- Onyxcoin emerged as a top -weekly gainer after exploding by +100% in three days

- Technical indicators suggested that the price of XCN could reverse and cool off soon

Onyxcoin [XCN] Was the best performing Altcoin Gem this week after exploding with 135% in the past three days. Moreover, it dominated the Daily Gainers list and it was the most popular trending assets on coinmarketcap, with a huge increase of +260% in trade volume in the last 24 hours.

Will the Onyxcoin rally expand?

Source: XCN/USDT, TradingView

De Wild Upswing pushed the daily RSI (relative strength index) to the overbough zone, warning that the rally could be a cooling. Moreover, the OBV (at balance volume) recovered strongly from the LOS points of April, but received the resistance near 91b.

All in all, the technical indicators have shown enormous purchasing pressure in recent days. However, they typed on the key levels that suggested that a light price determination or retracement could not be overrubs.

Bulls could extend the rally to the central bearing channel near $ 0.02 if the OBV knew the overhead hindernis above 91 billion. That would be a potential profit of 25%.

However, a price rejection in the middle range can drag XCN to the 200 DMA (daily progressive average), which stopped the quarter of Q1 2025 and coincided with the range of range.

Onyxcoin’s low sales pressure

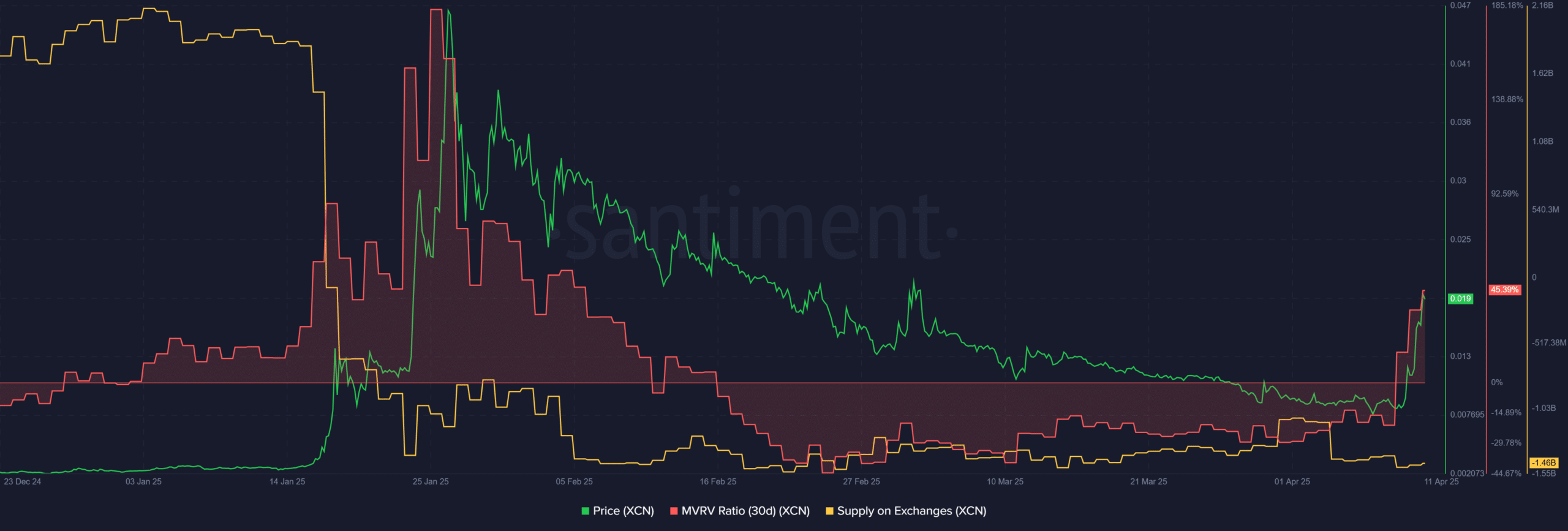

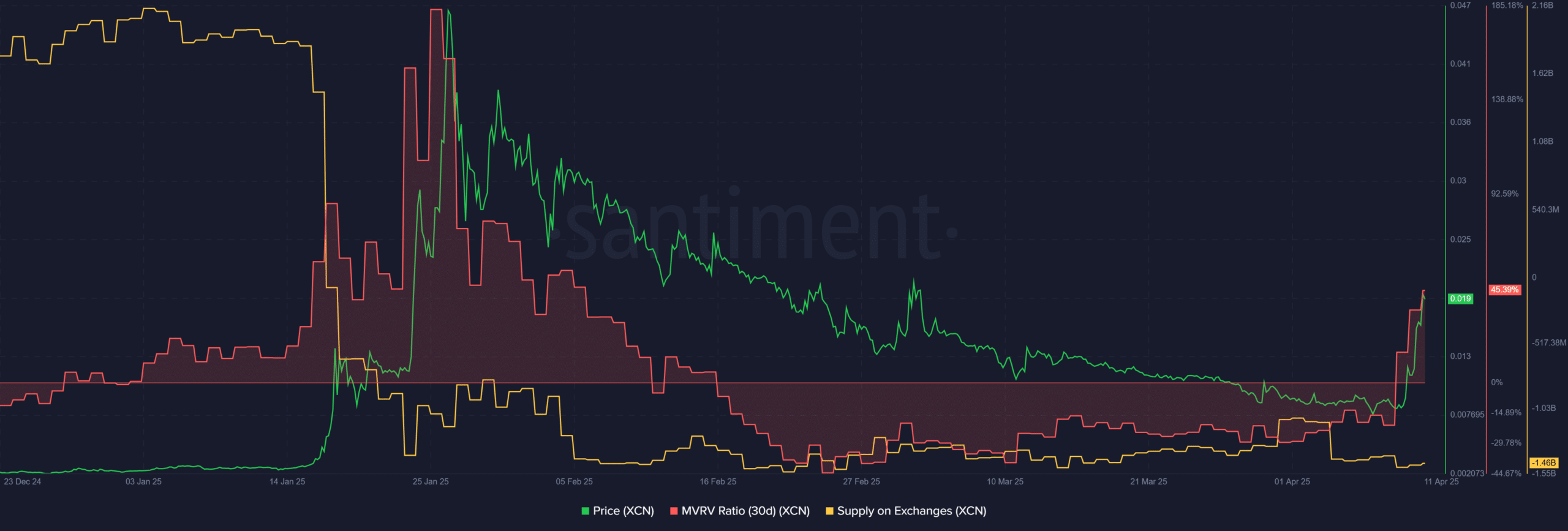

Source: Santiment

At the time of writing, the data from Santiment revealed that those who have held the Altcoin for a month had an average of 45% of non-realized profit per 30-day MVRV. In most cases this can make a profit and retain the recovery.

However, there was a low sales pressure at the time of people of these profitable holders. According to the range of santiment on the exchanges, the falling trend (yellow) meant more XCN tokens from fairs have been withdrawn than deposited for sale.

Simply put, Bulls had little room to push higher, according to the above indicators.

