- The double bottom formation signals a potential bullish reversal for Quant.

- Rising network activity and reduced foreign exchange reserves reinforce optimism about QNT’s price recovery.

Quantitative [QNT] is showing encouraging signs of recovery, with prices holding steady near key support levels despite a recent dip in momentum.

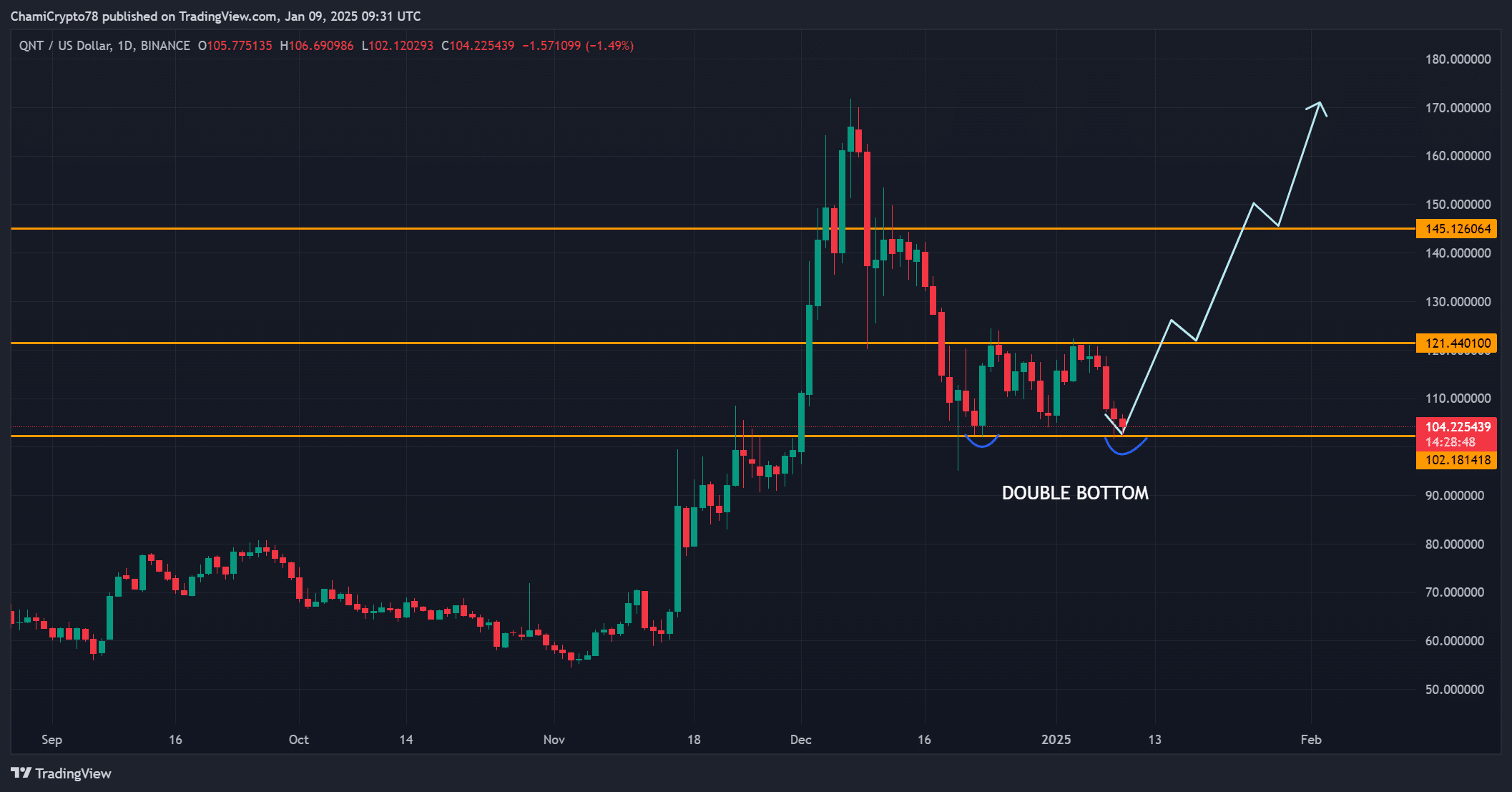

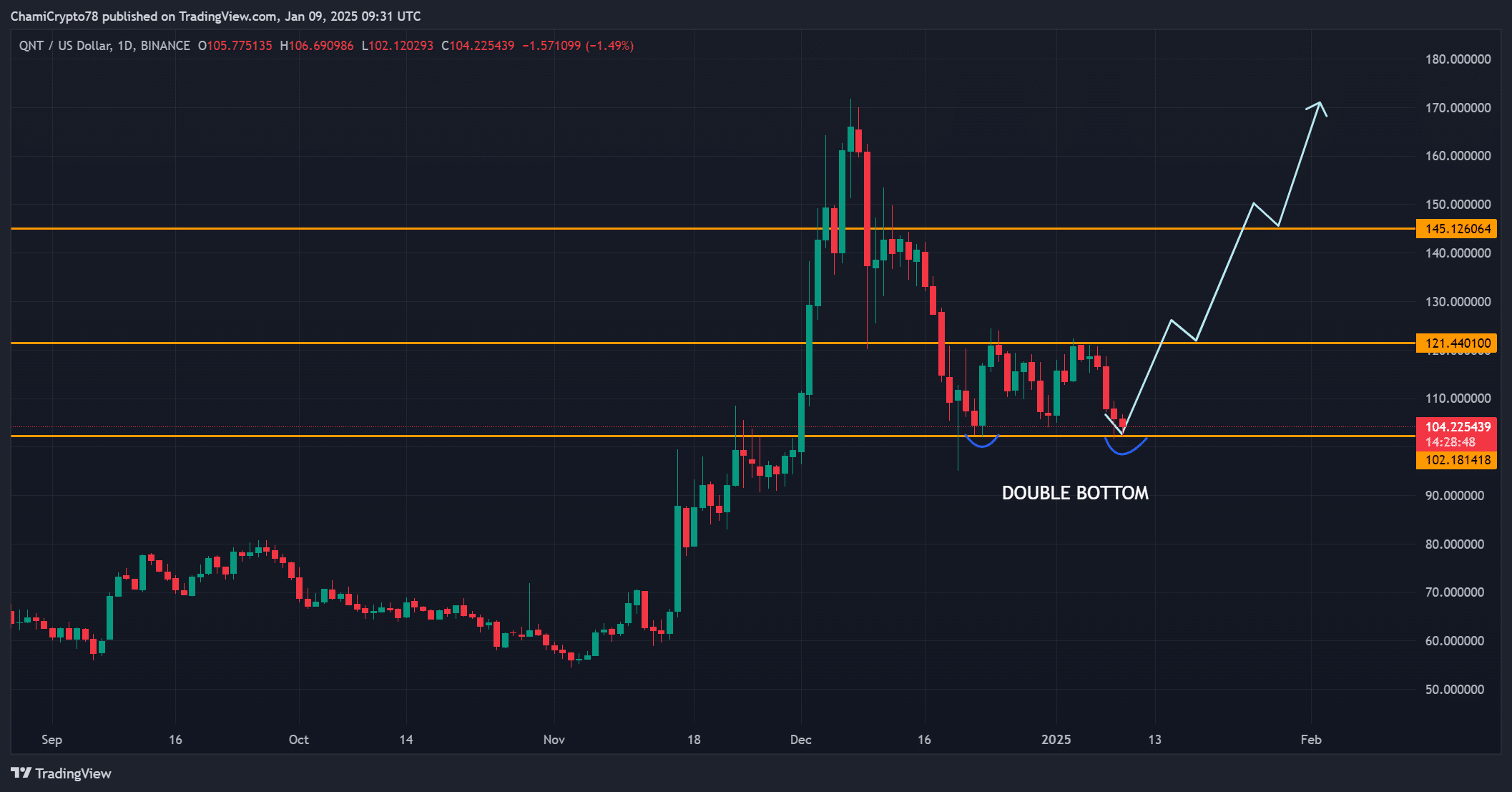

At the time of writing, QNT was trading at $104.17, down 1.05%, in 24 hours. The token formed a double-bottom pattern at $102, indicating potential bullish momentum.

However, the crucial challenge lies in breaking the USD 121.44 resistance level to consolidate a bullish trend.

Price movement and double bottom formation

The charts show a promising double bottom formation at $102, indicating potential bullish momentum. This pattern often signals a reversal of a downtrend, and Quant appears to be following this trajectory.

Breaking the resistance at $121.44 would confirm this reversal and open the way to the next significant resistance level at $145.12.

However, failure to hold at $102 could lead to long-term consolidation, delaying any substantial price movement. Consequently, the $102 support zone is critical for the short-term future of the token.

