- Sec GreenLighted Option Trading for BlackRock, Fidelity and Bitwise Spot ETFs.

- The agency could approve the setting of the products as quickly as possible, noted a Bloomberg analyst.

The US Securities and Exchange Commission (SEC) has approved options to act for spot Ethereum [ETH] ETFs. The desk green light Options act for BlackRock’s Ethha, Bitwise’s Bitw and Fidelity’s Feth.

According to Nate Geraci from the ETF store, the update could attract more ETH investments. He noted”

“SEC has approved options that act on spot -eth ETFs … as with BTC ETFs, expect to see a number of new launches of emennents. Covered call strategy ETFs, buffer ETH ETFs, etc.”

Assessment of the impact of the ETH price

Despite the positive update, Bloomberg analyst James Seyffart explained that the result was’100% expected‘Because it was the deadline for the SEC decision. Simply put, ETH had priced in the outcome.

But he added That turning off the products could be approved at the beginning of May or August, despite their October deadline.

“It is possible that they could be approved for the early postponement, but the last deadline is at the end of October.”

Most experts expected Approval of the ETH question and value more, especially of institutional investors who are looking for the extra 3% annual return of 3%.

Some analysts even believed that the lack of deportation was partly the fault of the lukewarm performance of spot ETF ETF compared to BTC ETFs.

Since their debut, the products have recorded $ 2.3 billion in cumulative inflow. Spot BTC ETFs, however, registered $ 35 billion in total inflow – that is 17x time outperformance by BTC ETFs.

That said, ETH rose +10% from $ 1400 to $ 1600 on April 9. This followed on the 90-day break of President Donald Trump at various rates. That is why the approval of the options was not an important catalyst for the quotation.