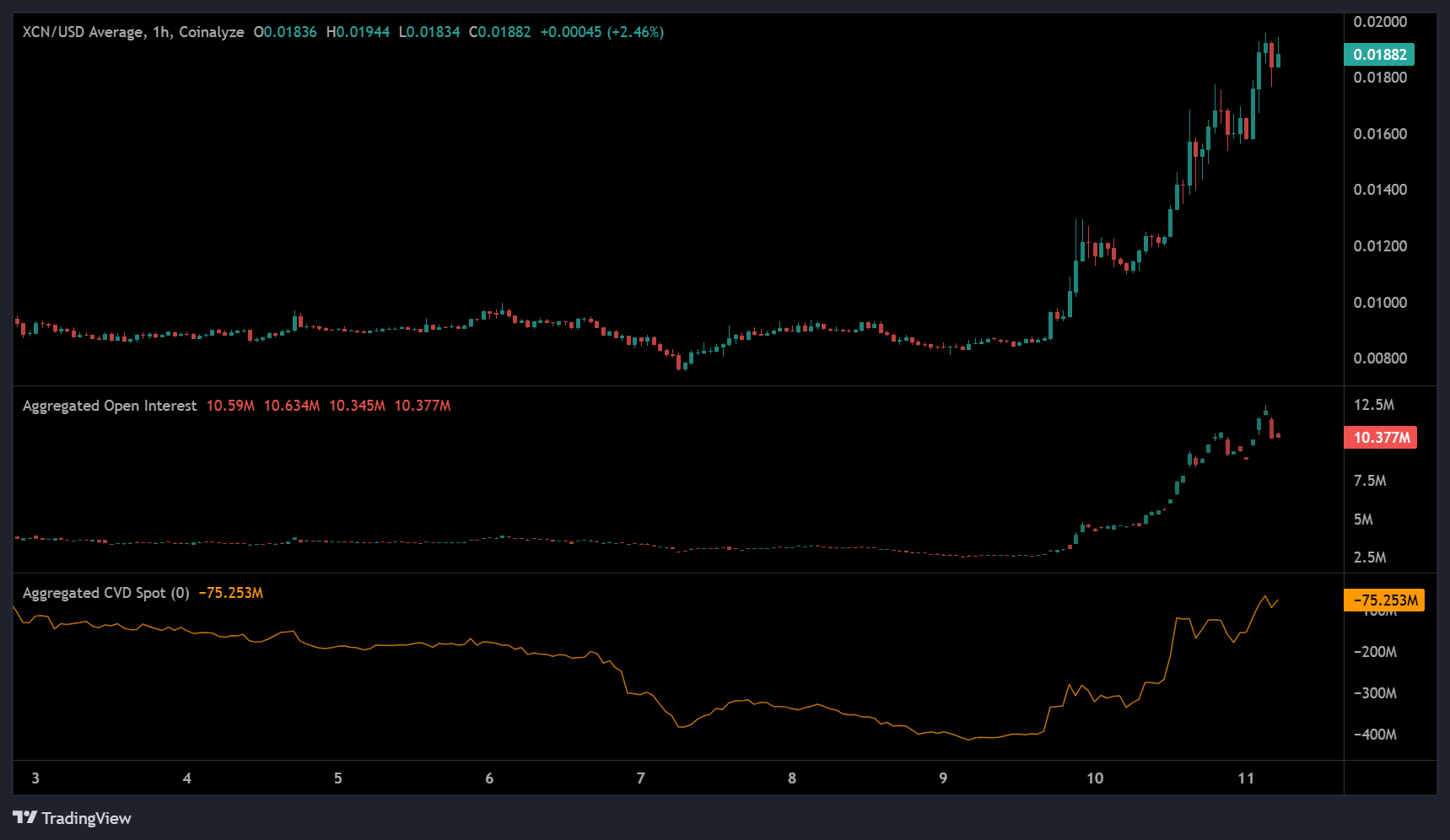

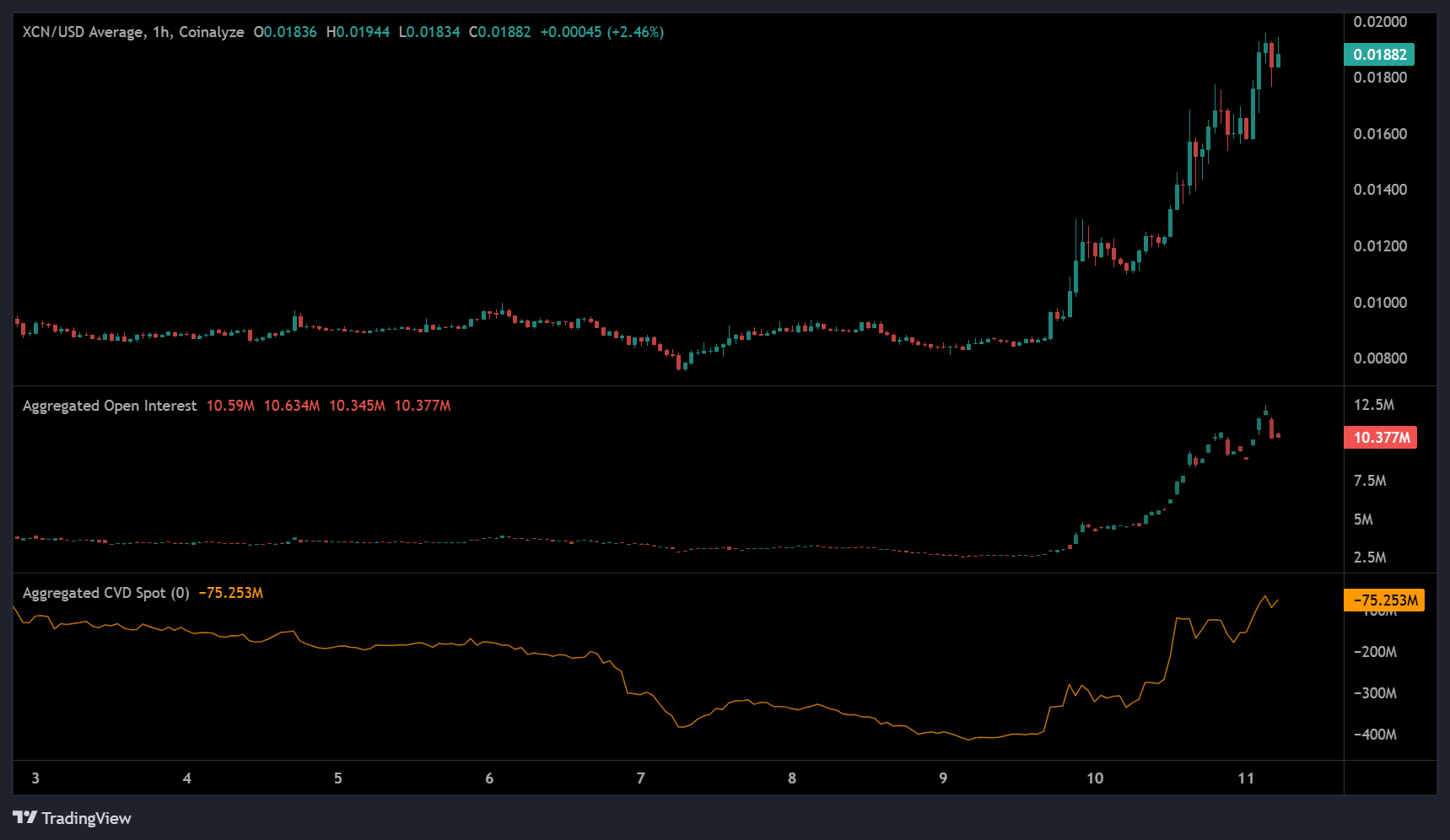

Source: Coinalyze

Another positive data point was that the rally was powered by the demand for a strong place and derivatives. This was illustrated by the rising CVD spot and open interest (OI) rates. Wilde liquidations can fall strongly the value of the asset when a rally is pure driven by leverage (peak in OI).

On the contrary, it could stabilize and push it up when the rally is supported by a strong location, as in the case of XCN.

In conclusion, Onyxcoin could extend the rally to $ 0.023 and add another 25% profit. Technical indicators, however, flashed a potential price reimbursement and cooling.