- DOT market indicators suggest the price could continue to rise with targets up to $6.96.

- Capital flowed towards the token and one analyst predicted a breakout.

In a surprising turn of events, Polkadot [DOT] became the biggest gainer among the top 20 cryptocurrencies on the market. At the time of writing, DOT was changing hands at $6.24, representing an increase of 5.18% in the last 24 hours.

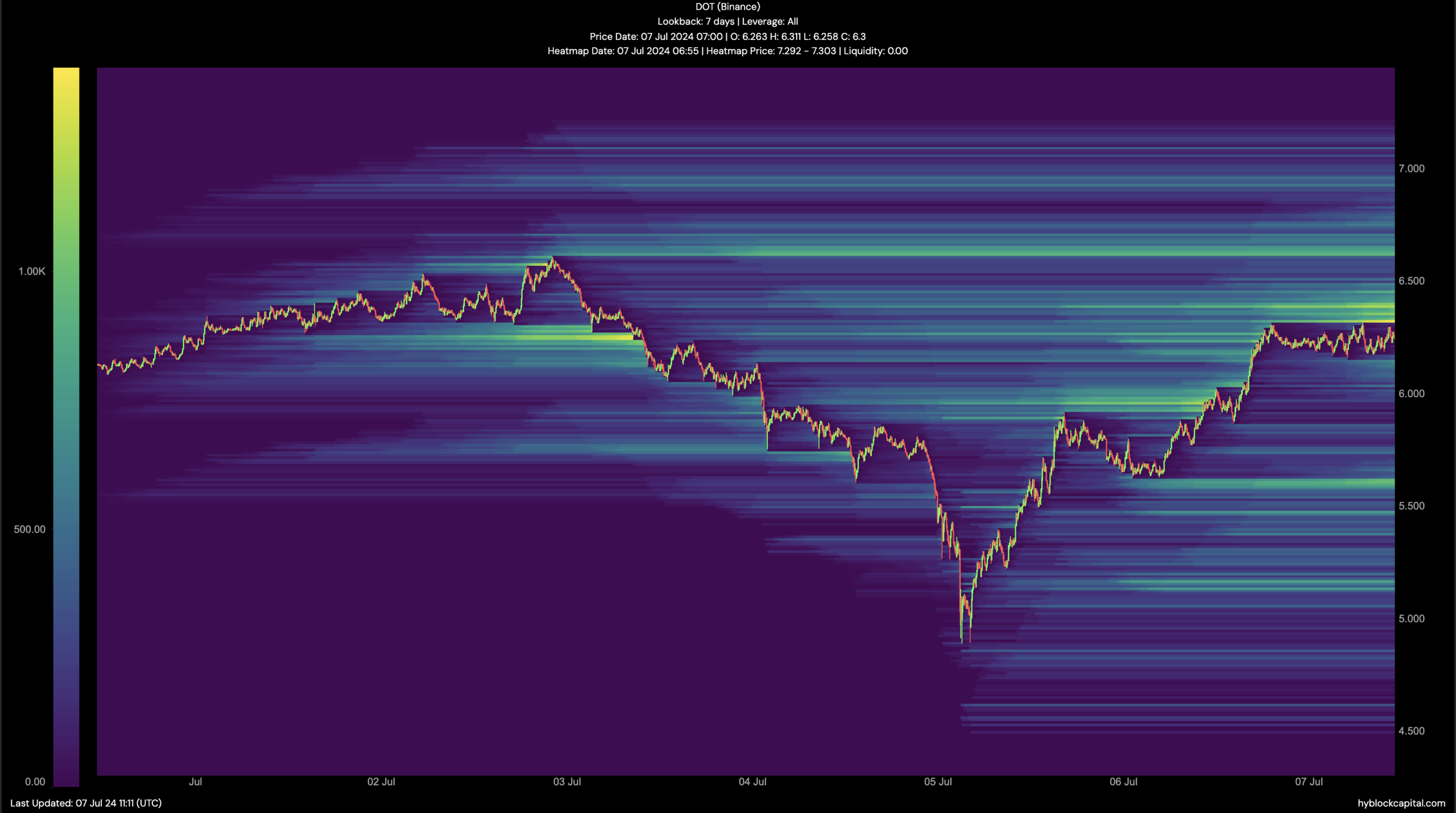

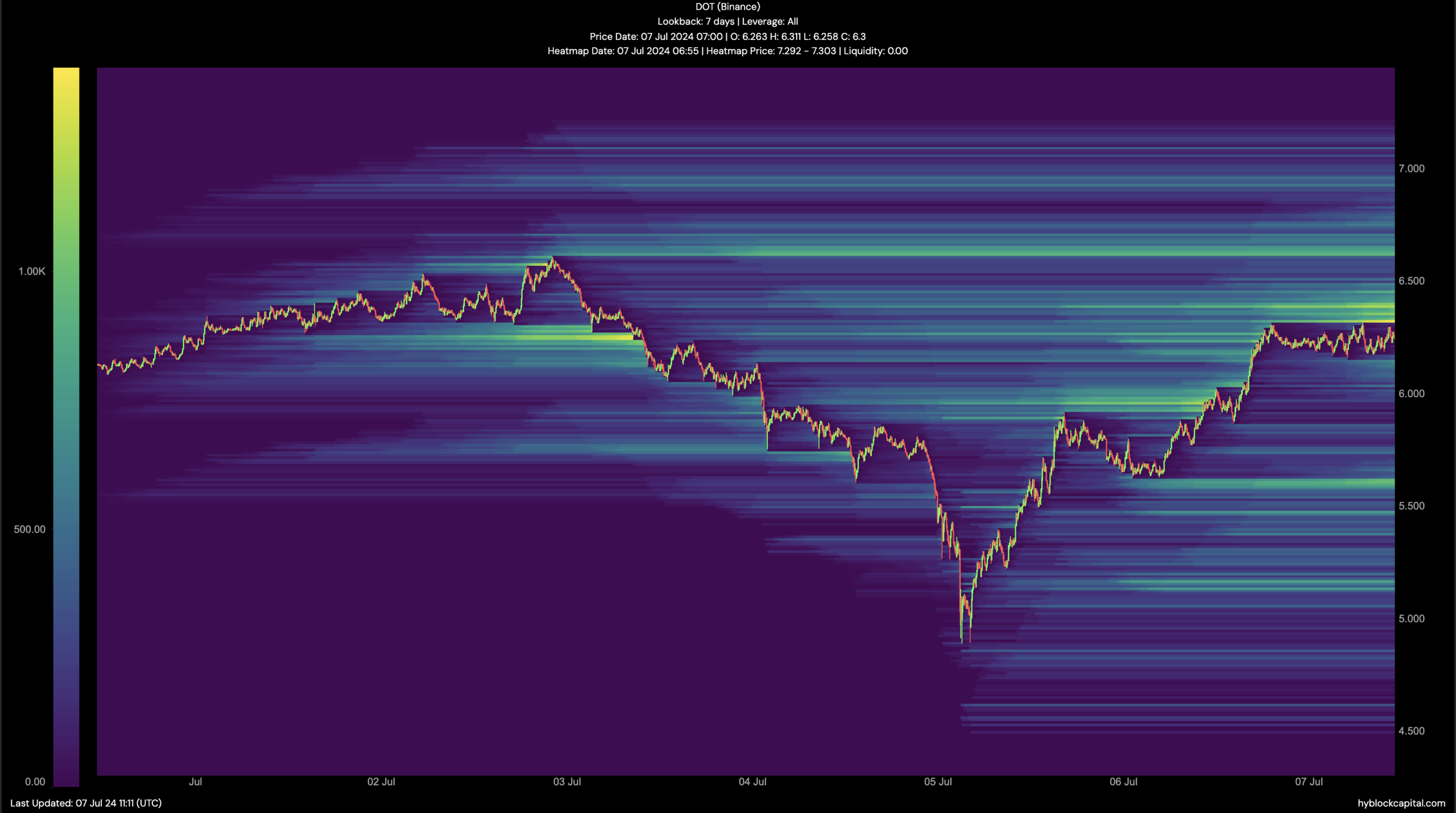

However, it doesn’t seem like the uptrend will stop anytime soon. This was based on clues from the Liquidation Heatmap. Simply put, Liquidation Heatmap predicts price levels at which large-scale liquidations could occur.

