- The number of largest POL whales, which held the largest number of tokens, fell sharply.

- A bullish trend reversal could push POL back above $0.4.

Polygon [POL] recently underwent a major upgrade that changed the name of the token, along with several other new updates. However, the latest update failed to cause a price increase. In the meantime, unusual whale activity was noticed.

What do whales do after the POL upgrade?

AMBCrypto reported rather that the upgrade from MATIC to POL went as planned by Polygon developers. The Polygon team said it took a year of community discussion to upgrade POL as the native token for Polygon.

Days after the upgrade, POL whales made a big move. Santiment recently posted one tweet showing that POL was one of many that saw a lot of price deviations after the whale exchange offering suddenly shifted to the whale cold wallet offering.

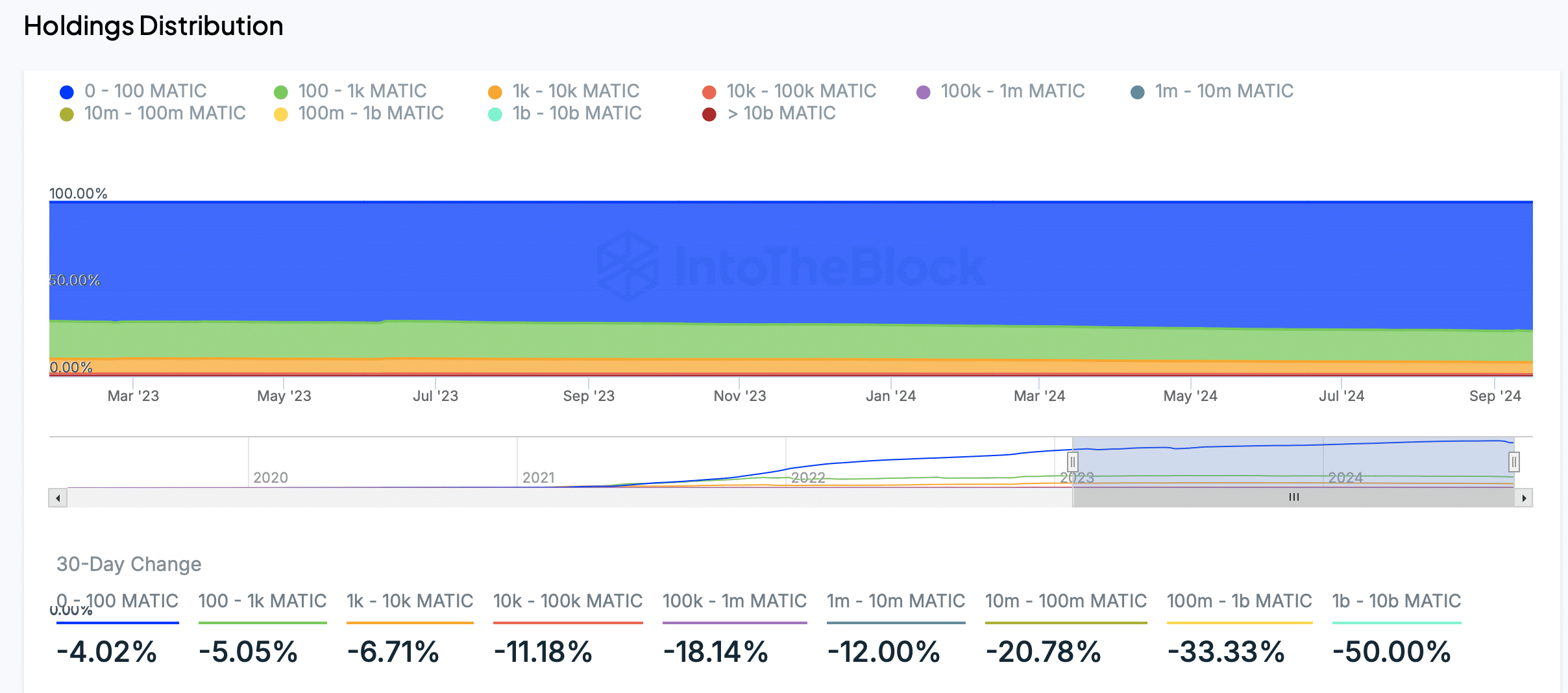

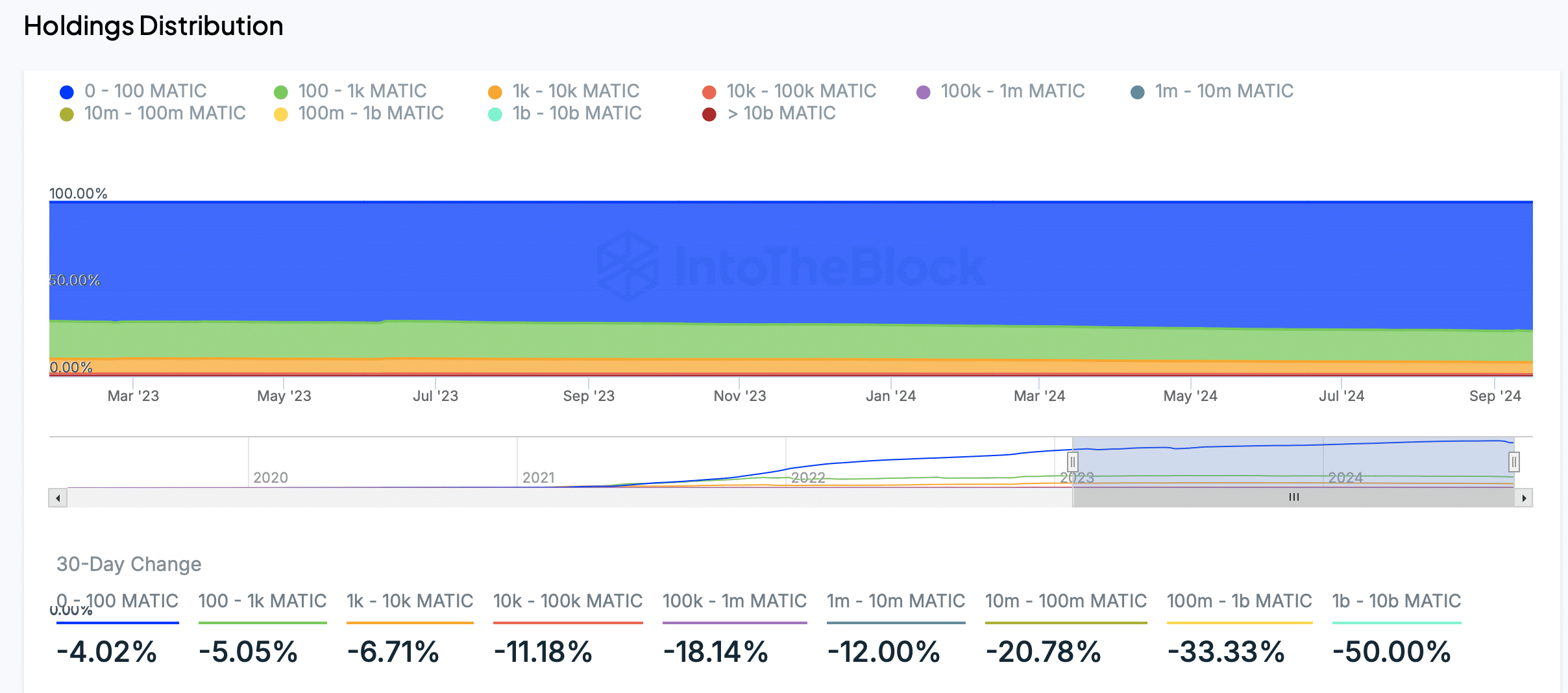

Therefore, AMBCrypto planned to check IntoTheBlock’s data to find out how MATIC’s supply distribution was affected. According to our analysis, the number of addresses holding 1 billion to 10 billion POL tokens has fallen by 50% in the last 30 days.

This measure clearly suggested that the largest POL whales had been reduced to half their size. In fact, the number of addresses with fewer tokens decreased over the same period.

Source: IntoTheBlock

Will Polygon see price increases soon?

While all this was happening, POL’s price volatility dropped. This was the case as both the weekly and daily charts moved marginally. Therefore, AMBCrypto planned to check the token’s on-chain data to see what to expect from it in the coming days.

