- The price of NOT has increased by more than 80% in the last seven days.

- Technical indicators suggest that the country is poised to continue climbing.

NOT, the token that powers Notcoin, the play-to-earn clicker gaming application on Telegram, is poised to extend its seven-day gain.

At the time of writing, the altcoin was exchanging hands at $0.02. According to CoinMarketCap According to data, its value has increased by 84% in the past week.

With key technical indicators confirming increased demand for the altcoin, it could surge towards a new all-time high in the near term.

NOT bulls are not willing to give up their dominance

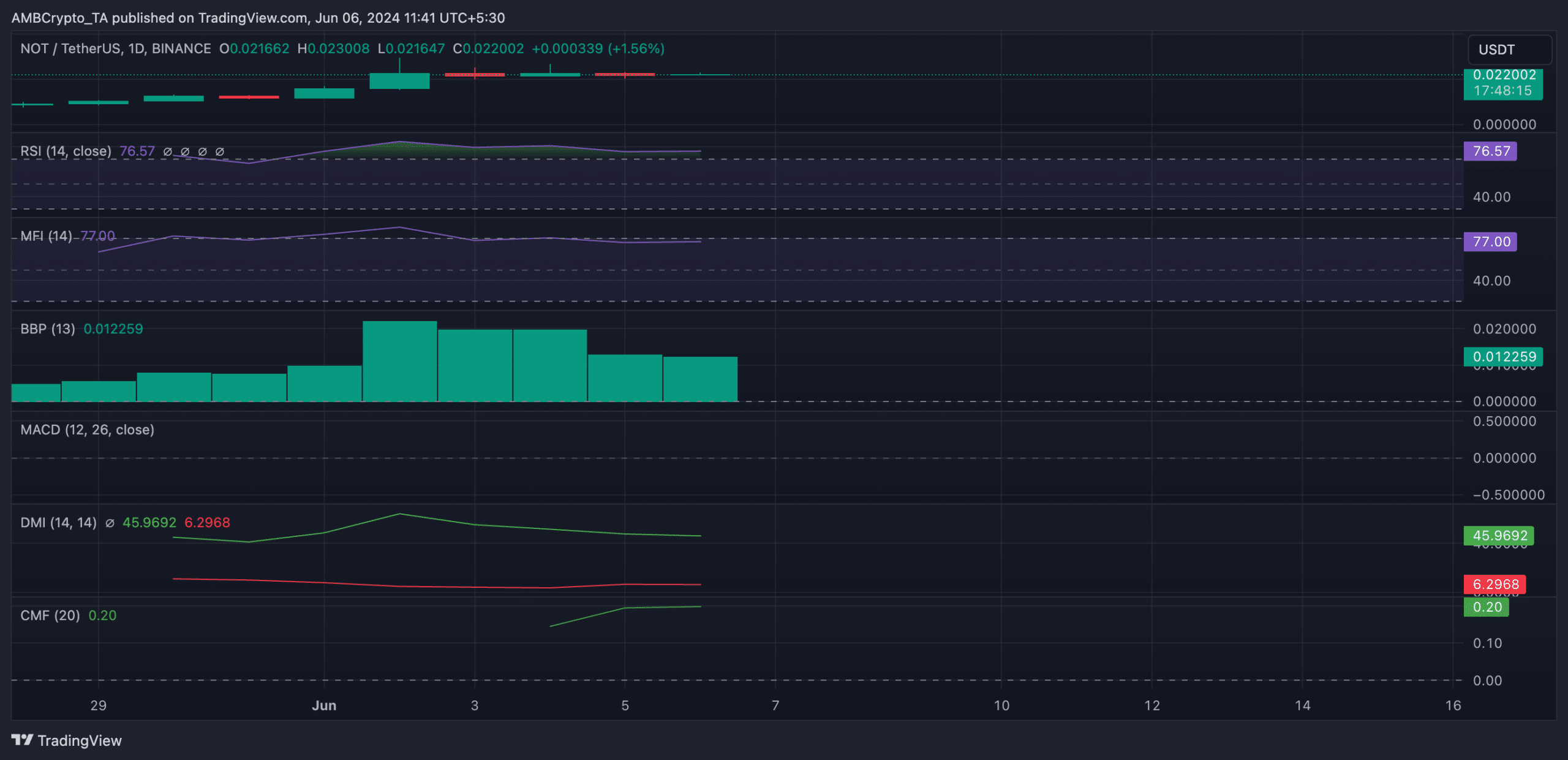

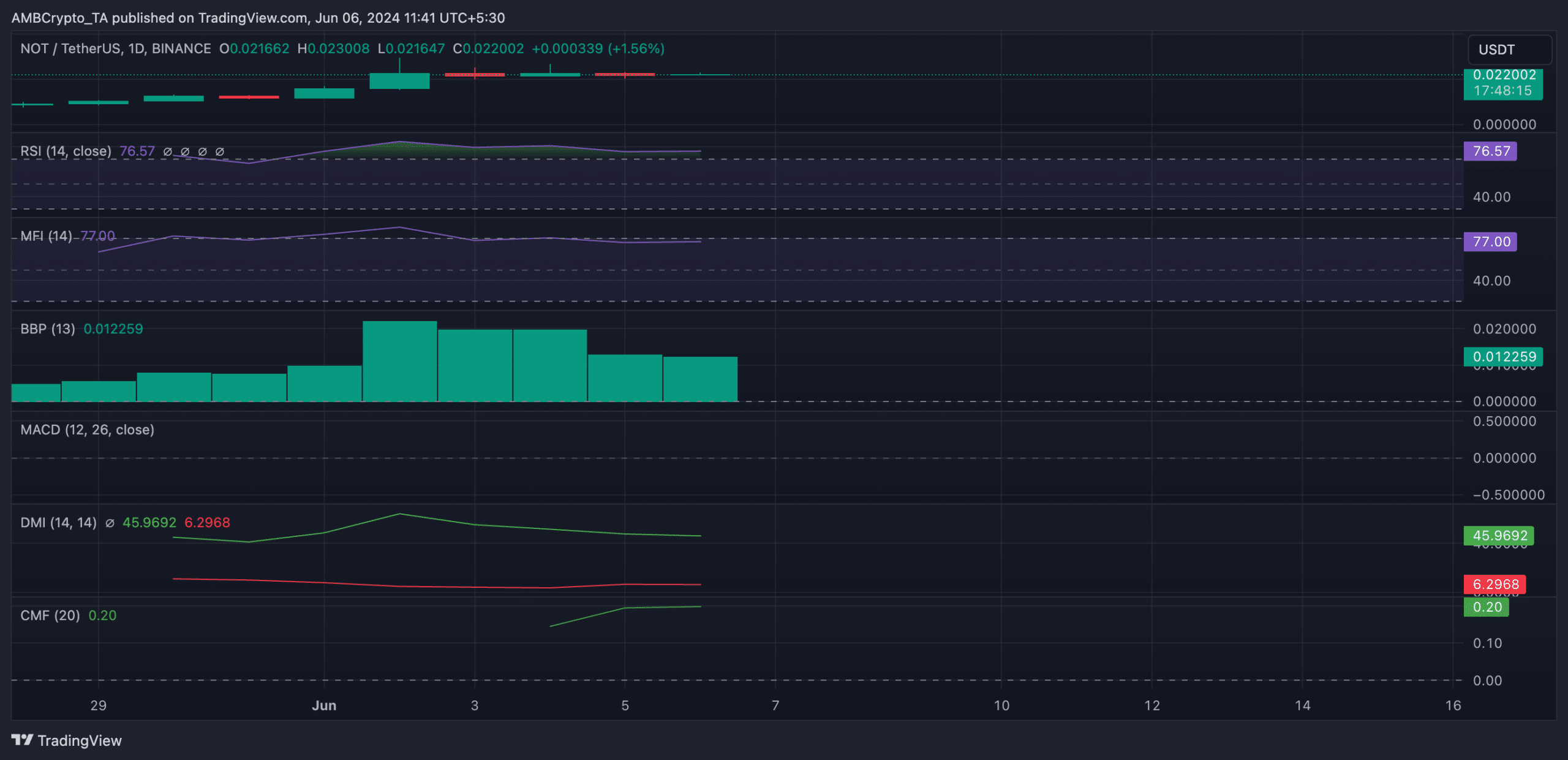

While there has been some profit taking in recent days, NOT’s momentum indicators remain significantly above their 50-neutral lines.

At the time of writing, the token’s Relative Strength Index (RSI) was 76.73, while the Money Flow Index was 77.

These indicators suggested that NOT purchasing activity remained significant and exceeded selling pressure.

However, it is important to note that NOT’s RSI at its value indicated that the token was overbought and that a potential price correction was imminent. When an asset is overbought, the exhaustion of buyers sets in and the price witnesses a pullback.

Although there is a risk of a slight correction in NOT’s price, the bulls remain firmly in control of the market. This was evident from measurements of the Elder-Ray Index. At the time of writing, the value of the indicator was 0.012.

This indicator measures the relationship between the strength of NOT’s buyers and sellers in the market. When its value is positive, bull power dominates the market.

Furthermore, the positive directional index (green), at 45.96, was above the negative index (red), at 6.2, at the time of writing. This indicated that the altcoin was experiencing stronger uptrend than downside momentum, even though some traders had started selling.

Furthermore, NOT’s Chaikin Money Flow (CMF) of 0.20 showed a significant amount of liquidity flowing into the market.

A positive CMF is a sign of market strength. It indicates capital inflows as demand for an asset rises, a bullish signal.

