- Market sentiment around Polkadot turned bearish.

- Statistics showed that selling pressure on DOT increased.

The crypto market has turned bearish in the past 24 hours as most cryptos faced price corrections Polka dot [DOT] was no exception.

In fact, DOT was hit the hardest among the top 20 cryptos in terms of market capitalization. That is why AMBCrypto has further investigated whether DOT can recover from this soon.

Polkadot’s latest price correction

While several cryptos saw a slight pullback, Polkadot’s value fell nearly 10% in the last 24 hours alone.

At the time of writing, the token was trade at $9.49 with a market cap of over $14.44 billion, making it the 15th largest crypto.

The bad news was that DOT trading volume increased 15% in the last 24 hours, which served as the basis for this price drop.

This downward price trend also had a negative effect on the token’s social metrics. Santiment’s data showed that DOT’s social dominance plummeted sharply – a sign of the token’s declining popularity.

Furthermore, Polkadot’s weighted sentiment entered the negative zone. This indicated that bearish sentiment around the token was rising in the market.

Source: Santiment

Can DOT recover quickly?

AMBCrypto then checked other data sets to find out if they show signs of recovery from this bearish trend in the short term. We found that as DOT’s price began to decline, investors chose to sell their holdings.

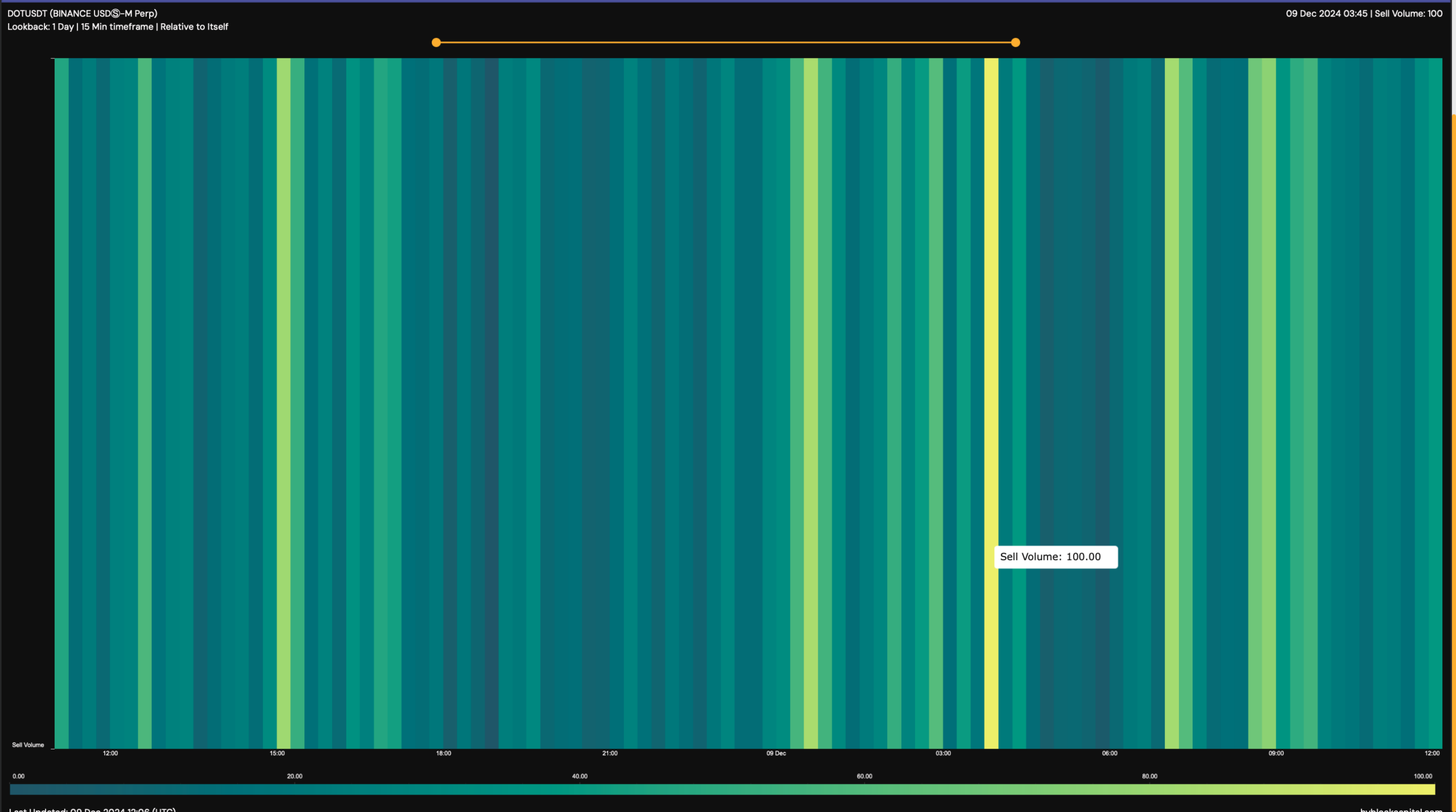

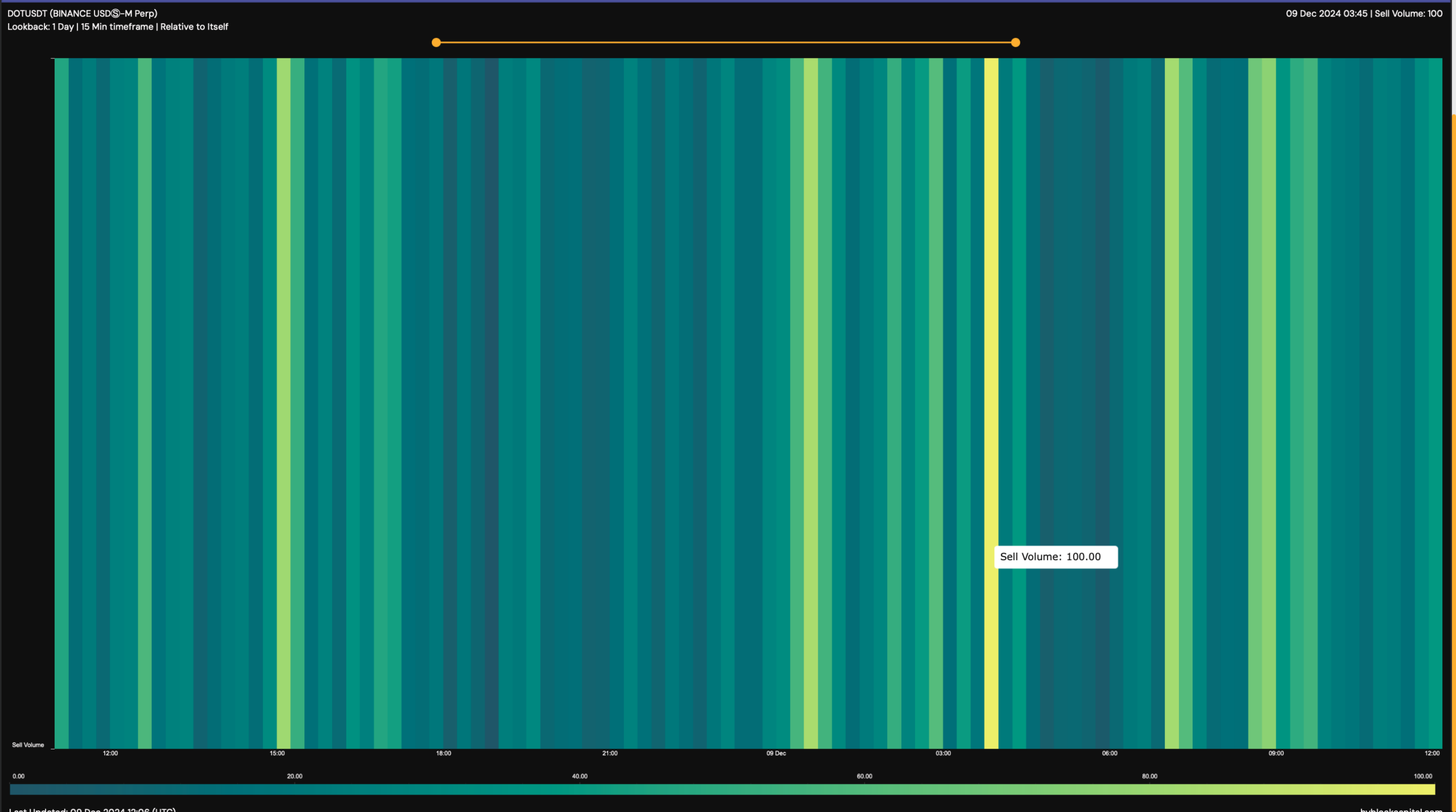

Hyblock Capital’s data showed that DOT sales volume spiked several times in the past 24 hours, rising to 100 in one case.

For starters, a number closer to 100 reflected the high selling activity in the market for a particular token.

Source: Hyblock Capital

Apart from that, Polkadot’s funding rate also dropped slightly, according to Coinglass’ report. facts. A decline in funding rates in cryptocurrencies indicates that short positions are becoming more dominant.

This could be a sign of bearish sentiment in the market.

Like the sales volume indicator, the Relative Strength Index (RSI) also painted a similar picture. The indicator registered a sharp decline, an indication of increasing selling pressure.

In the event of a continued downtrend, DOT could first drop to the 20-day SMA support as suggested by the Bollinger Bands. At that level, DOT could have an opportunity to spark a bull rally and recover.

