- BTC has to overcome a strong resistance with the range of $ 88k – $ 90k to maintain Bullish Momentum amidst the $ 16.5 billion outcome.

- A high concentration of Bitcoin call options near $ 90k and falling volume places on potential profitable or a break in the rally.

A record -breaking $ 16.5 billion in Bitcoin [BTC] Options are set to end on March 28, which means that intense speculation is led to the next major movement of the Activum.

While traders are bracing for this important event, the option market and technical indicators of crucial signals that can form the direction of Bitcoin in the short term.

Option market sees Bullish Tilt, but heavy clusters continue to exist

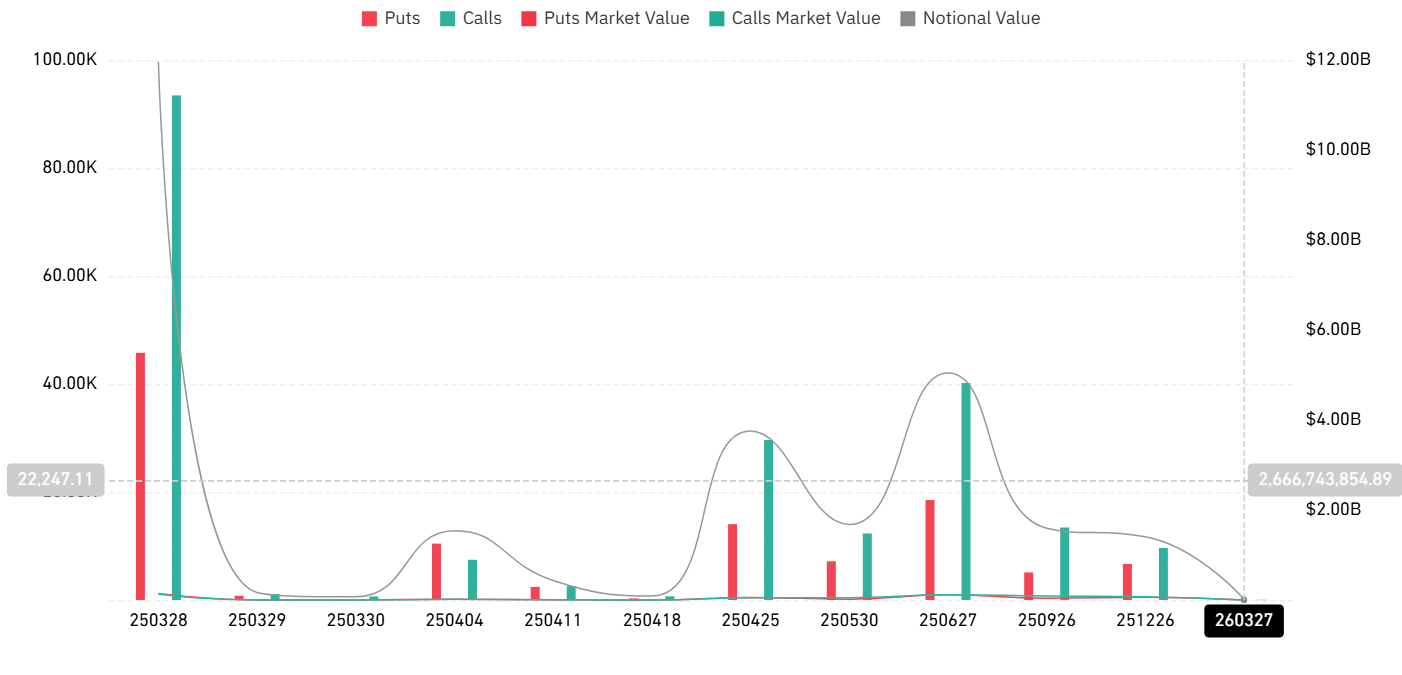

