Despite the total market losses, the demand for functions on chains remains strong. Various EVM-compatible L1 and L2 chains make an increase in new portfolios.

New active portfolios go to various EVM-compatible chains, which reflects the demand for activities in chains. Despite the overall market collection, Web3 activity and apps are active, so that broader acceptance builds up.

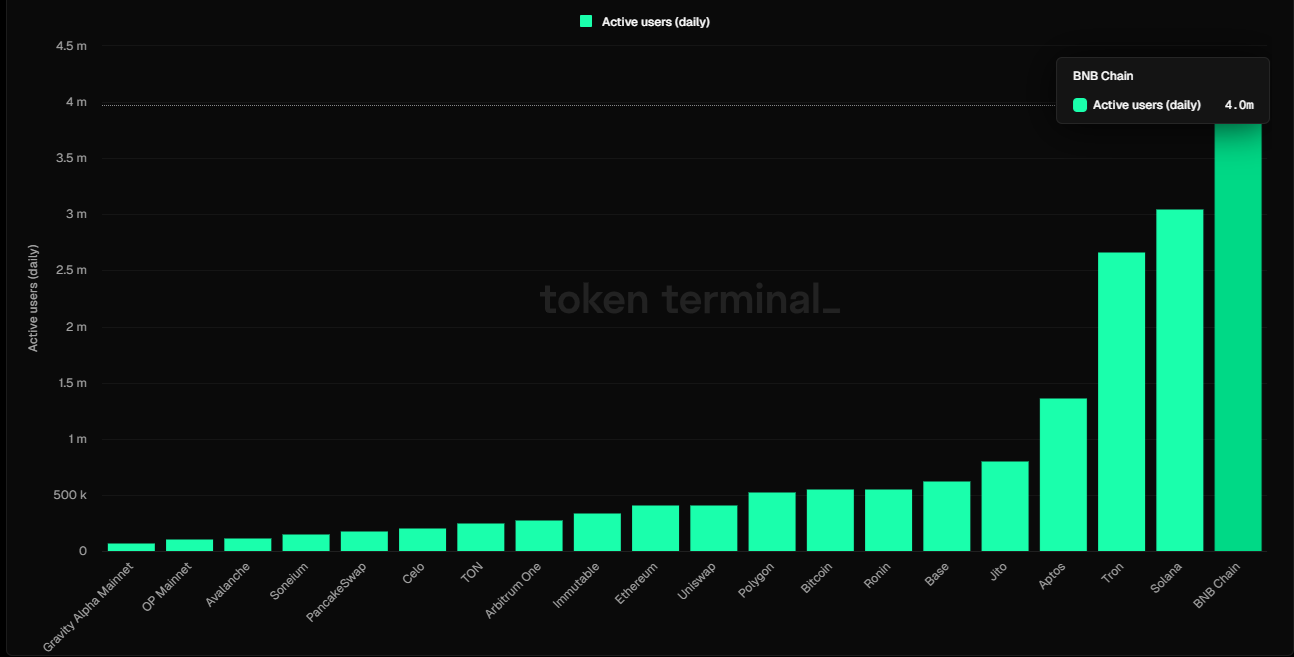

The activity continued to flow to BNB Smart Chain and Base, in response to a delay by Solana Meme. BNB Smart Chain became the leader with 4m active daily users, with only 2.7 m for Solana. Based on unique address factsIn the past week, Binance added another 2 meters of portfolios.

BNB Smart Chain surpasses Solana in daily active addresses, usually linked to pancake wap activity. | Source: tokenminal

Basically, the leader was in a new wallet, with a further 2.8 million addresses that came to the network last week. Basic unique address Went vertically in recent weeks and added to 30 million new addresses throughout the month of February. The continuous shift to the base showed the growing demand for cheap activities at the chain, together with a high available liquidity for defi-investments and passive income.

All L2 chains had a weekly involvement with more than 9 million weekly active portfolios, which grew the second week in a row. The L2 -Ecosystem remains close to peak activity, with more than $ 10.5 billion in Stablecoin -Liquidity to stimulate trade. Decentralized trade still reaches 18.5% of the exchange activity, which demonstrates the robustness of decentralized activities in the chains, even with reduced ETH prices and deteriorated sentiment.

The most active chains with new user growth try to avoid the fate of ‘dead networks’, whereby activity has only followed AirDrop campaigns. Some of the best growth rates started building their app collection during the Bull market of 2021 and have tried to return.

Ethereum -Ecosystem remains relevant

Other very active chains with a user inflow show former stars from the web3 bull cycle from 2021 are still relevant. Users flowed in Polygoon and Ronin, as well as the EVM-compatible L1 chain Avalanche.

Polygon has recently expanded its use, with some of the leading apps based on Dapadar facts. Polygoon activity depends on the Moonvil -Gaming -Ecosystem, the Polymarket Prediction -app and Legacy games that retain popularity.

Last week also saw a shift to Sonic (formerly Fantom), because the network was mentioned on a large scale on social media. Sonic also grew because it offered his own version of Meme tokens, a new start of the delay activity of Pump.Fun.

The recent expansion of users follows the robust demand for DEX trade. The TOP DEX is stimulating all EVM chains, especially Uniswap. Pancakes WAP increased traffic and the new user flows to BNB Smart Chain, while the basis benefited from the leading DexAerodrome.

One of the reasons for the activity of EVM-compatible chains is the relatively low gas price of Ethereum. Gas costs are as low as $ 0.04, while regular transactions on Ethereum are less than $ 1. This led to an increase in new Ethereum users and added 752K new addresses last week.

Smaller chains get on token -based traffic

Analysts in the chain have noted that activity in smaller chains reflects new token launches and DEX activity. Based on dex activity, Solana is still the highest network for tokenization, but base is arranged for a short second.

Based on Dexscreener -Polarity, Sonic is now in the top 5 of chains that serve as a token platform with high Dex activity. | Source: Dexscreener

Based on Dexscreener, the currently active chains reflect their trending tokens. Sonic is now in the top 5 token ramps, while Arbitrum is back in the top 15. PulSechain and Ton are just behind Sonic, who are in their own brand of Tokenmakers.

The use of bone use also changes the landscape for the most active networks. Solana seized 82% of bone users, but Bnbchain and Base have recently increased their share. Basic is still the smallest bone -driven chain, where still under 10k users with bots. The relatively lower competition can be a factor when driving DEX activity.