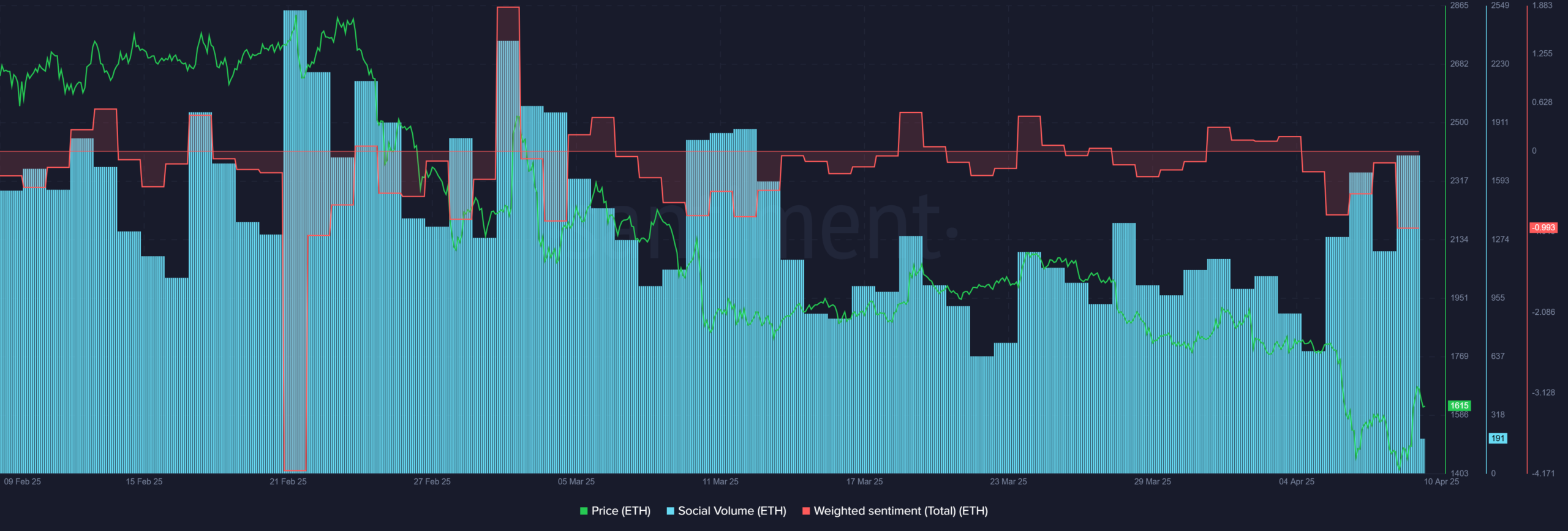

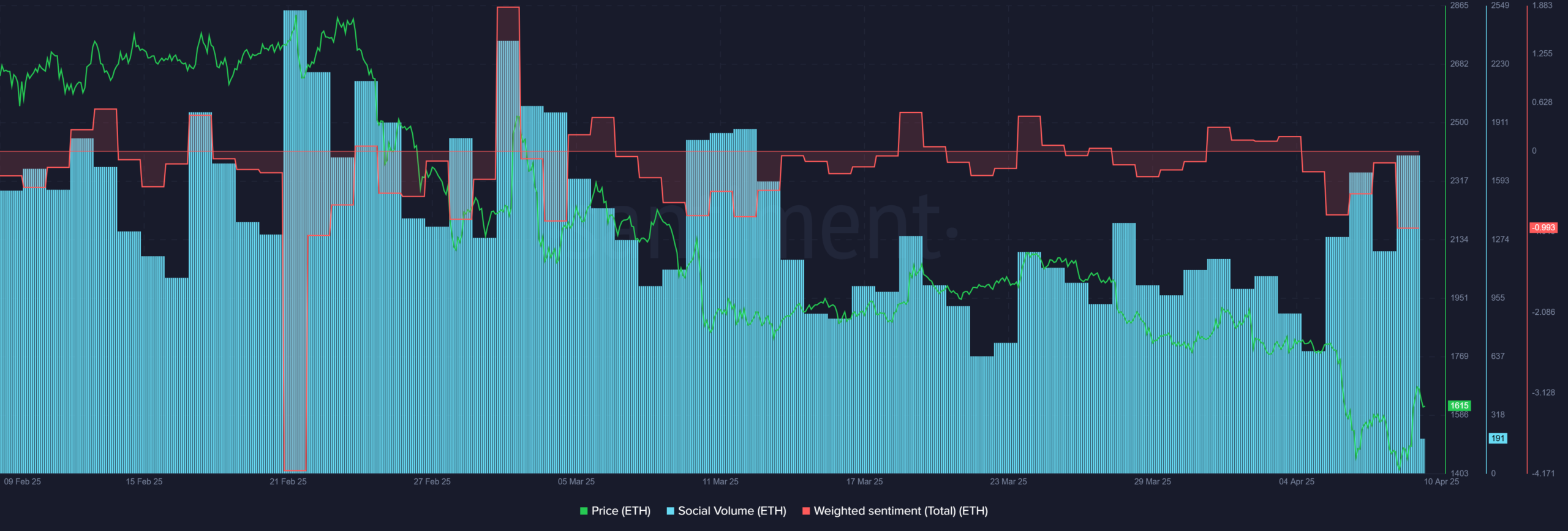

Yet there was a remarkable peak in market interests for the Altcoin, as revealed by the new high in the social volume of April.

