- The CKB token posted massive gains, surpassing two-month highs.

- Some short-term volatility and profit-taking could cause the price and OI to fall.

Nervos network [CKB] began to rise with force. Previously dormant trading volume skyrocketed. Within a day, it went from $5.94 million in trading volume to $264 million on September 13.

This enormous increase in volume was accompanied by a price increase of 51%. Since then, the token has continued to climb higher and higher. What is the Nervos Network price forecast for the coming weeks?

Nervos Network breaks down the July highlights

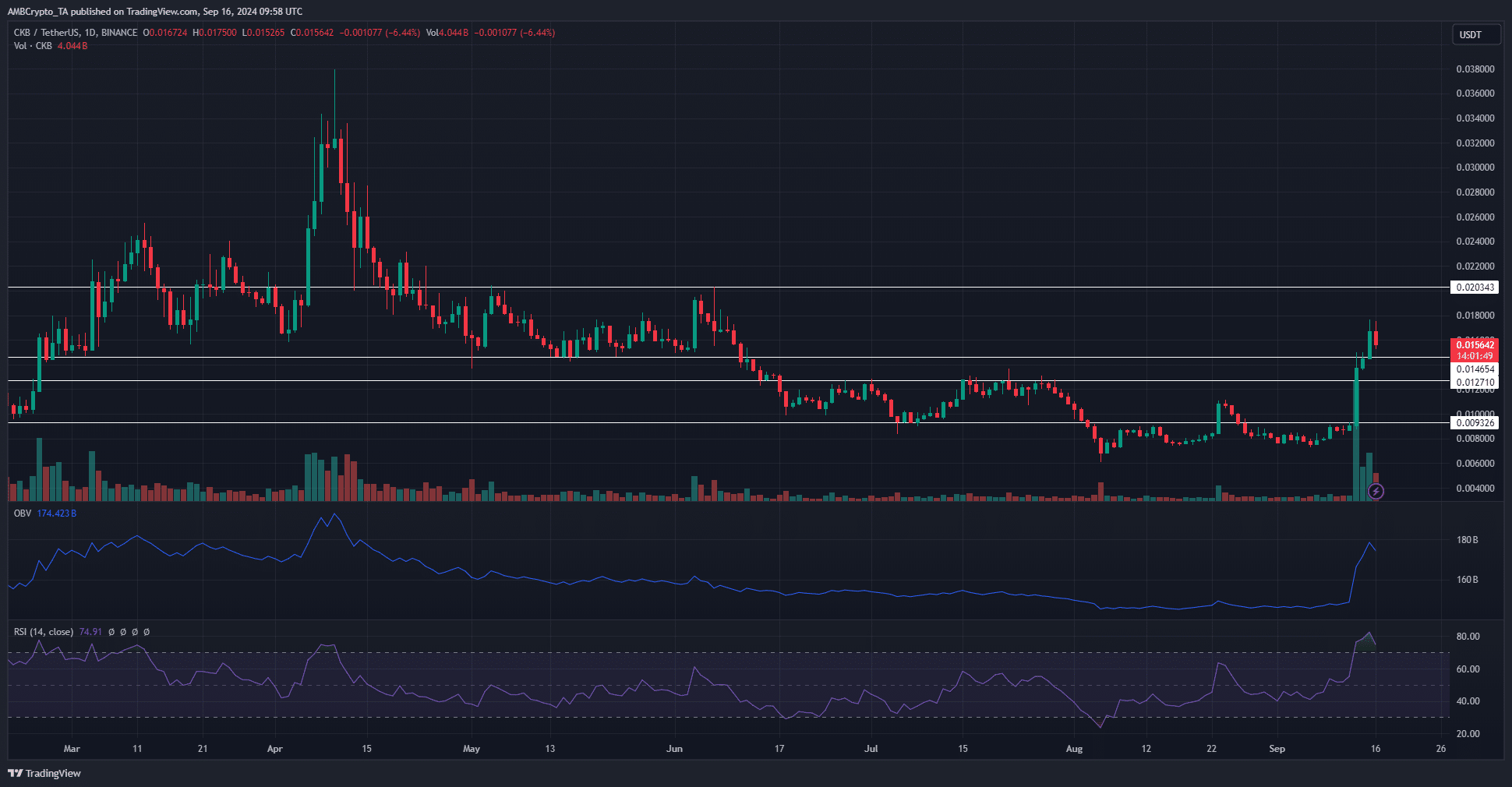

Source: CKB/USDT on TradingView

The increase in trading volume on September 13 saw the token end the trading session 51% higher than where it started. Since then, another 14.2% has been added.

The daily RSI was above 70, indicating overbought market conditions. So the momentum was clearly bullish, but there is also a chance of a price correction.

Therefore, the Nervos Network price forecast, even if bullish, could show a decline in the short term.

The OBV had been in a downtrend since April, but the recent price pump revived the uptrend. This wave of buying pressure could spark a sustained rally.

To the north, the $0.02 and $0.026 levels were the next major resistances.

