- New bitcoin whales reform the market structure, stimulate demand while the available supply is limited.

- This dynamic can feed upward price movement in the coming months.

Highet-worthy portfolios with 1,000+ Bitcoin [BTC] Accumulate quickly and signals strong confidence in Bitcoin. Since November 2024, new Bitcoin whales have added more than 1 million BTC, including 200,000 this month.

A short holding period (<6 months) indicates a strong conviction at the current price levels. This persistent purchasing pressure suggests that recent "dips" are being absorbed, reducing the chance of long -term corrections.

With the risk-off sentiment that dominates the market, retail capital still has to return. In this climate, the continuous accumulation of new whales could establish a strong price floor, which strengthens Bitcoin support in this cycle.

Bitcoin liquidity profile is shifting

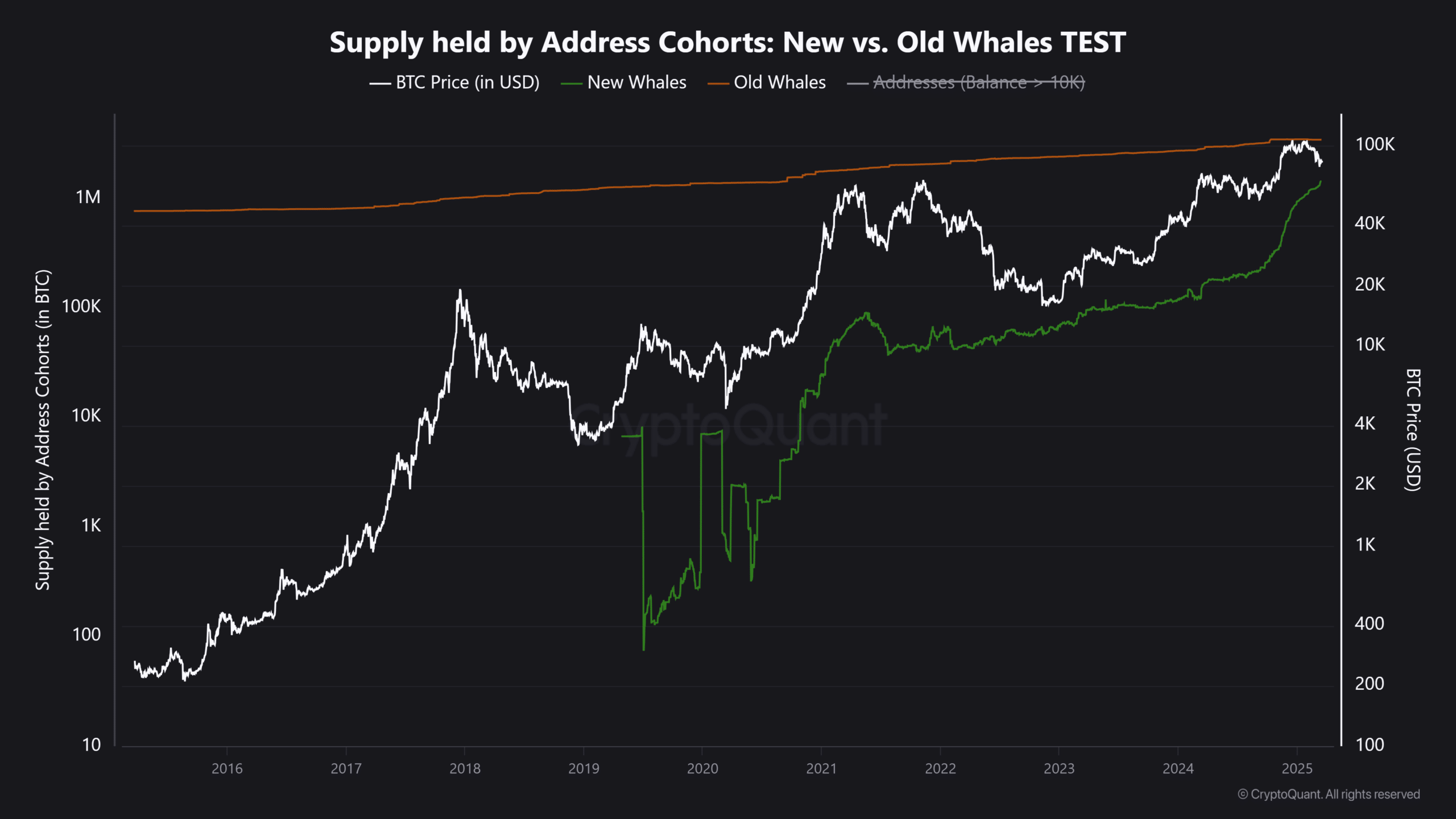

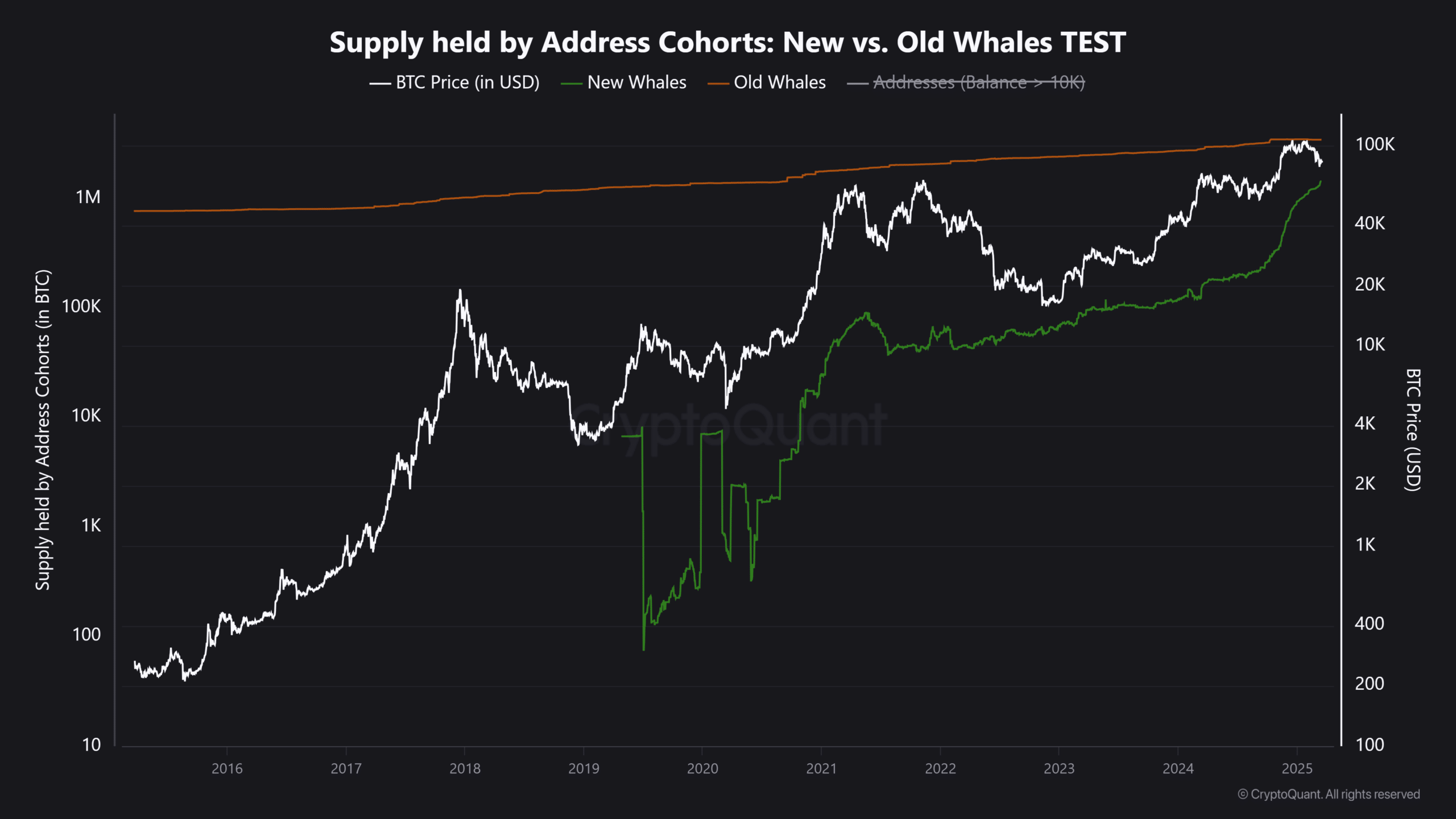

The rapid accumulation of new whale addresses indicates a strong influx of fresh capital, as reflected in the data below.