DOT is ready to be pulled out of the woods

Liquidation occurs when an exchange closes a trader’s position due to increasing price fluctuations. This also happens when the trader has insufficient ability to keep the position open.

But beyond that, the heatmap shows high liquidity areas, indicating the price levels where a crypto could move. For Polkadot, AMBCrypto noticed high liquidity between $6.45 and $6.96.

Source: Hyblock

Given this data, DOT’s price could build on its recent rise as buying pressure increases. If that is the case, the value of the token could reach $7 or trade above the level.

Is an outbreak coming?

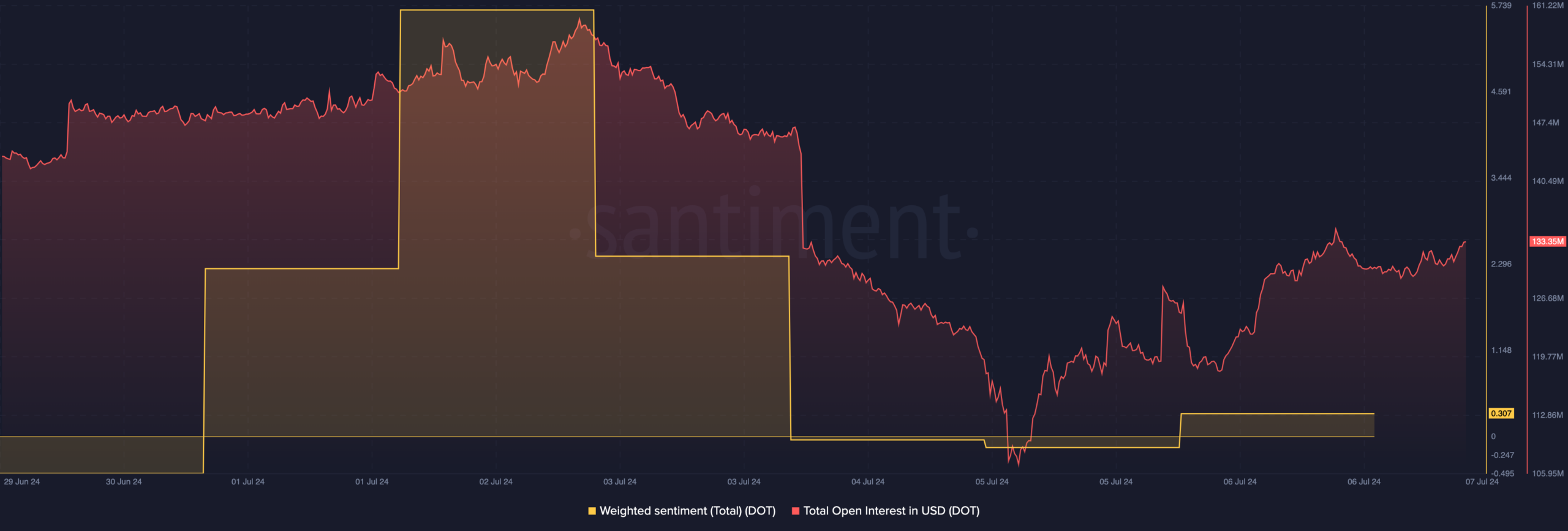

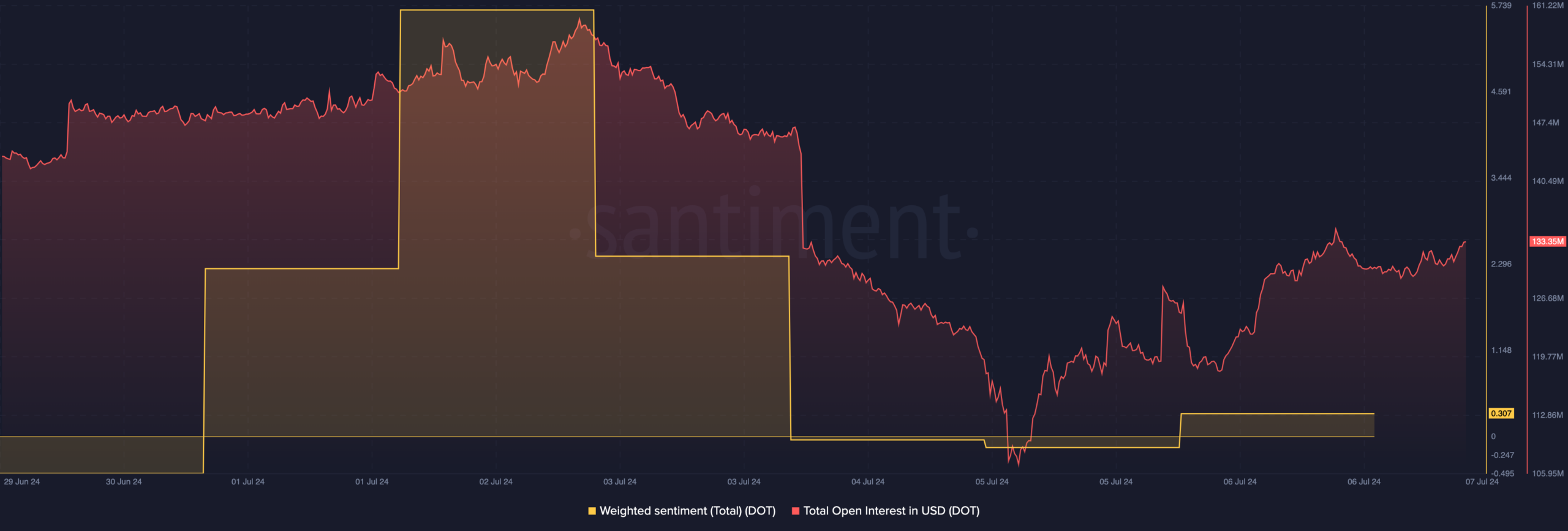

Another indicator that supported the increase was weighted sentiment. As a comprehensive look at social volume, Weighted Sentiment gauges the broader market’s perception of a project.

For example, if there are many positive comments online than negative ones, the reading will be positive. However, a greater number of negative comments would make the reading negative.

At the time of writing, Polkadot’s Weighted Sentiment was earlier. -0.143 had moved to 0.307. This reading implies a growing confidence in the potential of DOT.

If this continues, it could lead to increased demand for the token. Should this be the case, DOT’s price could rise back to $7 within a few days from the time of writing. Like sentiment, Open Interest (OI) supported a price increase.

Open Interest refers to the sum of all open contracts on the derivatives market. When it increases, it means that net positioning increases. This also implies that traders are deploying capital to profit from DOT price movements.

However, a decline indicates that traders are withdrawing money and closing their positions. At the time of writing, Polkadot’s Open Interest had done so got up to 133.35 million.

Source: Santiment

Should this increase continue, it could support a further price increase that takes DOT to $7.

Moreover, some analysts on X shared a similar view that the DOT price could continue to rise. One of them is Captain Faibik.

Read Polkadot [DOT] Price forecast 2024-2025

According to Faibik, DOT was close to a significant outbreak. In his post on X, the analyst shared his thesis via a graph, and specifically wrote:

“DOT has bounced back well and is on the verge of a wedge breakout, so keep a close eye on it.”