Polkadot ranks among the top blockchains, securing a spot in the top 20. Although the platform promotes blockchain interoperability, a feature needed in the era of increasing fragmentation, DOT prices have failed to inspire bulls.

This state of affairs on price charts reflects the general trend across the board, especially on leading smart contract platforms like Ethereum and Solana.

Polkadot Treasury reserves to an all-time low

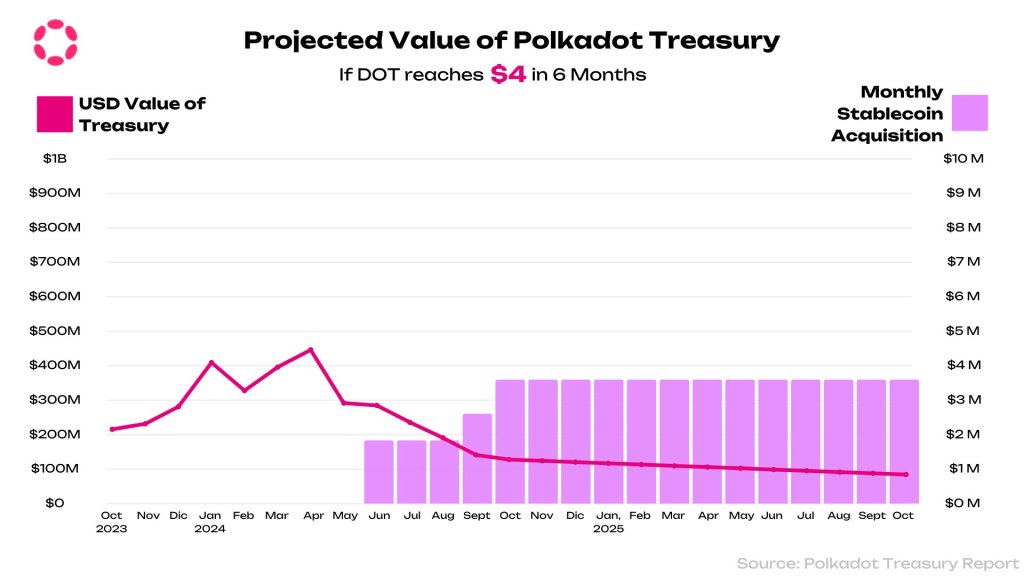

Unyielding bears have pushed prices down over the months since the DOT rose to around $10 in the first quarter of 2024, depleting Polkadot’s state reserves.

In early November, an observer on X said they were at an all-time low. However, things could get worse for Polkadot if the Q3 2024 bears return, pushing prices below local support levels.

The daily chart shows that DOT has critical support around $3.8. This level marks the lows of September and October. On the downside, the coin is facing strong liquidation pressure at $4.6 and $5.

As the coin moves, the direction of the breakout can determine the short- to medium-term trend, but also have an impact on the Polkadot Treasury.

Much depends on whether DOT prices will recover, which in turn will help restore Polkadot Treasury’s reserves. Technically, prices play a major role. When bulls take over, the reserve expressed in DOT increases in USD, reducing pressure on the team.

Policy intervention to stimulate funds

To further increase the inflow into the treasury reserves, the Polkadot community past a policy to reduce inflation. Specifically, the community voted to reduce annual DOT inflation from 10% to 8%.

With low inflation and continued demand from the chain, DOT prices may find support. In addition, 15% of staking rewards distributed by strikers will be moved to the Treasury.

The analyst predicts these changes could boost the Treasury by adding 1.5 million DOT. This will be a much-needed infusion of funds that could boost state reserves after months of low revenues.

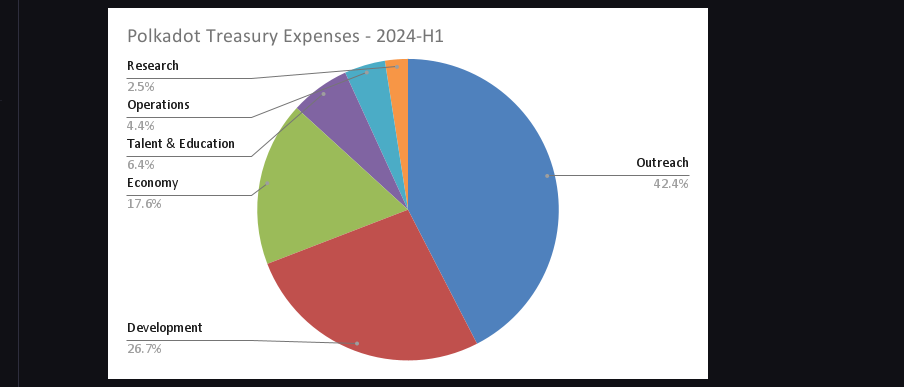

The team could build better and even high-quality partnerships, improving the blockchain ecosystem. Based on H1 2024 factsthe team spent the most on outreach, while almost 27% went on development.

The rest was divided between research funding, operations, talent and the economy. Considering the valuation in the first half of the year, they spent a total of $87 million, or about 11 million DOT.