- RLUSD integration and growth reflect Ripple’s urge to worldwide dominance of enterprise payments.

- Stablecoin competence increases as Ripple focuses on top-five status with $ 3 billion RLUSD market capitalization.

Ripple[XRP] Labs continues to make waves in digital financing by integrating its RLUSD Stablecoin directly into Ripple payments. Jack McDonald, CEO of Standard Custody, confirmed the rollout, says,

“RLUSD is now integrated into Ripple payments-unused cross-border payment solution with almost global coverage via 90+ payment markets … Enterprise Utility directly outside the box.”

The integration of RLUSD establishes connections with a robust network of banks, financial institutions and payment providers worldwide.

This Stablecoin offers direct access to deep liquidity, allowing companies to arrange efficiently cross -border transactions.

Ripple’s launch of RLUSD goes beyond the introduction of a stablecoin – it is the stage for scalable Enterprise acceptance. The company also announced plans to use RLUSD as collateral for Tokenized assets and to expand its application within Defi protocols.

How fast has RLUSD grown since the launch?

Since the official launch in December 2024, RLUSD has brought explosive growth. Ripple recently beat 50 million new RLUSD -Tokens on the XRP whides, which demonstrated the continuous demand.

Consequently, total market capitalization increased to an impressive $ 293.79 million, much more than the initial projections.

In addition, lists at large stock markets such as Kraken and Margex have reinforced the exposure of the token. These strategic movements not only stimulate accessibility, but also reflect the increasing trust at institutions.

While RLUSD still follows Titans in the industry such as USDT and USDC, the current process indicates that it could quickly close the gap.

That is why the implementation of Ripple around RLUSD proves that usefulness, compliance and adoption can scale together – well.

Is RLUSD a real competition in the Stablecoin Arena?

The Stablecoin market has become a fierce battlefield. Circle recently applied for an IPO and Tether has taken over 8,888 BTC, which signaled aggressive expansion strategies from Ripple’s most important competitors. These movements indicate that established players prepare themselves for the long -term dominance.

However, Ripple follows a different approach. By binding RLUSD to compliance with the regulations and infrastructure for business quality, Ripple wants to position the Stablecoin in the top five in the top five in the top five.

The company also tries to achieve a market capitalization of $ 3 billion, so RLUSD is firmly determined in the upper echelon of digital assets.

Unlike his competitors, RLUSD not only wants to compete – it tries to disturb. Its integration with regulated financing gives it a head start that many rivals lack.

How does XRP react to Ripple’s expansion strategy?

XRP remains essential in this story. A recent CNF report confirmed that Ripple locked 700 million XRP in Escrow after large-scale wallet activity.

This action strengthens long -term trust and reduces the immediate market stock.

At the time of writing, XRP [XRP] Traded at $ 2.05, as a result of a price decrease of 2.49% in the last 24 hours. The trade volume, however, increased by 63.28%and reached $ 6.82 billion – a strong indicator for active market involvement.

