- ONDO’s share price has fallen by more than 1.4% in the past 24 hours.

- Buying pressure on the token was high.

While several cryptos showered investors with profits over the past 24 hours, ONDO had other plans. This was the case as the price dropped during that time.

However, investors should not get discouraged as ONDO was at a crucial level, which could soon trigger a bull rally.

Should you buy ONDO?

According to CoinMarketCap factsONDO’s price turned bearish on July 7 as its value fell by more than 1.4% in the past 24 hours. At the time of writing, the token was trading at $0.9838 with a market cap of over $12.36 billion.

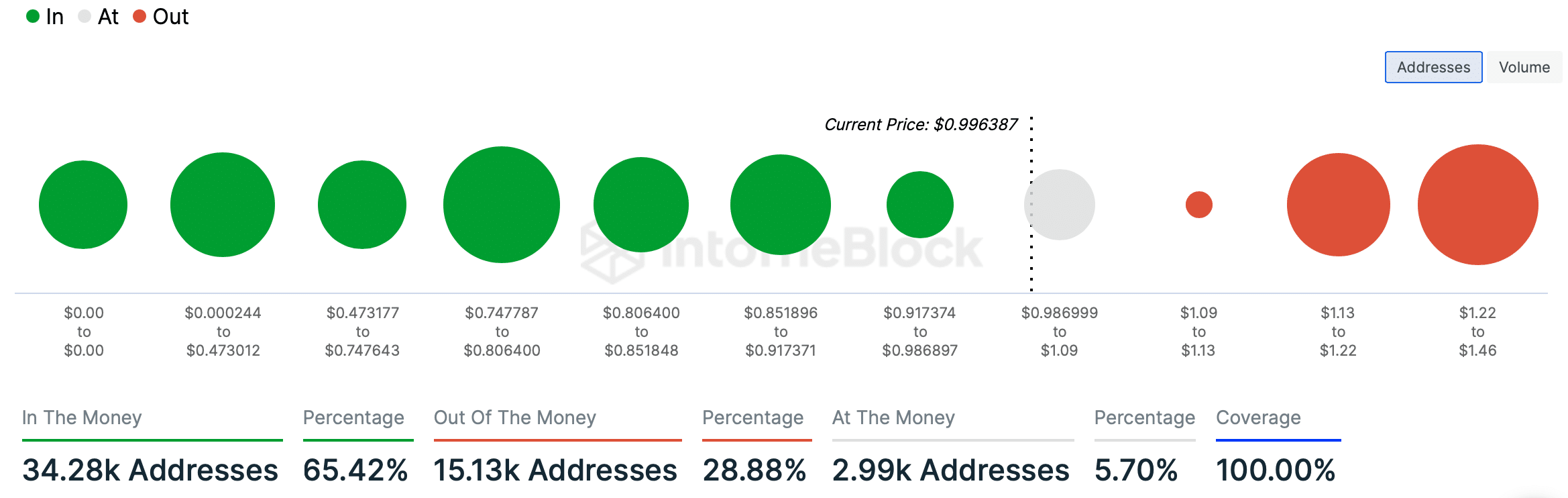

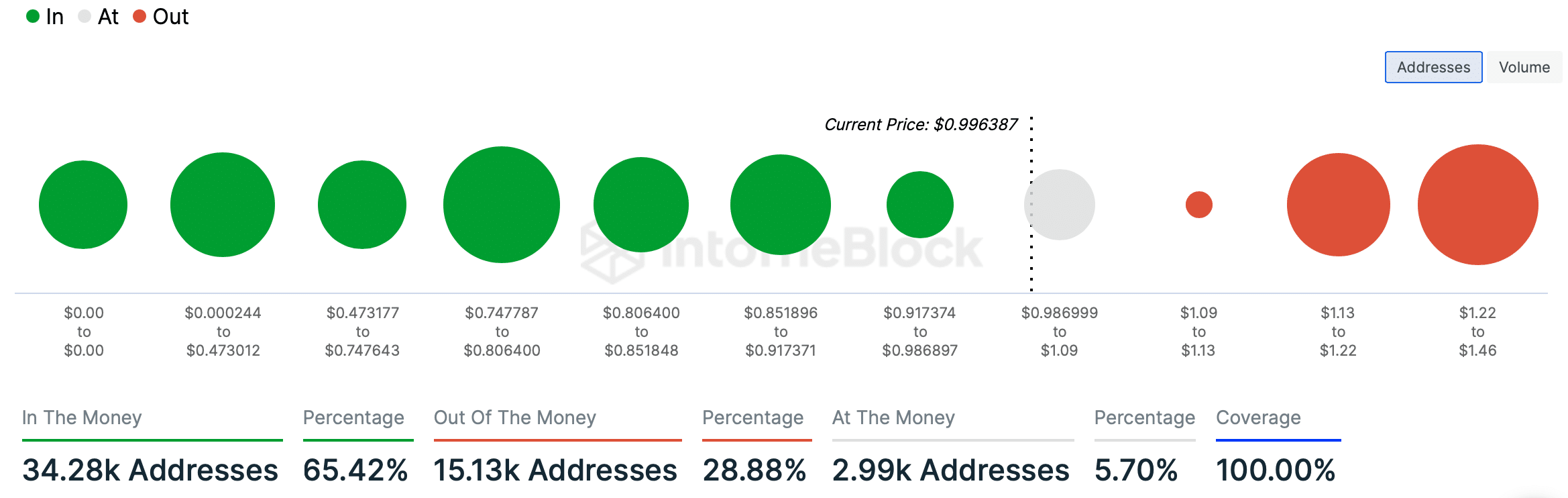

AMBCrypto’s look at IntoTheBlock’s data revealed that 65% of ONDO investors made a profit, accounting for more than 34,000 addresses.

