Santiment has broken down how the recent action in Bitcoin price may have been influenced by prevailing sentiment in the market.

Trends in Bitcoin’s social volume may have affected its price recently

Like the on-chain analytics company Santiment explained, BTC is generally moving in a direction the crowds are not expecting. The relevant indicator is ‘social volume’, which measures the total number of social media text documents discussing a particular term or topic.

The social media text documents here refer to a collection of social media posts collected by Santiment from various popular platforms such as Twitter, Reddit, and Telegram.

This indicator only checks whether a text document in this collection mentions the term at least once; posts with more than one mention of the subject still get the same weight as a document that only does it once.

To use this indicator to pinpoint discussions of market sentiment, the analytics company first found the social volume of Bitcoin and cryptocurrency in general. It then filtered it down to some specific terms that refer to the mindset of the investors.

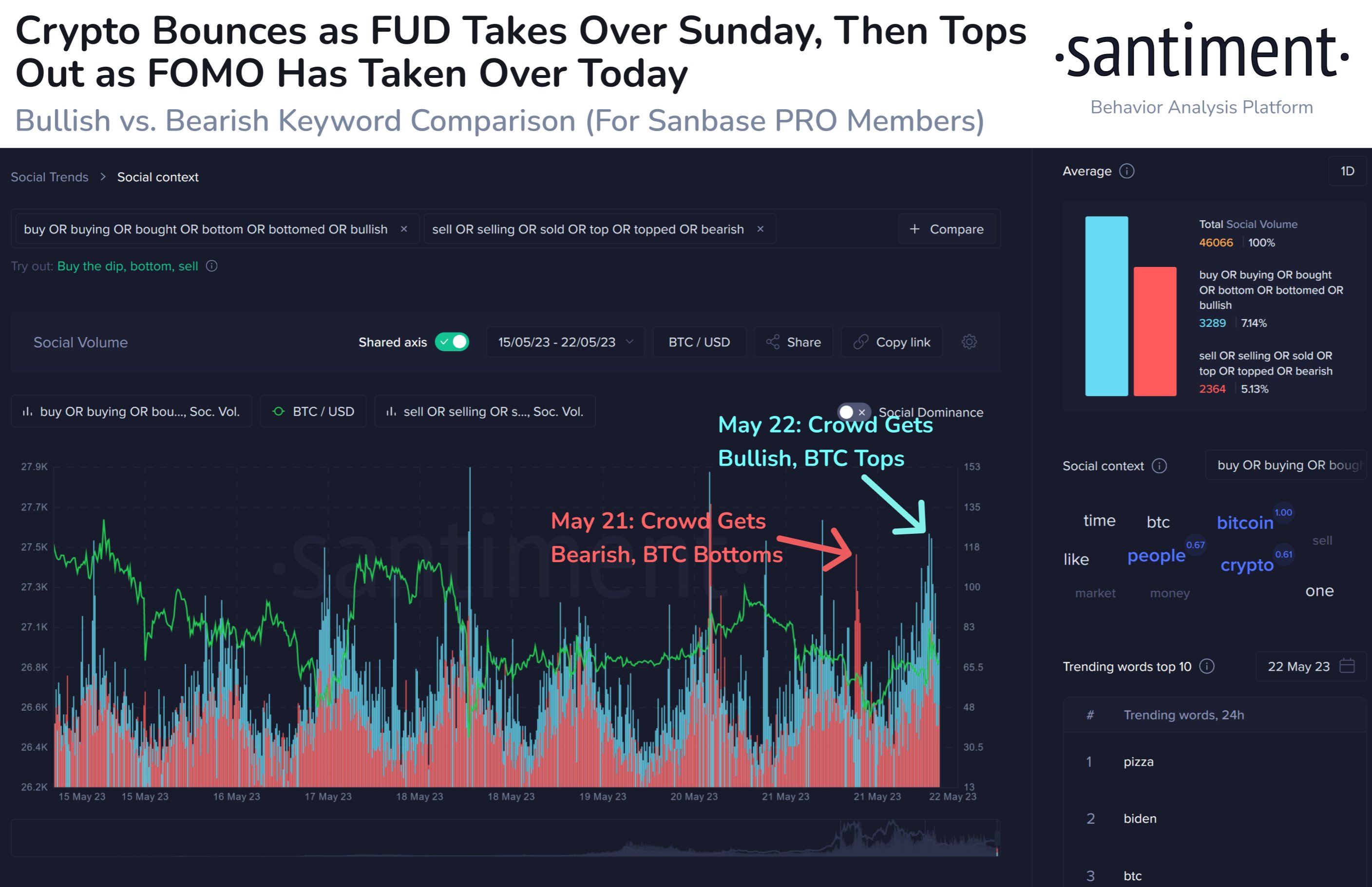

Here is a chart showing the trend in Bitcoin’s social volume for negative and positive sentiment over the past week:

The trend in the two market sentiments for BTC over the last few days | Source: Santiment on Twitter

The terms used here to separate the discussions related to positive sentiment are buy, bullish, and bottom. Likewise, sell, top, and bearish are some of the terms that have been used for finding negative conversations.

On the chart, Santiment has marked the pattern that the social volumes of these sentiments have followed over the past few days. On the 21st, after the fall in the price of the asset, the value of the negative mindset indicator experienced a major spike.

This means that the social media discussions had turned quite bearish when this price drop happened. However, once this mindset change took place, the cryptocurrency saw a local bottom formation.

The next day, the coin saw some gains and broke back above the $27,000 level. While this increase was taking place, sentiment turned positive again.

However, by the time the price broke above $27,000, the social volume of the greedy sentiment had reached quite high levels. Like when the negative sentiment had become overwhelming, the bottom had formed, a top emerged after this positive mentality spike.

Historically, the Bitcoin market has generally moved this way; when sentiment becomes too unbalanced towards one side, the market tends to move in the opposite direction to the sentiment of the majority.

BTC price

Since Santiment posted its analysis and the flush in positive sentiment, Bitcoin has surged back above $27,000. At the time of writing, the coin is hovering around $27,300, up 1% over the past week.

BTC has observed an uplift during the past day | Source: BTCUSD on TradingView

Featured image from Thought Catalog at Unsplash.com, charts from TradingView.com, Santiment.net