Source: TradingView

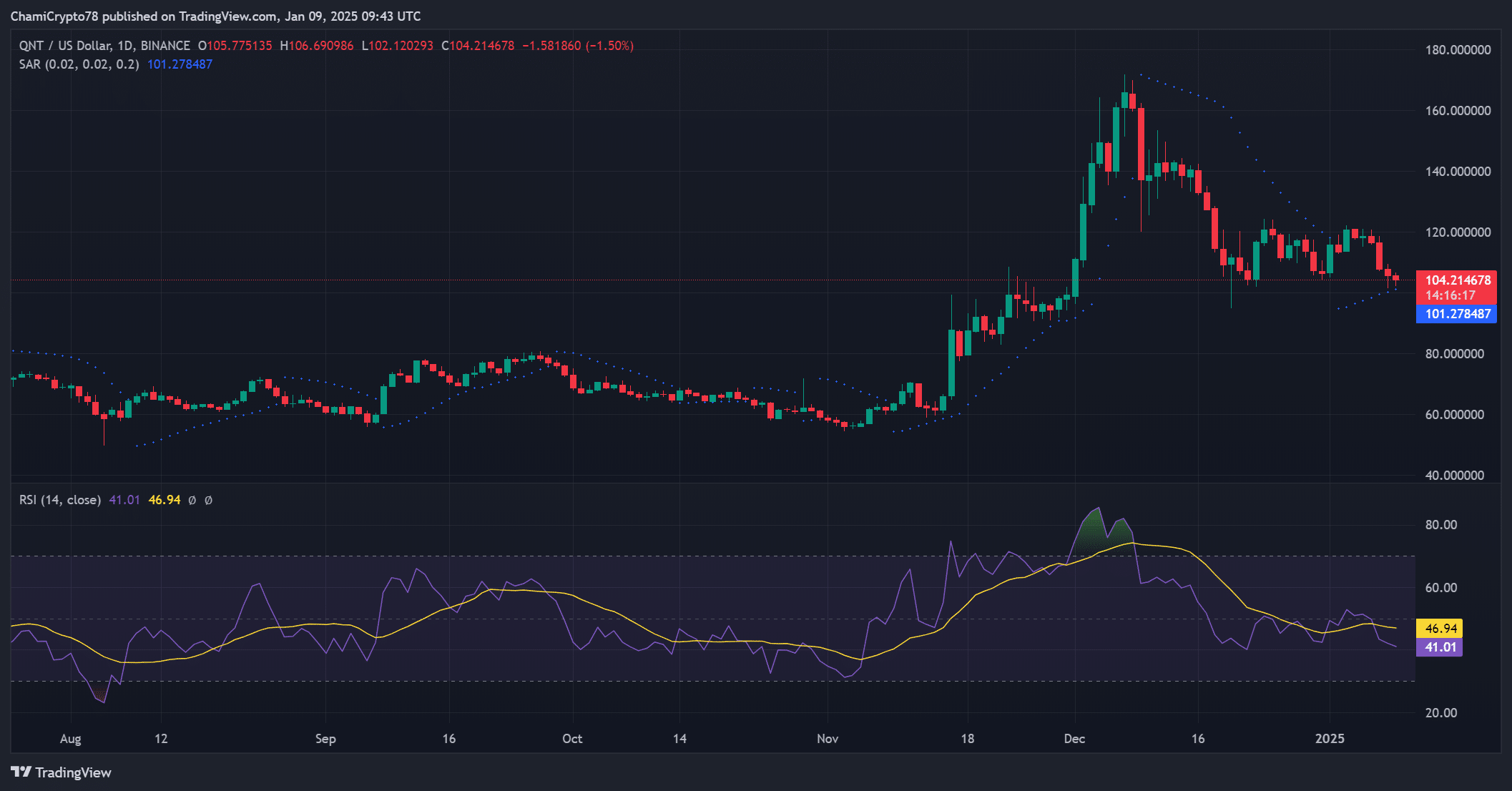

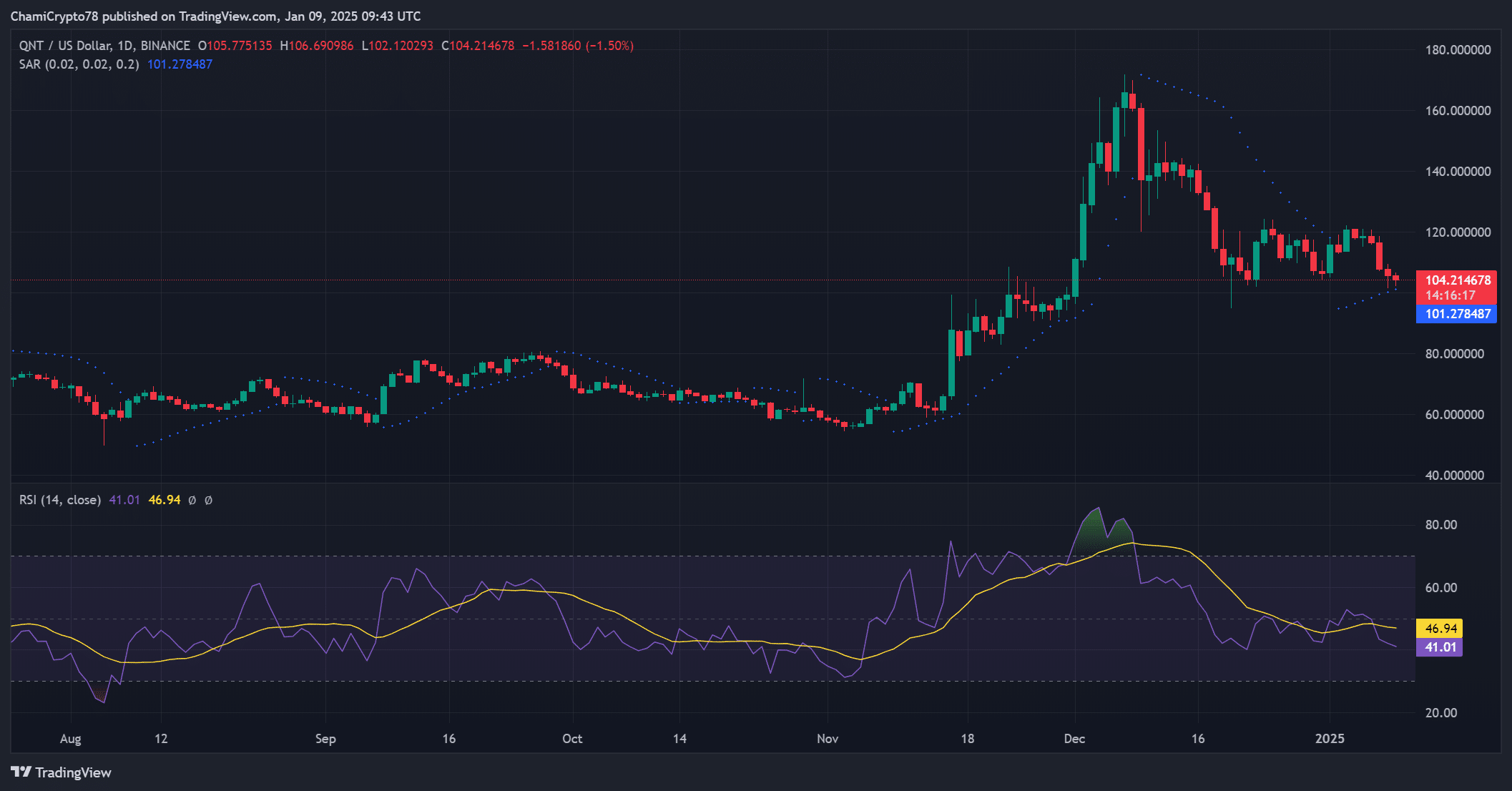

The parabolic SAR is already showing dots below the candlesticks, indicating that upward momentum is building. This indicator corresponds to the potential for further price increases, especially if QNT breaks through the resistance levels.

Furthermore, the Relative Strength Index (RSI) stands at 46.94, reflecting moderate buying interest. However, this position leaves room for growth, and crossing the 50 level would confirm a strengthening of buyer confidence.

Together, these indicators indicate that a bullish trend is developing.