Source: Santiment

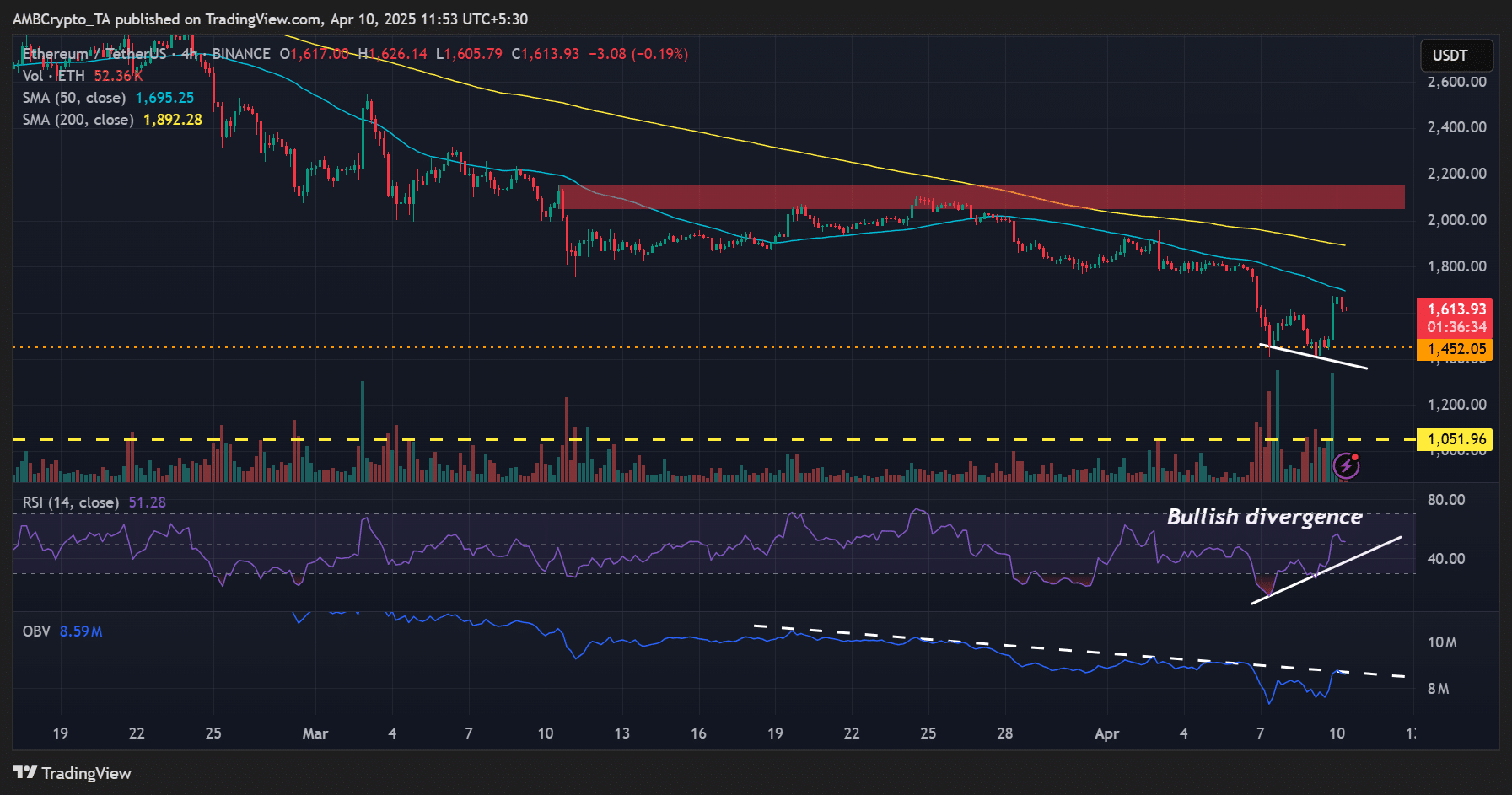

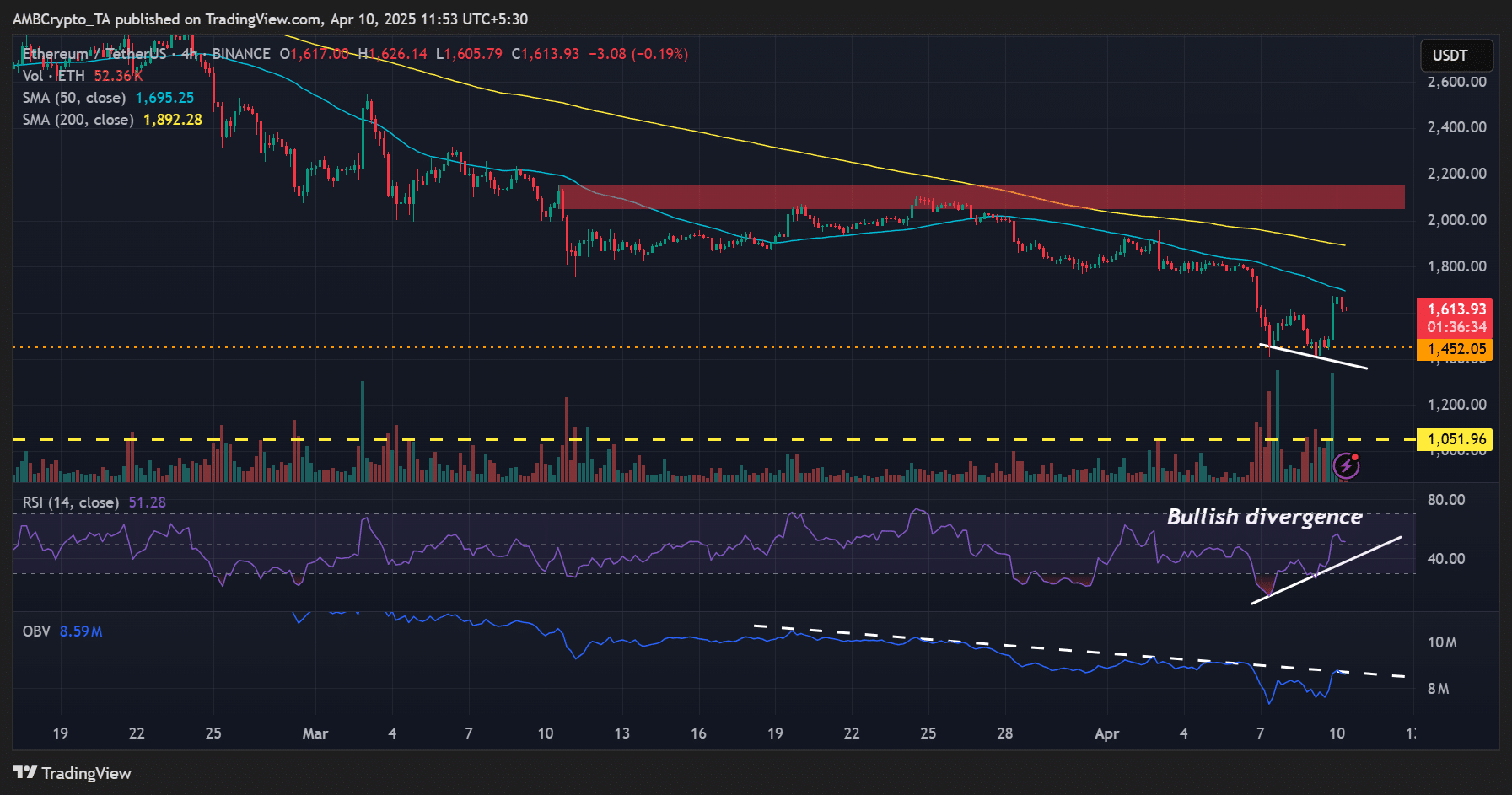

But sentiment was still negative to stimulate a sustainable recovery for ETH. On the 4-hour price diagram, ETH had a Bullish RSI-Divergency, which could indicate that a likely recovery was in sight.

However, the momentum could only be confirmed if it erased the overhead hindernis (trend line resistance) at balance volume (BBV).

Source: Eth/USDT, TradingView

In conclusion, the ETH price could block nearly 50MEE ($ 1600) in the short term, as it did in recent days.

However, a decisive movement and an improved trading volume above the obstacle can push it higher. But the long-term recovery can depend on a positive macro fencing and probably ETH ETF removal approval.