- Analysts believe altcoins may continue to underperform Bitcoin as the market deviates from previous patterns

- Solana could be the reason why the market cap of altcoins has not reached lower lows

Altcoins have underperformed Bitcoin (BTC) this year, with most of the top ten altcoins Binance Coin (BNB) And Ton coin (TON)and failed to regain their previous highs.

In fact, according to Andreas KangPartner at Mechanism Capital, the market is not following its previous patterns. Traditionally, when Bitcoin hits a new all-time high, altcoins follow suit. However, this didn’t happen for most altcoins earlier this year when BTC reached an ATH of $73k on the charts.

“Altcoin market caps (and ETH) should reach new highs in new cycles. It is becoming increasingly clear that this is not the case… Even if Bitcoin reaches new highs, it does not mean altcoins will keep up.”

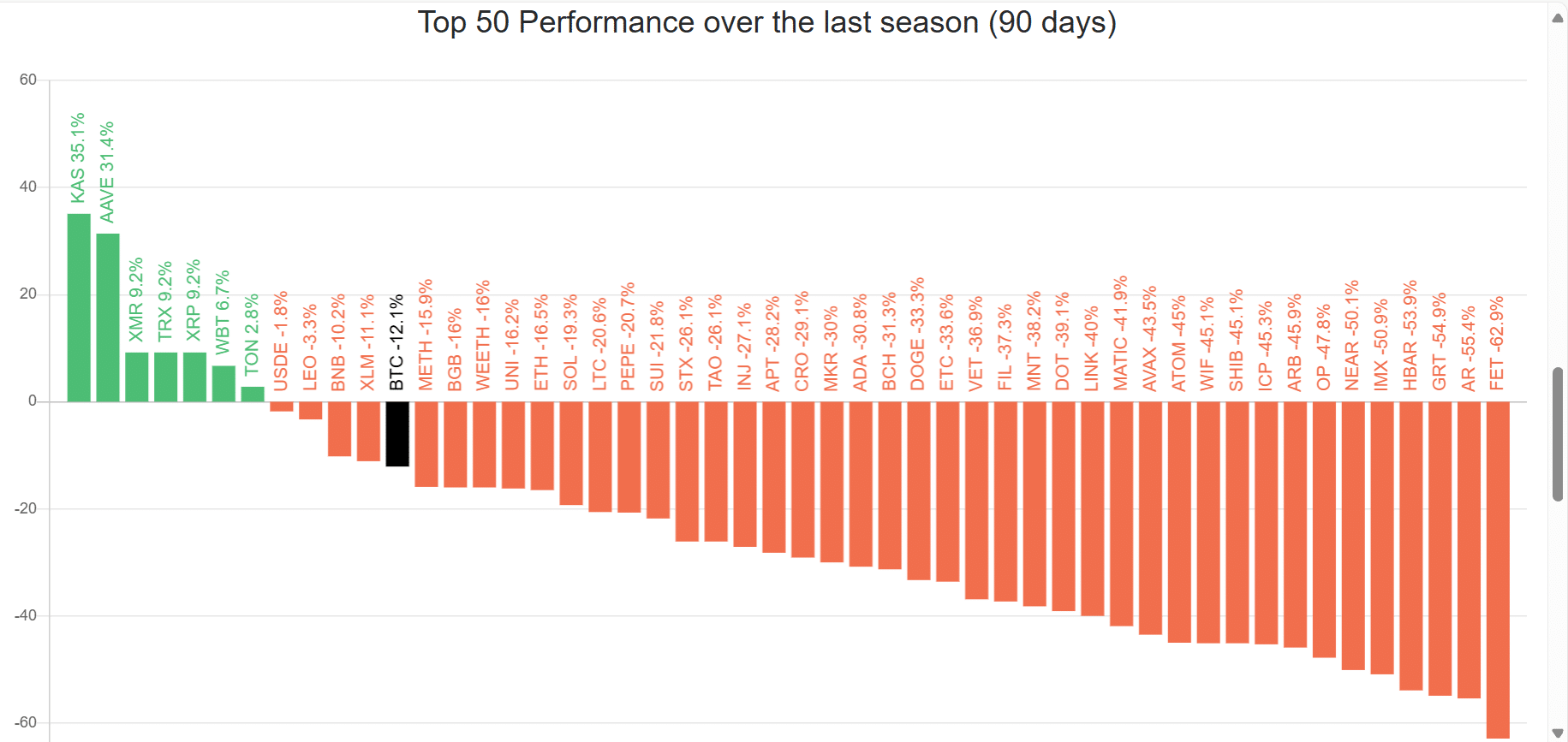

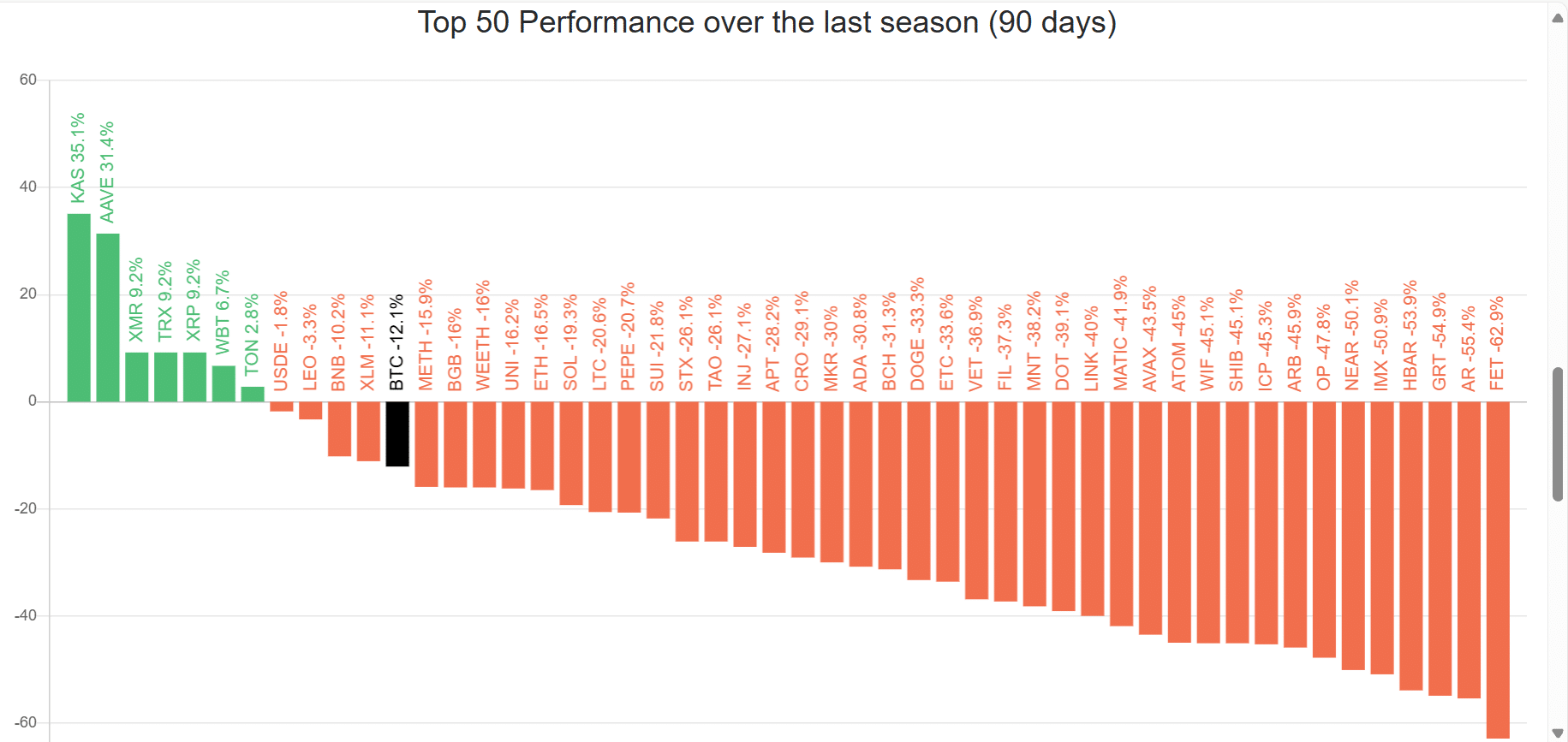

A look at data from Blockchain Center revealed that only 11 of the top 50 altcoins outperformed Bitcoin over the past 90 days.