Source: NOT/USDT on TradingView

Realistic or not, this is NOT the market cap in SOL terms

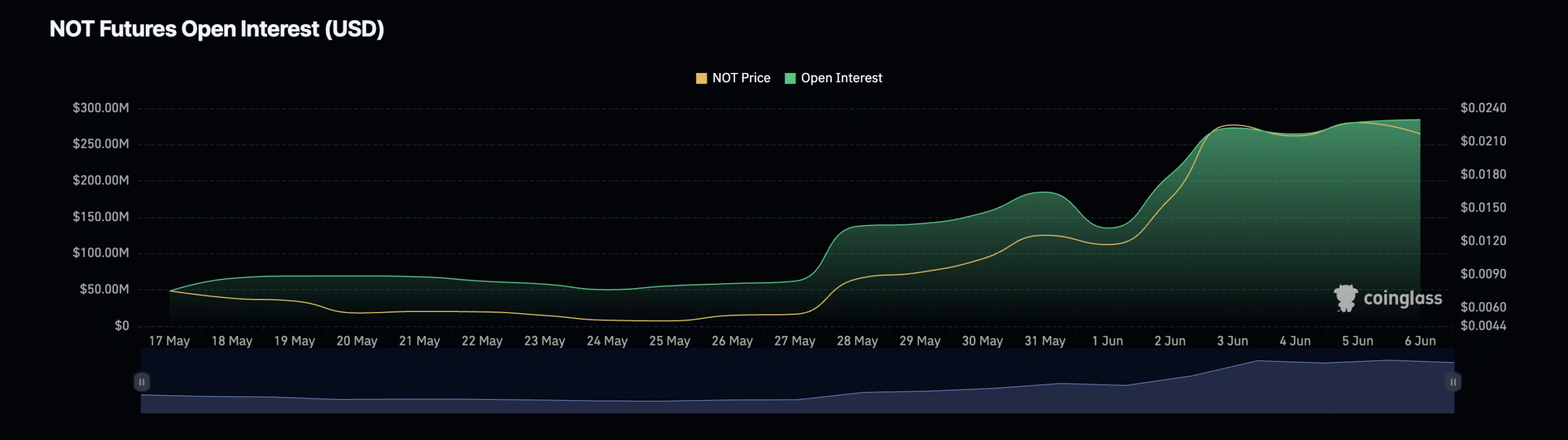

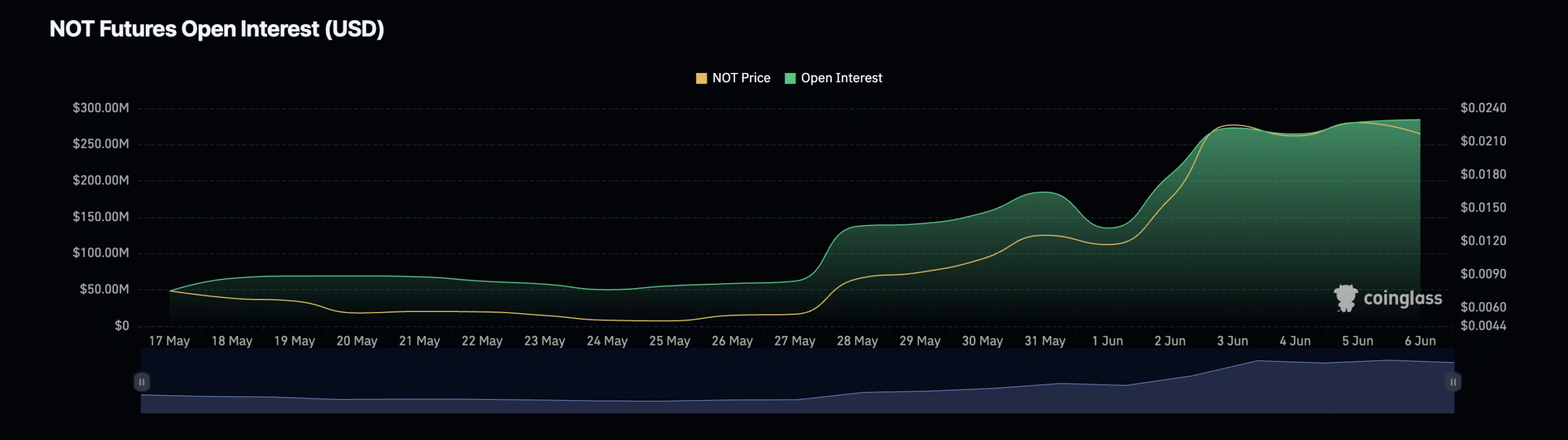

On the NOT futures market, open interest has reached new highs. According to Mint glass data, at $284 million at the time of writing, it was at an all-time high.

An asset’s open futures interest tracks the total number of outstanding futures contracts or positions that have not yet been closed or settled. When the price rises in this way, more market participants open new positions.

Source: Coinglass