- Despite efforts, daily operations and revenue on the Polkadot protocol declined.

- Proposed changes and XCM expansion were aimed at attracting users, but there are still pricing and staking concerns.

According to Polkadot Insider’s May 27 tweet, Polkadot [DOT] ranks fourth in token activity. Polkadot has surpassed networks like Solana [SOL]Filecoin [FIL] and Litecoin [LTC] in this connection. In addition, more than $11.4 million in token incentives were offered on the network.

WEEKLY TOP 10 BLOCKCHAINS BY TOKEN INCENTIVES

🔥 Explore the hottest blockchain networks offering lucrative token incentives over the past 7D💰

💪Discover the platforms where you can maximize your crypto

🚀 Brilliant, @Dot shines brightly at the top 4#Dot #POINT pic.twitter.com/gxfHAOc7PD

— Polkadot Insider (@PolkadotInsider) May 27, 2023

Is your wallet green? Check out the Polkadot Profit Calculator

Incentives not enough

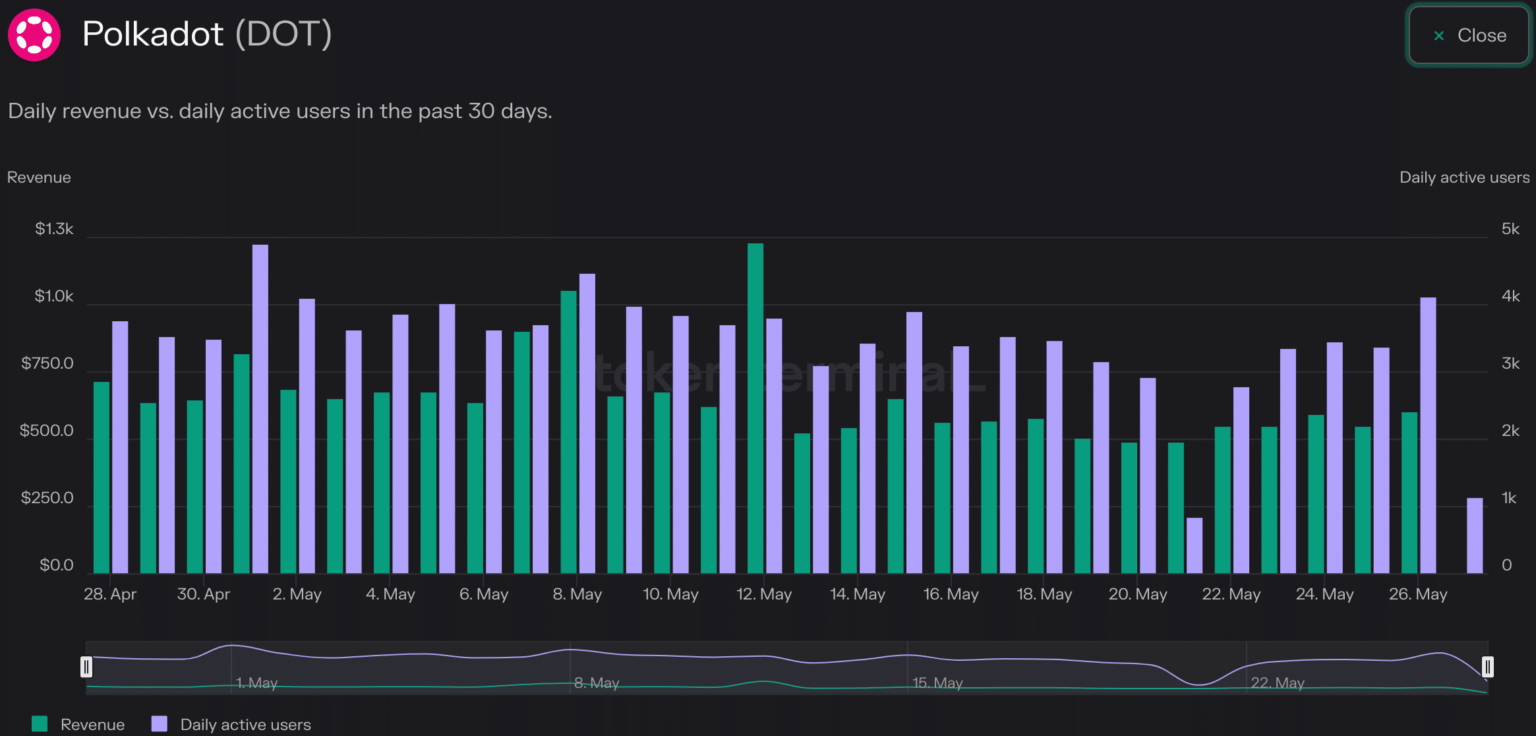

Despite numerous token incentives, daily activity experienced a substantial 69.9% decline over the past 30 days, according to Token Terminal data. At the same time, Polkadot’s revenue also fell by 25% during the same period.

These downward trends raise questions about the effectiveness of token incentives in attracting and retaining users.

Source: token terminal

To revive user engagement, proposals have been made to make changes to the Polkadot network. One of them includes one proposal to increase the number of validators. The suggestion includes a gradual addition of five new validators in each period until they reach 400.

This incremental increase is believed to strike a balance between security and network scalability. Core developers support such changes and further advocate for increased value and network participation.

Polkadot also saw positive developments in other areas.

For example, Polkadot’s cross-consensus message format (XCM) witnessed a remarkable expansion in the first quarter of this year, extending beyond transfers. The number of channels using XCM has increased by as much as 60%.

This growth indicates the increasing adoption of Polkadot’s interchain communication protocol, potentially promoting greater interoperability and functionality within the network.

Source: Messari

Looking at DOT

Despite efforts to boost adoption, the price of Polkadot’s native token, DOT, has continued to fall in tandem with trading volume. In the past month, DOT’s volume fell from 250 million to 90 million.

Realistic or not, here is DOT’s market cap in terms of BTC

This trend is consistent with the prevailing negative sentiment surrounding the token, as the crypto community has limited expectations of a quick price recovery.

Source: Sentiment

In addition, strikers have shown declining confidence, with only 45.3% of circulating DOT deployed according to Subscan data. This reduced participation in strikes raises questions about token holders’ confidence in Polkadot’s future prospects.

Source: Subscan