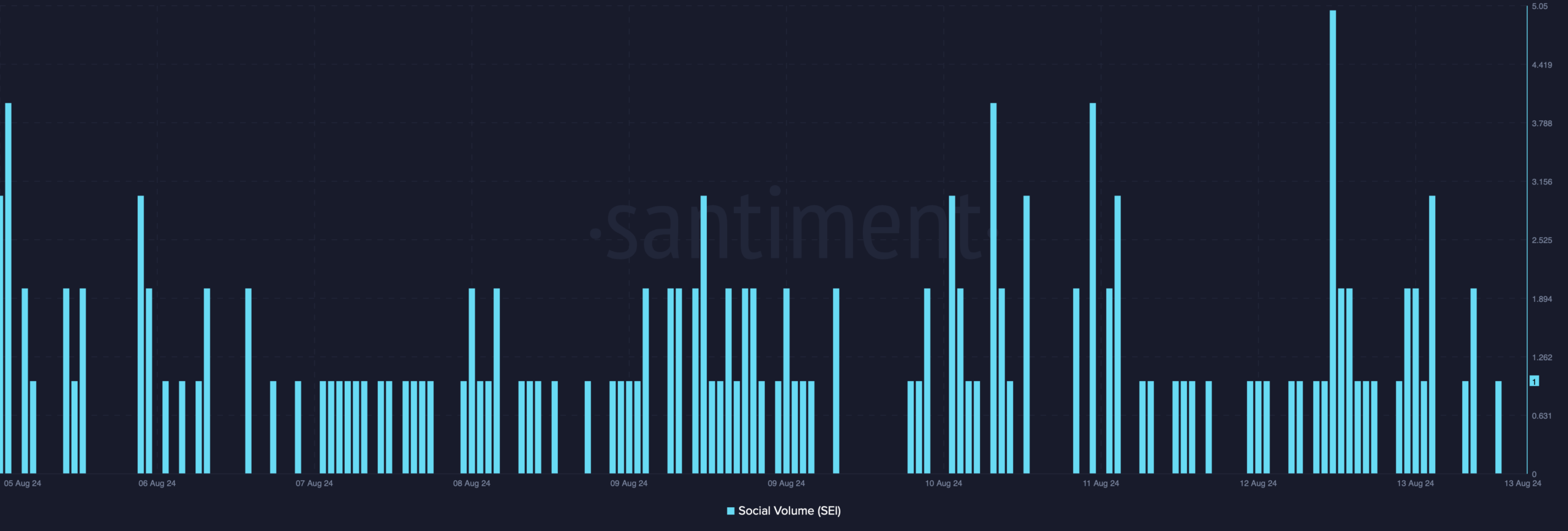

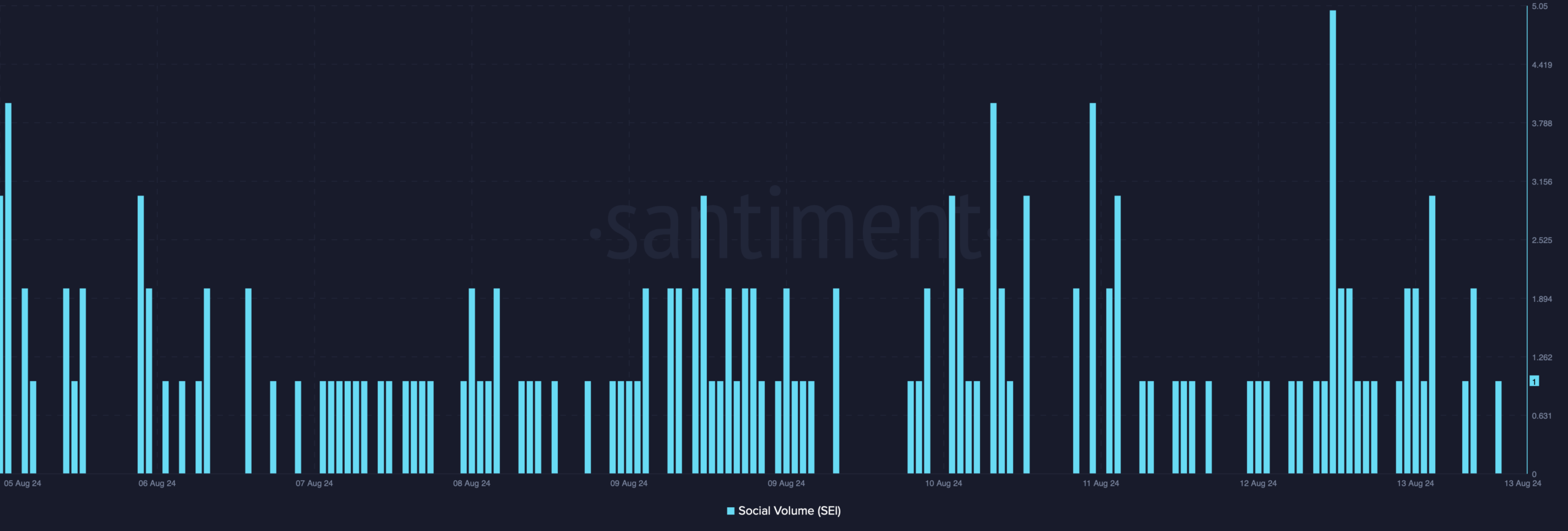

- Thanks to the price increase, SEI’s social volume also increased.

- However, some metrics were bearish on the token.

S.E.Ilike several other cryptos, have shown commendable performance over the past week. Since the token has been doing well, let’s take a closer look at its current state to find out the statistics and other factors for SEI’s price prediction.

How are things going with SEI?

CoinMarketCaps facts revealed that SEI bulls surged last week as they pushed the token price up by double digits. To be precise, the token witnessed an increase of over 20% in the last seven days.

Also in the last 24 hours, the bulls performed their operation, while the value of the token increased by almost 5%. At the time of writing, SEI was trading at $0.2927 with a market cap of over $929 million, making it the 68th largest crypto.

As the token gained bullish momentum, so did its social volume. Instead, the price peaked on August 12, reflecting its popularity in the market.

Source: Santiment

SEI Price Prediction

Since the token has performed well over the past week, AMBCryptoi planned to dive deeper into the state to figure out the targets that investors could pay attention to this week.