Source: TradingView

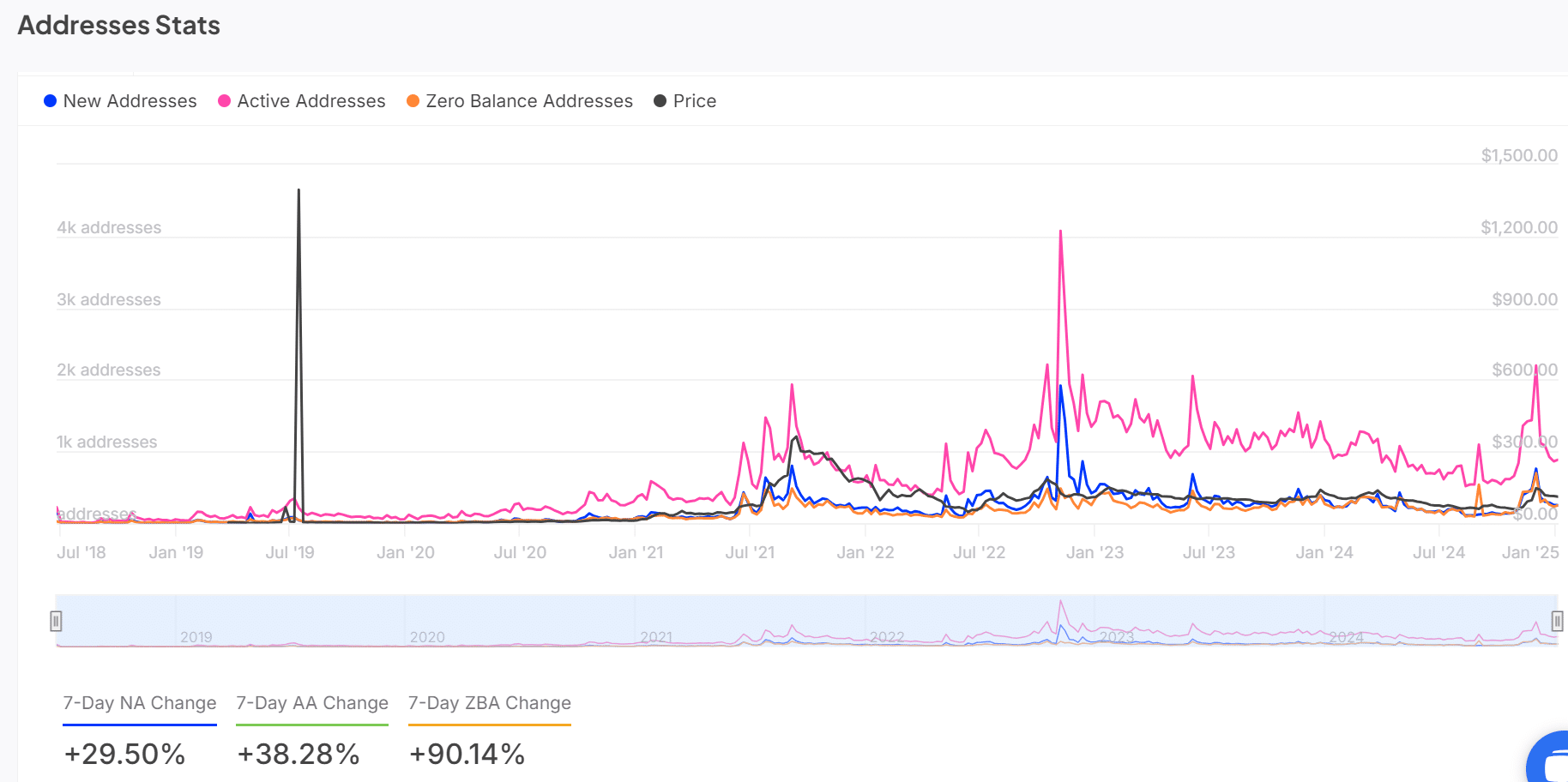

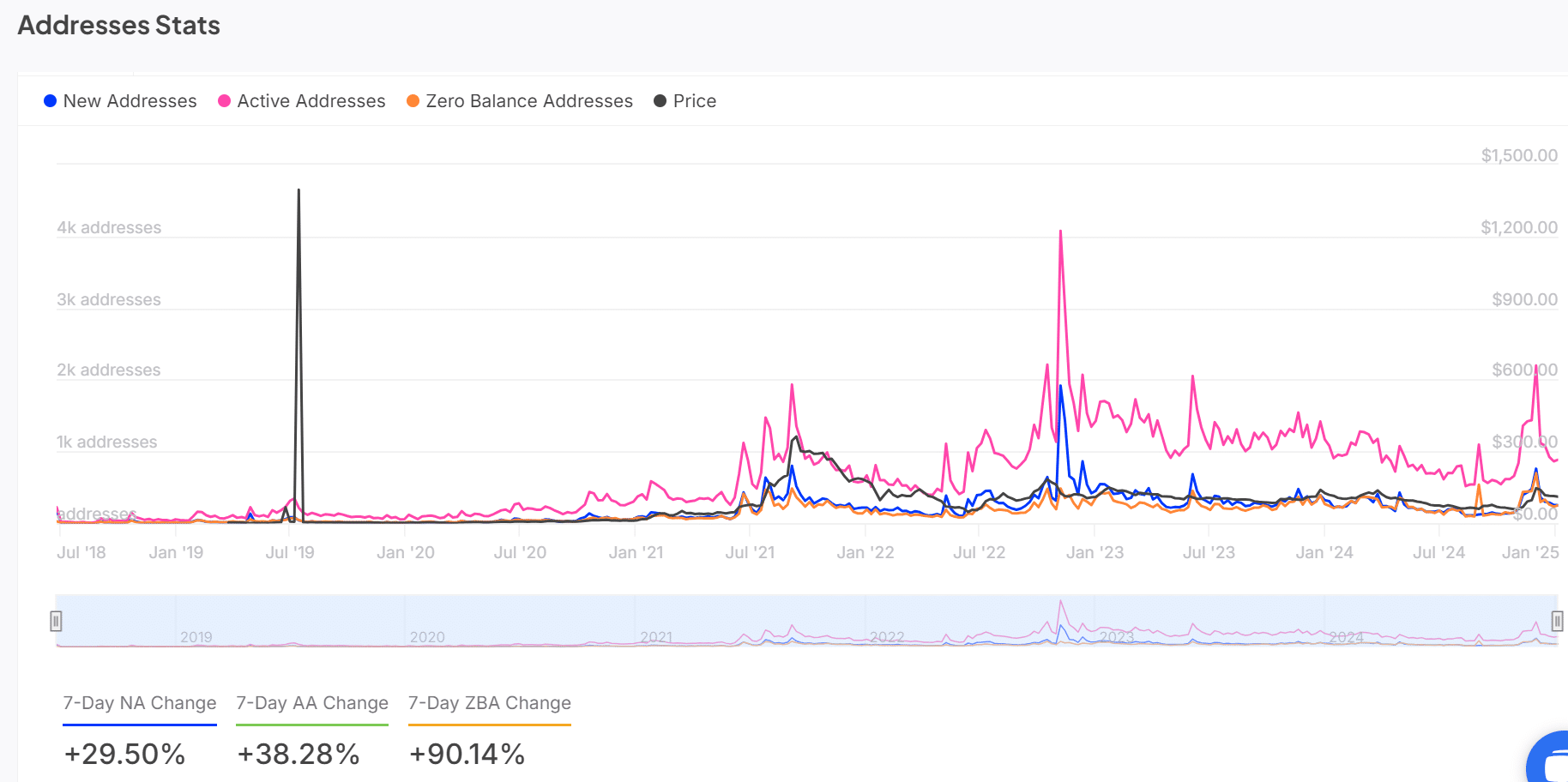

Network activity is increasing

Network activity increased, reflecting increased user interest and participation. Over the past seven days, active addresses have grown by 38.28%, while new addresses have increased by 29.50%.

This increase indicates greater engagement from both new and existing users, which often translates into stronger price action. Consequently, growing participation reinforces optimism about QNT’s near-term potential.

