- SEC’s position on Pow -Mining removes regulatory uncertainty, for the benefit of miners and promoting the growth of the industry.

- Altcoins surpassed the assets of Major Pow and indicates a shift in investment trends after the clarification of the SEC.

The US Securities and Exchange Commission (SEC) recently confirmed that mining activities (POW) (POW) do not fall under securities instructions.

This clarification, especially for cryptocurrencies such as Bitcoin [BTC]” Litecoin [LTC]and Bitcoin cash [BCH]offers miners the much needed legal security. As a result, miners can now operate without the fear of being regulated as effects, which has long been a concern in industry.

This decision is important for miners, because the uncertainty about the legal status of Pow -Mining eliminates. It establishes a clearer regulatory framework, so that miners can expand the activities without fear of legal challenges under the securities laws.

Moreover, the investors reassure, which increases their trust in POW -Mijnbouw projects and promotes more confidence in the sector.

How do market participants respond to these developments?

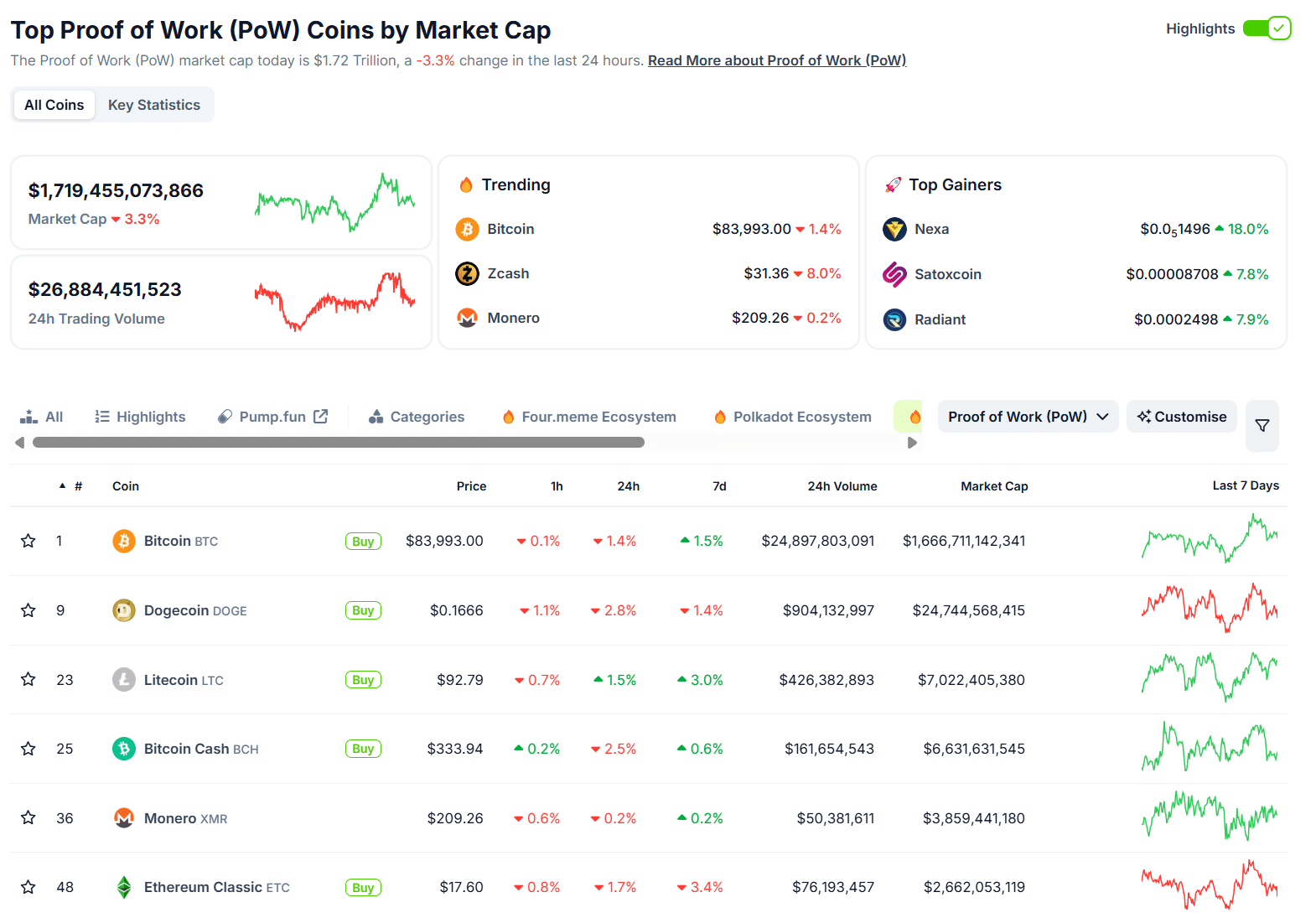

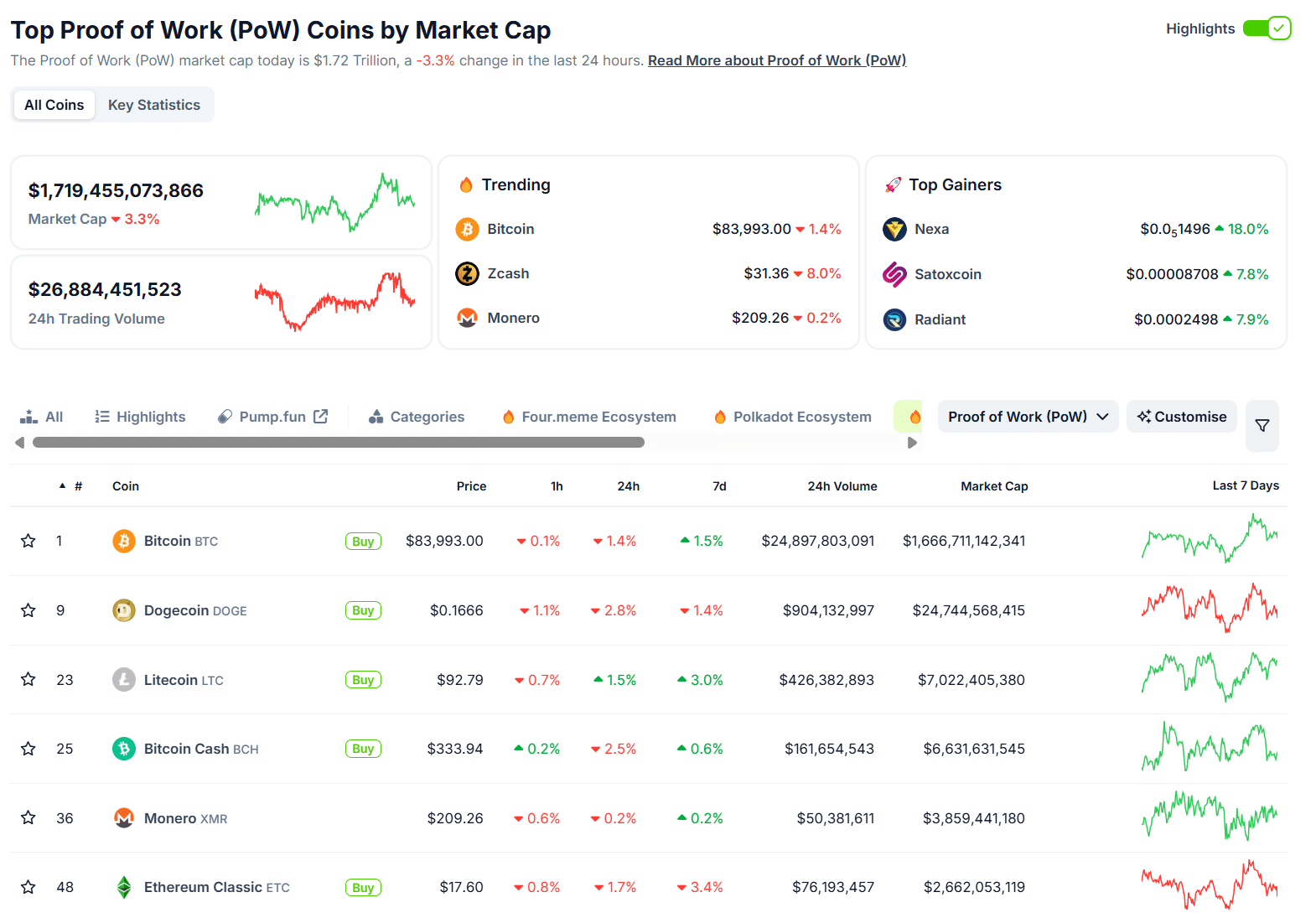

The market showed noticeable shifts in response to the decision of the sec. Major Pow assets such as Bitcoin and Dogecoin registered losses, with Bitcoin 1.4% dropping to $ 83.993 and Dogecoin fell by 2.8% to $ 0.1666. Bitcoin Cash also fell by 2.5%and reached $ 333.94.

Letere Pow Altcoins, on the other hand, surpassed, in which Nexa 18% rose to $ 0.0051496, while satoxcoin and Radiant won 7.8% and 7.9% respectively.

This trend indicates that investors are shifting funds from larger assets to smaller Pow Altcoins. The clarification of the SEC strengthened Bitcoin’s status as a merchandise.

Although sentiment remained stable for larger assets, interest in emerging POW coins increased considerably.

Coentecko

What does this mean for the future of cryptocurrency regulations?

This SEC clarification is in line with the wider trend of more defined, transparent cryptocurrency regulations. The SEC has also clarified its attitude in the field of meme coins, which confirms that they do not constitute effects.

Moreover, the end of the legal battle with Ripple offers extra security. These developments point to a future in which the regulatory landscape for cryptocurrencies is more structured, with less dependence on enforcement actions.

Is the decision of the SEC a bullish signal for crypto?

The recent SEC clarification on Pow -Mining offers a positive view of the crypto industry. Miners can now work with confidence, while investors can explore emerging POW coins with clearer guidelines.

While Bitcoin and other Large-Cap saw losses of losses, the growth in Altcoins indicates that investors position for long-term profit.