- The sharp drop in the DXY index impacted the share of stablecoins in Bitcoin volumes in 2023.

- Binance was guilty of a major contributor to the downturn.

Bitcoin [BTC] in 2023 it is no longer what it used to be. Volatility at record lows, weak exchange volumes and a slumbering disinterest among day traders have become the norm for the asset class, which recently built the fortunes of many in the 2020-2021 bull market.

Read Bitcoin’s [BTC] Price Forecast 2023-24

James Butterfill, head of research at digital asset investment firm Coinshares, cited input from the organization’s trading team to highlight how market makers and retailers have steadily exited the exchanges in recent months. “Some are now only working five days a week on a 24-hour schedule, rather than daily,” Butterfill added.

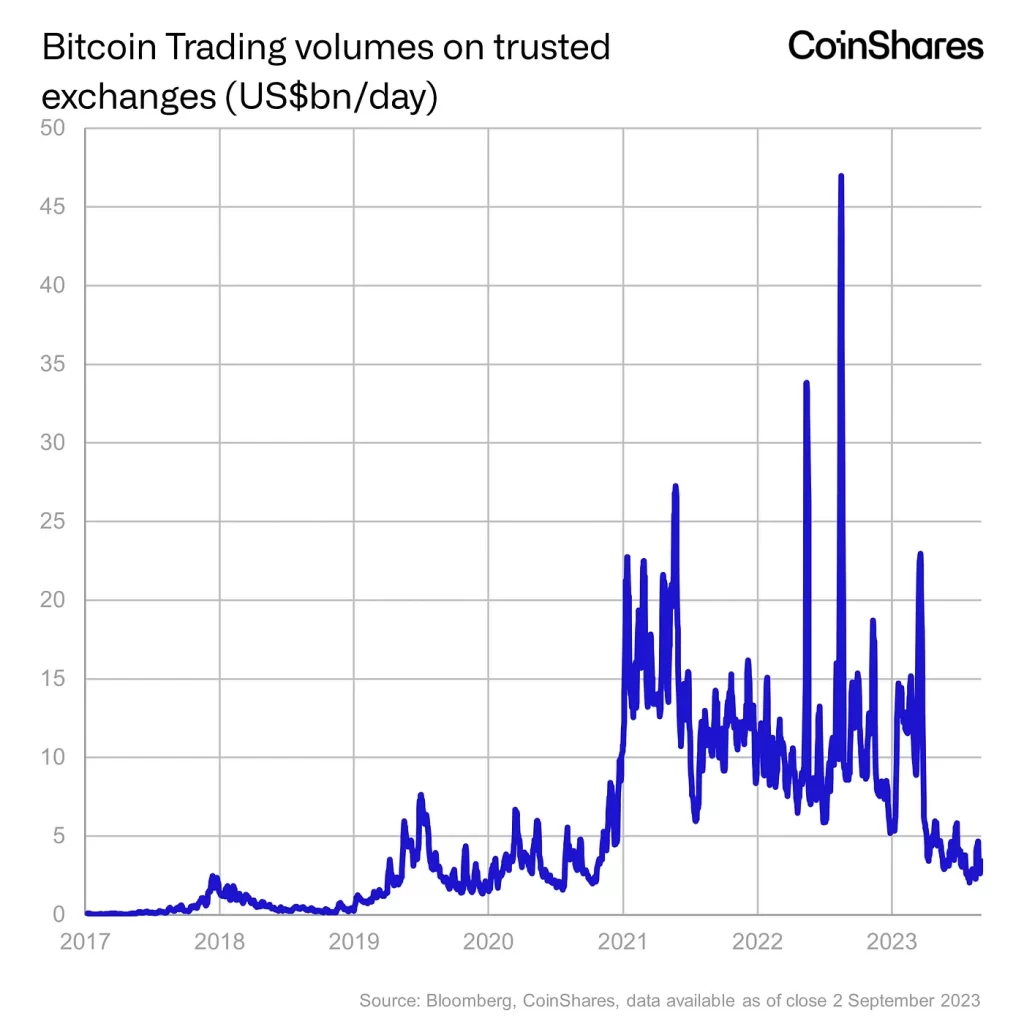

Daily average volumes decrease in 2023

A look at the daily trading volumes in 2023 was enough to paint the contrast. On average, about $7 billion in transactions involving Bitcoin were settled on centralized exchanges this year, significantly down from the $13.8 billion and $11 billion in 2021 and 2022, respectively.

Particularly from the second quarter of 2023, there is a significant decline in trading volumes, reminiscent of the period before the 2019-2020 bull run.

Source: Coinshares

Butterfill drew attention to some fascinating discoveries while also explaining the reasons behind the drop in trading activity.

Decreasing demand for USD-pegged stablecoins

As becomes clear below, the first phase of the 2021 bull run was driven by trades against altcoins and fiat currencies. As the end of 2021 progresses, demand for US dollar-backed stablecoins suddenly increased. The trend continued into 2022 and the first quarter of 2023.

Source: Coinshares

Growing demand for stablecoins, and by extension the USD, coincided with the start of the US Federal Reserve’s rate hike cycle. In March 2022, the central bank approved its first rate hike in more than three years as part of its efforts to combat rising inflation.

Rate hikes by the Fed exert significant upward pressure on the US Dollar Index (DXY) as the policy results in increased demand for dollars from foreign investors.

Naturally, a strengthening USD has prompted investors around the world to liquidate their Bitcoin holdings in favor of stablecoins. Note how DXY was highly correlated with stablecoin market share in Bitcoin trading volumes around that time period.

Source: Coinshares

However, inflation in the US has slowed relatively in 2023, raising hopes that the Fed’s cycle of aggressive supply increases would eventually come to a halt. This resulted in a sharp fall in the DXY and high stablecoin volumes fell as a result.

Binance led decline

While a drop in stablecoin’s share of Bitcoin volumes could partially explain the low exchange trading activity in 2023, other notable factors were at play. Ironically, the largest crypto exchange in the world, Binance, was one of the main contributors to the decline.

Source: Coinshares

This drop was mainly due to Binance ending its no-fee trading program earlier this year in March. According to an earlier report According to Kaiko, zero-fee trading volume made up the bulk of total volumes on Binance, almost 66%, through mid-March 2023. Note that Binance managed to snatch a significant share from rivals after the attractive plan was introduced .

Add to that the increasingly aggressive stance of US regulators towards crypto participants. Binance was on the radar of the US Securities and Exchange Commission (SEC) in 2023, with the latter filing a lawsuit against the crypto giant in June.

Fears of a repeat of an FTX-like situation that saw many locked out of the exchange led to a gradual withdrawal from Binance.

In addition, there is the significant decline of Binance USD [BUSD] volumes, again accelerated by the regulatory crackdown, contributed to Binance’s troubles in 2023.

Bitcoin has more addresses than…

While Bitcoin has been moderate on trading platforms, it has not had any impact on global adoption trends. According to a September 3 post by popular on-chain sleuth Ali Martinez, the total number of BTC addresses recorded another milestone. With a count of 48.5 million, Bitcoin had more wallets than the entire population of Spain.

Today the number #Bitcoin holders has surpassed the entire population of Spain 🇪🇸, with over 48.5 million $BTC hodlers! pic.twitter.com/uWQVRQsLm6

— Ali (@ali_charts) September 3, 2023

Is your wallet green? Check out the BTC Profit Calculator

It should be noted that there is no 1:1 mapping between a holder and a wallet, as multiple wallets can be linked to a single holder of BTC.

At the time of writing, BTC was exchanging hands for $25,961.49, per dates CurrencyMarketCap.