- The overall outlook for the FET was bullish, despite starting the week with an 11% loss.

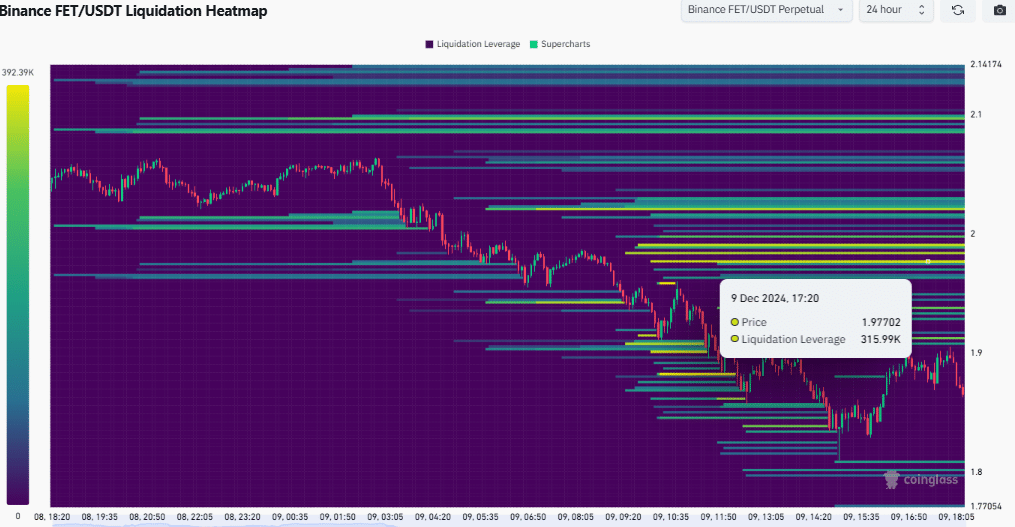

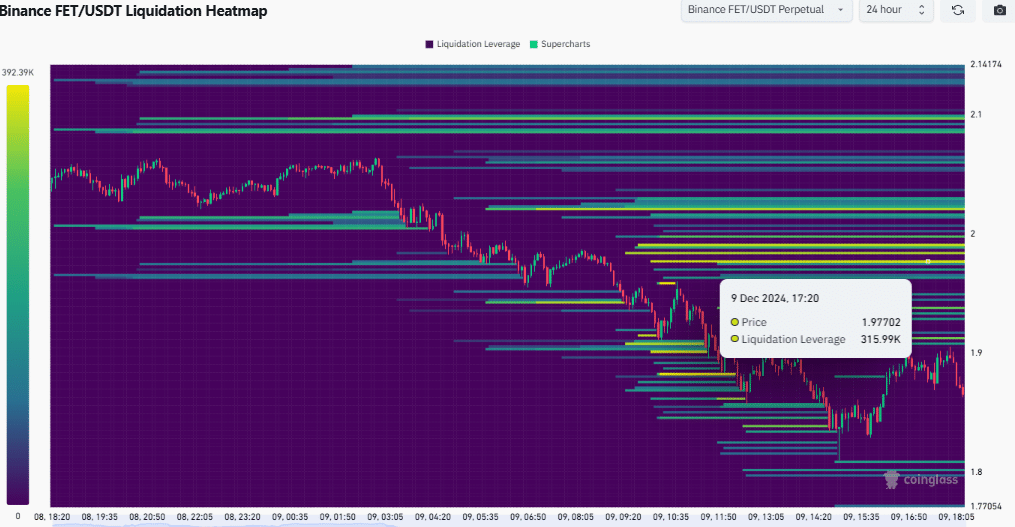

- More than $1.2 billion in leveraged positions risk liquidation if the price returns to around $2.

Artificial Superintelligence Alliance (FET) is down more than 11% in the last 24 hours, with daily trading volume up more than 150%. In fact, an analysis of the weekly chart of FET/USDT showed that the price was bullish as the price was yet to break below $1.74 – a level that may determine the structure shift in this case.

The solid uptrend emerged as the price of FET gradually rose from $0.5 in September to the press-time level of $1.74. Here, the market structure was framed by a series of higher lows and higher highs, indicating strong buying pressure.

The $1.74 level is critical as it has acted as a transition zone between bullish and bearish sentiments. However, the small bullish wick under this week’s candle indicated a possible continuation of the uptrend.

