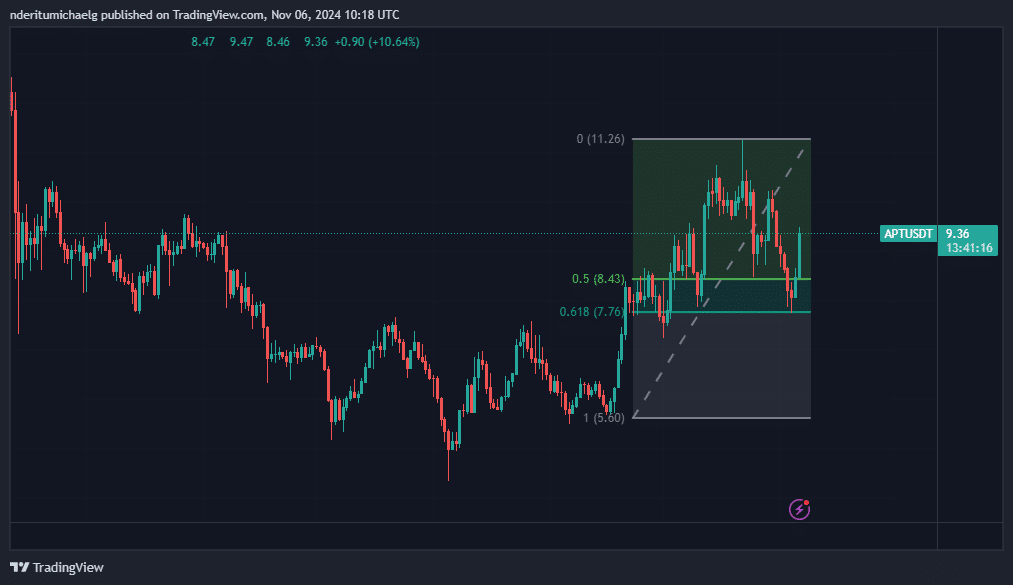

- APT is turning in favor of the bulls after entering the key Fibonacci range, signaling the possibility of more upside potential.

- Aptos’ on-chain data showed the status of activity with the network and whether it could provide more benefits.

Aptus [APT] has been in a bearish retracement since the last week of October. However, the performance of the past two days indicated that the price was ready to resume the bullish trajectory seen in mid-September.

APT recently retreated as much as 30% from its October high. However, the withdrawal ended in a notable price range.

This is because the pullback was expected to end within the range of $7.68 to $8.43. This was chosen based on Fibonacci retracement from the lowest price point in September to the highest price in October.

Source: TradingView

APT fell to $7.74 earlier this week, followed by a bullish pivot, meaning the Fibonacci retracement zone was spot on.

The cryptocurrency has since risen by about 21% to a press time price of $9.38. Despite the recovery, APT still had a 19% gain to go before hitting its October low.

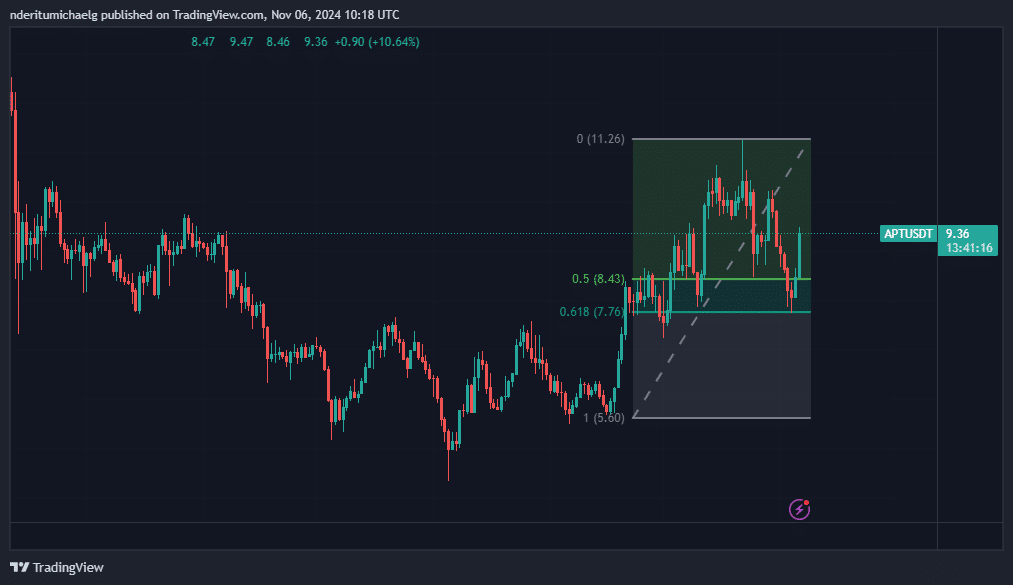

Assessment of Aptos network activity

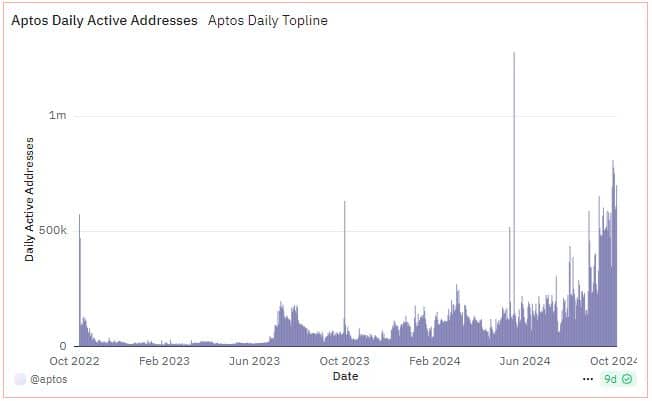

Will APT’s network activity support APT’s recovery? The network has experienced growth in several key areas. For example, Aptos has seen robust address growth so far in the second half of 2024.

The daily active number of addresses peaked above 1.27 million addresses in June, which was the highest level on record. The lowest level of daily active addresses in the second half of 2024 was just below 50,000 addresses.

Meanwhile, the growth in the number of addresses has continued to grow over the past three months, reaching 808,313 addresses.

Source: Dune.com

An increase in the number of daily active addresses suggested that the network is experiencing healthy network usage.

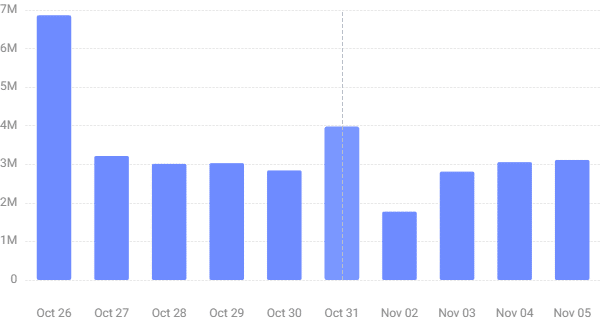

This outcome was also reflected in daily user transactions, although the number of transactions dropped significantly at the end of November.

The network had as many as 6.86 million transactions on October 26, but cooled to 1.77 million transactions on November 2, the lowest number of transactions in the past ten days.

However, Aptos transactions have since recovered and recently recorded 3.11 million transactions on November 5.

Source: Aptoscan.com

The slight decline in the number of transactions from the end of September was in line with the uncertainty in the run-up to the US elections. However, markets are expected to experience more recovery and excitement after Trump’s victory.

Read Aptos’ [APT] Price forecast 2024–2025

A healthy network business combined with overall bullish sentiment could contribute to APT’s recovery in the coming weeks.

However, investors should also be cautious of unexpected large pullbacks as more volatility returns to the market.