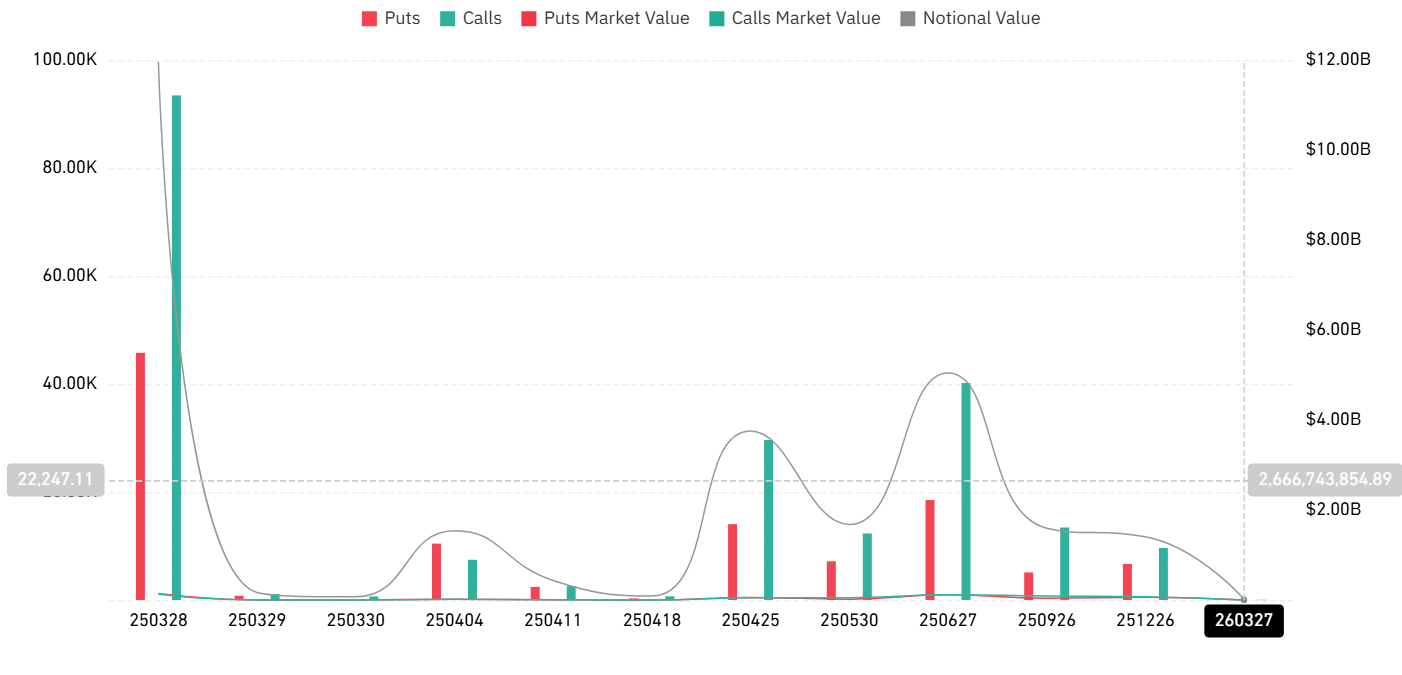

Data of Coinglass Shows mass open interest (OI) near the exercise price of $ 90K, with a remarkable tilt to Call options.

The fictional value of the outstanding contracts has reached a record high, which emphasizes an increased market barking.

Source: Coinglass

Interesting is that there is a large concentration of on -call options around the brands of $ 90k and $ 95k, suggesting that bulls are gambling on an outbreak outside these resistance levels.

However, there is also a considerable put cluster near the $ 80k $ 82k range, which means that a failure to climb over $ 90,000 can cause downward pressure if traders aggressively covered their positions.

