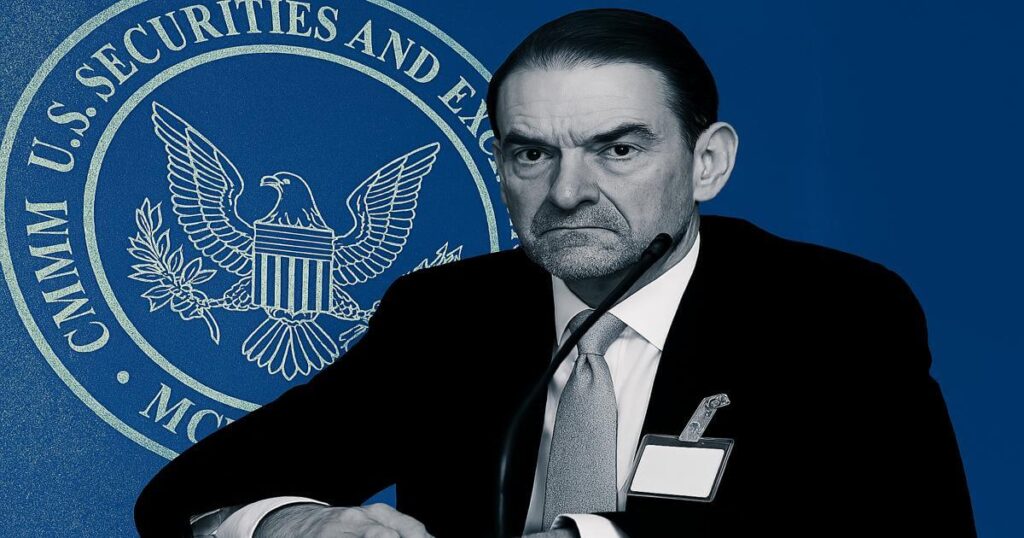

Paul Atkins, former SEC commissioner and the candidate of President Donald Trump to propose the US Securities and Exchange Commission (SEC), appeared on March 27 for the Senate Banking Committee and promised to restore clarity and restraint to the regulatory agenda of the agency.

An important focus of his testimony was the need for coherent rules for digital assets, which he described as an urgent challenge for both innovation and the protection of investors.

Atkins criticized aspects of the term of office of former SEC chairman Gary Genler, and emphasized concern about federal courts that cancel out regulatory initiatives, increased staff output and controversial enforcement actions against cryptocurrency companies.

He argued for a shift to deregulation and emphasized the need for clear and effective rules that promote innovation and at the same time protect market integrity. He promised to bring the agency back to his core mission to protect investors, promote efficient markets and to facilitate capital formation.

Concern about conflicts, crypto past

During the confirmation hearing session, Senator Elizabeth Warren Paul Atkins asked sharply about his connections with the cryptocurrency industry and financial companies.

In a letter submitted prior to the hearing, Warren wondered if Atkins could remain impartially in view of his consultancy with the industry, in particular his role that FTX advises before its collapse.

She also issued concern about his personal financial disclosures, which show that substantial interests related to the crypto sector in total around $ 6 million.

Warren urged atkins to commit to reconsidering future matters in which his former customers were involved and to prevent him from returning to the financial sector at least four years after serving. She emphasized that such steps were needed to restore the trust of the public in the independence of the SEC.

Paul Atkins responded to the interrogation of Senator Warren by emphasizing his dedication to ethical standards and complete transparency. He assured the committee that, if confirmed, he would dispose of all financial companies that could present a conflict of interest, including crypto-related assets and his consultancy, Patomak Global Partners.

He also stated that he would comply with all federal ethical rules and sec protocols with regard to recovery. While he stopped recording a formal prohibition after the services, Atkins claimed that his decisions would be led exclusively by the public interest and the legal mandate of the sec not by earlier relationships.

Atkins positioned his experience in the private sector as an active, with the argument that it gave him the insight that was necessary to make effective regulations without suppressing innovation. He rejected the idea that his work from the past endangered his ability to manage impartially, and said it had equipped him instead to understand the realistic impact of the rules of the office.

He also promised to further investigate the FTX collection and to ensure that the SEC has thoroughly investigated the case in response to the concern of Senator Chris van Hollen.

Mapping a new course

Looking ahead, Atkins said that one of his top priorities would work with fellow commissioners and legislators to make a regulatory approach to digital assets that is in principle, structured and technology neutral. He said that the current lack of clarity has led to confusion and discouraged innovation.

He argued that the US could strengthen its leadership in financial innovation with appropriate rules and attract global investments. Atkins also signaled his opposition against what he described as “exaggerated politicized” regulations and called on the SEC to concentrate on his legal obligations instead of the promoting partisan agendas.

With the SEC at a crossroads, the nomination of Atkins is expected to form the direction of the agency on issues ranging from cryptomarkets and ESG -public making to enforcement priorities and reforms of the market structure.

The Senate Committee will continue his evaluation before he votes whether he should promote his appointment. If the committee votes before the benefit, the appointment goes to the entire Senate for a confirmation voice. A simple majority is needed there for the final confirmation.