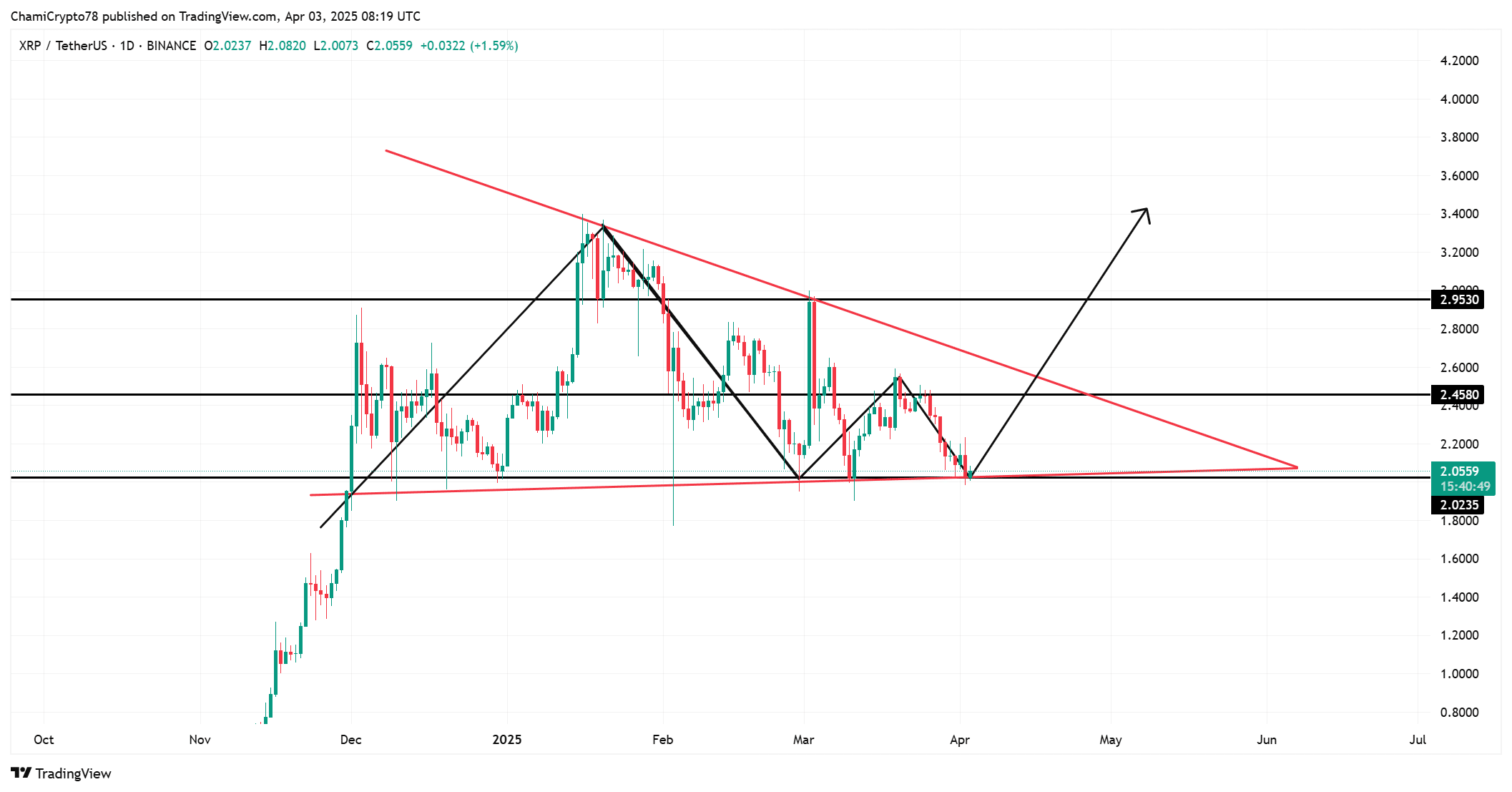

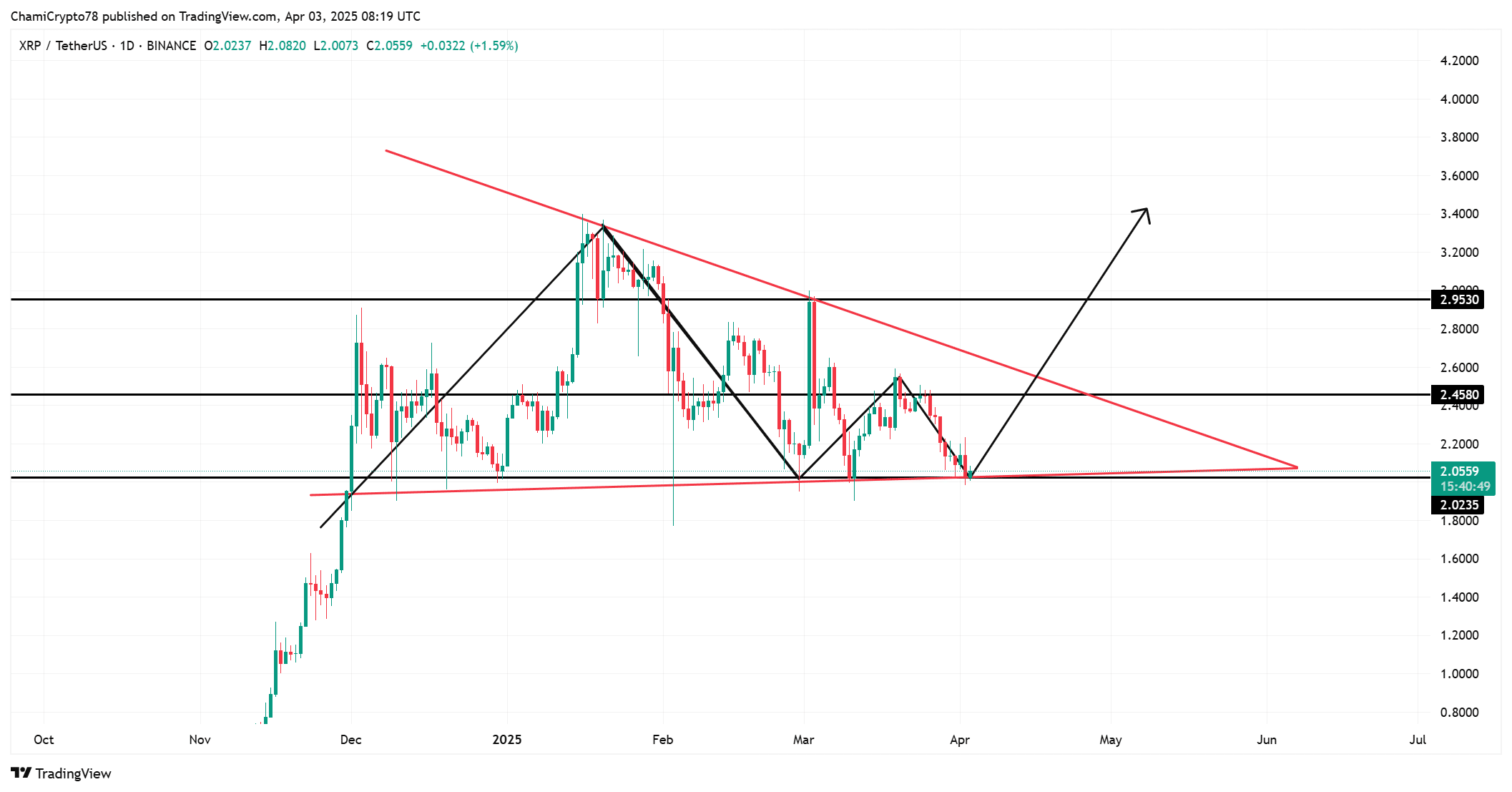

From a technical point of view, XRP traded within a bullish pennant flag, as shown in the latest graph. The token bounced from the $ 2,0235 key support, signaling potential up momentum.

If this breakout occurs, XRP can push to the next major resistance levels at $ 2,4580 and $ 2,9530.

That is why the current Setup of XRP offers a possibility with a high probability for bulls. Moreover, the RLUSD integration strengthens the basic principles, so that both assets are tailored to ongoing growth.

Source: TradingView