The technical arrangement of Bitcoin Hints with caution despite the momentum

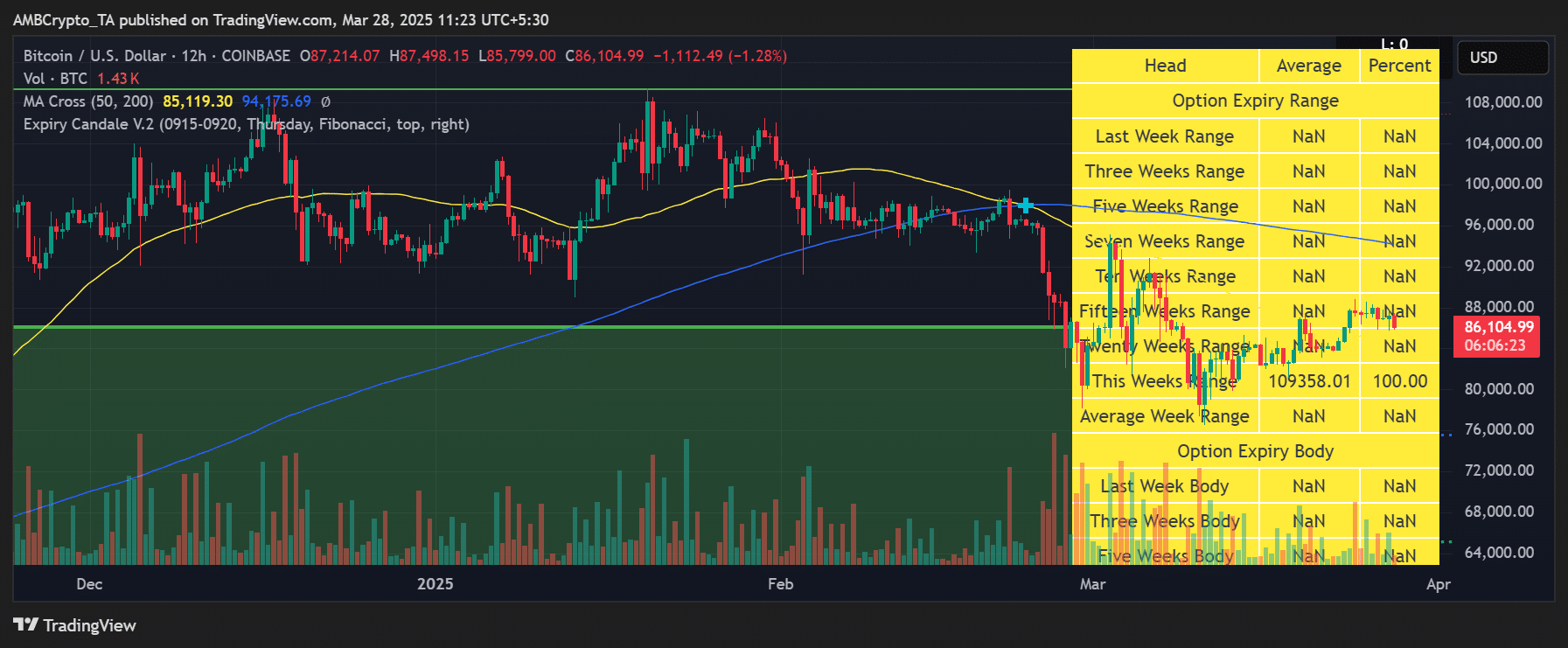

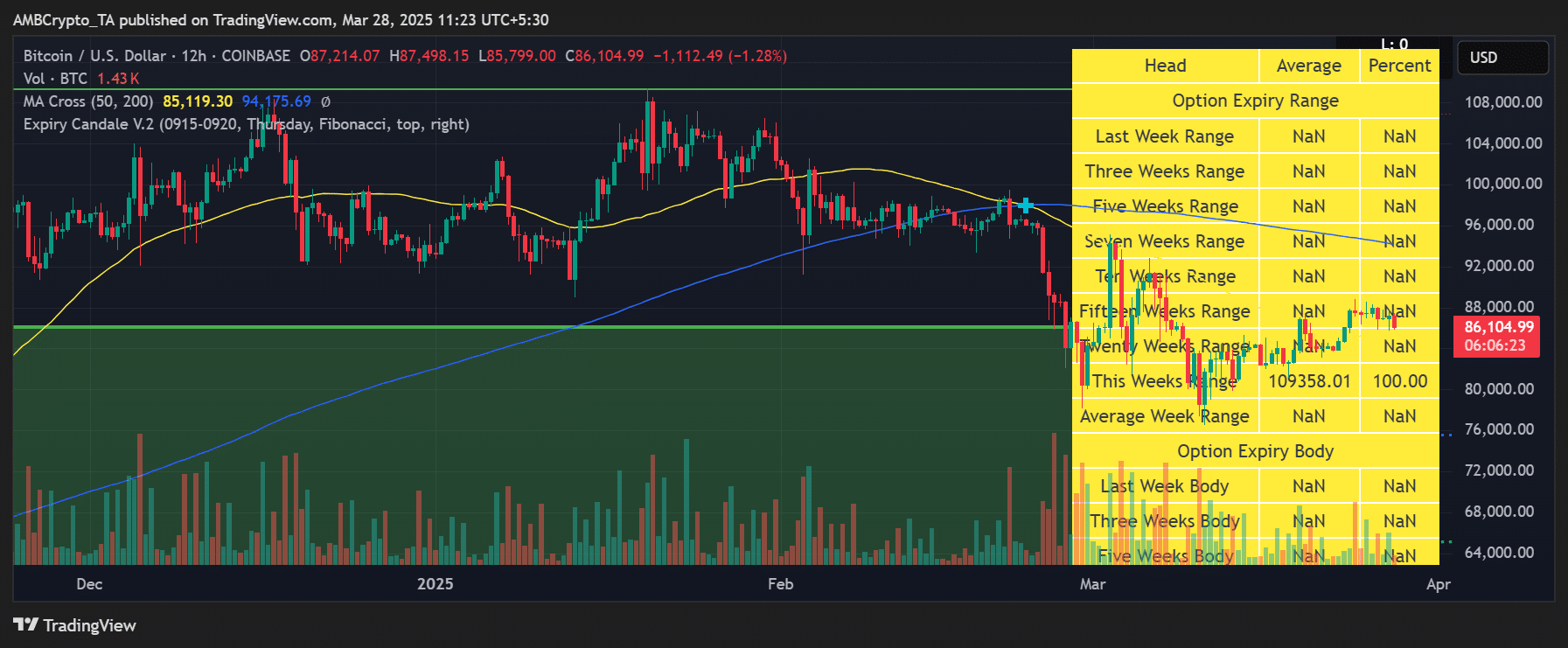

On the BTC/USD graph of 12 hours, Bitcoin traded around $ 86,100 and struggled to maintain up momentum.

The 50-day MA at $ 85,119 acted as support in the short term, while the 200-day MA loomed at $ 94,175 overhead as an important resistance.

Source: TradingView

Adding to the uncertainty is the Fandnijkstaarse -indicator, which marks the current weekly decay range at $ 109,358, well above the current price.

Historically, option -expiration date events can introduce volatility spikes, but often fail to push BTC further than the most important psychological levels, unless the volume follows.

Low volume and high risk: can Bitcoin bulls maintain the push?

Volum statistics suggest weakening participation, as reflected in the relatively muted trading activity despite increased OI.

This divergence indicates that although positions are stacked, the actual belief remains low. Even small price shifts can cause liquidations and exaggerated movements in such an environment.

In the meantime, data on the chain shows some support near the $ 85K region. If Bitcoin succeeds in maintaining this level due to the expiry date, it could serve as a launch platform for a retest of $ 90k. However, a break below can invite sales in the short term, especially with a heavy leverage.

Conclusion

As Bitcoin approaches the next $ 16.5 billion options, all eyes are aimed at whether bulls can reclaim $ 90k or that the replacement will generate a temporary withdrawal by the replacement.

With heavy OI, mixed signals and thin volume, the next 48 hours can be decisive for the trend of BTC in Q2 2025.