Source: Blockchain Center

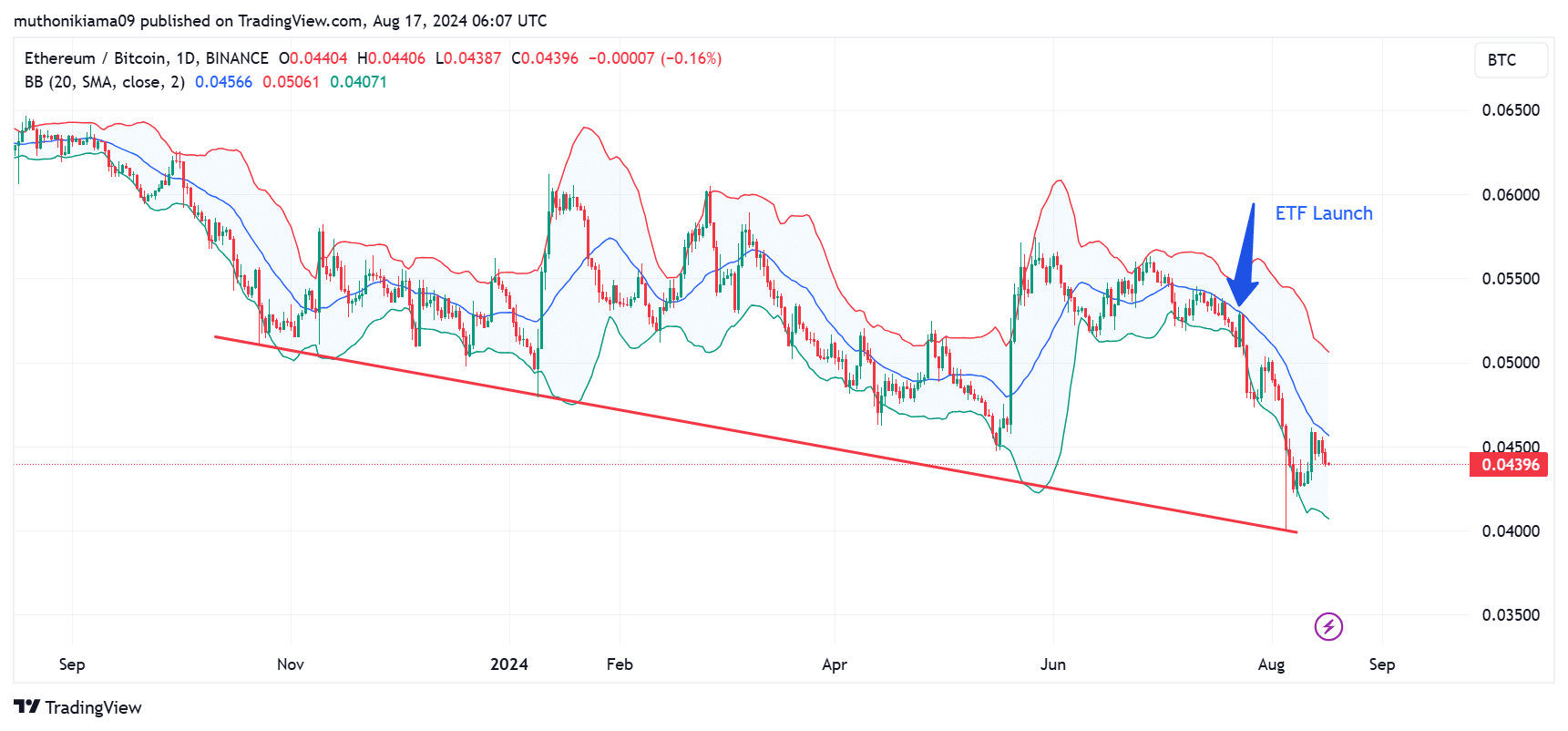

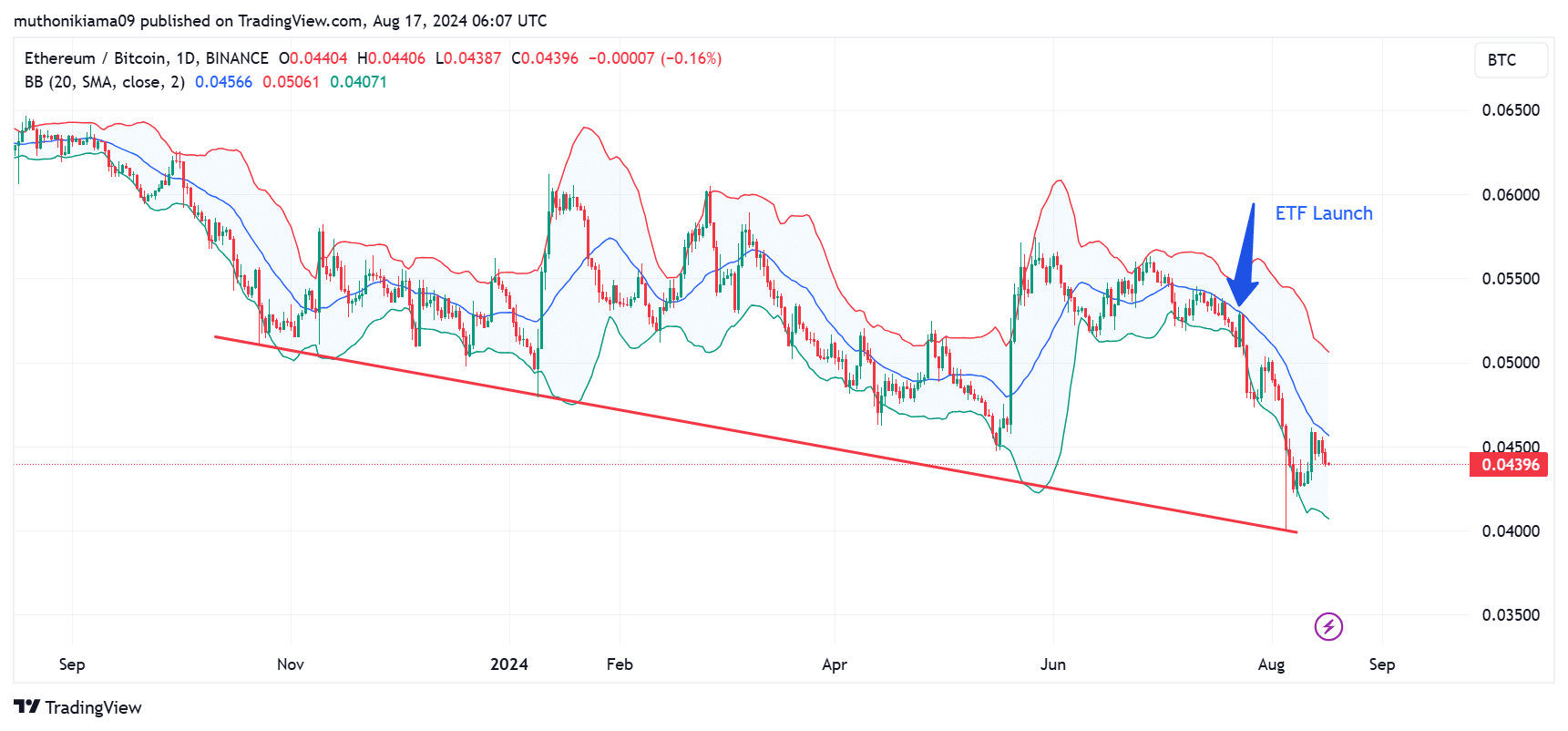

ETH forms yearly lows against Bitcoin

Kang’s analysis comes as Ethereum hit a yearly low against Bitcoin on August 9. The daily ETH/BTC chart also revealed that the largest altcoin has made lower lows against BTC since October last year.

Furthermore, ETH has failed to recover from the middle Bollinger band (20-day Simple Moving Average) since Ether Exchange-Traded Funds (ETFs) began trading in July. This is just a sign of underperformance.

Source: ETH/BTC, TradingView

According to Kang, altcoins are likely to bottom out in 2025 before making a bullish rebound.

Solana is the safety net?

But that’s not all, as Kang believes Solana (SOL) is the only reason why the market cap of altcoins, currently around $1 trillion, has not reached a lower low on the charts.

