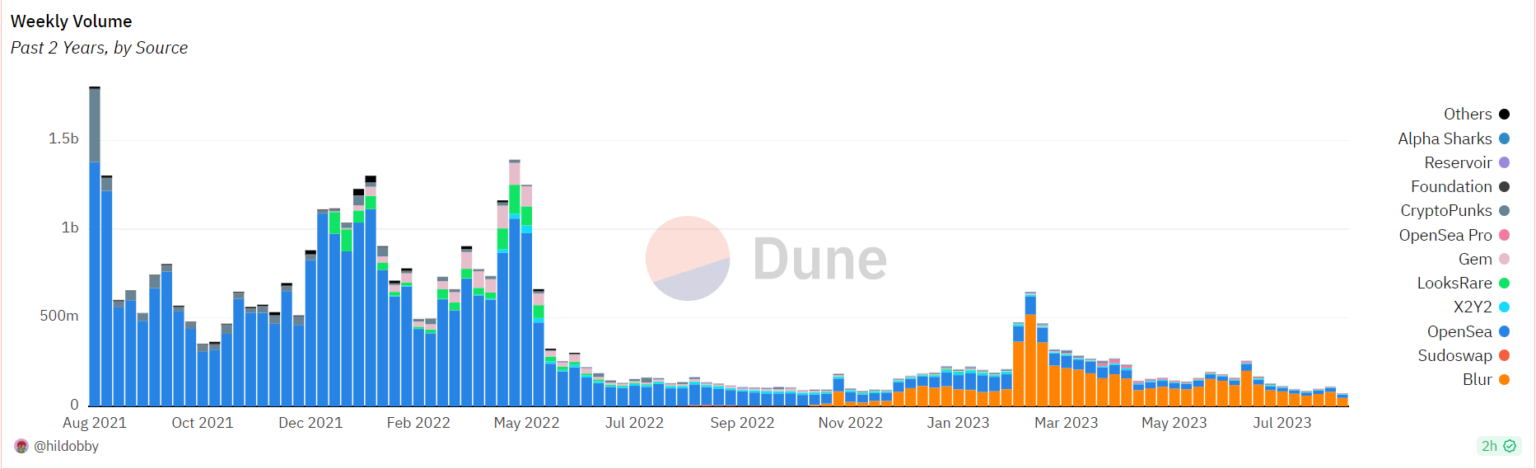

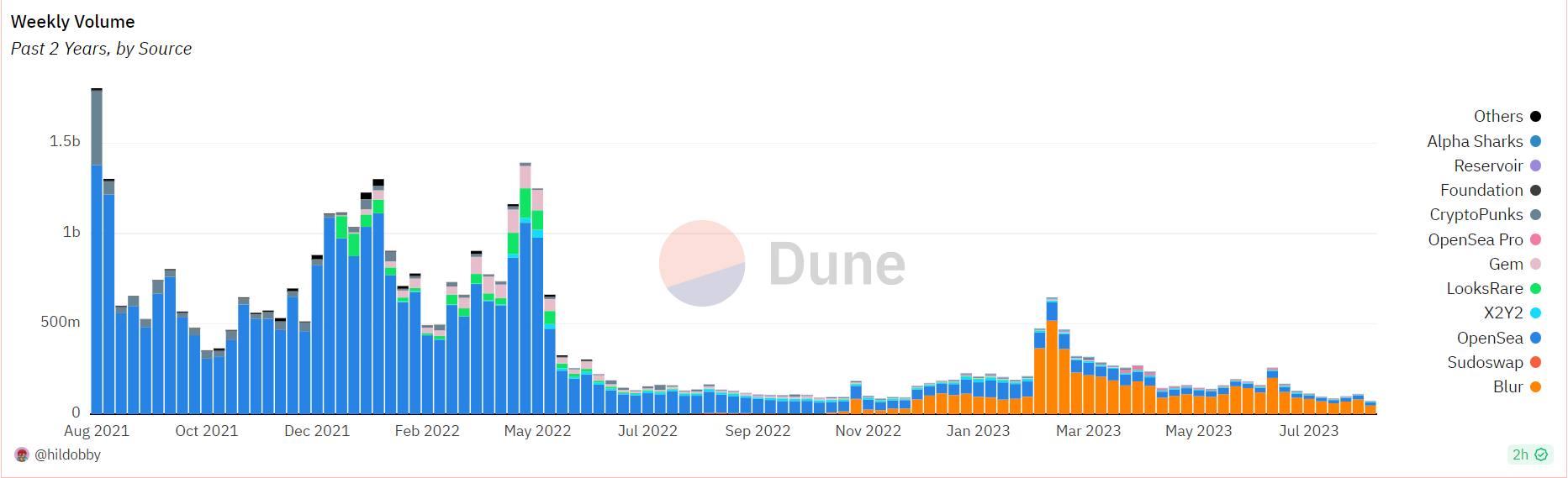

According to data from Dune, the NFT is witnessing a serious decline as the network-wide NFT trading volume index hit $73.2 million last week, its lowest level in two years. With Blur, the free NFT marketplace, currently accounting for the majority of weekly volume, at 65.1%, compared to Opensea’s 23.7%.

Source: Dune

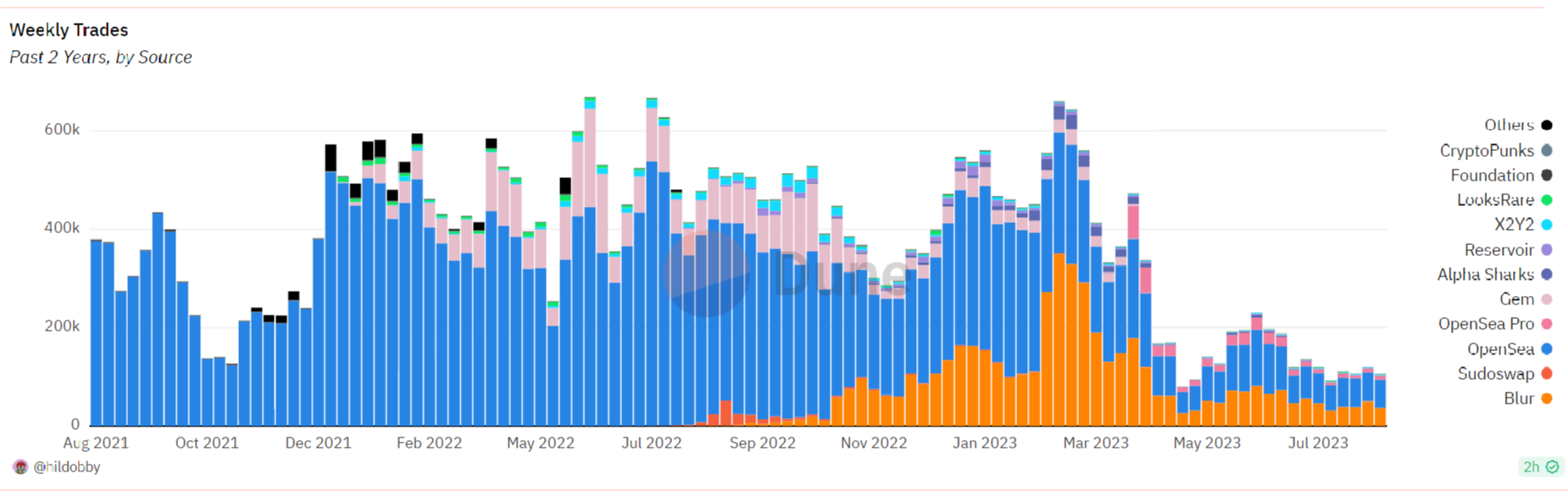

Adding to the concern is that the number of users participating in NFT transactions across the network has also hit a two-year low, hovering around 50,000 users in recent weeks.

Source: Dune

The NFT market has been in the doldrums for quite some time now. Compared to the heyday, weekly trading volume could reach $1.8 billion by 2021.

In July 2023, a series of the most popular and sought-after NFT collections experienced a significant drop in price floors, culminating in famous blue chip projects, including CryptoPunks, Bored Ape Yacht Club, Mutant Apes and Azukis, which increased by 62% this month. plummeted .

This market break reflects an increase in investor risk aversion and a decrease in confidence in the NFT. Investors may become more cautious and reluctant to make riskier investments, which may lead to a shift to safer assets or a reduction in overall market participation.

Moreover, this decline may soon continue, with negative consequences from the regulators. Yesterday, the SEC, a powerful regulator with no sympathy for the cryptocurrency market, took its first action against the NFT market by accusing Los Angeles entertainment company Impact Theory of developing and deploying NFT without registration, which is also the first enforcement action by the regulator is against the NFT.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.