Source: IntoTheBlock

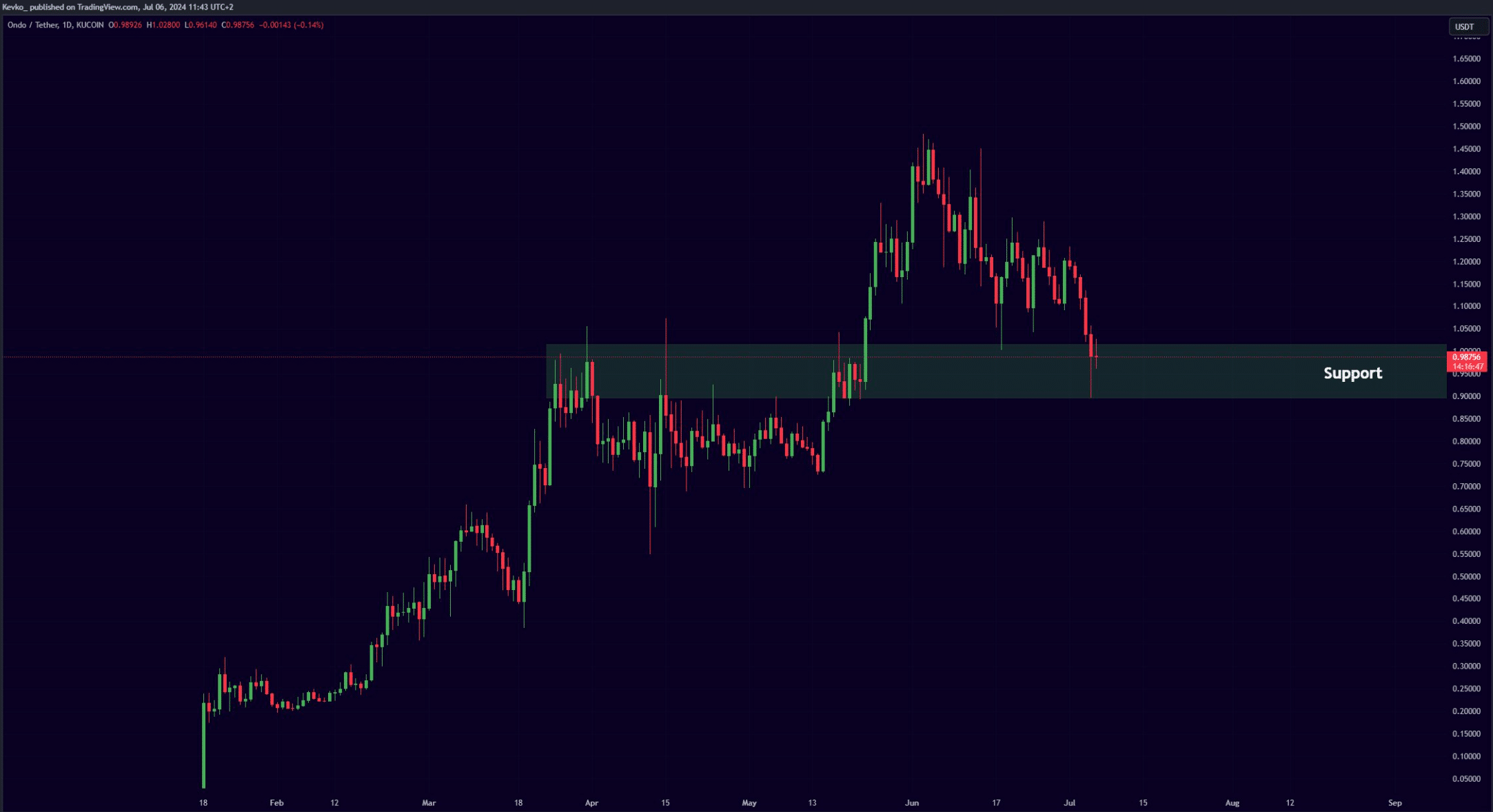

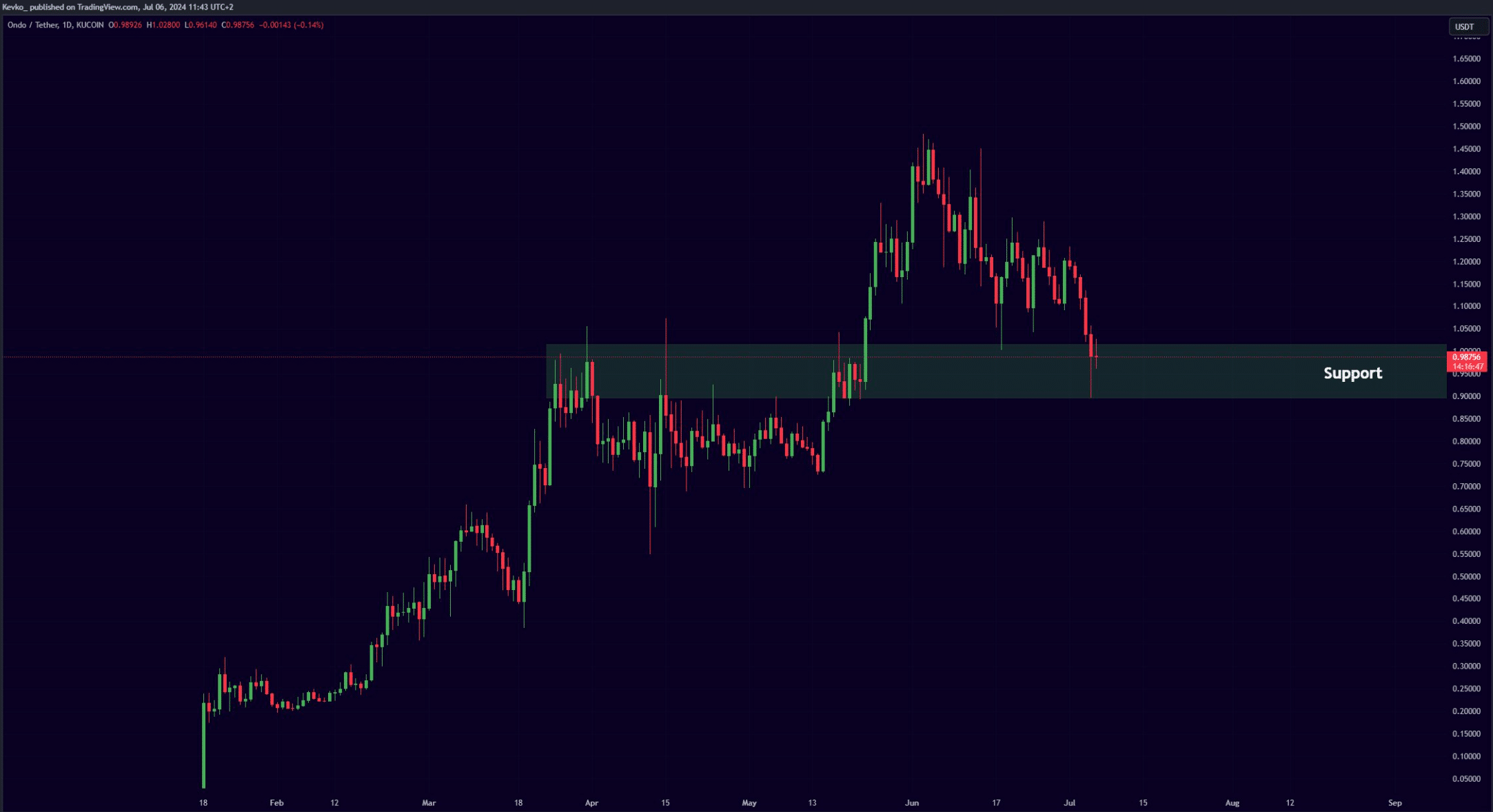

Meanwhile, Mister Crypto, a popular crypto analyst and investor, recently posted tweet to draw attention to an interesting development. According to the tweet, the token’s price was within a support range.