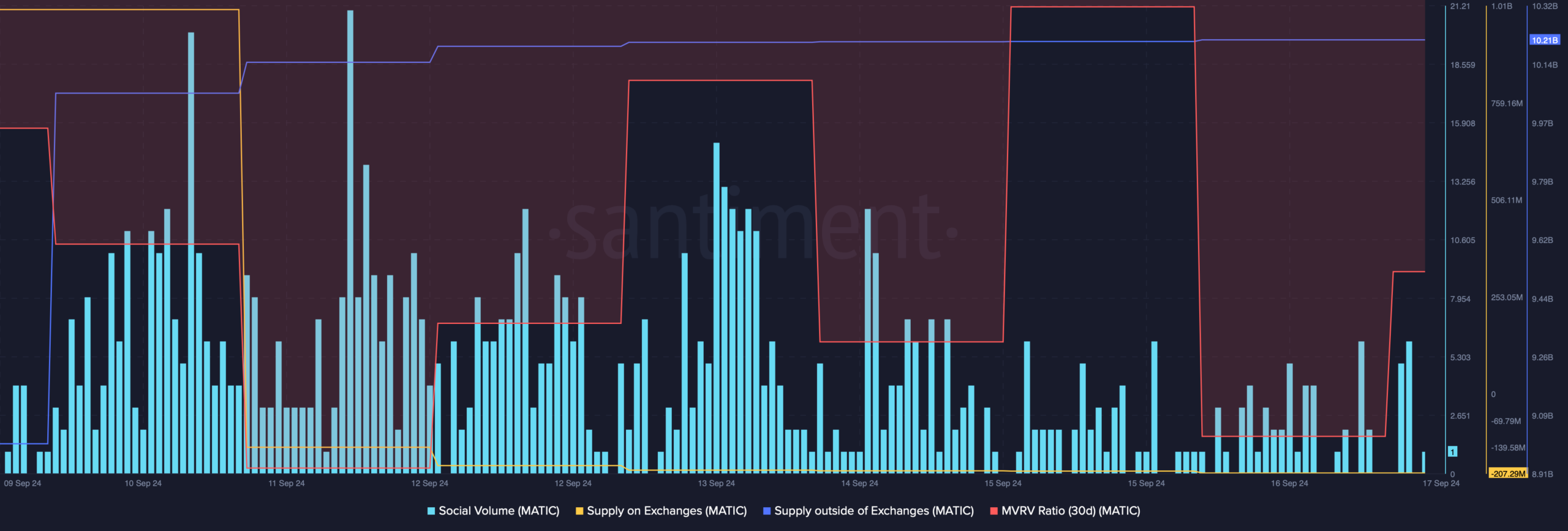

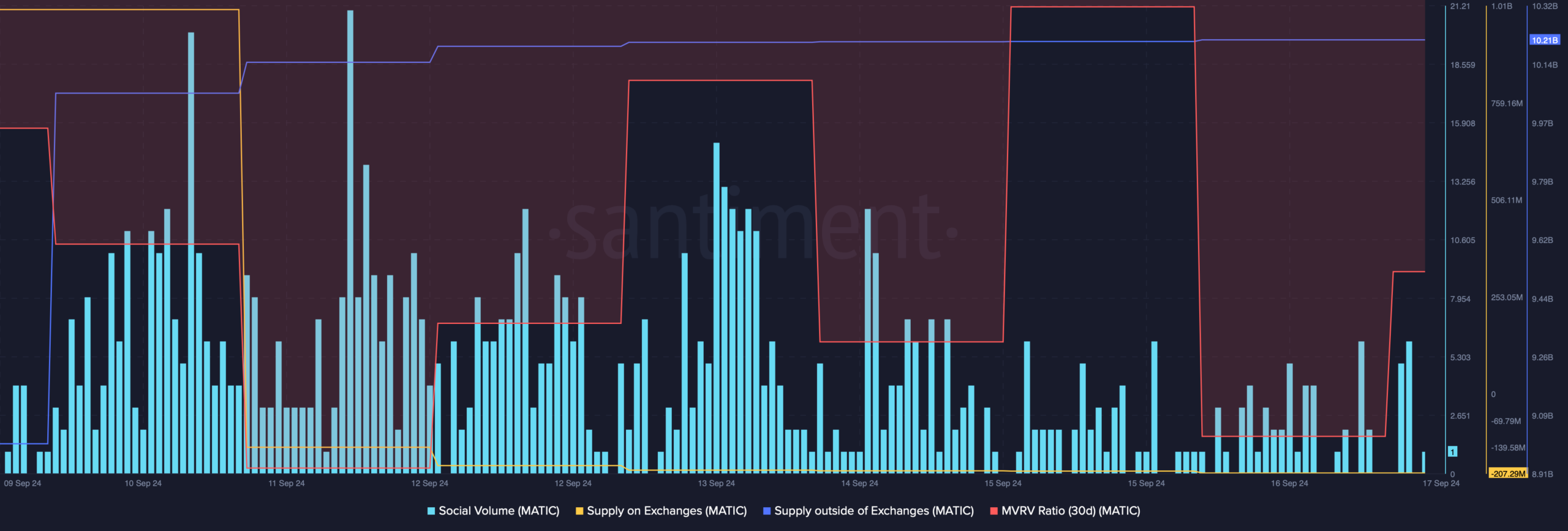

Our analysis of Santiment’s data showed that blockchain social volume was declining. This happened despite the fact that Polygon recently underwent a major upgrade.

Apart from that, POL’s MVRV ratio also fell which can be inferred as a bearish signal.