The total companies by these entities (1,000+ BTC, <6 months old) have risen from 345K BTC to more than 1.5 million BTC. For the current market price of $ 83,580 this means about $ 125 billion in Bitcoin.

Source: Cryptuquant

In the meantime, long -term whales (BTC that is held for several years) have fallen from 3.48 million to 3.45 million BTC, in accordance with the price correction of Bitcoin of the $ 109k of all time high on January 20 to $ 96k on 6 February.

The Sell-Side Liquidity of both old whales and weak hands have been absorbed Because of these new whales, whose 2.00,000 accumulation this month has prevented BTC to return below $ 78k.

New bitcoin whale signal strength: what is the next step?

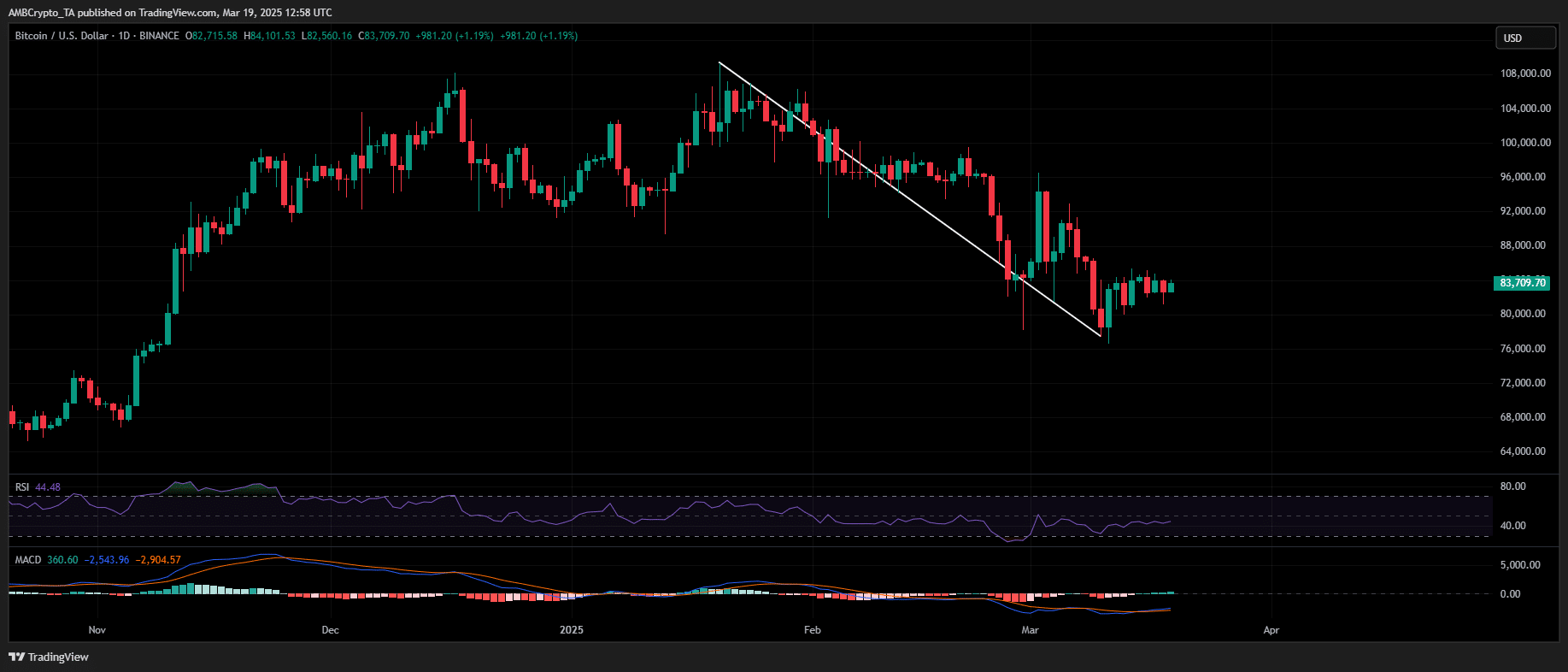

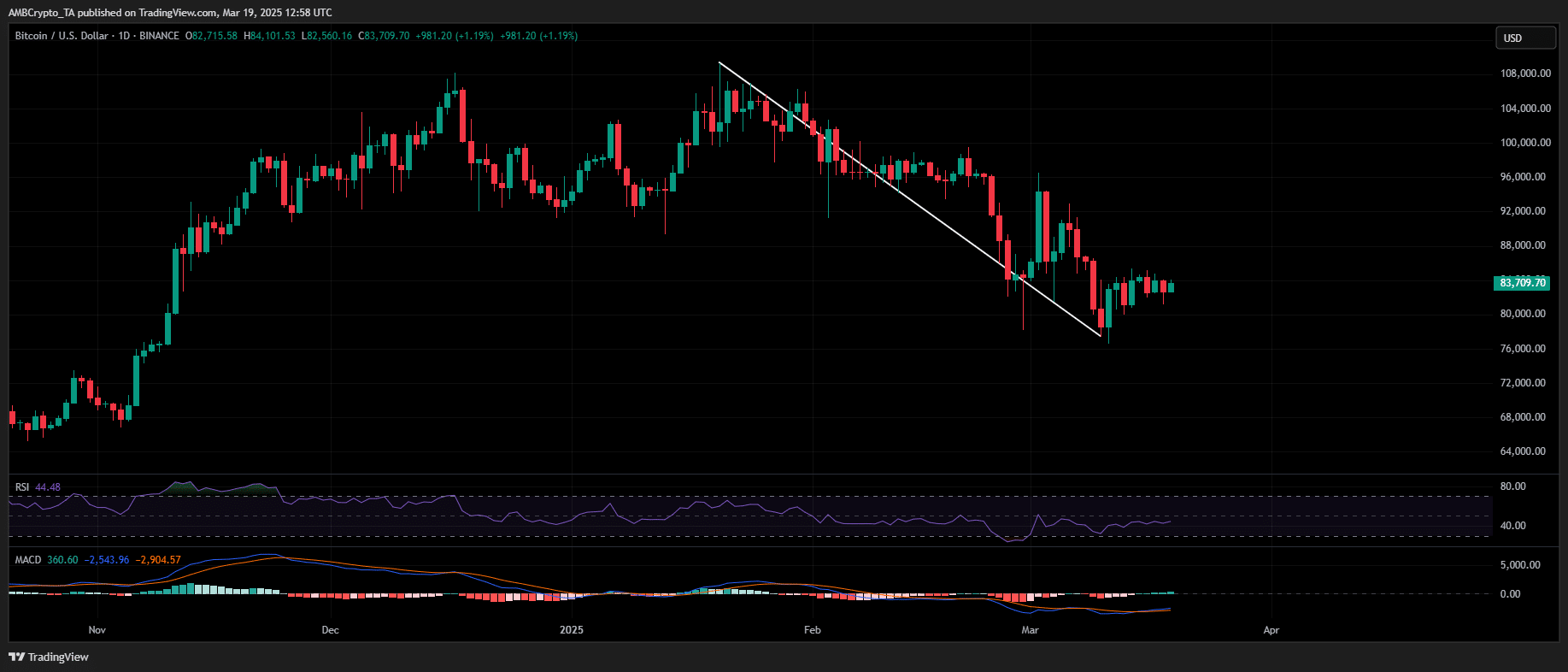

The recent price fluctuations of Bitcoin-van de ATH from $ 109k to its drop below $ 80k largely influenced by old whale distributions and macro-powered liquidity shifts.

Source: TradingView (BTC/USDT)

However, new Sleekbalstroom reinforce support, so that the downward risks are mitigated. If the accumulation continues at the current levels, the chance of BTC to restore a reteste of all time.

In addition, macro-factors such as potential tariff reductions, as soon as the Trump economic reset comes into force, further reinforce the Bitcoin long-term process, so that $ 150k $ 160k is placed as a viable long-term objective.