A successful test could spark a massive bull rally, which could see the token retest its June high. Therefore, this could be the right opportunity for investors to buy the token while the price is low.

Source:

The buying pressure is already high

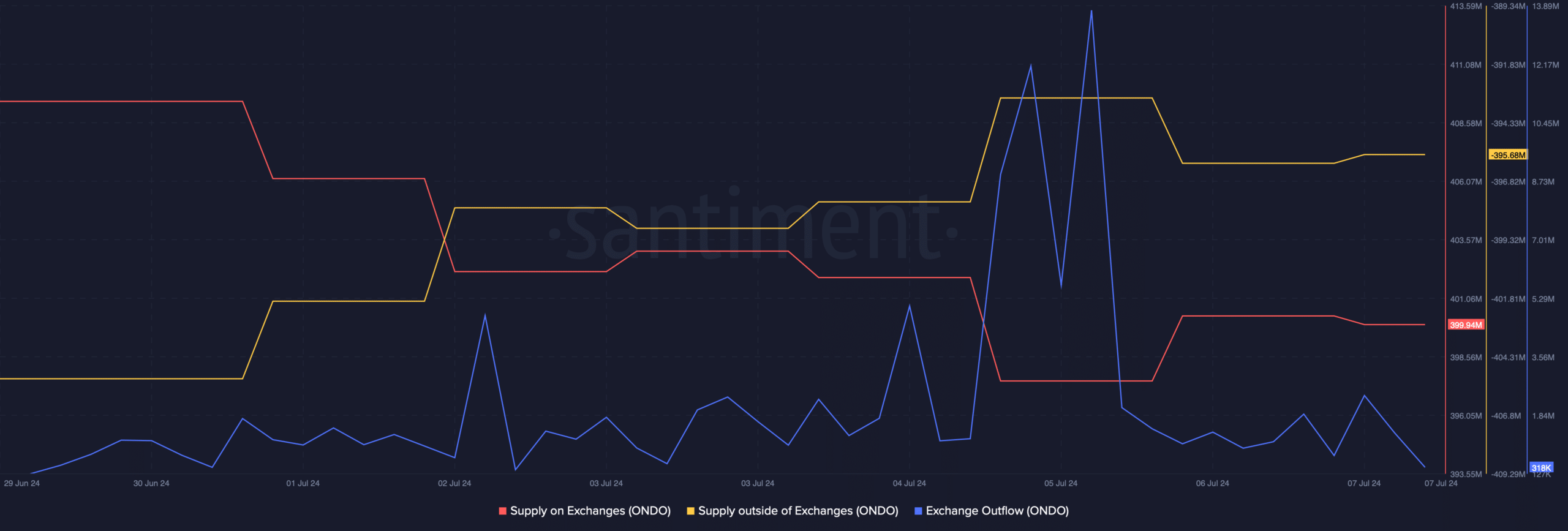

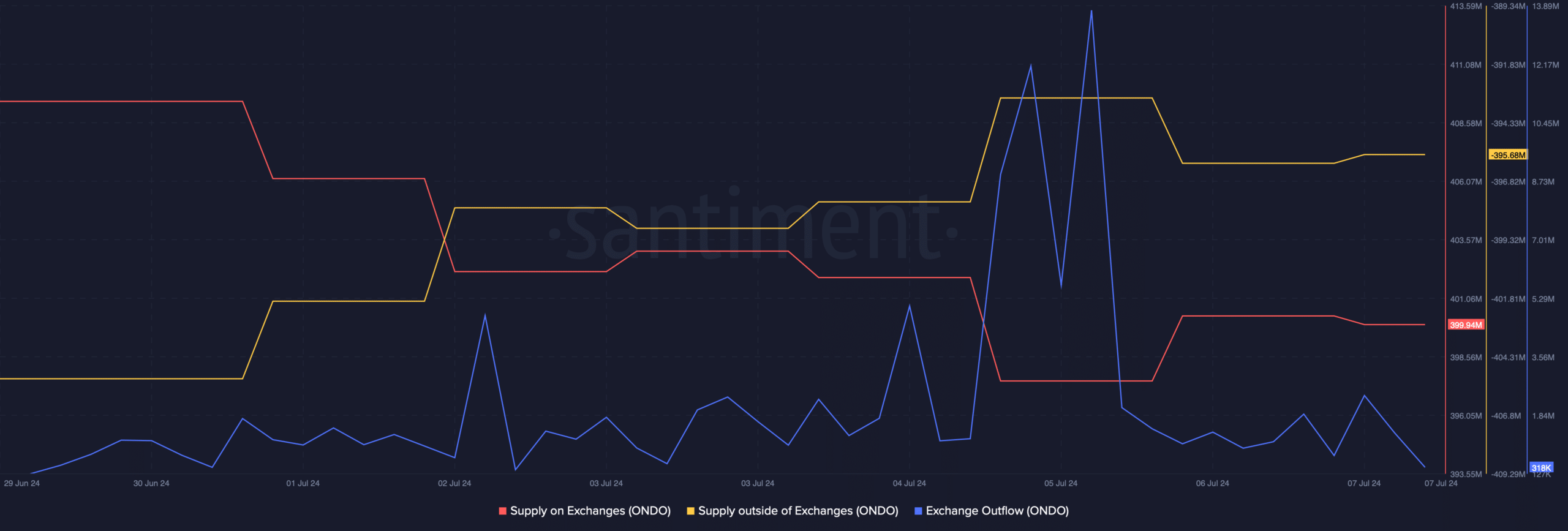

Since this seemed like a good opportunity to accumulate ONDO, AMBCrypto analyzed Santiment’s data to find out if investors have already started buying the token.

We found that token outflows spiked, indicating high buying pressure.

Moreover, the supply on the exchanges decreased, while the supply outside the exchanges increased. This further confirmed the fact that investors were stockpiling ONDO.

