- The SEC has amended its case against Binance to redefine crypto securities.

- The decision comes after the court ruled that BNB is not a security.

In recent months, the Securities and Exchange Commission has been dealing with over-regulation and compliance issues with Binance [BNB]. After many losses, fines and prison sentences for the CEO, Binance’s fortunes changed in July.

As previously reported by AMBCrypto, Binance reported legal victories after the court allowed the company to use customer funds in the US Treasury Department.

In the recent turn of events, the SEC is considering the case against Binance, considering tokens like Solana [SOL] as effects.

SEC changes case against Binance

After a lengthy legal battle, the SEC is reconsidering its case against Binance and former CEO Zhao.

According to a recent report, the commission has amended the case against the crypto exchange regarding the issuance of third-party crypto asset securities.

The court file via the official statement stated that,

“Defendants were unwilling to agree to commence discovery, claiming they could not do so without reviewing the SEC’s proposed amended complaint. However, the SEC is not asking Defendants to agree to conduct an investigation into potential new allegations in the SEC’s proposed amended complaint.”

The SEC’s decision comes amid several changes after the court argued earlier this year that BNB was not a security. The CFTC chairman clarified that 80% of cryptocurrencies are not securities.

It will take 30 days to amend the motion and resolve any pending issues.

The development is significant for the broader crypto markets, as the SEC has prosecuted several cryptos and exchanges over the security statutes of their tokens, such as Ripple. [XRP].

Most importantly, the SEC’s decision will have a significant impact on Binance Coin.

Potential impact on BNB

At the time of writing, BNB was trading at $573.53, having fallen 2.17% on the weekly charts. Moreover, on the daily charts, BNB is down 3.41%.

Despite the price drop, trading volume has increased by 12.92% over the past 24 hours. The prevailing market sentiment was positive.

Source: TradingView

For starters, BNB’s Directional Movement Index (DMI) showed prices had higher highs than lows. At the time of writing, the positive index stood at 21 higher than the negative index at 15.

This suggested that buyers were stronger than sellers, allowing prices to rise.

Furthermore, the moving average convergence divergence (MACD) showed that the 12-period EMA was above the 26-period EMA. So the short-term momentum was stronger than the long-term momentum.

Source: TradingView

Also, the altcoin Chaikin Money Flow (CMF) was positive at 0.08, meaning buying pressure was higher than selling pressure at the time of writing.

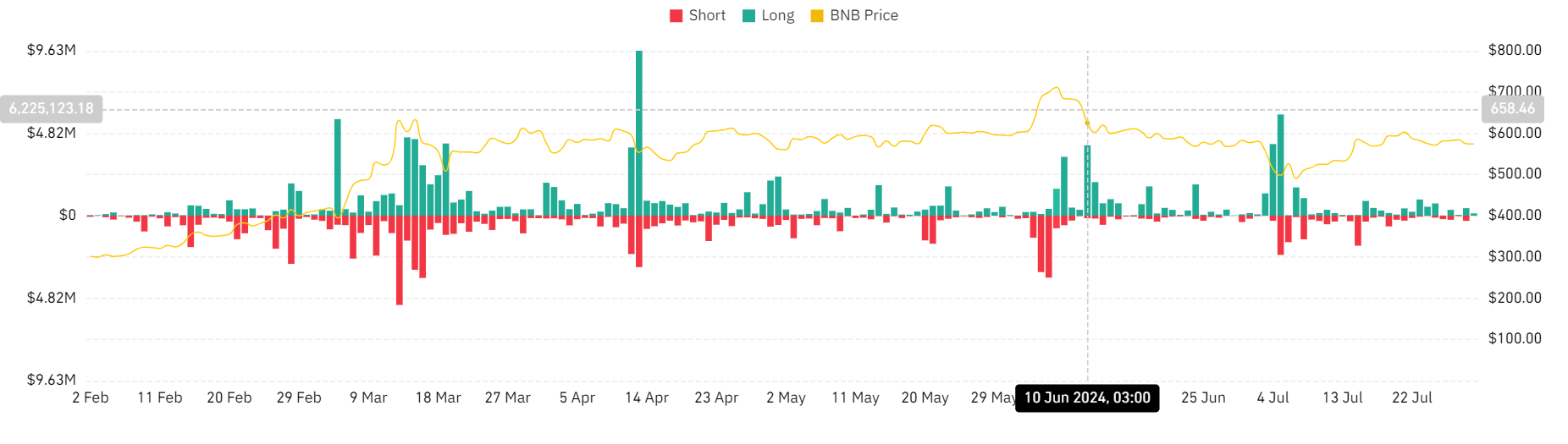

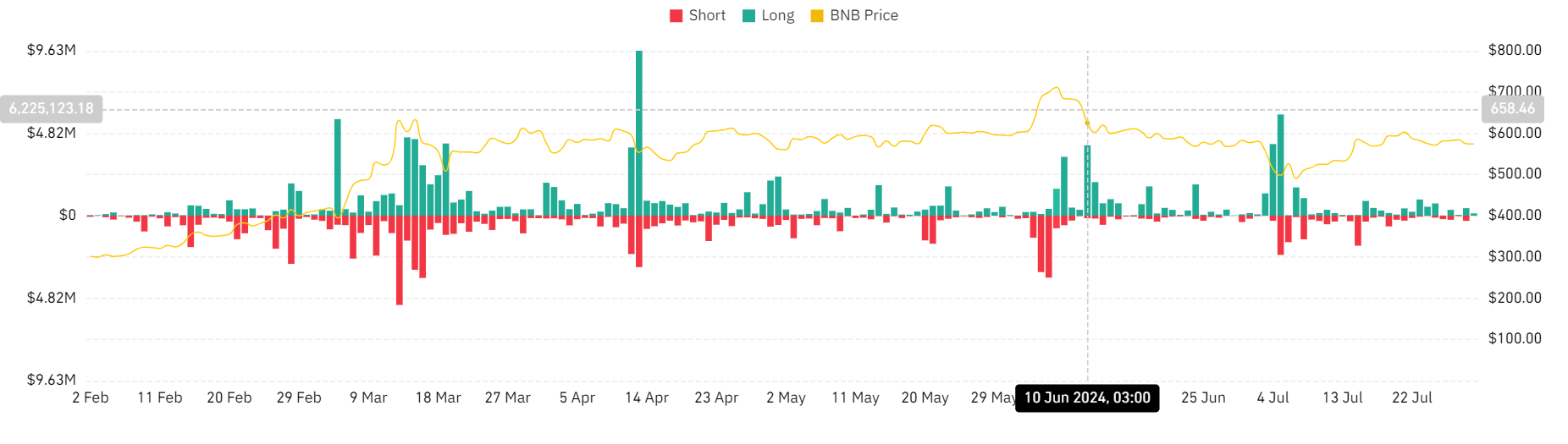

Source: Coinglass

Looking further, AMBCrypto’s analysis of Coinglass showed that BNB has experienced stability during liquidation. Over the past seven days, liquidation of long positions has fallen from $943,000 to $131,000.

The number of liquidations of long positions also decreased in the same period.

Read Binance’s [BNB] Price forecast 2024-25

Therefore, the analysis shows that with a favorable legal status for Binance, the native token, BNB will experience a price increase.

Ongoing regulatory issues reduce investor confidence; Thus, with a clear path, Binance will attract and increase investor confidence, further increasing BNB’s buying pressure.