Source: trading view

The small fuse represented buyers trying to push the price higher, although some resistance emerged near $2. Simply put, the chart patterns suggested a possible rise towards $3.5, with continuation based on existing bullish momentum.

If the uptrend maintains its strength and market conditions remain favorable, reaching or surpassing the $3.5 target could be achievable in the coming weeks to months. This would represent an increase of more than 99% from the price level at the time of writing.

Major liquidation zones for FET

The 24-hour FET/USDT liquidation heatmap on Binance highlighted key liquidity zones and potential leverage risks.

With the price of FET nearing $2.00, over $1.2 billion in leveraged positions appeared to be at risk of liquidation. Especially if the price rises above this average price level.

The $1.8 level is a critical support zone as the large number of liquidations at this level could lead to further price declines.

Source: Coinglass

Conversely, the resistance zone was found around $2.1, where liquidations could fuel upward price movements.

This scenario indicated potential volatility, with price moving towards these zones of high liquidity, significantly impacting market dynamics.

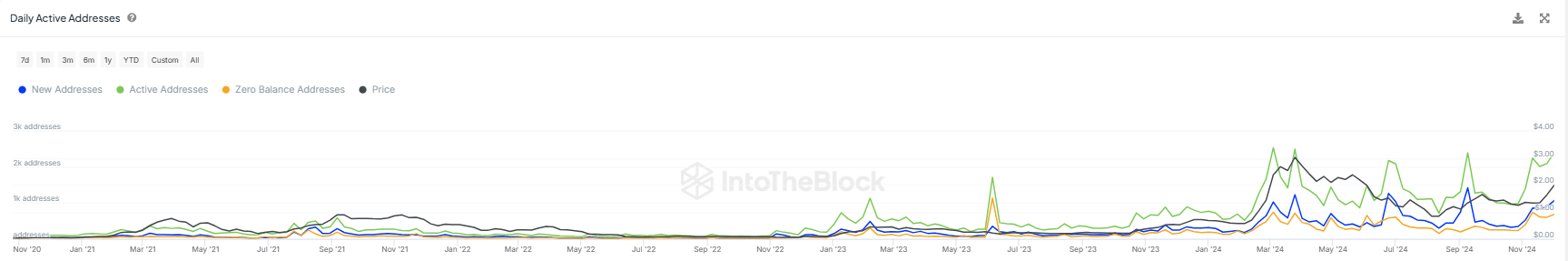

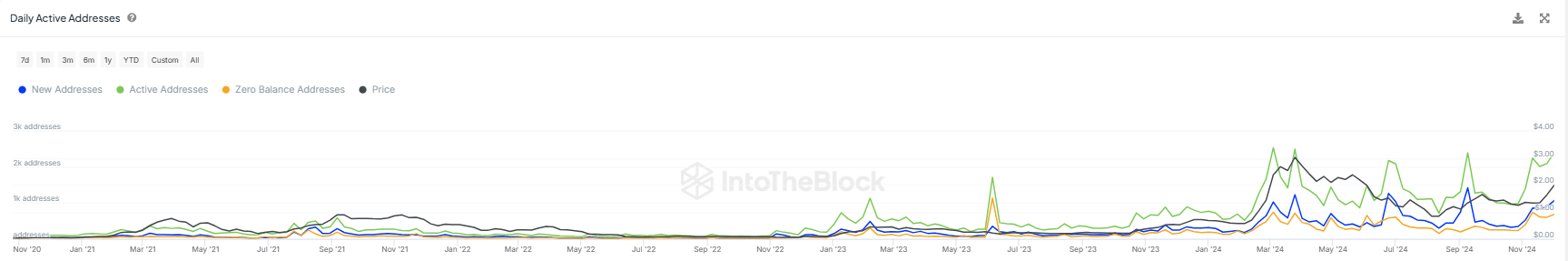

Daily active addresses

Analyzing FET-on-chain activity revealed clear trends in network engagement over time. The peaks of active addresses recently reached new highs. The significant observation was also the correlation between peaks in active addresses and price increases.

This pattern suggested an increase in network activity, often coinciding with rising prices – possibly indicating buying pressure or increased trading activity.

New addresses also peaked around these periods, which could indicate new user adoption or increased interest in FET.

Source: IntoTheBlock

Conversely, zero balance addresses did not show a consistent pattern with price, indicating that they could not directly influence price movements, but rather reflected the post-transaction state.

This activity seemed to be in line with FET’s bullish price action. This suggested that as more users engage with the network, possibly through trades or by holding FET, demand increases – a bullish signal.