- Bitcoin continues to create new ATHs.

- Critics believe that Trump’s pro-Bitcoin stance was just a vote-winning tactic.

Bitcoins [BTC] The rapid rise has captured global attention and is reaching new record highs every day. The coin rose to a historic value peak of more than $82,300 as well.

At the time of writing, the stock was trading at $82,025, an impressive 120% gain over the past year. This rally is over urged by US President Donald Trump’s pro-crypto stance and the support of a Congress leaning towards digital assets.

Peter Schiff’s criticism

While Bitcoin’s rise has excited many investors, not all observers are convinced of its long-term viability.

Peter Schiff, chief economist and global strategist at Euro Pacific Asset Management and a noted Bitcoin critic, weighed with harsh skepticism about X. He noted:

“Over the years, Bitcoin promoters have corrupted many.”

He argued that public figures often change their stance on Bitcoin for political or financial gain, citing Trump as a prime example.

According to Schiff, Trump’s new advocacy for Bitcoin was not driven by faith, but by the pursuit of political capital and support.

BTC: No threat to the dollar

Schiff further explained that when Trump was not in the political spotlight, he was outspoken in his negative views, calling BTC “a threat to the US financial system” and believing it could “undermine the US dollar.”

However, Schiff argued that Bitcoin itself is not a problem threat to the US dollar, nor to the US financial system.

The director believes that it is rather the country’s financial irresponsibility and gold that can make this happen. He emphasized this to report,

“Bitcoin is only a threat to those who HODL it or invest in related companies.”

Optimism from market leaders

On the other side of the debate, Bitcoin continues to find strong advocates within the financial sector.

Bitwise Asset Management CEO Hunter Horsley recently highlighted a distinctive aspect of Bitcoin compared to traditional stocks after on X.

He explained that as a company’s share price rises, so do its valuation multiples. This often leads investors to view the stock as overvalued, decreasing their interest until the price falls.

However, when Bitcoin’s price rises, it improves perceptions of its potential success and future value, which could attract more investors and drive the price even higher, he noted.

For example, Horsley noted:

“It will probably rise further.”

