- Jerome Powell talked about rate cuts as the Fed’s short-term liquidity weakened

- Bitcoin and the broader crypto market are showing signs of bullish sentiment

Jerome Powell is recent statement has paved the way for significant shifts in the cryptocurrency market. Powell’s indication that “the time has come for policy adjustment” suggests that US rate cuts are on the horizon.

This move, combined with strong global liquidity, is expected to significantly weaken the US dollar (USD). With the USD weakening, Bitcoin (BTC) and other cryptocurrencies could be poised for significant gains.

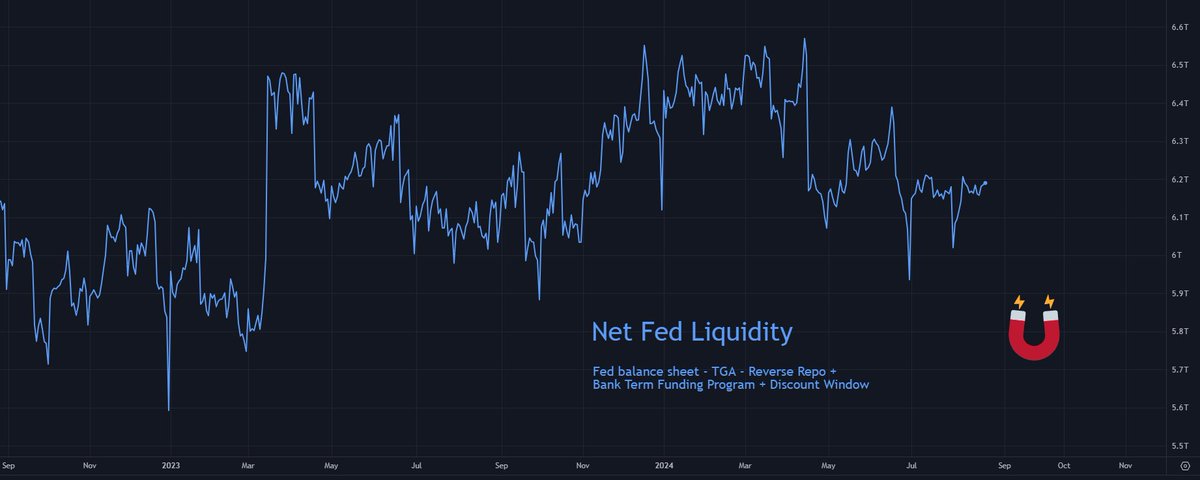

However, in the near term, the Federal Reserve’s liquidity outlook remains weak, continuing the medium-term downward trend that began in April.

Source: Tomas/X

This trend suggests that Fed liquidity could reach a new “lower low” in late September, possibly reaching the lowest level since March 2023.

As liquidity decreases and interest rate cuts loom, Bitcoin’s peg to the USD becomes increasingly beneficial. Especially as Bitcoin prepares to close its seventh consecutive monthly candle above its all-time high in 2021.

Source: TradingView

The longer Bitcoin’s price consolidates above this level, the stronger the support, paving the way for a possible breakout in September when the Fed begins cutting rates.

The profitable days of Bitcoin

Bitcoin has historically performed strongly, with over 96% of its history showing profitability for holders.

This historical trend, coupled with the impending weakening of the USD, makes a compelling case for an increase in Bitcoin’s price.