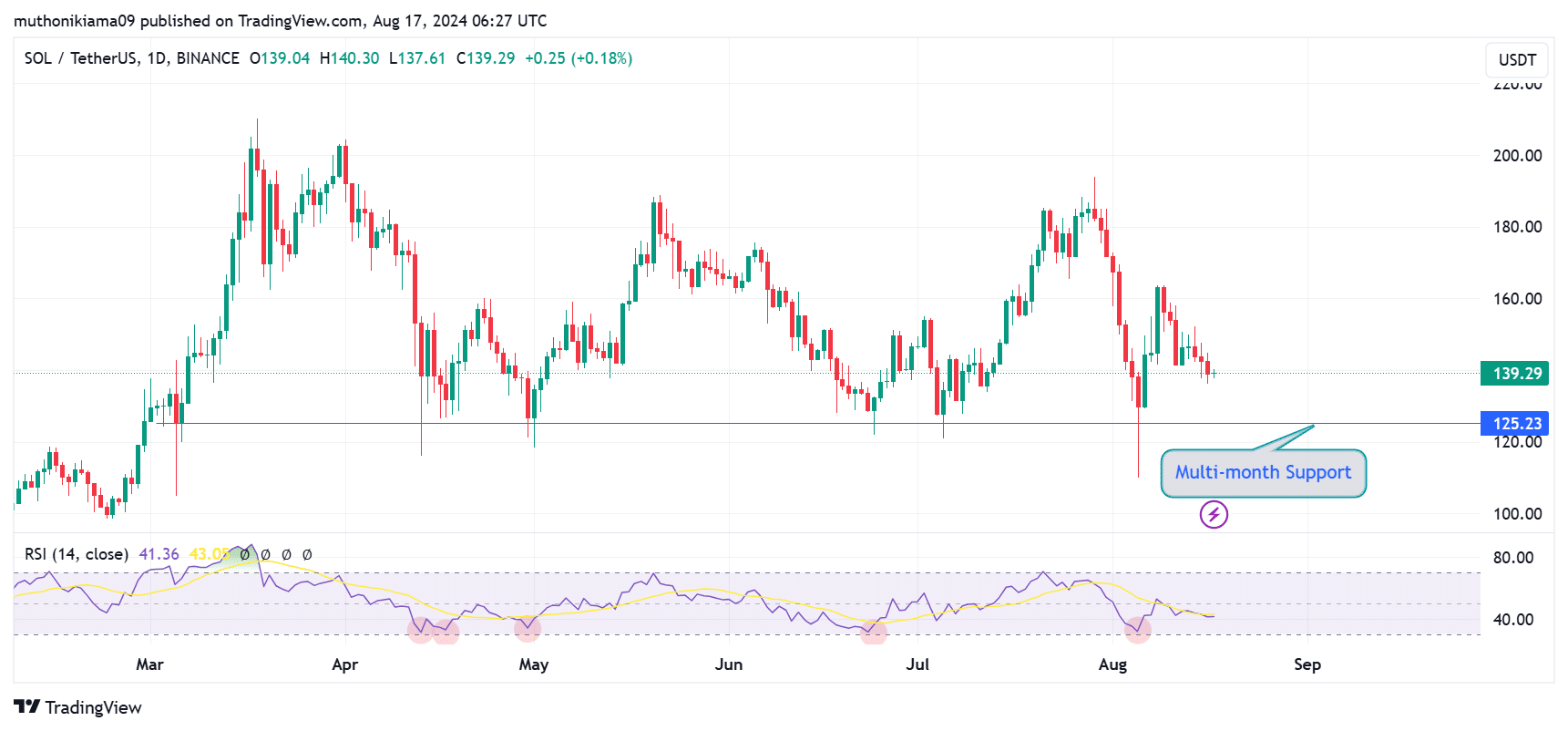

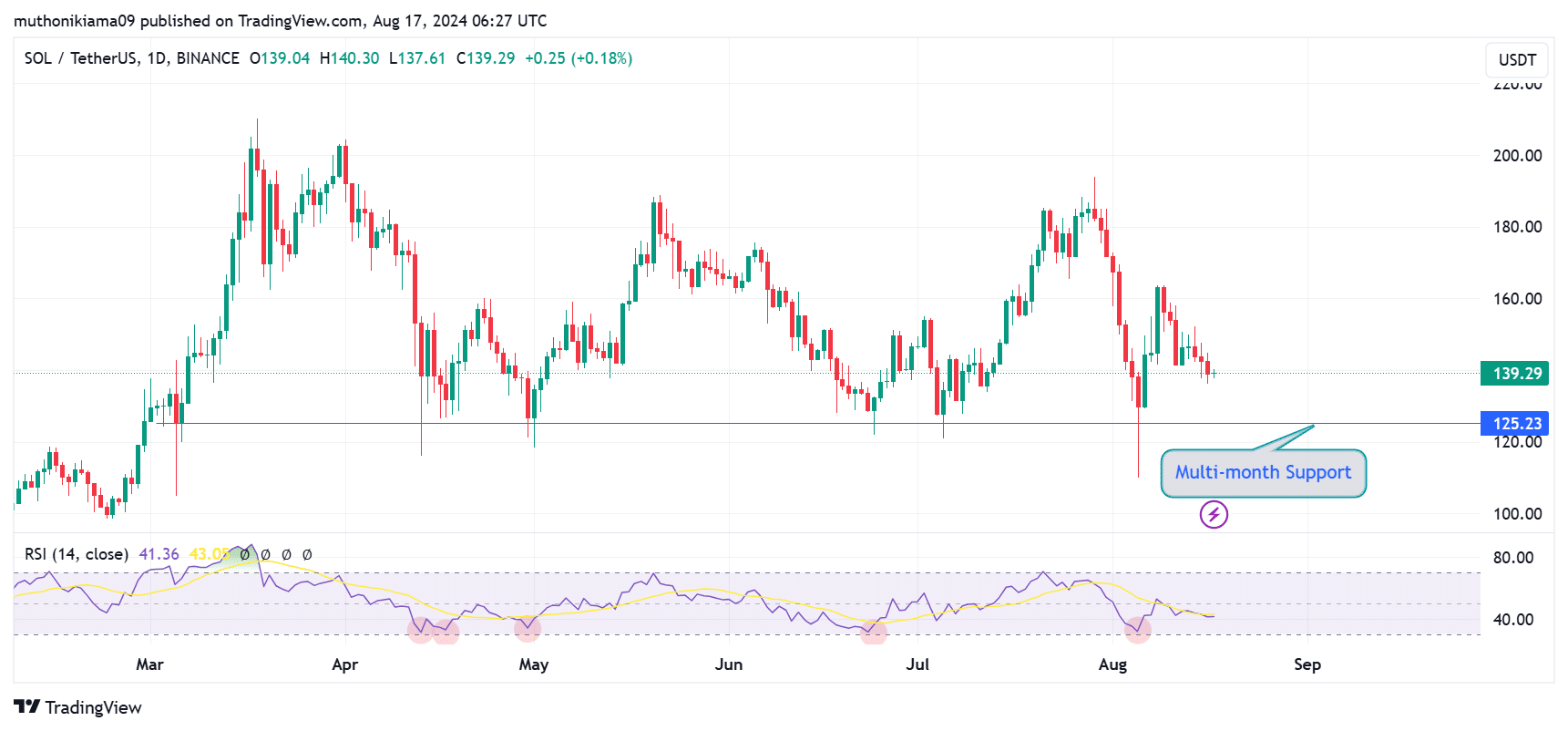

Solana has even been defending a multi-month support level of $125 since March 2024.

Source: SOL/USDT, TradingView

The psychological level of $125 is a crucial price to watch as it showed that despite downward pressure, SOL has established a stable foundation that prevents steep declines.

The Relative Strength Index (RSI) has also maintained levels above 30 since March – a sign that SOL has not been oversold for some time.

This trend indicated that buyers avoided significant downside risk. This strong support for SOL supports Kang’s contention that Solana’s price is less likely to reach a lower low.