Private interest rates are rising again

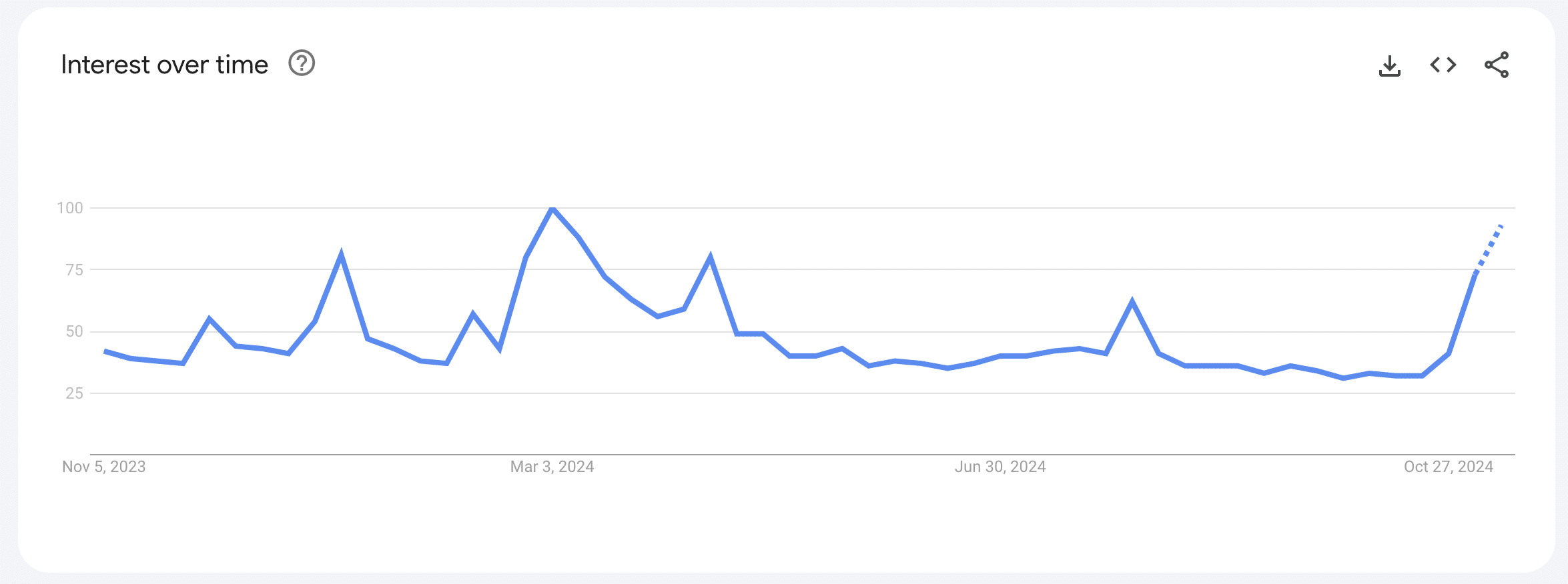

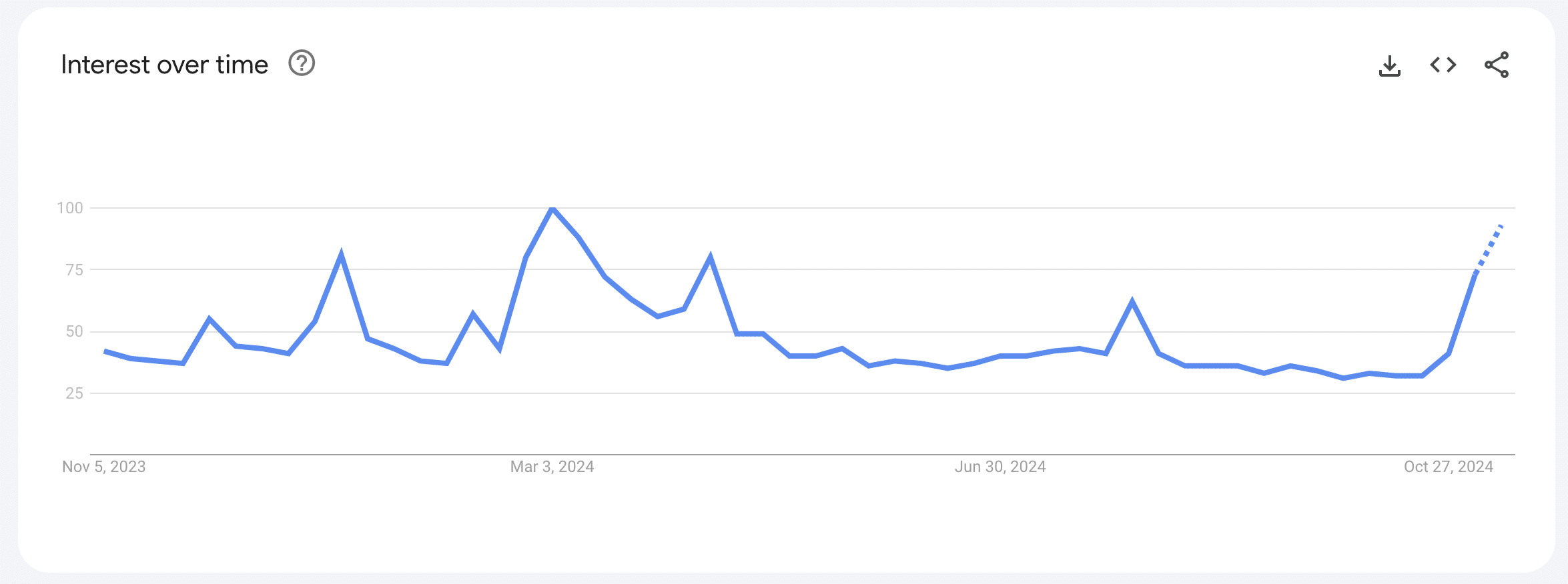

Meanwhile, after sleeping on BTC for a while, it appears that retail interest is finally returning. GoogleTrends facts The past week has seen an increase in Bitcoin-related searches, with a score of 73, up from sustained lows since April.

At the time of writing, the score had risen to 93, indicating a significant revival of interest from individual investors.

Source: Google Trends

Read Bitcoin (BTC) price prediction 2024-25

As retail participation increases and institutional confidence in Bitcoin remains strong, one question remains: how far can Bitcoin’s current momentum go?

Well, for now, the country appears poised for further growth, riding the waves of increased interest and political tailwinds.