Source: Bitcoin Magazine PRO

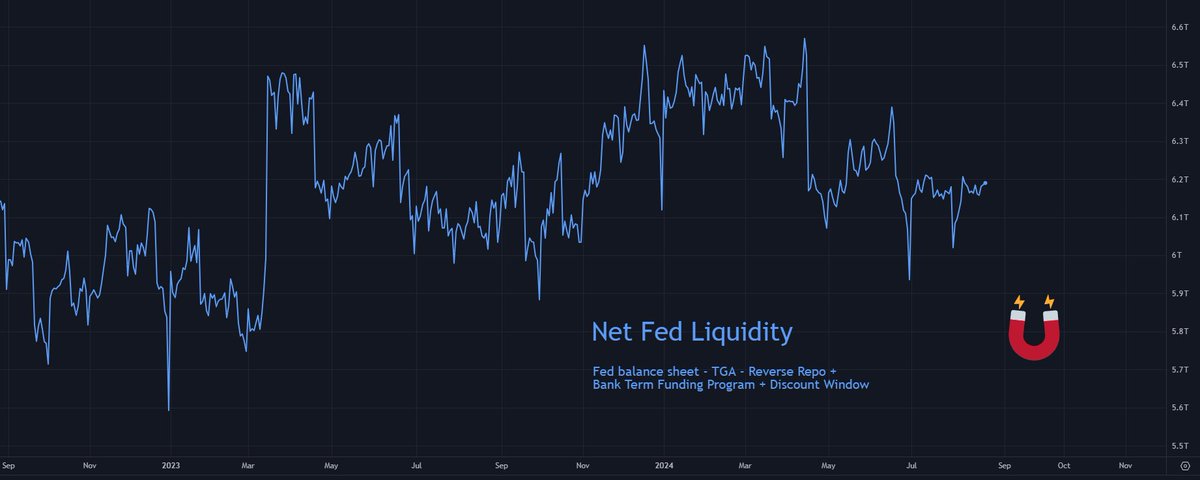

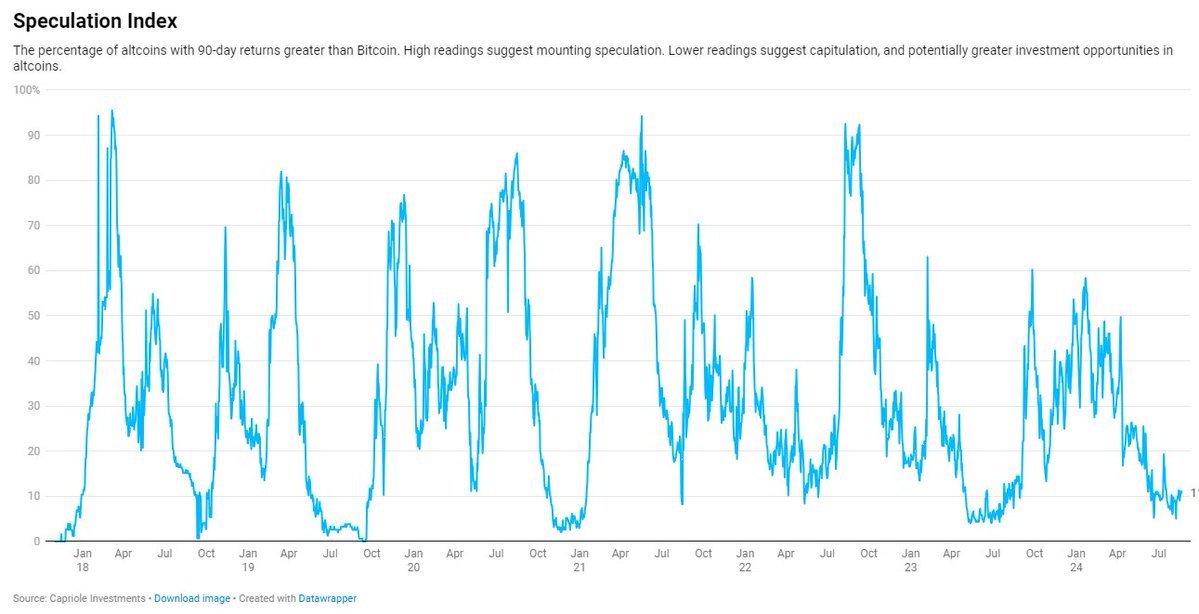

The Altcoin Speculation Index

However, Bitcoin won’t be the only beneficiary of the Fed’s actions. The entire crypto market, including major altcoins like Ethereum, BNB, Solana and XRP, is likely to see a boost.

At the time of writing, the Altcoin Speculation Index, which is at its lowest point since July 2023, indicated that altcoin prices may have bottomed out. Simply put, this index could signal growth opportunities as the USD weakens.