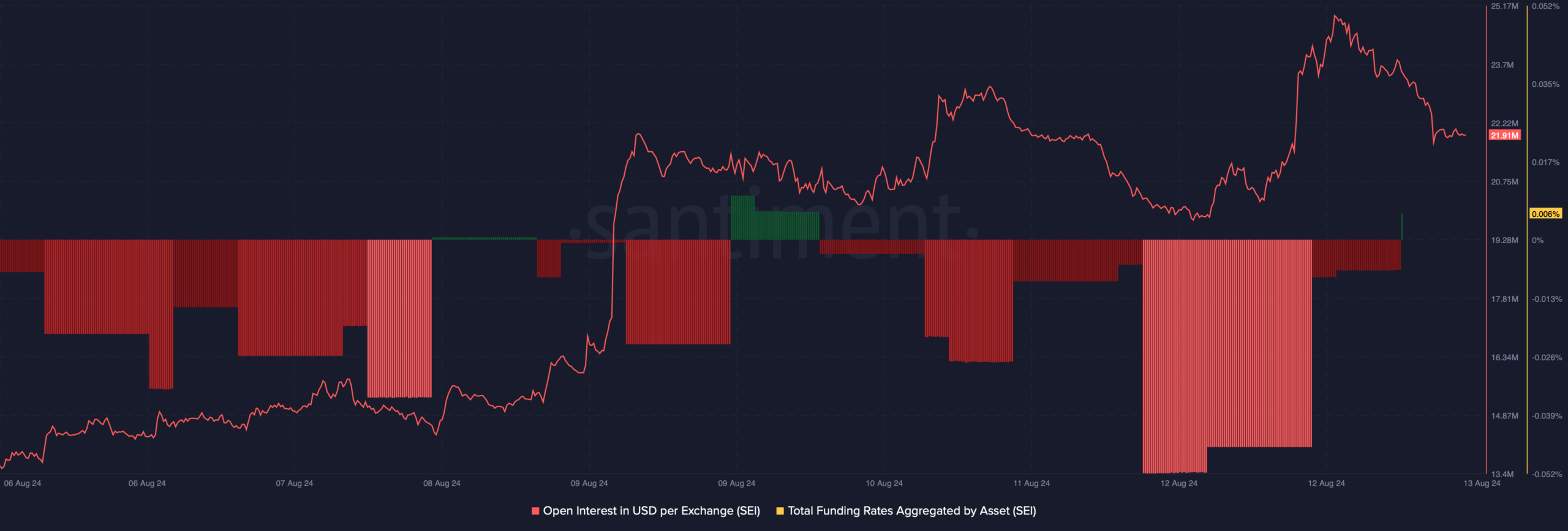

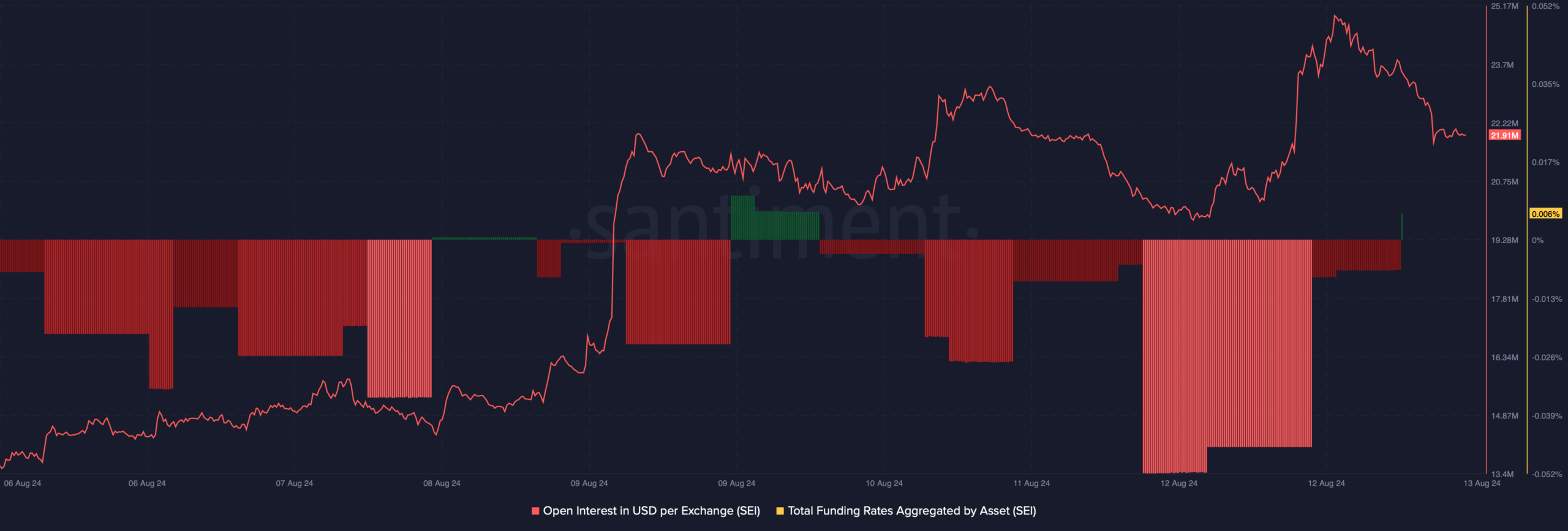

Our analysis of Santiment’s data showed that the token’s open interest fell while its price rose. A decline in the metric often indicated a trend reversal, which in this case was bearish.

Source: Santiment

However, the financing rate was in the red, which generally means a rise in prices as values tend to move in the opposite direction to the benchmark.

Apart from that, AMBCrypto’s look at Coinglass’ facts revealed another bearish signal. We found that the long/short ratio recorded a sharp decline within a four-hour time frame, which can be inferred as a bearish signal.

Notably, SEI’s whale versus retail delta had a value of almost 25. This indicator ranges from -100 to 100, with 0 representing whales and retail positioned exactly the same..

A value closer to 100 indicates that whales were active. Since the number was 25, it therefore indicated that retail investors were slightly less dominant in the market compared to the whales.

Source: Hyblock Capital

Realistic or not, here it is The market cap of SEI in BTC terms

We then checked the daily chart to better understand the price targets for this week. We found that SEI was testing its resistance level at $0.3. In the event of a bullish breakout, the token could reach $0.39 soon.

A further move north would allow an eye on $0.5. However, if the bears take over, the token could fall to $0.22 this week.

Source: TradingView