- ONDO posted a 14% gain but faced an overhead hurdle near the $1 level.

- Despite the recovery, overall market sentiment for ONDO was still weak.

Just like the overall market, Ondo Finance [ONDO] followed Bitcoins [BTC] recovered, posting a recovery gain of more than 14% since July 8.

Ondo Finance, a leading issuer of tokenized securities, posted a 4% gain on July 10, coinciding with its Pyth network integration.

The partnership will allow Ondo’s USDY/USD price feed to be displayed on more than 60 blockchains.

With gains of over 10% since Monday, can the ONDO bulls make more gains, or has the steam run out?

What’s next for bulls?

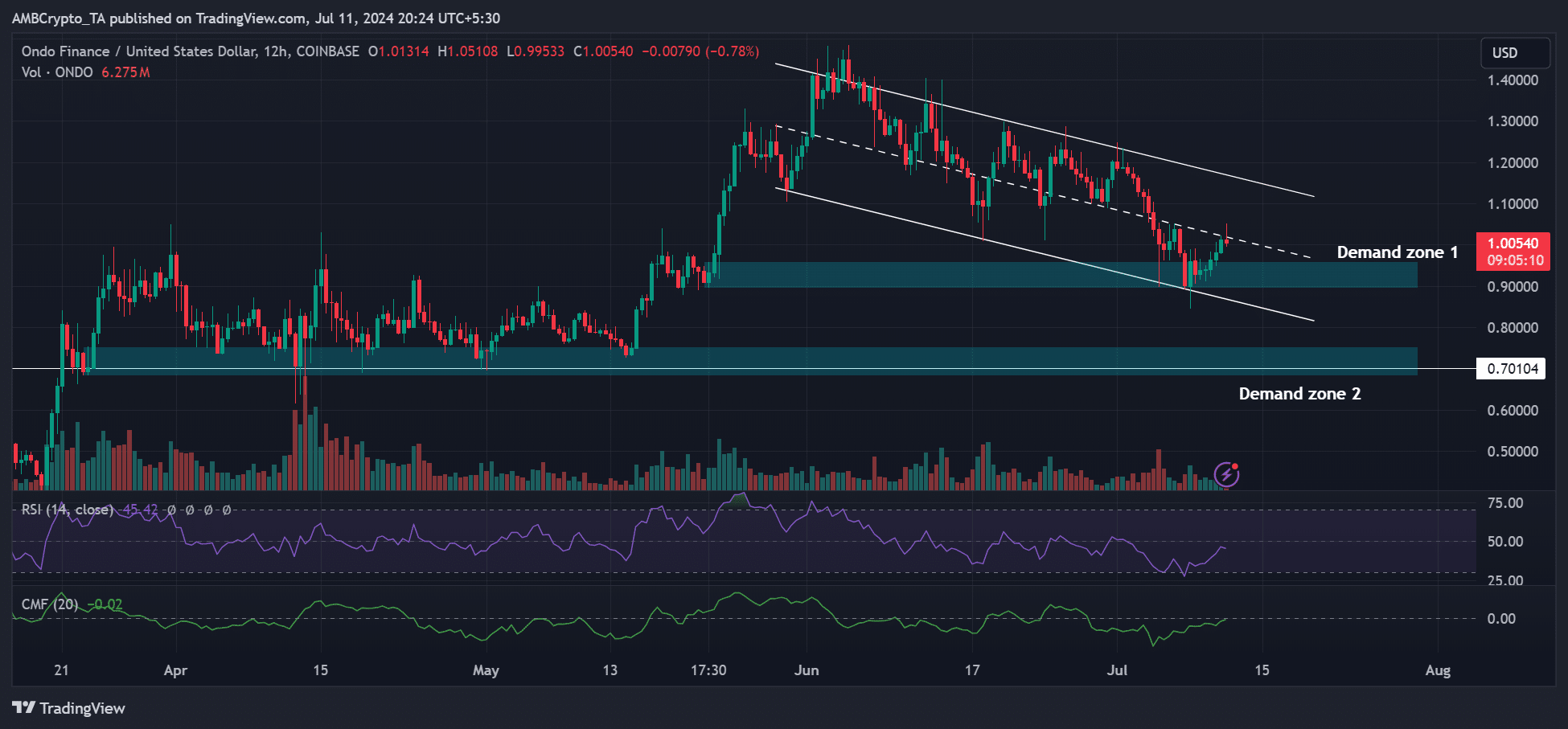

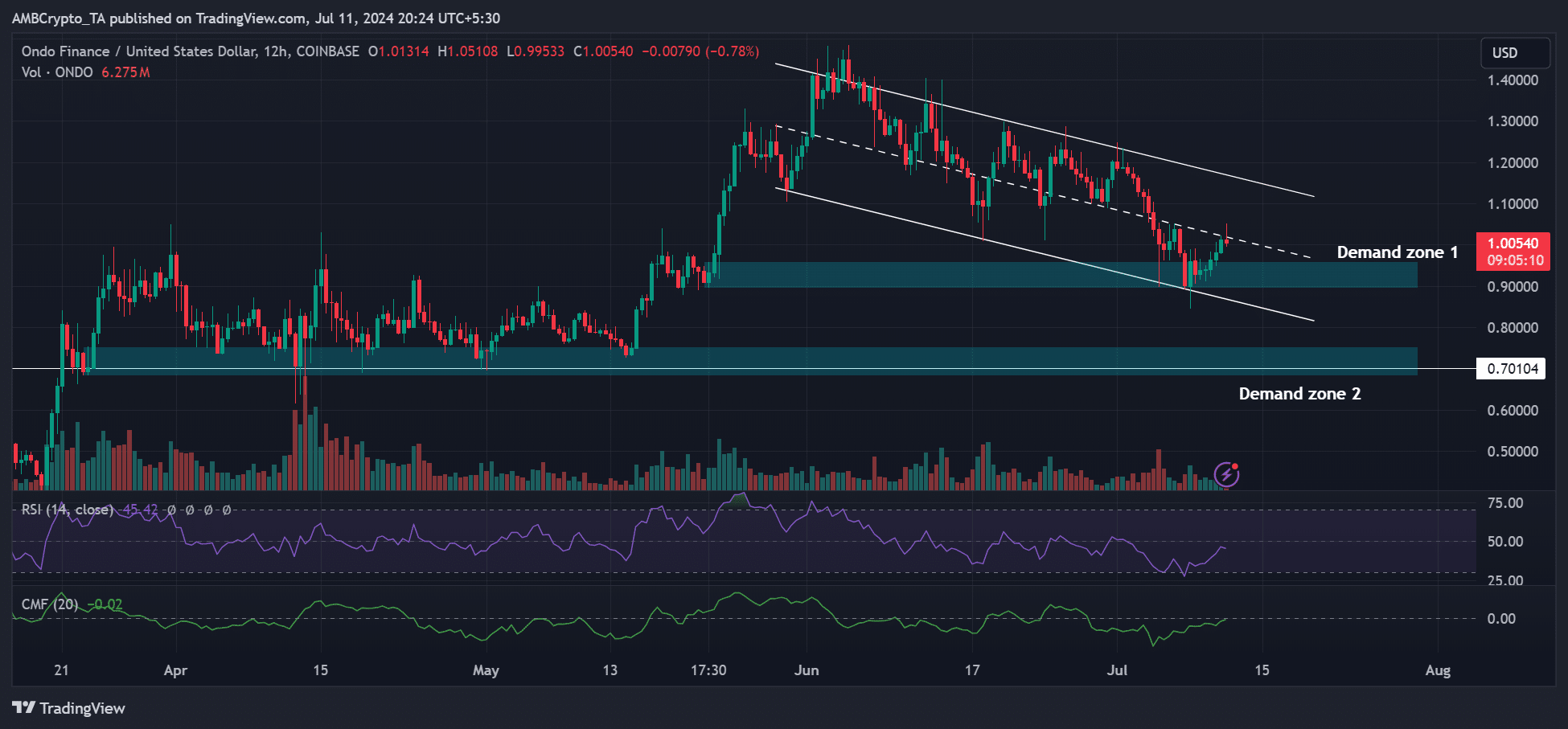

Source: ONDO/USDT, TradingView

ONDO’s impressive recovery, which started from the first demand zone and the bullish order block at $0.9, met immediate resistance as of the time of writing.

Based on the values of the price chart indicators at the time of writing, both the RSI (Relative Strength Index) and the CMF (Chaikin Money Flow) were in a neutral position.

It meant that buying pressure and capital inflows improved, but were substantial for additional upside momentum.

Furthermore, the price on the 12-hour chart had not closed above $1, which meant that, on a higher time frame, ONDO’s market structure had not yet shifted to bullish at the time of writing.

ONDO could therefore retest demand zone 1, especially if BTC fails to recover $60,000 in the near term.

However, bulls can leverage the market and look for an additional 10% if ONDO closes above $1 and eyes the descending triangle’s range high.