CKB is confident of a good performance

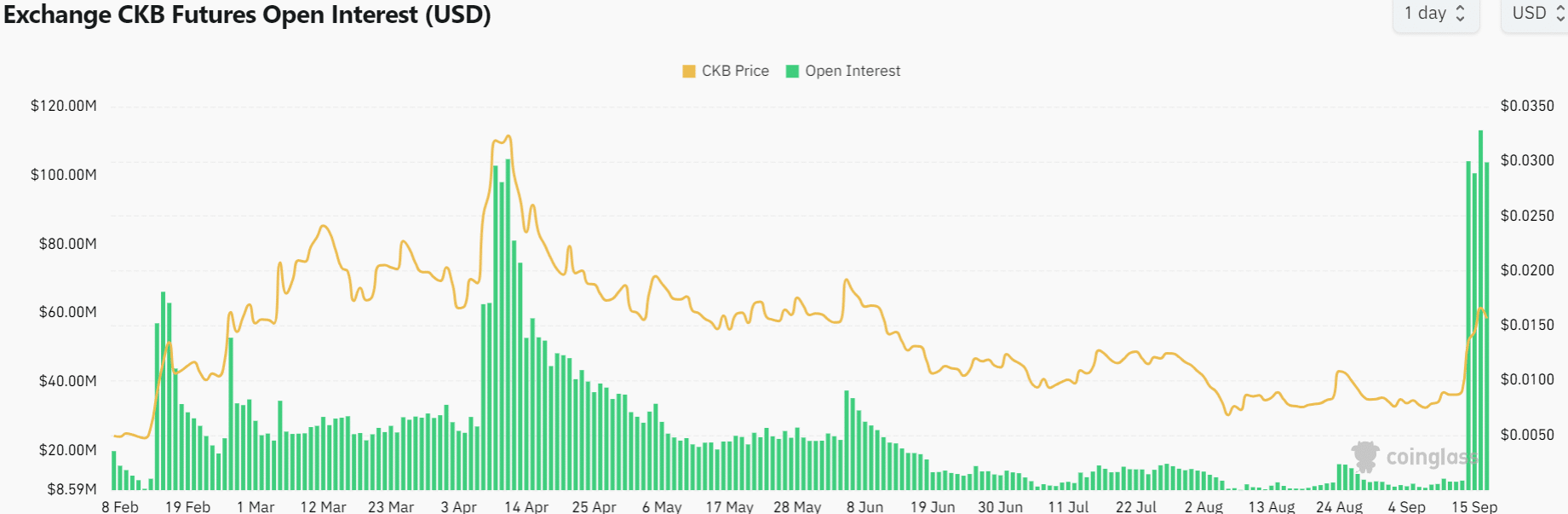

Source: Mint glass

Open Interest increased from $11.3 million to $104 million on September 14. This nearly 10x OI growth signified the massive influx of speculators into the market. It also underlined the positive expectations.

In the short term, this could be the undoing of the bulls. The huge speculative volume around the rally would mean that price would be busy looking for late long positions rather than continuing the trend.

It remains to be seen whether the market will become overloaded as it was in mid-April earlier this year.

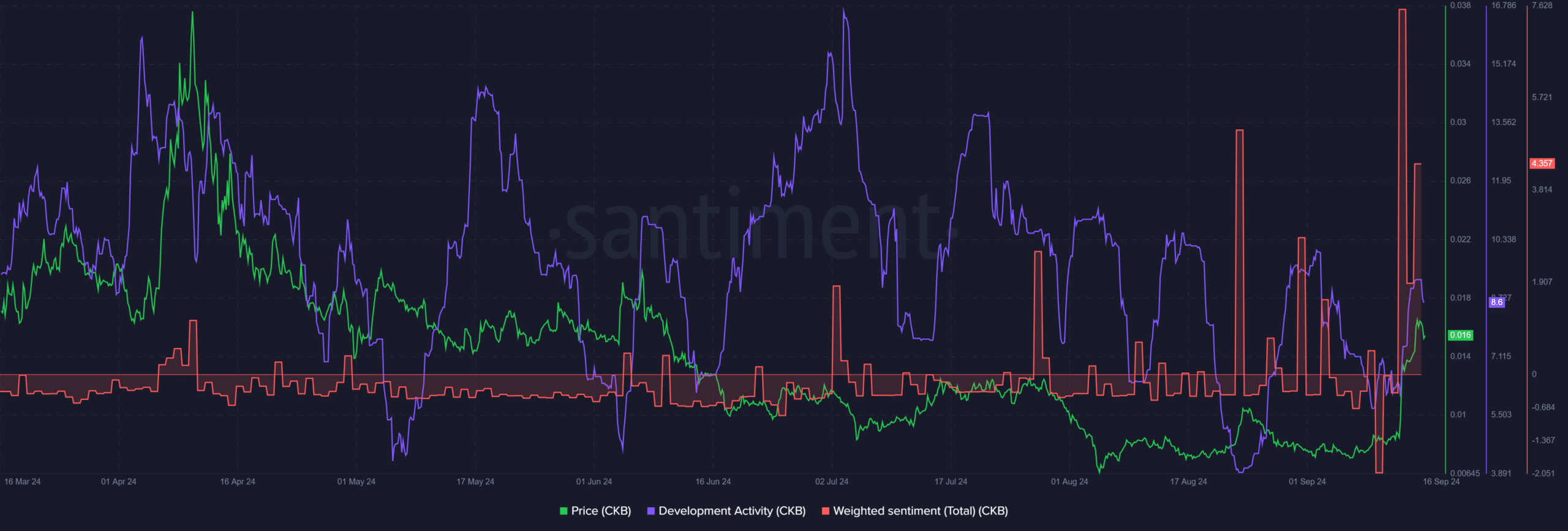

Source: Santiment

Realistic or not, here is the market cap of CKB in terms of BTC

Weighted sentiment reached a level not seen in more than six months. Development activity has trended lower in recent months, but was still relatively high.

Overall, long-term investors in the Nervos Network can be confident of another rally, but short-term volatility has been a threat.

Disclaimer: The information presented does not constitute financial advice, investment advice, trading advice or any other form of advice and is solely the opinion of the writer