Source: IntoTheBlock

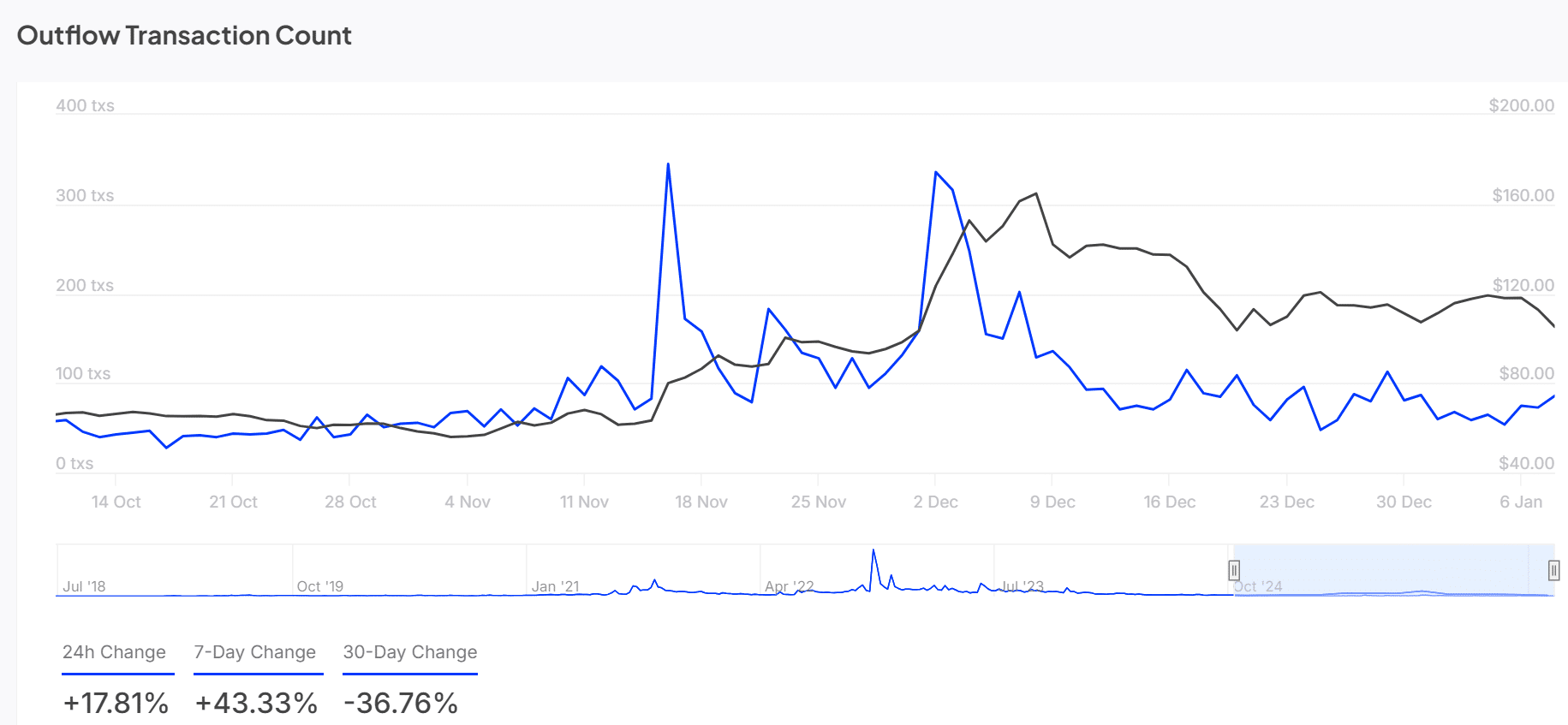

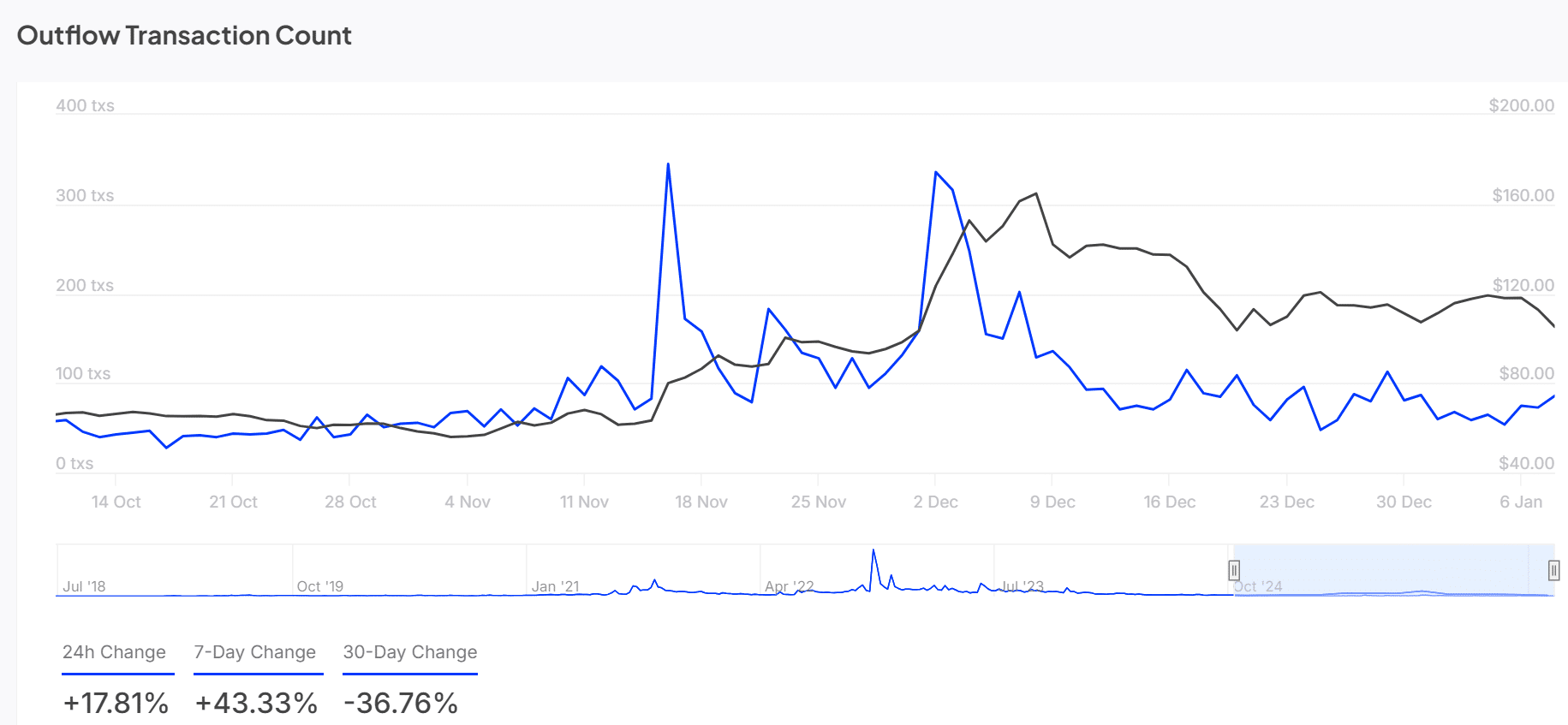

Decreasing selling pressure for Quant

The number of outflow transactions increased by 43.33% over the past week, indicating reduced sales activity and increasing accumulation.

This trend corresponds with the increasing number of investors choosing to hold QNT rather than sell it. Consequently, such behavior often precedes bullish momentum, as demand exceeds supply in the market.