Source: Capriole Investments

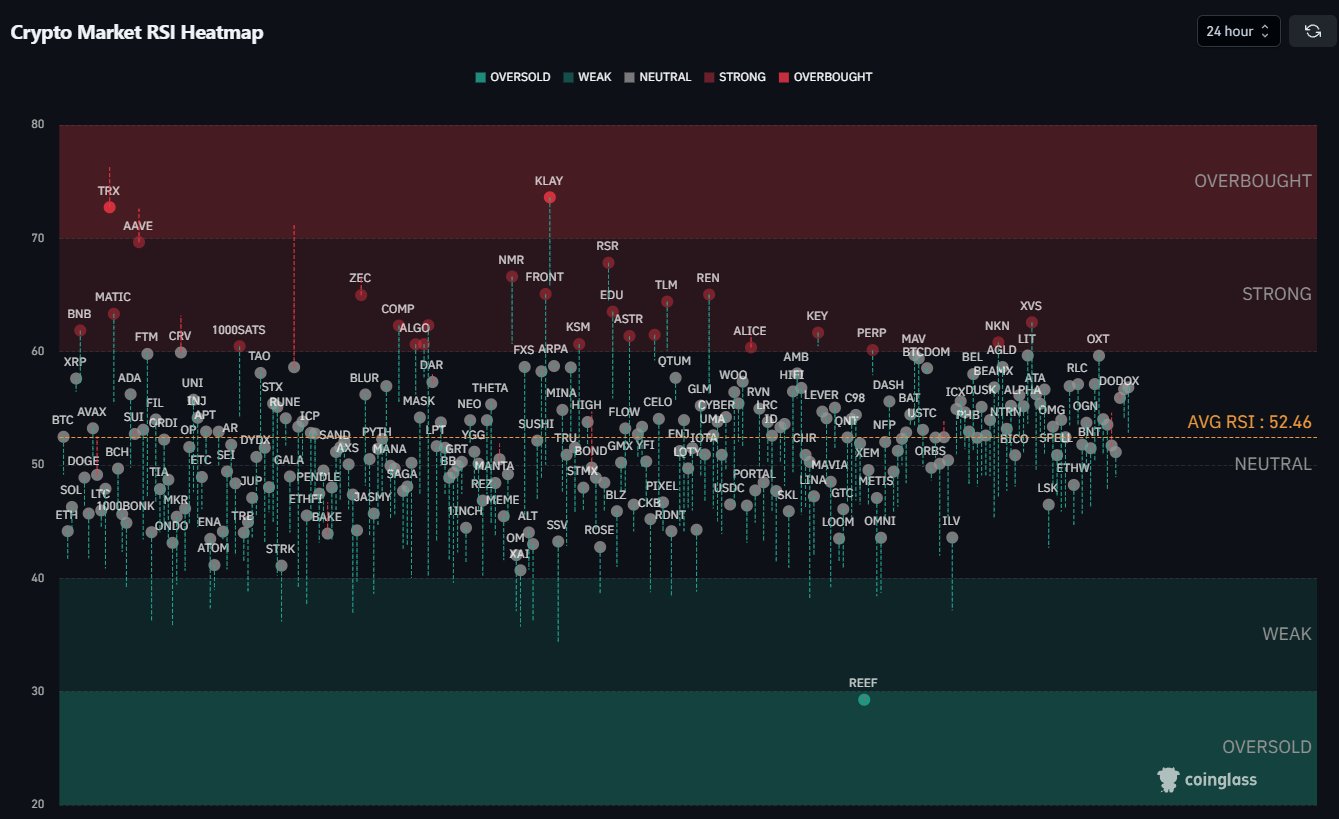

Crypto market RSI heatmap

Here it is worth noting that the broader crypto market is also showing signs of recovery. The Crypto Market RSI Heatmap recently moved from oversold to neutral, indicating that the market may be ready for a recovery.

Daily RSI levels have also crossed the 50 level, indicating healthy momentum with room for further gains before reaching overbought territory.

Source: Coinglass

As the Fed moves toward rate cuts and global liquidity strengthens, the stage is set for the rise of Bitcoin and the broader crypto market. This offers potential profits for investors across the board.