Whale accumulation suggests more upside down

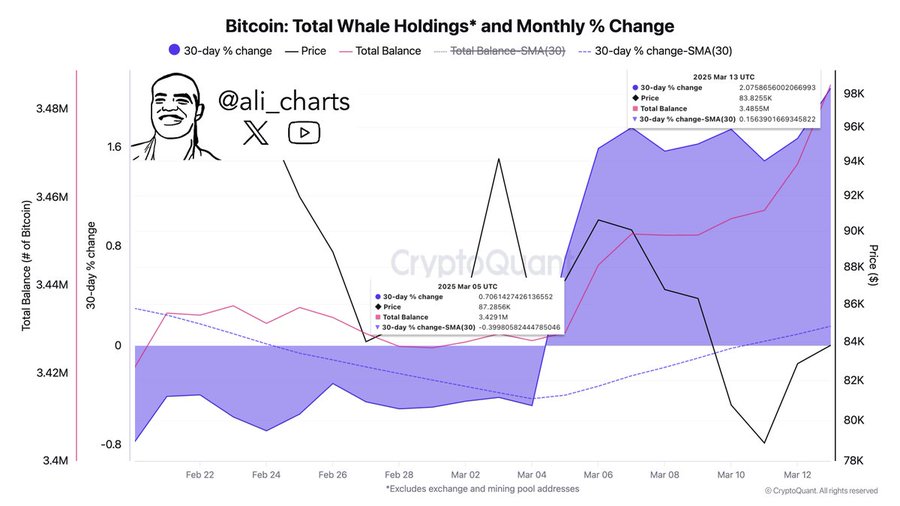

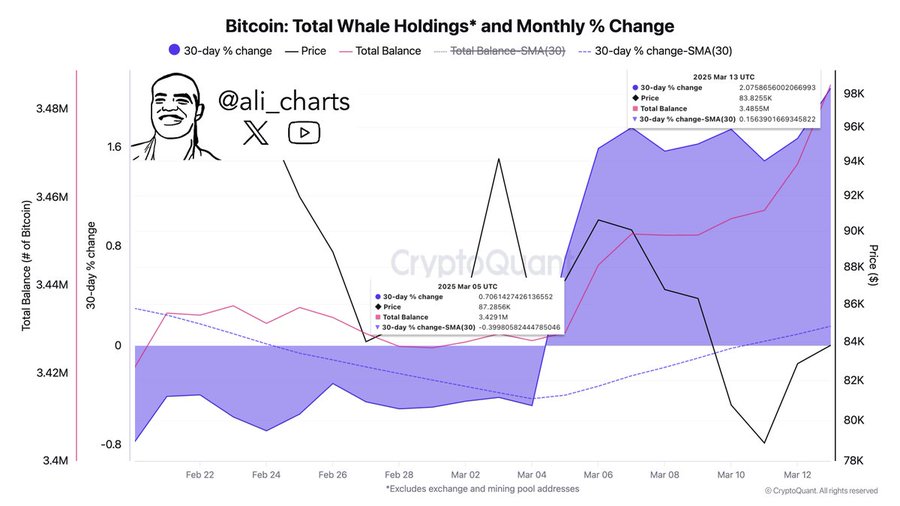

Support for the case for a continuous bull run is the behavior of the biggest holders of Bitcoin.

In the past week alone, Whales are collected More than 60,000 BTC, a strong voice of trust that corresponds to historical post-Defense trends.

Latest data show a sharp increase in the total whale stores over 3.45 million BTC-Eens a remarkable positive swing in the 30-day percentage change.

Source: X

This increase in accumulation usually indicates a bullish prospect of long -term investors, who tend to run the most important price movements.

In combination with the post-relieving historic window that points at the Midden-Late 2025 for a cycle top, this renewed whale activity adds fuel to the thesis that the current Bitcoin rally still has room to walk.

Consolidation in the short term, but the momentum can return

Despite bullish signals in the longer term, the short -term provision of Bitcoin remained mixed. The daily graph showed BTC around the level of $ 84,000 after a withdrawal of recent highlights.

The RSI was at 44.20, which suggests a weak momentum and leaving space for further down before it is actively sold over. In the meantime, on trending has been down, which reflects a decreasing buying pressure.

Source: TradingView

Nevertheless, price action seems to stabilize after a lot of sharp losses, by pointing to potential consolidation before the next movement.

If Bulls succeed in defending the $ 83,000-$ 84,000 support zone, BTC could try a push to $ 88,000 in the short term. However, not holding the current levels can open the door for a retest of $ 80,000.