Source: Santiment

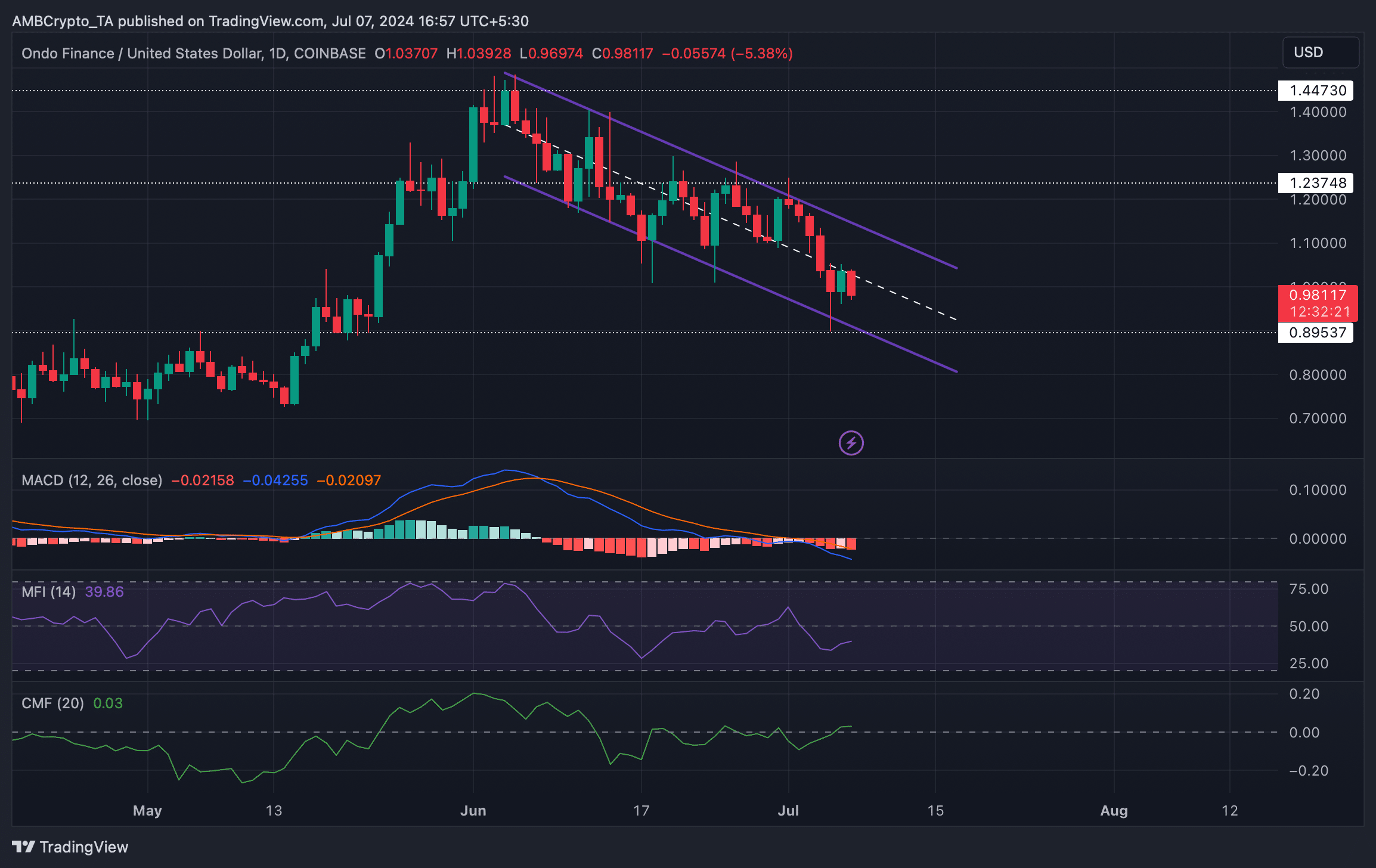

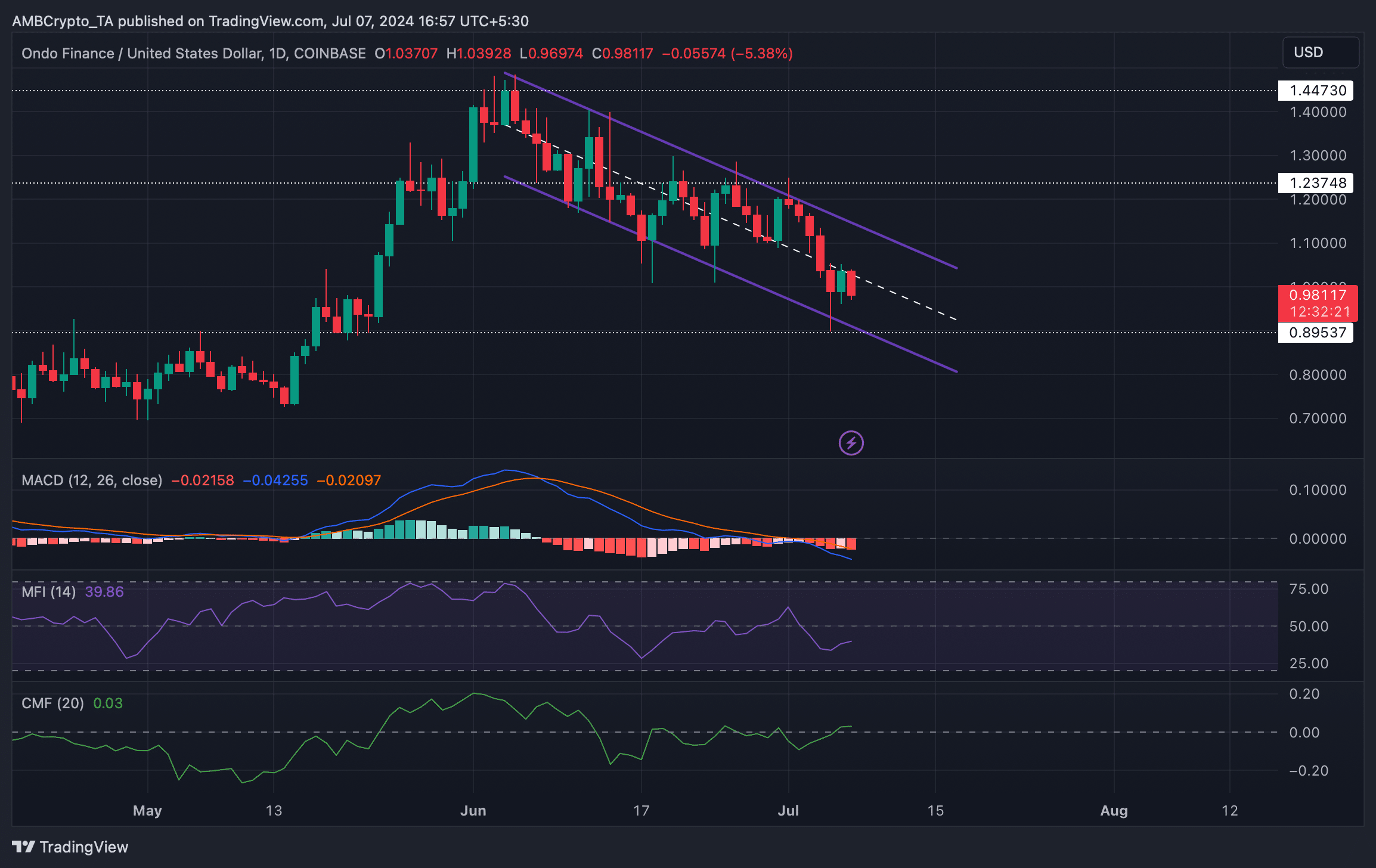

AMBCrypto’s analysis of the token’s daily chart revealed another bullish signal. We found that a bullish flag pattern was forming on the token’s chart.