Source: TradingView

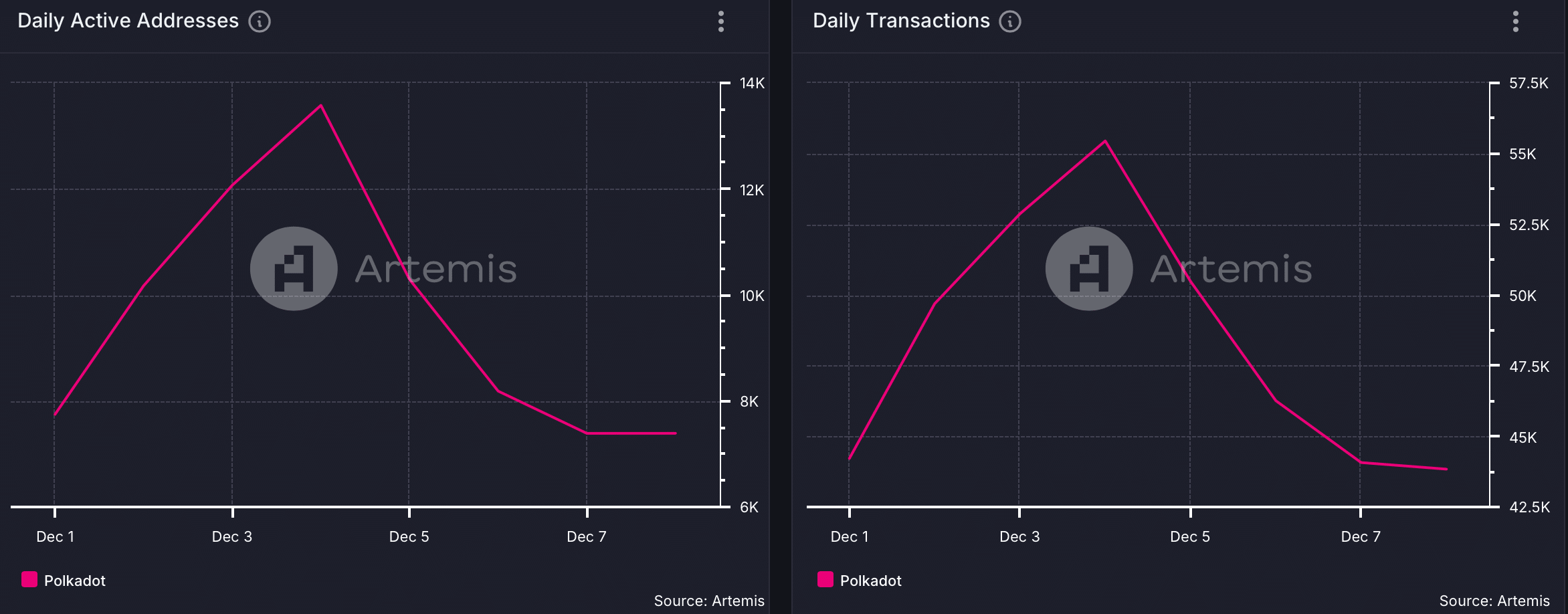

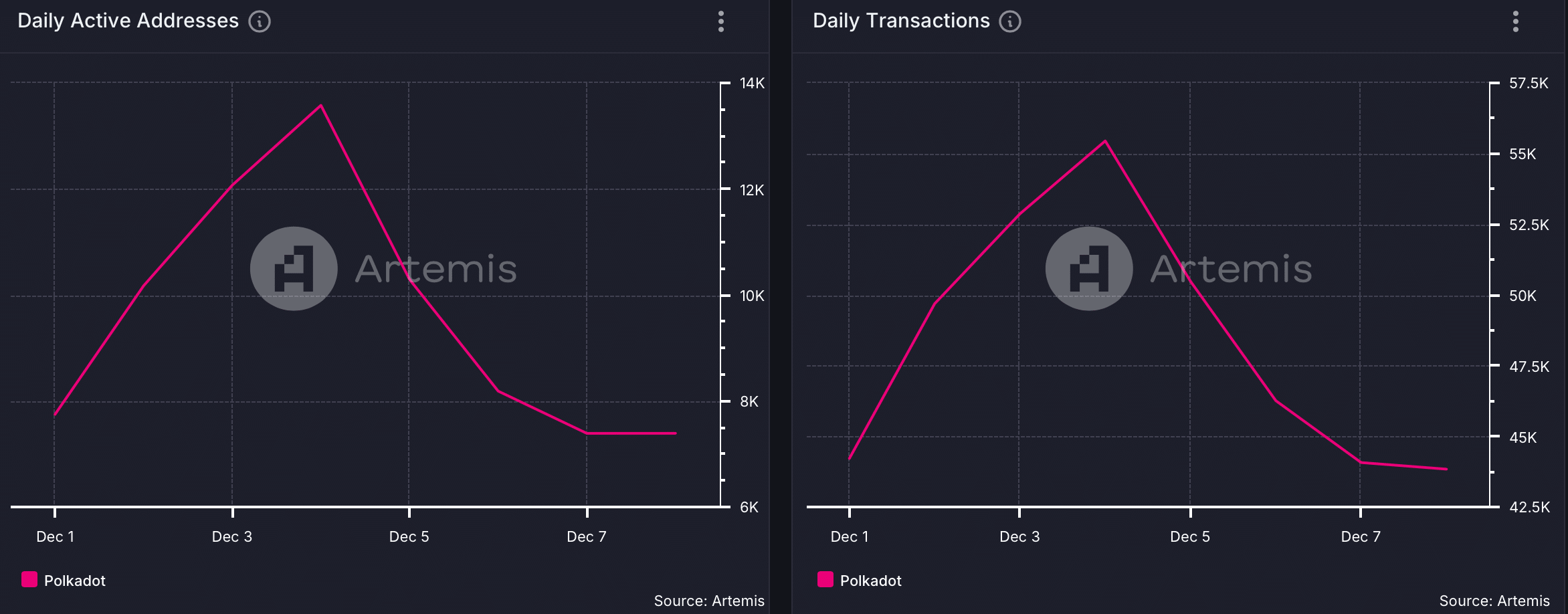

Interestingly, not only did Polkadot’s price drop, but its network activity also followed a similar trend.

Read From Polkadot [DOT] Price prediction 2024-25

AMBCrypto’s look at Artemis data indicated that both DOT’s daily active addresses and transactions have fallen sharply in recent days.

This meant that users were not actively using the blockchain, which could cause further problems for DOT.

Source: Artemis