However, it was interesting to note that while the number of whale addresses dropped, buying pressure on the token increased. This was evident from the enormous drop in supply on exchanges and a peak in supply outside the exchanges.

In general, an increase in purchasing pressure results in price increases.

Source: Santiment

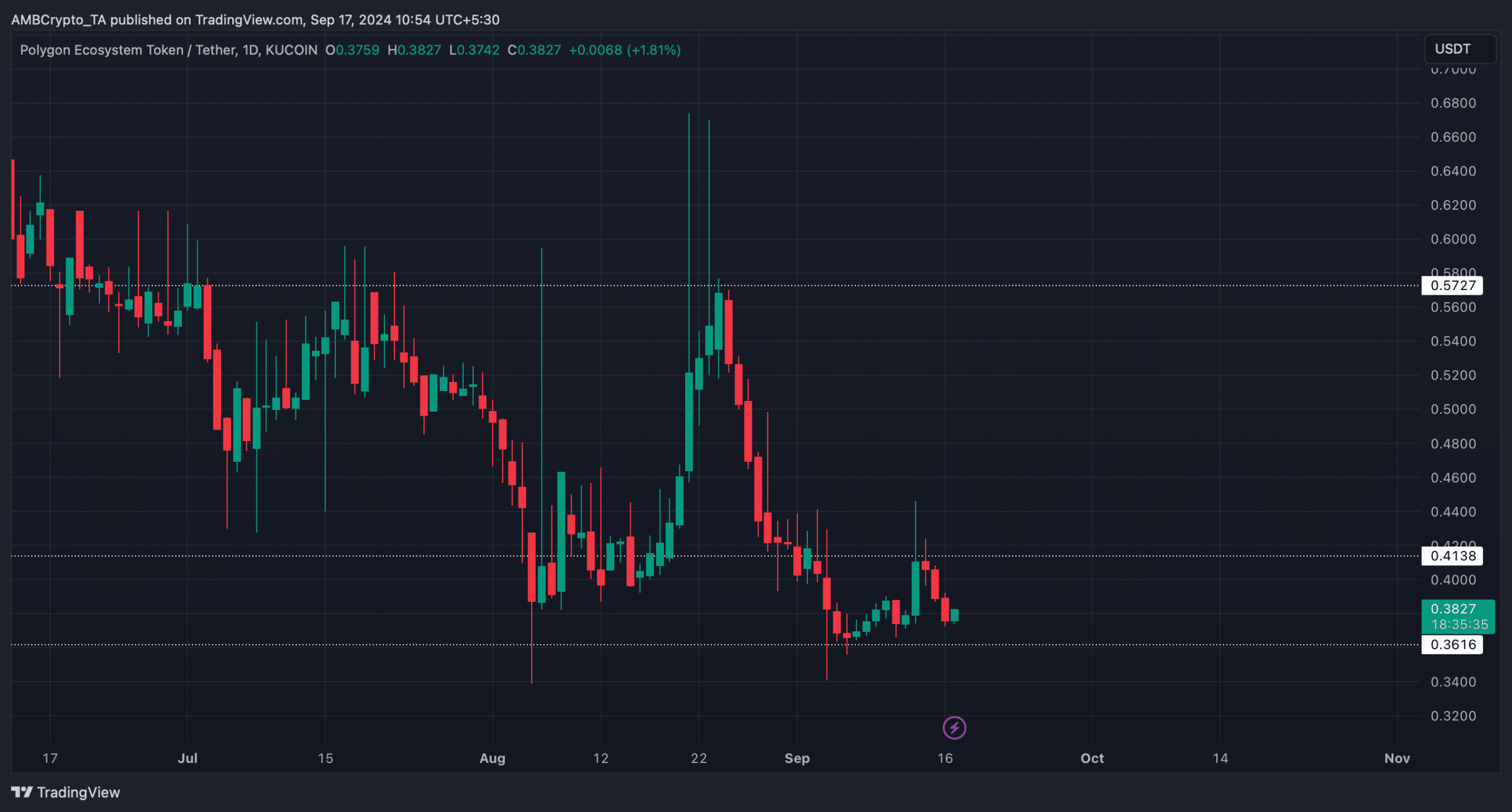

AMBCrypto then checked the token’s daily chart to identify possible targets of POL. We chose to do that as, at the time of writing, Polygon’s fear and greed index was in a neutral position.

Is your portfolio green? View the MATIC profit calculator

When the measure reaches this level, it indicates that the market could move in either direction in the coming days. If the bears continue to dominate the market, POL could soon drop to $0.36.

But if the bulls step up their game, it won’t be surprising to see Polygon hit $0.41. A breakout above could push the token to $0.57.

Source: TradingView