After reaching an all-time high in June, the token’s price began to consolidate within the pattern. A successful breakout could see the token reach $1,237 before its eyes retest its ATH.

The technical indicator Chaikin Money Flow (CMF) registered an increase. Moreover, the Money Flow Index (MFI) also moved north towards the neutral point, indicating that ONDO was likely to successfully test the bullish flag pattern.

Nevertheless, the MACD showed a clear bearish advantage in the market.

Source: TradingView

Read ONDO’s price forecast 2024-25

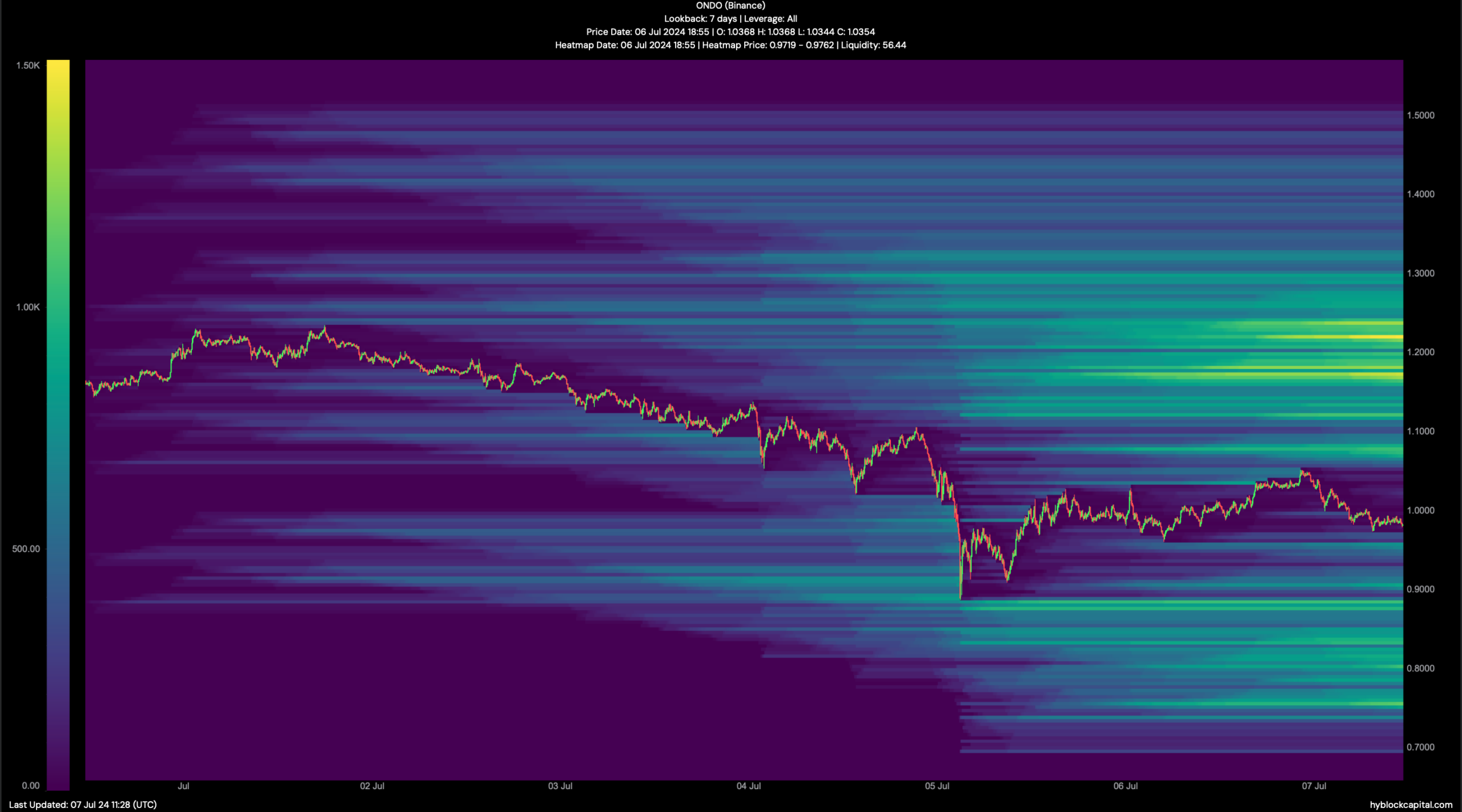

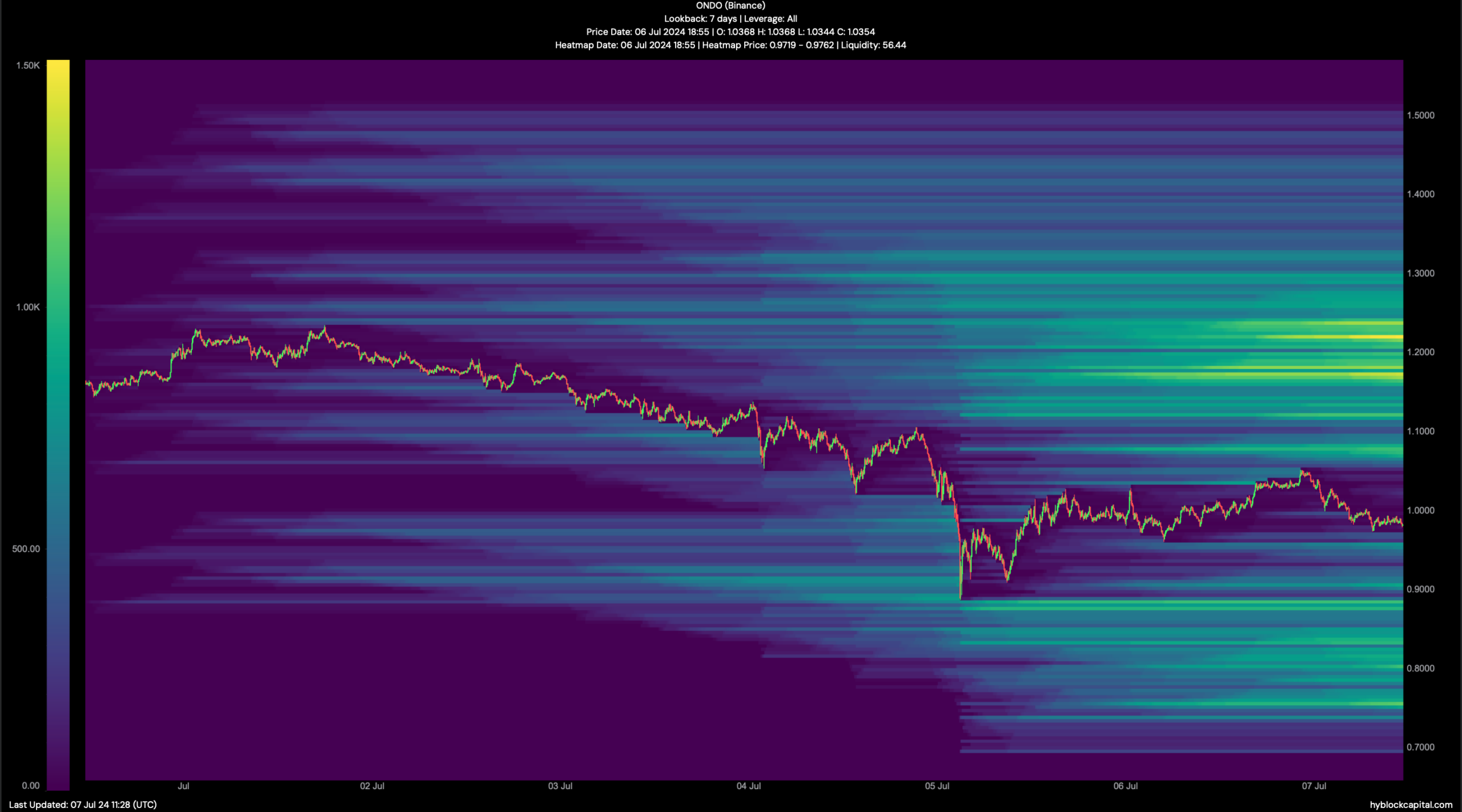

Our analysis of Hyblock Capital’s data showed that the token’s liquidation would rise to almost $1,079. Therefore, it would also be critical for the token to break above that level, as high liquidation often results in short-term price corrections.

If that happens, the path to his ATH would be pretty clear. However, if the bears dominate, the token’s price could drop to $0.88.

Source: Hyblock Capital