- The Optimism Bedrock upgrade reduced costs by more than 40%.

- OP struggled to maintain the $1.3 price region as it returned more than 4% gains.

Optimism [OP] has taken an important step towards becoming a practical Layer-2 platform through the groundbreaking Bedrock upgrade, introducing numerous improvements. Of these improvements, the most notable was a reduction in fees.

Read Optimism [OP] Price Forecast 2023-24

Now several weeks have passed since this upgrade. Has it successfully attracted a wave of activity to the platform?

Optimism Bedrock crashes fees

from Messari recent post highlighted the impressive results of Optimism’s Bedrock upgrade. In particular, fees have dropped significantly by around 47% along with faster deposit times.

Also, gas cost per transaction is down about 70% making Optimism Mainnet the most cost effective Ethereum [ETH] Layer 2 solution for token swaps. In addition to the cost reduction, the Bedrock upgrade has moved Optimism closer to becoming a Superchain.

Has this affected the network?

The number of users sees a boost

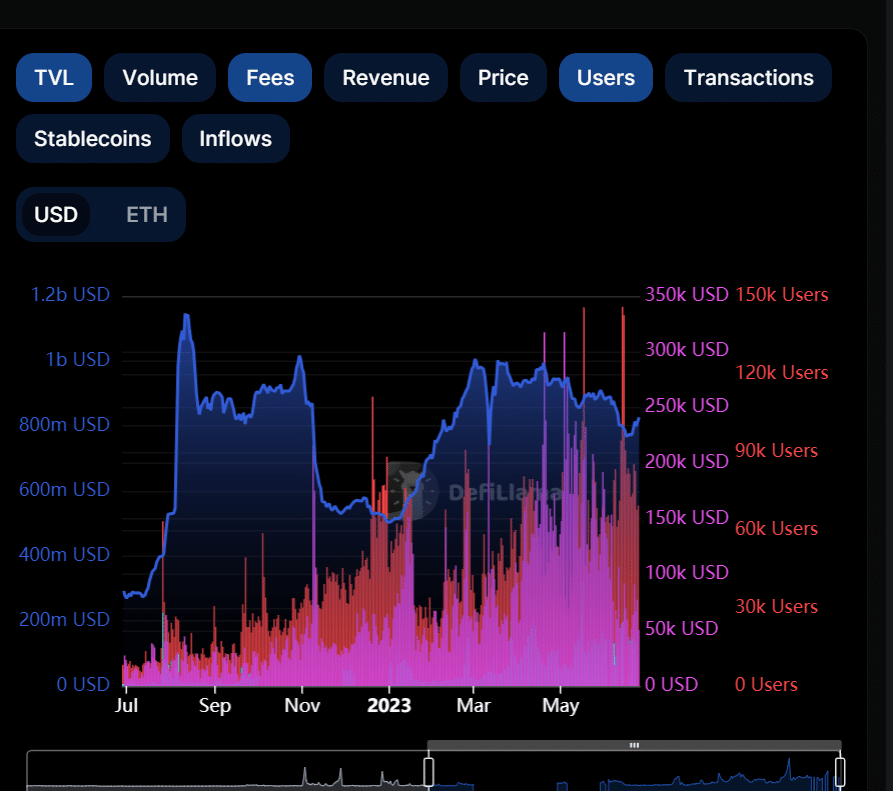

According to Defillama, the Bedrock upgrade has delivered positive results, particularly in terms of user adoption. After the upgrade, the platform witnessed a substantial user spike, surpassing the 100,000 mark.

In addition, the number of new users has grown steadily over the past few weeks, indicating continued interest since Bedrock’s upgrade.

At the time of writing, the number of returning users was over 60,000, indicating a favorable retention rate.

While the Total Value Locked (TVL) initially fell after the upgrade, it has since resumed an upward trajectory. At the time of writing, the TVL had crossed $827 million.

In addition, the DefiLlama chart showed a noticeable decline in fees, with press time costs about $50,000.

Source: DefiLlama

Additionally, according to L2 Beats data, Optimism’s rollup has emerged as the second highest TVL. The TVL was $2.23 billion, accounting for more than 23% of the market share.

ON price development

Analysis of OP’s daily timeframe chart showed that the Bedrock upgrade had a notable impact on price dynamics. On the day of the upgrade, June 6, the token experienced a remarkable increase of more than 7% in value.

However, this gain was short-lived as the price fell, erasing the accumulated gains and recording a net loss.

Source: TradingView

Nevertheless, on June 20, OP witnessed a significant 17% spike in value, to about $1.3. However, maintaining this price level proved to be a challenge. At the time of writing, OP was trading around $1.36, indicating an additional gain of over 4% in value.

The Relative Strength Index indicated that the overall trend was bullish, albeit with a weak tendency.

How much are 1,10,100 VPs worth today?

In addition to the price movements, the Bedrock upgrade has contributed to significant user growth, a resurgence of Total Value Locked (TVL) and a reduction in costs.

As the market continues to develop, the following weeks will play a critical role in determining the extent of the Bedrock upgrade’s impact on OP’s performance.