Ondo Finance’s weak sentiment

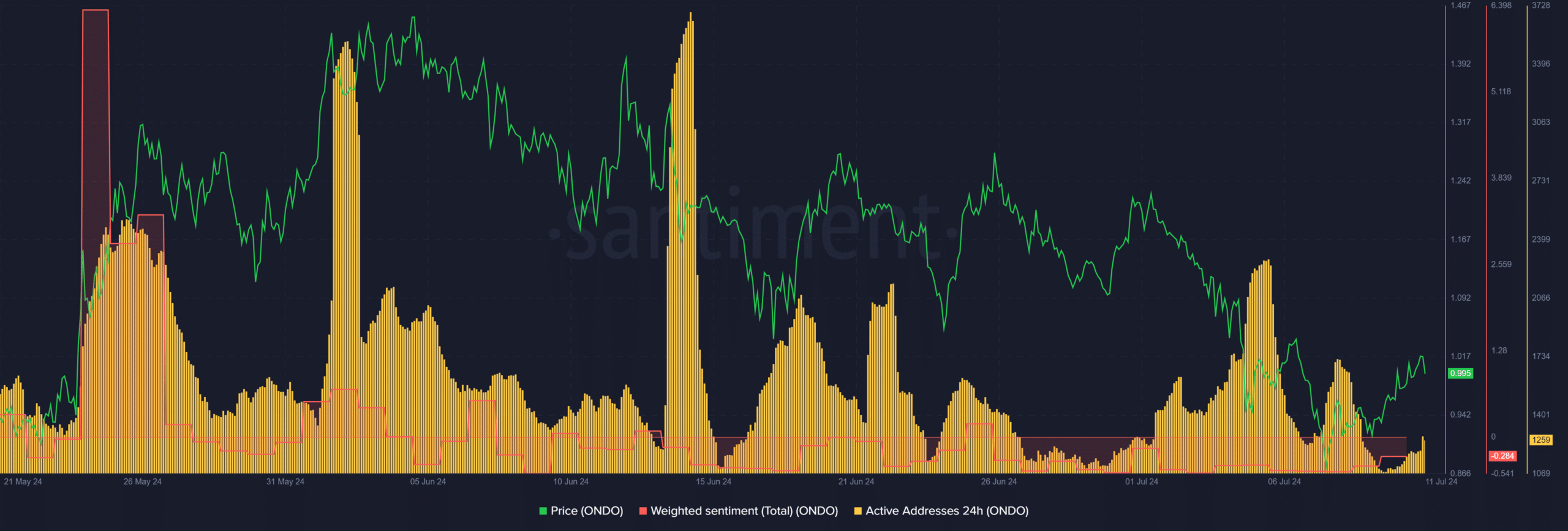

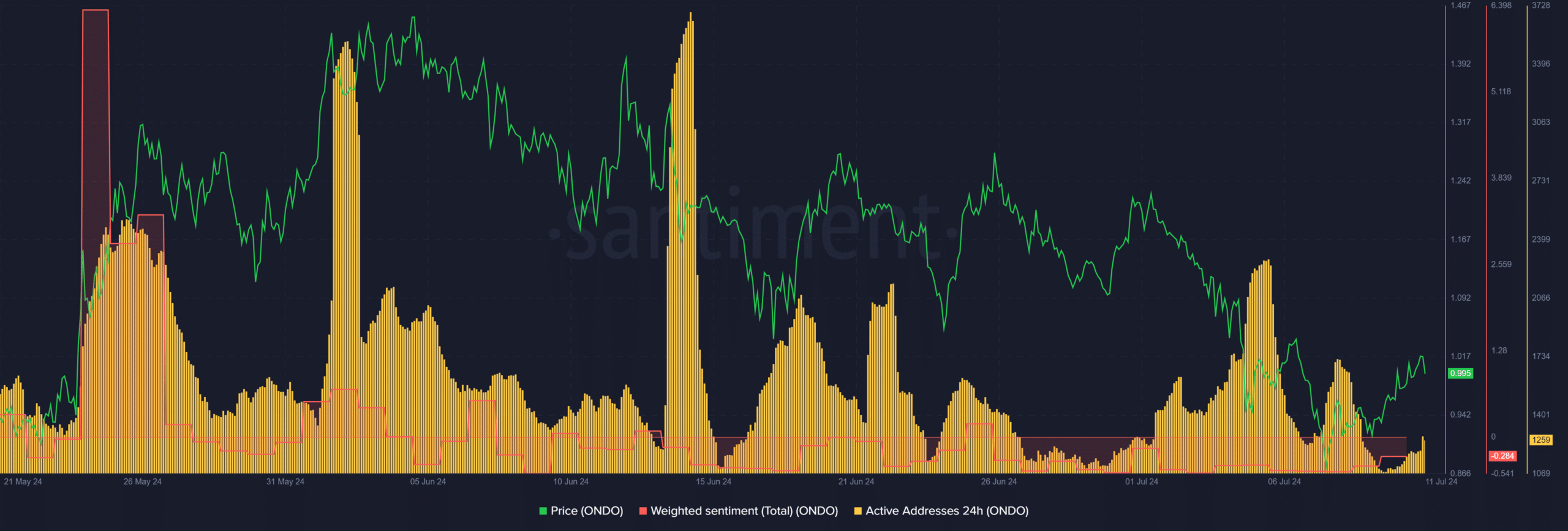

Source: Santiment

ONDO’s rise could be further delayed based on Santiment’s numbers, which showed weak sentiment as evidenced by negative weighted sentiment.

Read the one from Ondo Finance [ONDO] Price forecast 2024-25

Additionally, the daily active address, highlighted by yellow, has dropped significantly since July 5. It meant fewer users or addresses were conducting ONDO transactions, which could further delay the additional rebound.

However, a bullish BTC could debunk the above statement.