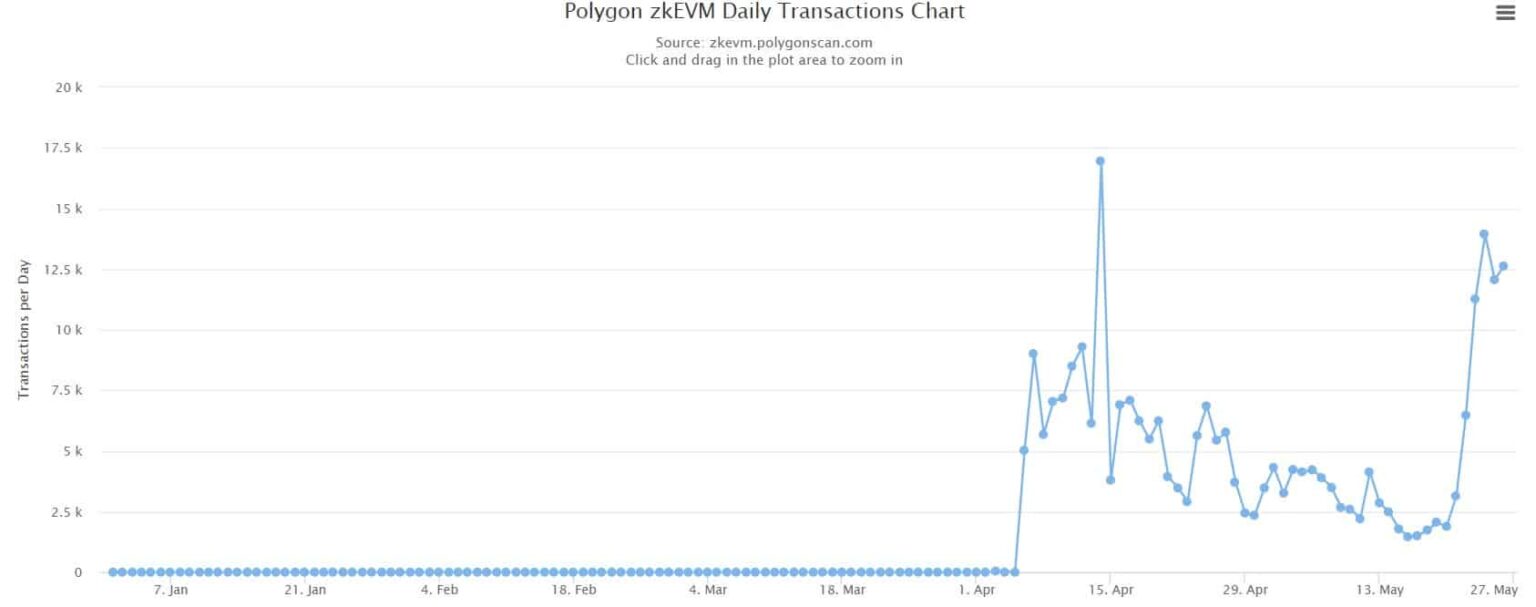

- In addition to the transaction volume, the number of daily transactions of zkEVM and daily gas consumption have also increased.

- MATIC’s on-chain metrics suggest investors can expect a trend reversal.

Polygon [MATIC] zkEVM has once again made headlines with its latest achievements. Polygon (Labs) shared in a tweet dated May 17, 2023 that transaction volume on zkEVM reached a new all-time high.

Growth and transaction volume on Polygon zkEVM reached record highs:

✅70% increase in TVL, the biggest week-over-week increase since launch

✅One-day record for successful transaction volume: +13K, on Sunday pic.twitter.com/tA5pwfkWu9— Polygon (Labs) (@0xPolygonLabs) May 16, 2023

Is your wallet green? Check the Polygon profit calculator

The one-day record for successful transaction volume passed 13,000 on May 14, 2023. Rates went down during that period.

More transactions mean more users share the cost of posting call details. Given the current state of MATICwill the recent success of zkEVM play a role in a change in the token’s space?

Polygon zkEVM is growing on multiple fronts

Not only did transaction volume hit a new ATH, but according to Polygon scanthe number of daily transactions also increased sharply.

Source: Polygon scan

In addition, there has been a significant improvement in the number of unique depositors. It also appears that the use of the network has increased in recent days, as evidenced by an increase in daily gas consumption.

Polygon zkEVM’s TVL on the rise

Polygon tweet also mentioned that zkEVM’s TVL jumped 70%, its biggest week-over-week increase since launch.

According to DeFiLlama, zkEVM’s TVL shot up more than 100% in the past 24 hours, giving hope for further growth in the coming days.

Source: DeFiLlama

A look at the state of MATIC

While zkEVM continues to set new records, MATIC, on the other hand, has had a rough time. According to CoinMarketCapthe price of MATIC is down more than 2% in the past seven days.

The decline was accompanied by an increase in volume, which is typically bearish. At the moment of writing, MATIC was trading at $0.8547 with a market cap of over $7.9 billion, making it the 10th largest crypto by market capitalization.

These stats looked bullish…

From CryptoQuant, MATIC’s Relative Strength Index (RSI) and stochastics were both in oversold positions. This can help increase buying pressure, which in turn can increase the price of MATIC.

MATIC’s foreign exchange reserve also declined, suggesting that the token was not under selling pressure.

Source: CryptoQuant

Realistic or not, here it is MATIC market cap in BTC‘s conditions

In addition, the MATIC offering on exchanges registered a slight decrease. This happened as off-exchange supply increased, indicating greater accumulation.

Negative feelings around MATIC also appeared to have fallen, as evidenced by an increase in weighted sentiment. MATIC’s network growth was also high, which is generally a positive sign.

Source: Sentiment