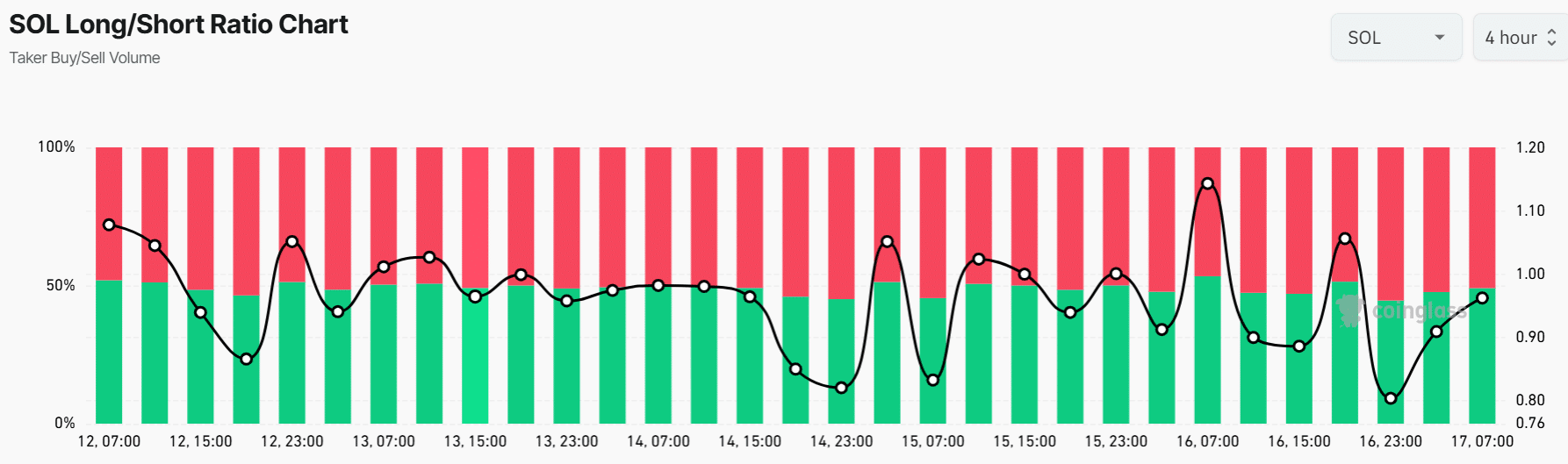

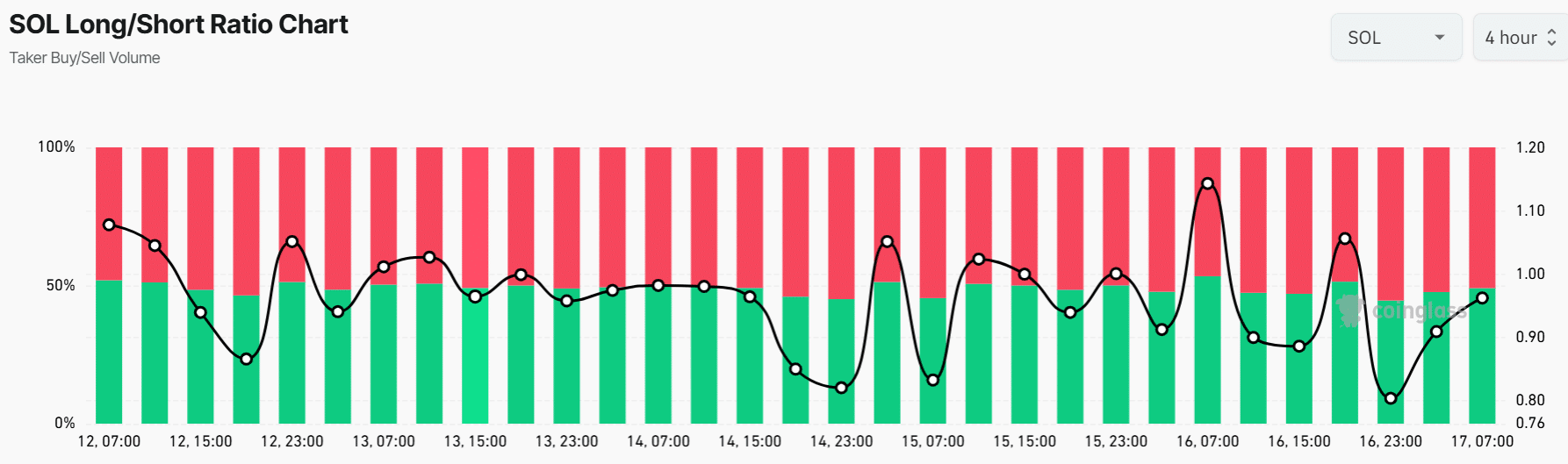

Moreover, the Futures market showed almost balanced sentiment around SOL by traders. The long/short ratio for SOL at the time of writing was 0.97, indicating that short positions are slightly higher than long positions.

Source: Coinglass

Nevertheless, Solana’s strength has not been enough to support the altcoin market. At the time of writing, the Altcoin Season Index had a value of 22, indicating that the market currently favors Bitcoin over altcoins.