Source: IntoTheBlock

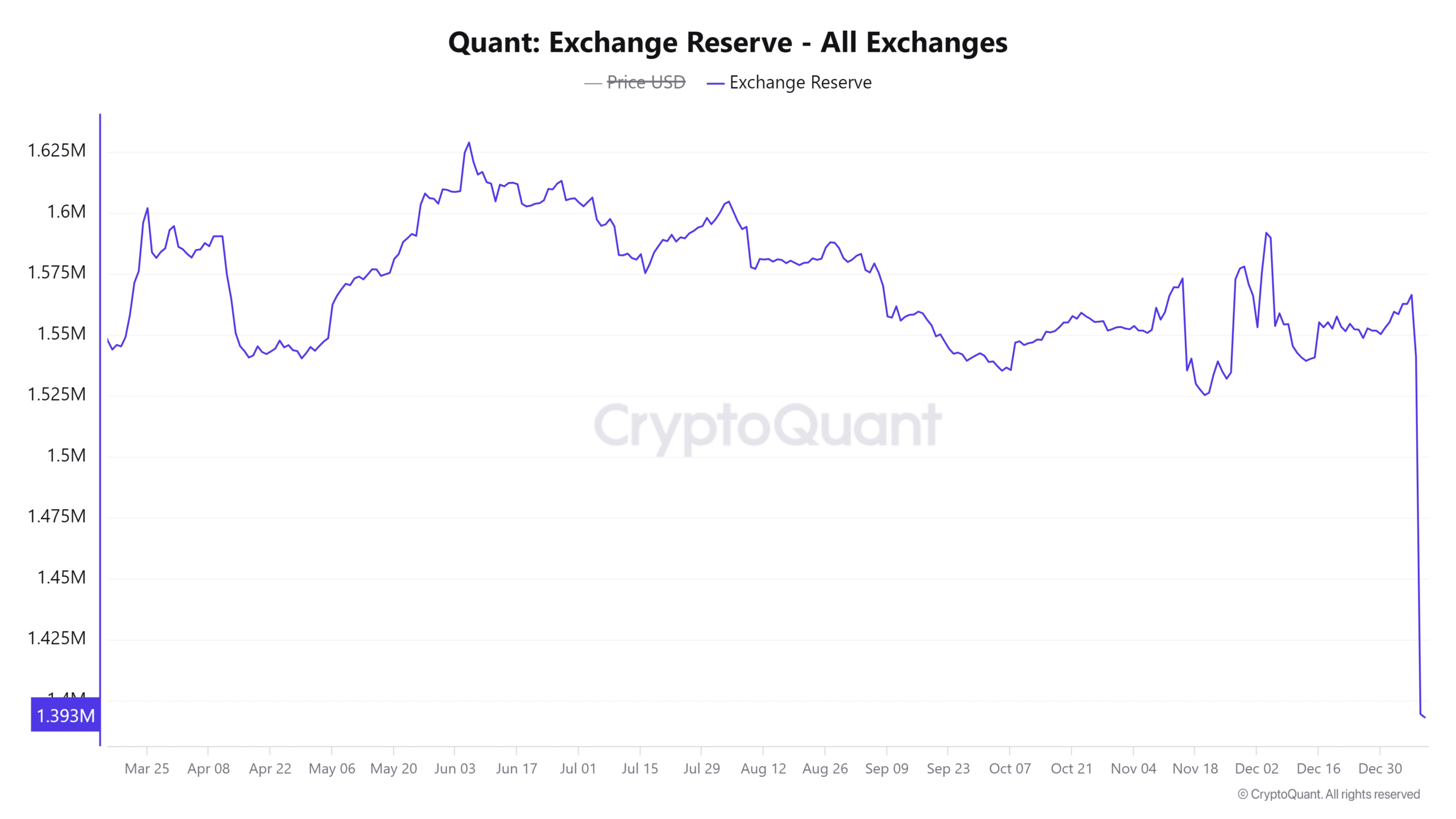

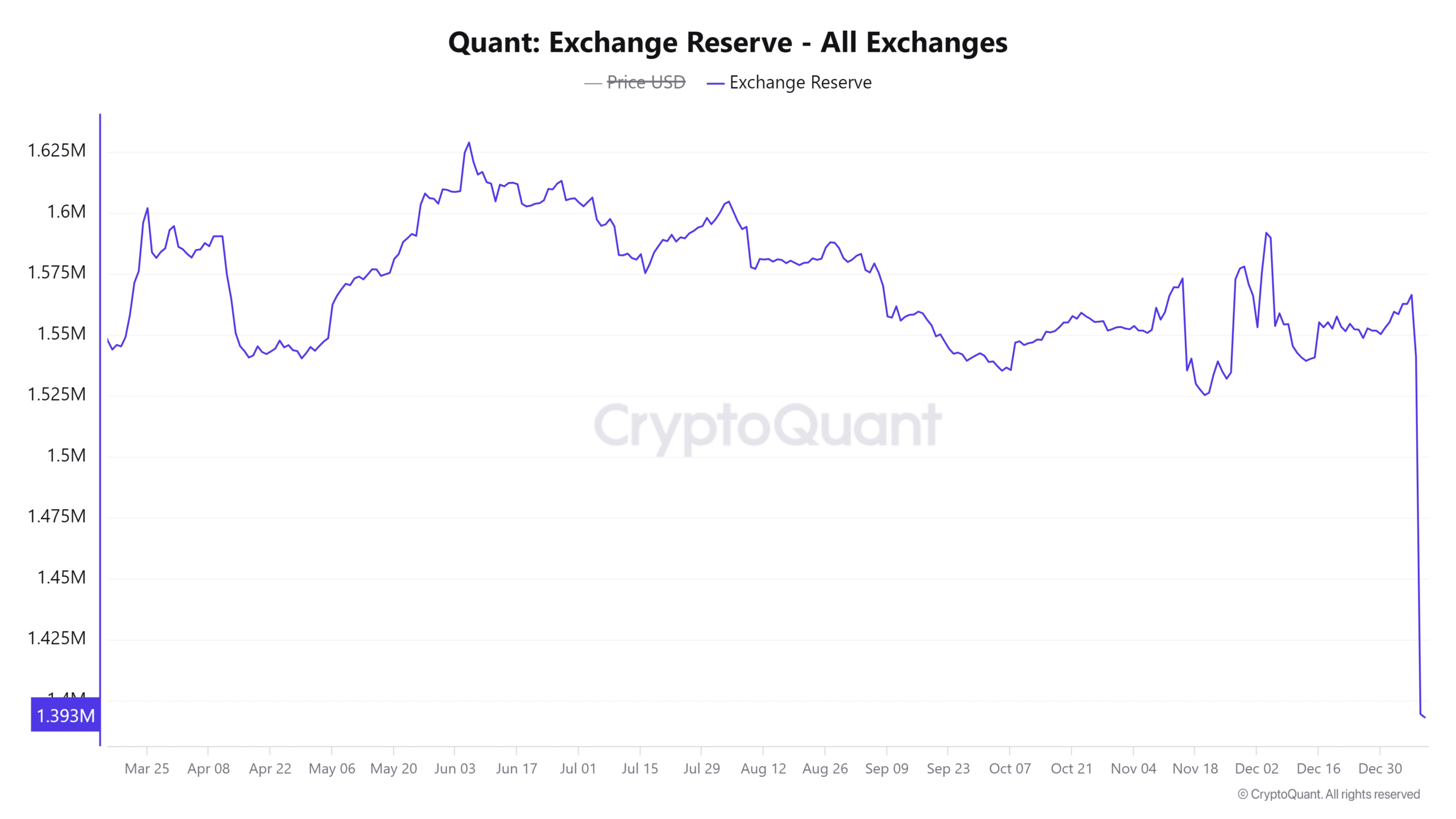

Analysis of exchange rate reserves

The foreign exchange reserve for QNT decreased by 0.24% in the past 24 hours, falling to 1.3927 million QNT. This decline reflects increased withdrawals as investors withdraw their tokens from exchanges for long-term investments.

Therefore, the declining reserve indicates confidence in QNT’s future potential. Furthermore, lower reserves often indicate reduced selling pressure, which supports the bullish situation.

Source: CryptoQuant

Read Quants [QNT] Price forecast 2024–2025

QNT showed promising signs of a bullish breakout, supported by a double bottom formation, rising address activity and reduced foreign exchange reserves. If the token successfully recovers €121.44, it can target €145.12 and above.

However, continued upward momentum depends on maintaining network participation and overcoming resistance levels.

While QNT’s future looks optimistic, the coming days will be crucial in determining its direction.