- Pi Network Token saw the RSI climb over 50 to signal Bullish Momentum, but this can be a false alarm.

- The capital outflow and the financing percentage suggested that Beren were dominant.

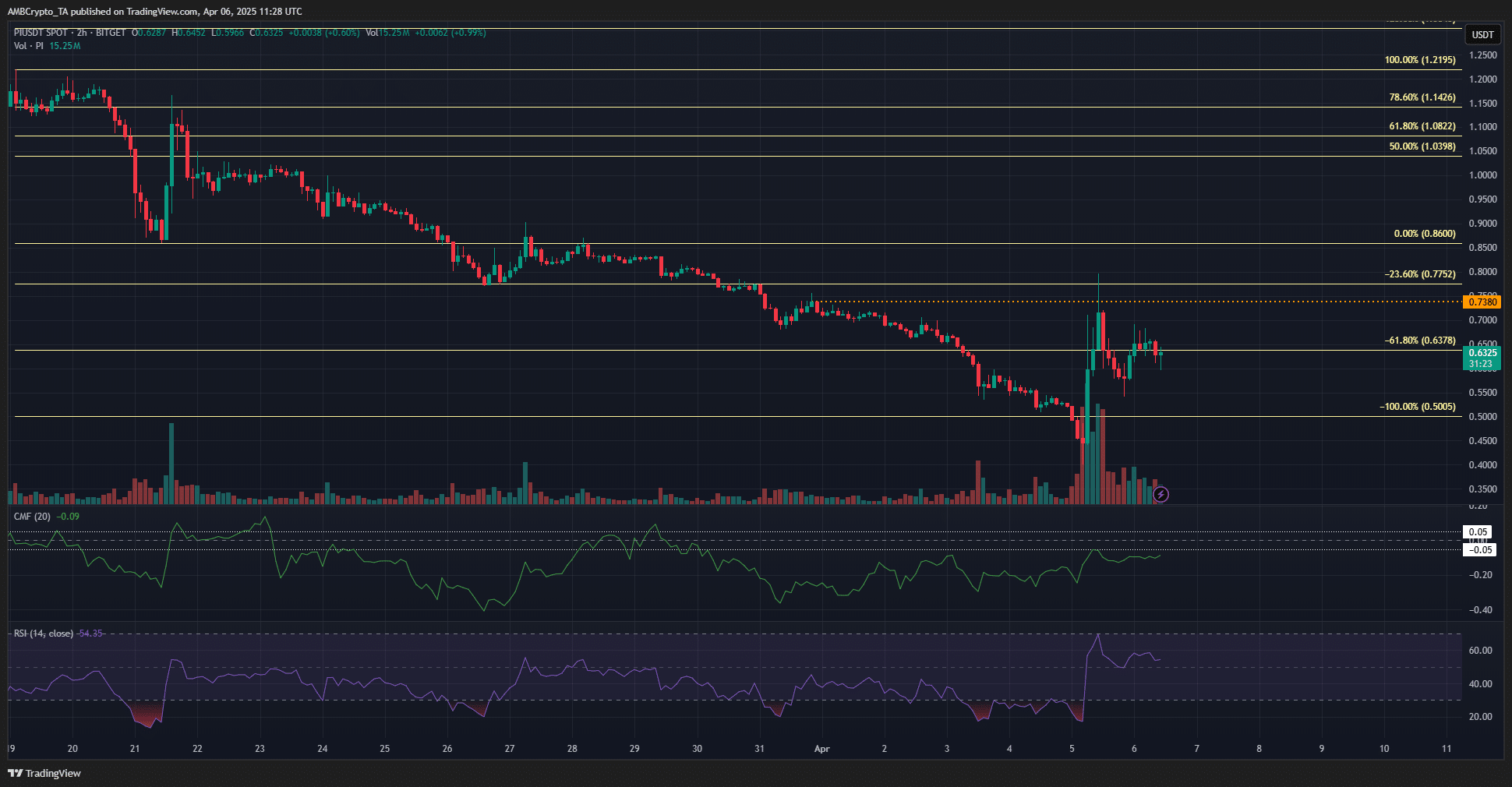

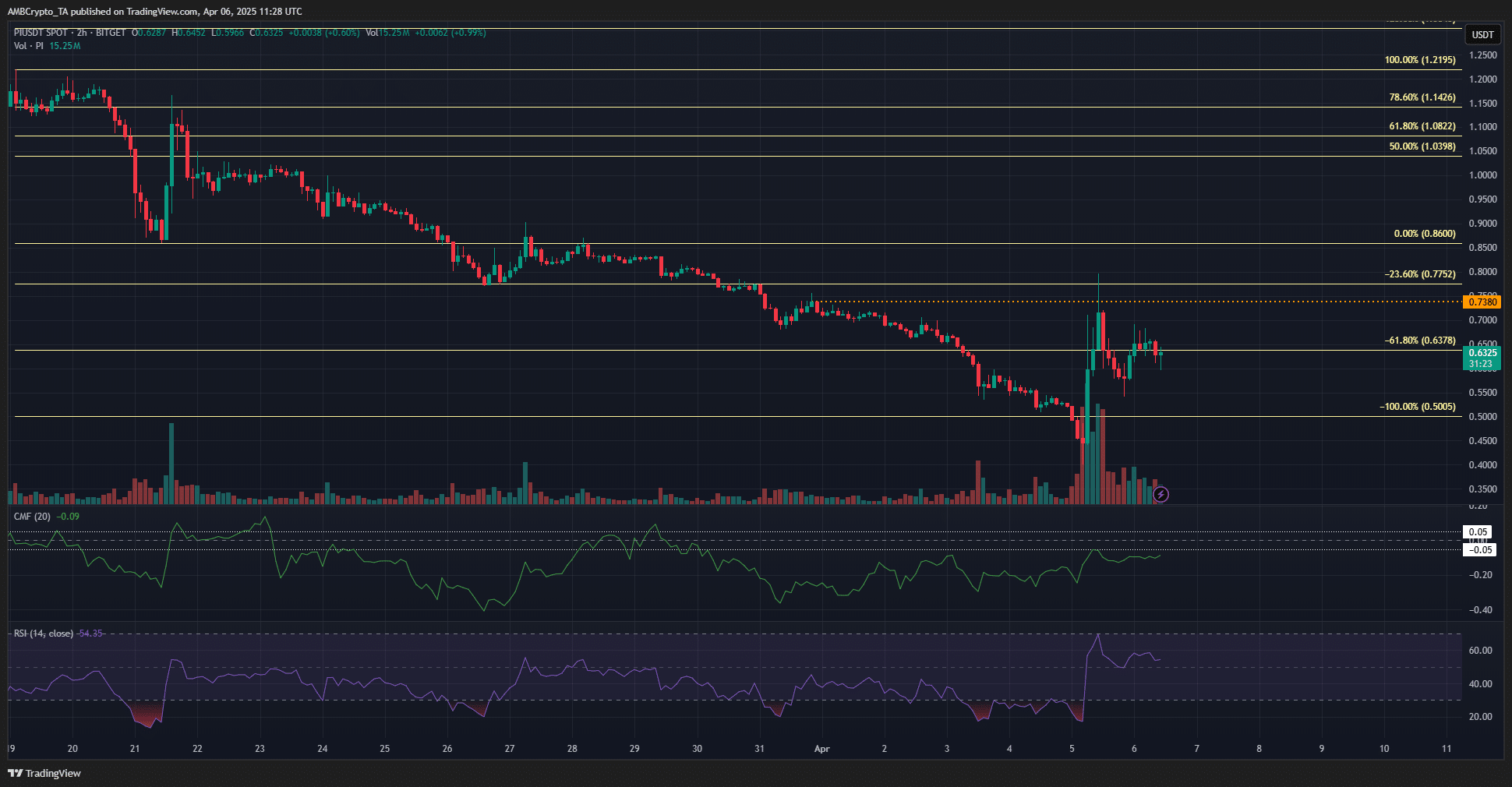

Pi -Network [PI] Had been in a bearish trend in March. In an earlier analysis it was emphasized that the Pi -Token would fall to $ 0.64. It had become so low and even lower and reached $ 0.4 on the weekend.

The trend has not yet shifted bullishs, although token saw a price of 99% bouncing in the 6 -hour period on 5 April.

The $ 0.75 was a critical resistance level in the short term. In the long term, the fears for centralization continued to exist and helped explain the consistent sales pressure.

Pi -Token test again overhead liquidity band, rejected bulls

Source: Pi/USDT on TradingView

The volatility on Saturday did not end with a bullish structure break on the price chart. The level of $ 0.738 (Orange) was the lower high from March for the bulls to break. They temporarily recorded the prices up to $ 0.8, but could not keep the profit.

The subsequent sales pressure around the local High suggested the Dominance of Beerarish. For the Bulls, PI has taken its best into the short term in a consolidation phase. The levels of $ 0.55 and $ 0.75 were probably extremes of a short -term range.

