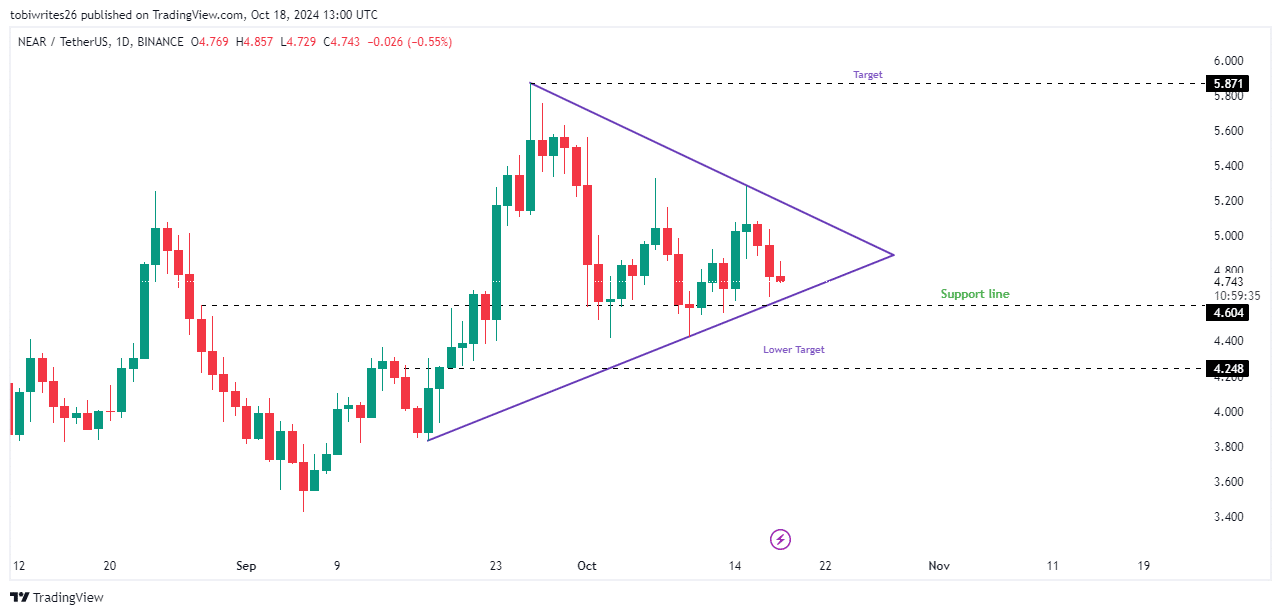

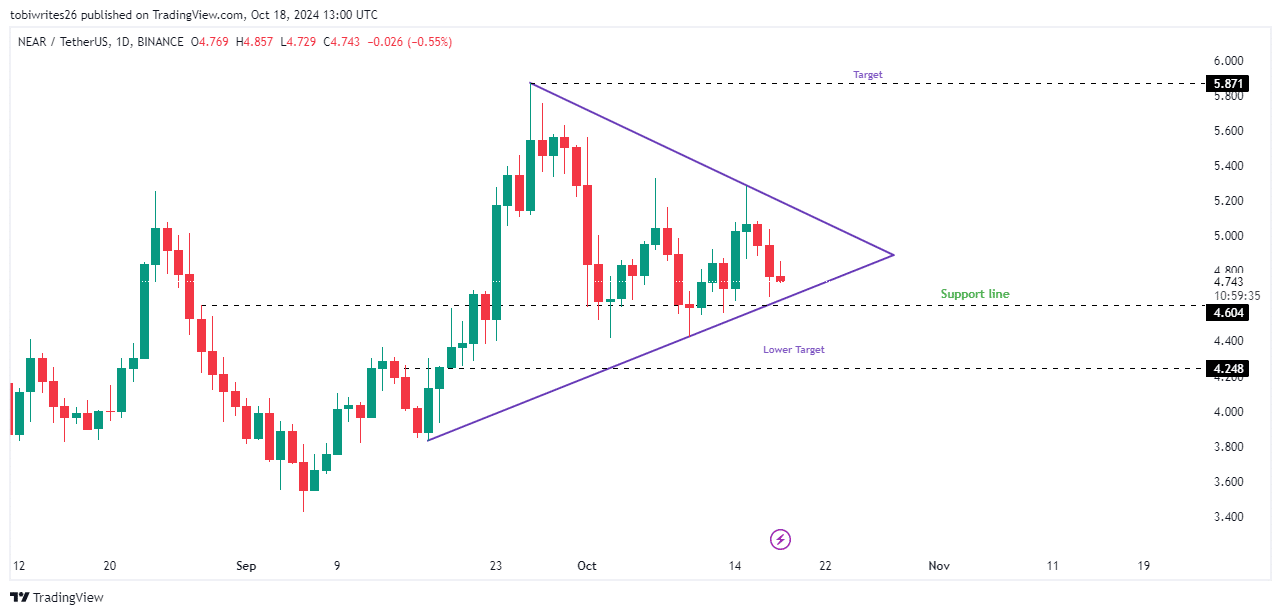

- NEAR has recently entered a symmetrical triangle formation, and a breakout to the upside could push the price towards $5.8.

- Market sentiment was largely bullish at the time of writing, with a majority of traders showing confidence

Despite the recent bullish trend, NEAR’s movement on the price chart has been quite limited. It posted a modest gain of just 0.14% over the past 24 hours and an increase of 0.36% over the seven-day period.

This period is known as consolidation and indicates that traders may be accumulating NEAR in anticipation of a major price move. In light of these findings, AMBCrypto a closer look at possible next steps for NEAR.

The support level is critical to NEAR’s expected price swing

NEAR, at the time of writing, was trading within a symmetrical triangle – a pattern formed by converging support and resistance lines. This formation hinted at a consolidation phase in which buyers steadily accumulate assets.

If this pattern is broken to the upside, NEAR could potentially rise to the pattern peak of $5,871. However, before this upward move, NEAR is likely to test the $4,604 support level first, which will play a crucial role in determining the next move.

Should this support at $4,604 fail to hold, NEAR could see a further decline and fall below the pattern’s support line to a local support level – $4,248.