However, it was likely that no reach is possible. This was because of the strong sales pressure, which has not yet been relaxed. The CMF did not run above the level of -0.05 last week. This meant that a strong capital outflow of the PI market is common.

Without a break in sales pressure, it would be extremely difficult for the bulls to control a rally. Although the RSI was above neutral 50, Bullish power was not visible.

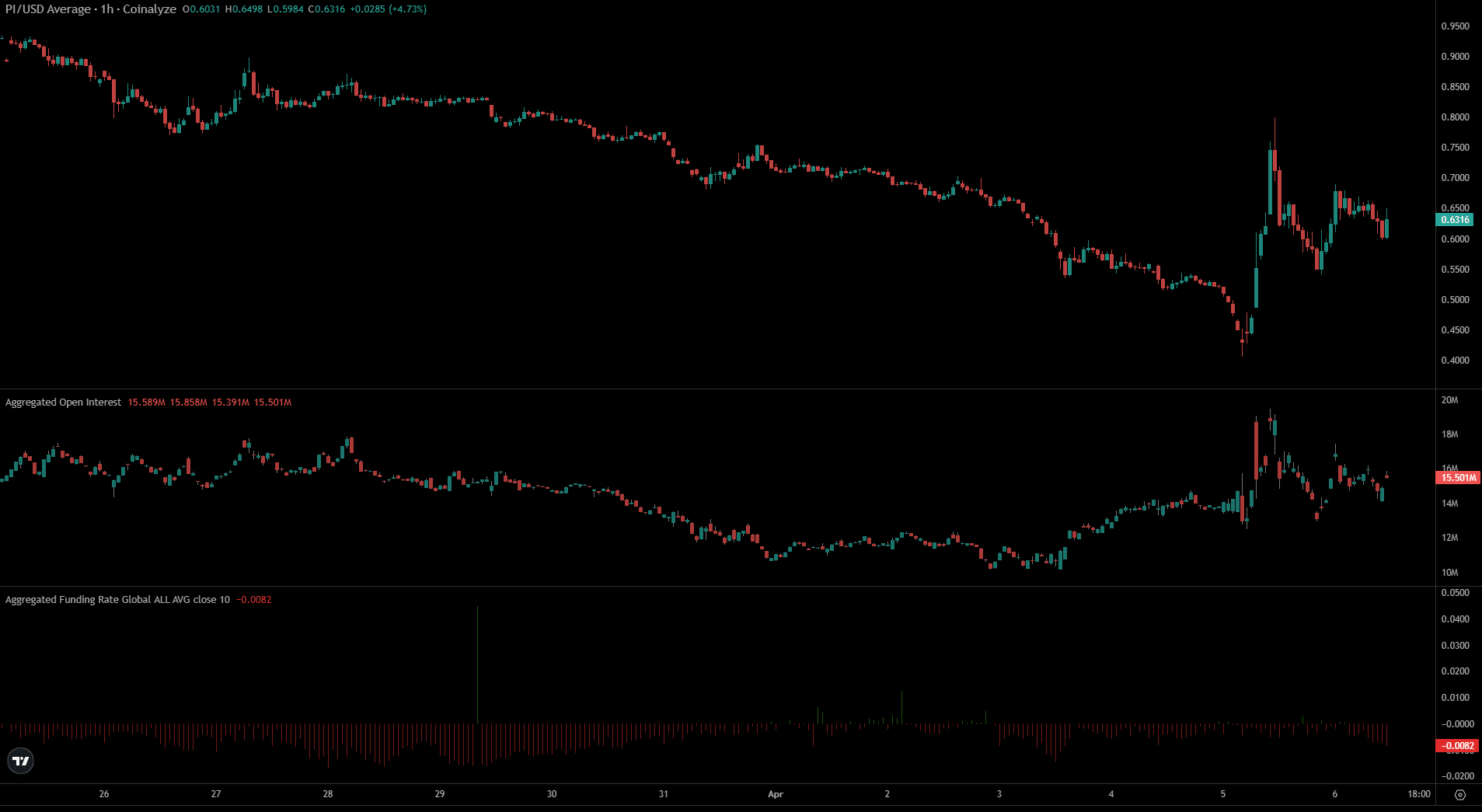

The open interest has been sinked higher in the last three days, besides the wild price bouncing from $ 0.4.

This indicated speculative interest and only bullish conviction in the short term. On the other hand, the financing percentage Beerarish remained.

That is why we can see a short squeeze in the coming days to catch the bullish speculators. As an alternative, if the PI price can recover $ 0.75 as support, a recovery can be in sight.

Disclaimer: The presented information does not form financial, investments, trade or other types of advice and is only the opinion of the writer