Source: trading view

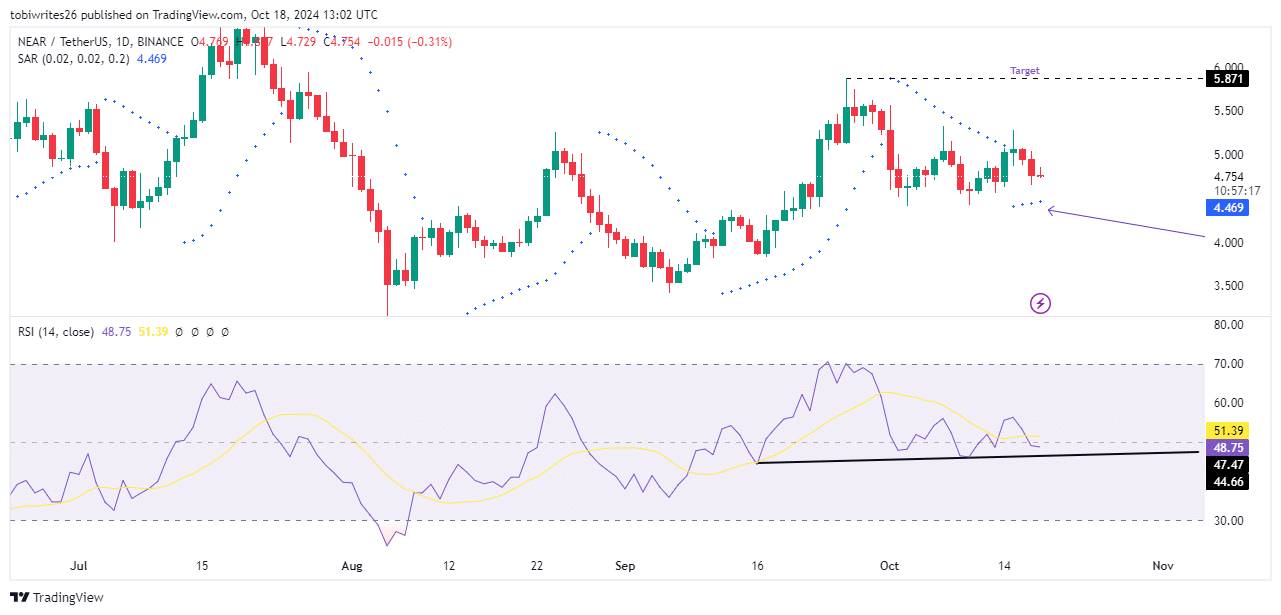

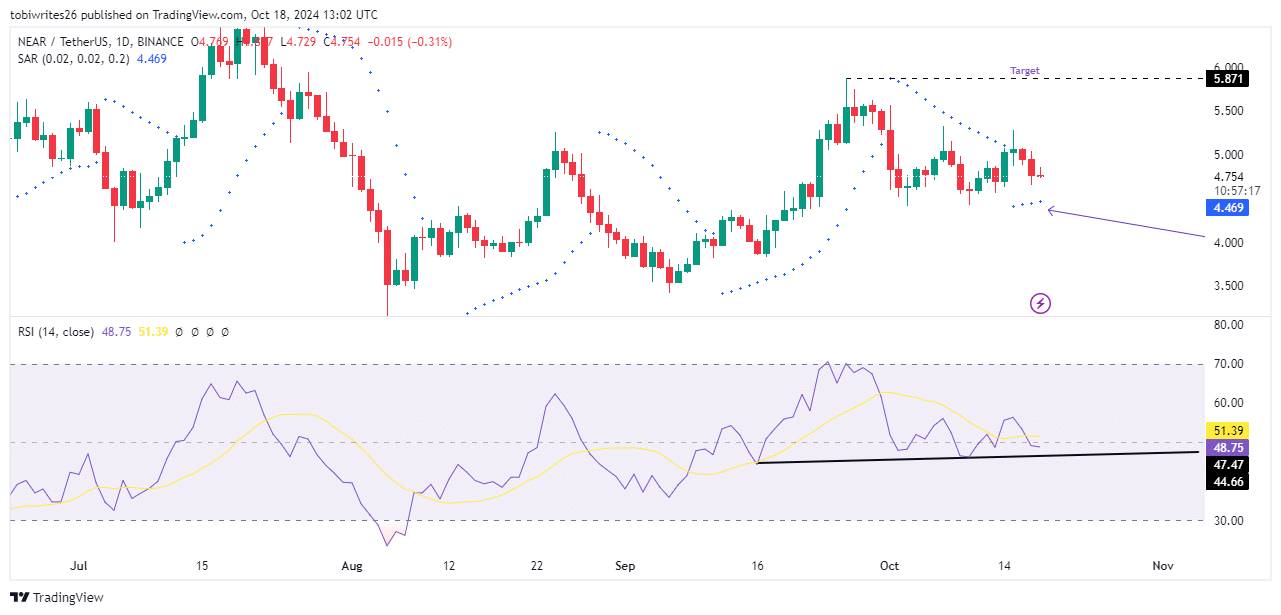

Indicators point to active buying for NEAR

Both the Parabolic SAR (Stop and Reverse) and the Relative Strength Index (RSI) suggested that NEAR could also be poised for a rebound.

The Parabolic SAR, with dotted marks below NEAR’s press-time price, indicated continued buying pressure and a bullish trend. If these markers continue to multiply and move beyond four consecutively, it will likely confirm NEAR’s continued upward momentum.

Meanwhile, while the RSI appeared to be pointing south, it appeared bullish. It is expected to test the supportive trendline it pushed forward, with NEAR’s price moving along with it.

Source: trading view

However, this short-term dip in the RSI could lead to a price decline towards the $4,604 support level. From there, NEAR can be expected to change direction and resume its upward trajectory.

The enormous outflow of liquidity is to NEAR’s advantage

NEAR has experienced significant outflows from the stock markets, according to NEAR data Mint glass.

Over the past seven days, NEAR saw net flows of $1.62 million, indicating a bullish outlook as investors have withdrawn assets from the exchanges. Here it is worth pointing out that this is often an accumulation and long-term investment strategy.

Source: Coinglass

If this trend of negative net flows continues over a broader time frame, it would further confirm the strong bullish sentiment.

By extension, this would point to a possible future rally while strengthening the overall health of NEAR’s ecosystem.